The document provides a summary of business and economic news from Mongolia in its Issue 336 dated August 1, 2014. Some of the key highlights include:

- Turquoise Hill announces the sale of a 29.95% stake in SouthGobi Resources to a Hong Kong company.

- Erdenes TT partners with Korean and Mongolian companies to develop a coal-to-methane gas facility at Tavan Tolgoi.

- Xanadu Mines expands drilling at its Altan Tolgoi copper-gold project, intersecting additional mineralization.

![Aspire Mining Ltd. announced plans to begin an exploration drilling program at the Nuurstei Coal

Project for its Ekhgoviin Chuluu joint venture with Noble Group.

The drilling program designed to confirm resource continuity to enable preliminary economic

assessment, as well as provide samples for testwork, will commence in August 2014. Regulatory

approval for an environmental plan submitted prior to the acquisition is first needed before drilling

can begin. Drilling will target the northern part of the Nuurstei Project tenement area, and consist

initially of 20 holes at an average 100 meter depth. After reviewing data from a 2011, 11-hole

drilling program at Nuurstei that focused on the northern region, Ekhgoviin Chuluu approved a 20-

hole drilling program with a budget of USD 500,000. Drilling is expected to be completed by the end

of September 2014, with laboratory analysis expected to be received in the December quarter.

Results from the drilling program will be used to prepare a pre-feasibility study, which will allow for

the grant of a mining license, and for the completion of a general environmental impact

assessment. Enkhboviin Chuluu believes there is already justification for a possible small-scale road-

base due to near-surface quality coking coal and close proximity to existing road infrastructure.

Coal produced at Nuurstei could be transported along this road to Erdenet where product could

then be loaded onto trains and delivered to customers. Land purchased at Erdenet by Aspire in 2012

could be used as a coal stockpile and train load-out area.

A paved road is currently being constructed between Moron Soum, Khuvsgul Aimag and the city of

Erdenet, where existing rail infrastructure terminates. Sealing of this road commenced in 2012 and

is due to be completed at the end of 2015. Ekhgoviin Chuluu will consider completing an ore-

feasibility study into a small scale operation following the results of the 2014 drilling program.

Source: Aspire Mining Ltd.

MEC TO LAUNCH MINING AT KHOSHOOT COAL MINE

Hong Kong-listed Mongolia Energy Corp. (MEC) plans to begin mining coal at the Khoshoot mine

located in Darvi Soum, Khovd Aimag [Source provides no data of commencement -ed].

MEC in 2014 sold 15,300 tons of coal, or three times as much as the year before. The company

reported that it narrowed it pre-tax loss to USD 1 billion, despite having to lower prices due to a

declining market conditions for coal.

Khoshoot has an estimated reserve of 141.5 million tons of coal.

Source: UB Post

GUILDFORD TO BEGIN TRIAL SHIPPING FROM BARUUN NOYON UUL COAL MINE

Guildford Coal Ltd. announced that trucking of trial batches of coal from the Baruun Noyon Uul

mine in the south Gobi will commence in mid‐August to the Shivee Khuren-Ceke border for planned

washing and testing of logistics.

Guildford is negotiating with a number of customers in China to take delivery of initial parcels and

bulk samples as part of its strategy to establish and position the Baruun Noyon Uul coking coal brand

in the Chinese market. This is a significant milestone for the future development of the mine and

Guildford's other mining licenses in the region.

Source: Guildford Coal Ltd.

ALS OPENS COAL ANALYTICAL LABORATORY AT TT

Diversified testing services provider ALS Group LLC announced the opening of the new coal

analytical laboratory at the Tavan Tolgoi mine in Umnugobi Aimag.

The coal arm of ALS (formerly Stewart Mongolia) has invested in a new state-of-the-art facility

comprising of an over 1,000 square meter building located just next to the Tavan Tolgoi mine. The

new laboratory will service state-owned Erdenes Tavan Tolgoi LLC, with whom ALS has a long-term

cooperation agreement. The new facility provides sufficient infrastructure to allow installation of

additional capital equipment on a ―plug & play‖ basis facilitating an increase in production capacity

at any given time. The new facility is equipped with the latest technologies available such as

sample preparation, proximate analyses, determination of calorific value, determination of total

sulphur and phosphorus and free swelling index, and geotechnical analyses.](https://image.slidesharecdn.com/nw336-160215022025/85/01-08-2014-NEWSWIRE-Issue-336-4-320.jpg)

![Source: ALS Group LLC

MINING MINISTRY TO COOPERATE WITH MIRECO FOR 'FRIENDLY' MINING

The Ministry of Mining has partnered with the Mine Reclamation Corporation of Korea (MIRECO) to

explore environmentally friendly and sustainable mining methods.

