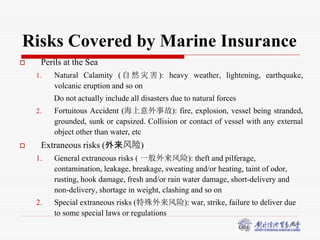

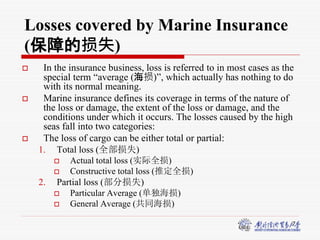

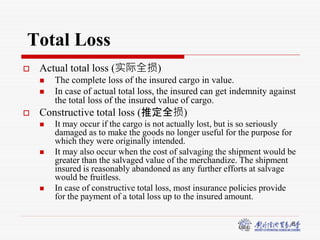

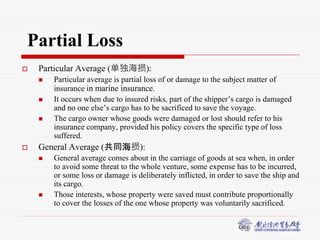

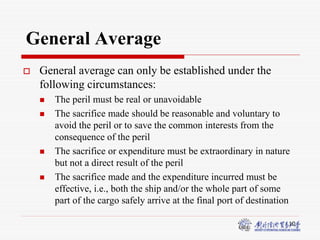

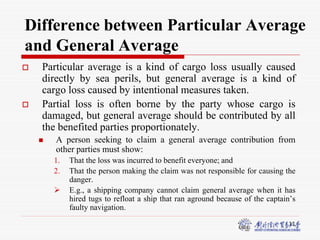

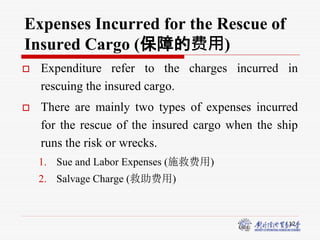

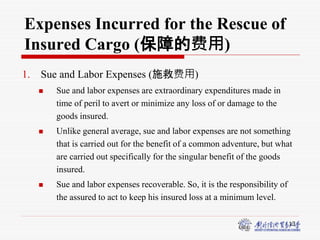

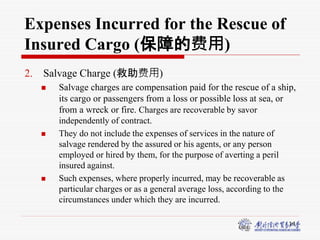

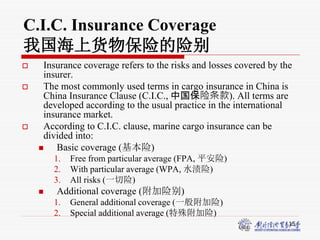

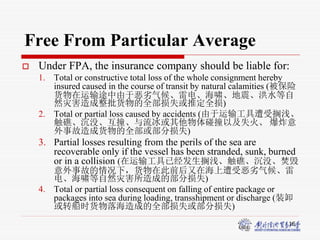

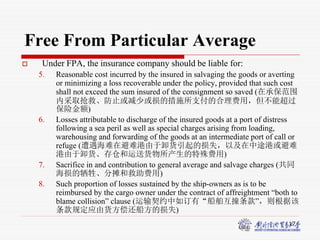

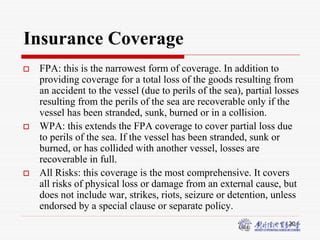

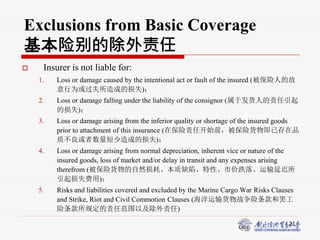

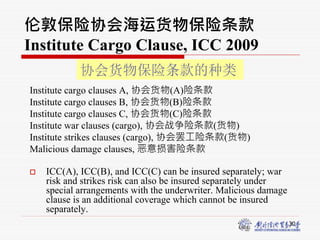

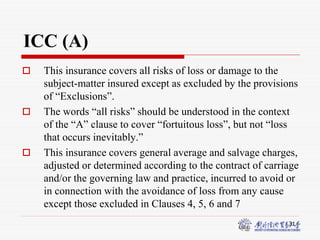

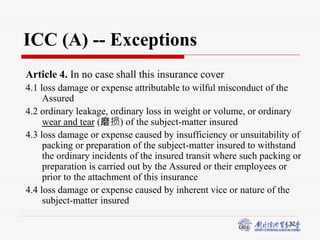

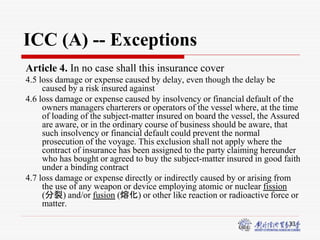

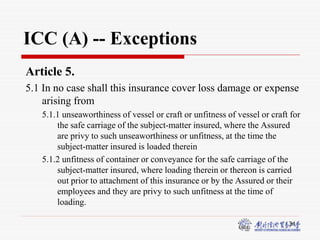

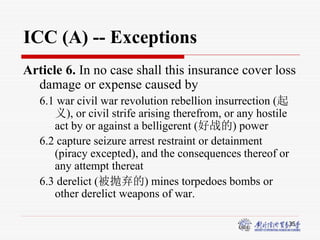

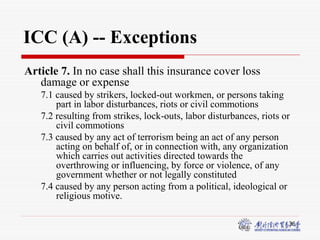

