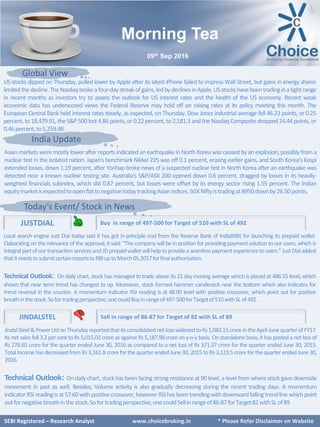

- Local search engine Just Dial received in-principle approval from RBI to launch a prepaid wallet, allowing it to provide payment solutions to users as part of its transaction services. Just Dial needs to submit additional reports to RBI by March 5, 2017 for final authorization.

- Technical analysis indicates Just Dial stock has formed a hammer candlestick pattern near the bottom, suggesting a trend reversal. The stock is recommended as a buy between Rs. 497-500 with a target price of Rs. 510 and stop loss of Rs. 492.

- Jindal Steel reported a widening of consolidated net loss for the April-June quarter compared to the same period last year, while net sales also