A memorandum was signed Tuesday by R. Jigjid, state secretary of the Mining Ministry, and MIRECO

Chief Executive Officer Kwon Hyuk-in. MIRECO's plans include prevention long-term damage from

mines, improvement projects effects on the environment, treatment of water used for mining

operations and contaminated soil, and forestry reclamation.

Source: Montsame

KEPCO TO BUILD POWER PLANT IN MONGOLIA

KEPCO, Korea's biggest power supplier, won the exclusive right to build and operate a fossil fuel

power plant in Ulaanbaatar, Mongolia, the company said Friday. Chief negotiators from KEPCO and

the Mongolian Energy Ministry signed a memorandum of understanding in Mongolia, Thursday, three

months after the two sides agreed to work together to improve the power supply infrastructure in

Mongolia.

"This is a milestone making it possible for us to make inroads into the fast-growing power supply

market in Mongolia," KEPCO said in a statement. "This project will make it possible for us to win

other projects there."

It is uncertain when the two sides will sign an official contract and when construction will begin.

"We will start a feasibility study soon," said a KEPCO official familiar with the case. "So it's hard to

predict when we will sign an official contract."

KEPCO is the world's sixth-largest power plant builder, having built nearly 40 nuclear and fossil fuel

power plants in 20 countries. KEPCO said it was seeking business opportunities in other developing

nations in Central Asia.

Source: Korea Times

AUSTRALIAN WOLF STALKS MONGOLIAN OIL OPPORTUNITIES

Australia's Wolf Petroleum Ltd. is hoping the recent passing of a new petroleum law will open up oil

production opportunities in Mongolia.

Wolf Petroleum is the only Australia-listed oil and gas company operating in Mongolia. But the

industry minnow, capitalized at just AUD 5.5 million (USD 5.2 million), claims a position as

Mongolia‘s largest petroleum acreage holder, with one production block and two exploration areas

covering more than 74,400 square kilometers (18,000 million acres). The long-awaited petroleum

law, which was enacted on 1 July, replaced one which had been on the books since 1991.

The new law is designed to boost foreign investment in Mongolia‘s petroleum industry and provide

among the most competitive production-sharing terms in the world, Wolf Petroleum Ulaanbaatar-

based Chief Executive Officer Bataa Tumur-Ochir said via email. Under the new law, production-

sharing contracts can be approved by the government within 180 days of request by the developer.

Royalty payments are 5 percent and contractors are exempt from customs duty, value-added tax in

the first five years and income taxes from oil sales. In addition, exploration, operation,

development and production costs can be recovered 100 percent.

Mongolia has a history of producing and refining its own oil, but the domestic industry shut down in

the 1960s. According to the U.S. Energy Information Administration, oil production resumed in a

small way in 1998, but did not start climbing significantly until after 2005, reaching 14,050 barrels a

day in 2013.

―PetroChina and Sinopec started their first oil production in 2005 and production has multiplied 25

times within the last nine years,‖ Tumur-Ochir said. ―Mongolia forecast annual production for this

year would be close to seven million barrels/year and by 2016 [it would be] over 10 million

barrels/year,‖

The EIA put Mongolia‘s oil consumption at 23,260 barrels a day in 2012, with net petroleum imports

estimated at 13,330 barrels a day. With plans afoot to build a new refinery in the country, albeit](https://image.slidesharecdn.com/nw336-160215022025/85/01-08-2014-NEWSWIRE-Issue-336-5-320.jpg)

![led by more than 30 percent of the population, Mongolia is looking to capitalize on its unique

culture and attractive scenery in a bid to open the world‘s eyes to many of its strengths as a place

to visit and do business. As a country rich with natural resources and a well-established mining

industry, Mongolia has been actively promoting itself to investors and business owners around the

globe, including in Canada through its newly established Canada Mongolia Chamber of Commerce,

located in Toronto.

―These days, Mongolian cashmere and sea-buckthorn berries have been two of the latest Mongolian

exports to gain popularity on the world stage. And likewise, as a country that has seen regular

double-digit growth, its emerging middle-class enjoys traveling to other countries and imported

goods,‖ said the chamber‘s executive director, Bolor Sambuu.

Canada is the second largest investor in Mongolia, and Export Development Canada (EDC) is actively

pursuing business there, having assisted 28 Canadian firms from its regional offices in Moscow,

Russia. Canadian businesses already export nearly USD 72 million to Mongolia. The Canadian

government has taken an important step to offer additional support to Canadian businesses by

opening up a Canadian Embassy in Ulaanbaatar.

