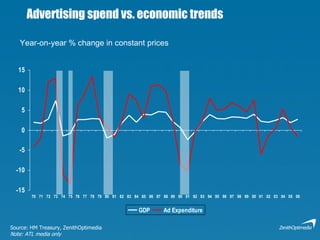

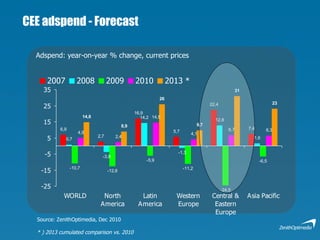

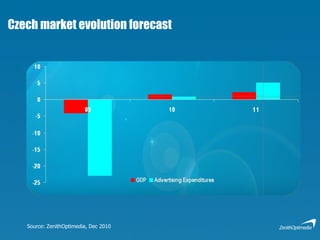

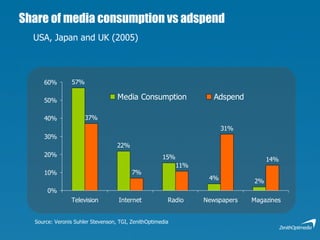

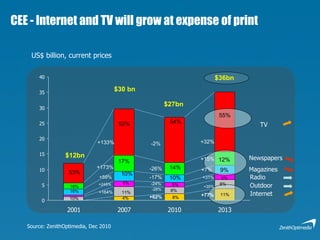

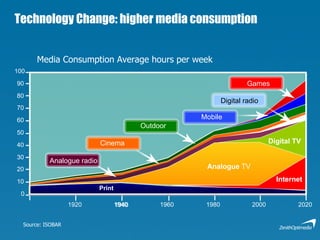

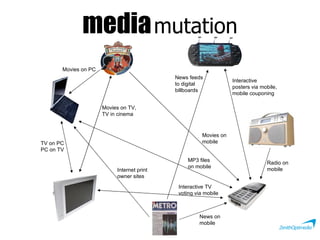

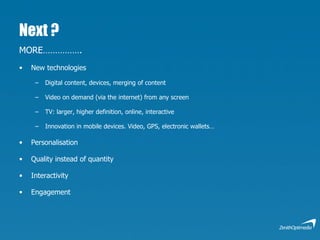

The document discusses changes in the media landscape as of January 2011, highlighting the growth of internet and TV advertising at the expense of print media. It includes statistics on advertising spend and media consumption trends, projecting a significant evolution in the Czech market by 2013. The report emphasizes the impact of technological advancements on media consumption habits and the shift towards digital and interactive content.

![Thank you for your attention Contact: Petr Majerik CEO ZenithOptimedia Prague Lecturer, University of Finance and Administration Prague [email_address]](https://image.slidesharecdn.com/1changesinmedialandscape100111-110418073249-phpapp01/85/Petr-Majerik-Zenith-OptiMedia-MediaTalk-11th-January-2011-10-320.jpg)