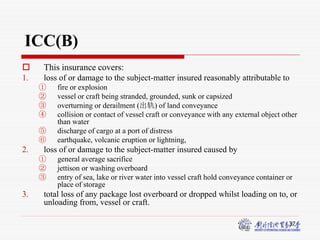

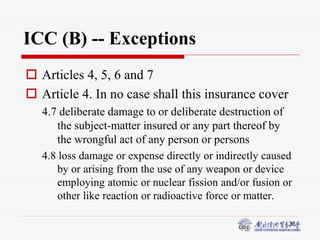

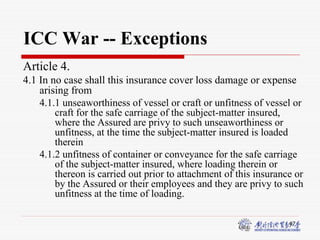

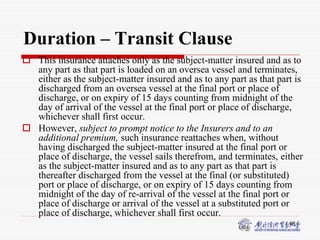

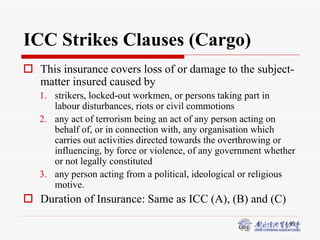

This document discusses various aspects of cargo insurance. It begins by explaining the basic principle of indemnity in insurance, which is to place the insured in the same position after a loss as before. It then discusses the importance of cargo insurance for protecting interests in goods in transit and enabling trade financing. The document goes on to explain different types of marine cargo insurance coverage including FPA (free from particular average), WPA (with particular average), and all risks. It defines losses covered such as total loss, partial loss, general average, and expenses incurred to rescue insured cargo. Finally it outlines exclusions from basic coverage under cargo insurance policies.