Source: Tradeready.ca

VISA-FREE TRAVEL TO MONGOLIA FOR CITIZENS FROM 42 ADDITIONAL COUNTRIES

The Mongolian people easily find common ground with others, regardless of differences in religion,

culture and background, and Mongolians appreciate the value of meeting new people and learning

new things—a legacy deeply rooted in their nomadic origin, so now since 25 June, visitors from 42

nations no longer require a visa when traveling to Mongolia.

The government on 12 June issued Resolution No. 186, which opens up the opportunity for citizens

of a number of countries to visit Mongolia without obtaining a visa in 2014 and 2015. The resolution

has become effective starting 25 June and will remain valid until 31 December 2015. By eliminating

the step of obtaining a visa, Mongolia hopes to advance its tourism sector using the opportunity of

having the ―Welcome to Mongolia‖ Year 2015.

Now, 42 additional countries are included in the list of the countries that can visit Mongolia without

a visa: Luxembourg, Norway, Switzerland, Austria, Netherlands, Ireland, Sweden, Iceland, Belgium,

Denmark, Finland, France, Italy, Malta, Slovenia, Czech Republic, Slovakia, Estonia, Greece, Spain,

Portugal, Lithuania, Poland, Hungary, Latvia, Bulgaria, Romania, Lichtenstein, Monaco, Andorra,

Gibraltar, Vatican, Bahamas, Barbados, Trinidad Tobago, Argentina, Uruguay, Panama, Chile,

Grenada, Costa Rica, and Seashells. Thanks to this new resolution, visitors from these countries can

now enjoy a stay in Mongolia of up to 30 days from the date of entry without the hassle of obtaining

a visa. The only thing that a visitor should do before setting foot on the plane is to check whether

his or her passport is valid for at least 6 months. Travelers are invited to take advantage of this

unique opportunity while it is available.

In addition to the 42 countries mentioned above, 36 countries hold bilateral agreements with

Mongolia, which allows their citizens to visit Mongolia without a visa depending on their passport

types.

Source: 4Hoteliers.com

MINE SAFETY IN QUESTION AS 20-YEAR-OLD WORKER DIES OF SUFFOCATION

An accident resulting in the death of a 20-year-old artisanal miner at a micro-mine in Ulaanbaatar's

Nalaikh District on Tuesday has raised new questions about mine safety there.

The Mine Rescue Services (MRS) received a report that an unconscious young man had been pulled

out from 100 meters below ground. The young man had reportedly suffocated to death because of

poor safety precautions. The death follows a similar incident last year in May, when a 40-year old

man was found dead, also due to suffocation.

The mine, which is located at Orosiin Nuur in Nalaikh, is owned by Zoljargal [Source does not

provide a full name -ed]. Nalaikh District‘s inspectors and police at the scene of the accident

discovered that the mine‘s power had been cut off before the accident occurred. Authorities sealed

off the mined after their investigation.](https://image.slidesharecdn.com/nw336-160215022025/85/01-08-2014-NEWSWIRE-Issue-336-13-320.jpg)

![Ulaanbaatar Governor Erdene Bat-Uul in May issued an ordinance for the closure of all the micro

mines in Nalaikh District to prevent more accidents. A total of MNT 55.6 million was spent from the

city budget to close down the mines. The ordinance is still effective, despite opposition from

Nalaikh District residents, and there have been several reports that miners are still illegally mining

coal from those mines.

―Brick factories buy coal from micro-mines in Nalaikh all year round, so illegal miners do not cease

extraction despite low coal demand in warm seasons,‖ said MRS Squad Chief D. Purevsuren.

Including this most recent death, two miners have died this year at the Nalaikh mines, and 27

miners have been rescued by the MRSM. On average, ten to 17 people die in the Nalaikh mines

every year, with 125 reported deaths between 2004 and 2009 and 287 injuries. In total, 61 miners

died in the Nalaikh micro mines between 2010 and 2013. The majority of the victims were between

15 and 35 years old, and the most common reason for accidents was either soil collapse inside the

underground mines or lack of air provisions.

Source: UB Post

OVER 87,000 CITIZENS TO RECEIVE FOOD STAMPS

The government is prepared to deliver foods stamps to 87,778 people from 15,137 families,

according to the Ministry of Human Development and Social Welfare.

The government has run its food stamp program for 5 years, making low-income citizens with wages

below the country's poverty line eligible for foods stamps accepted at 668 shops in Ulaanbaatar.

Coupons are able to redeem MNT 10,000 in food such as meat, milk, flour, eggs, vegetables, rice

and fruit for adults and MNT 5,000 for children.

Source: UB Post

JAPAN‟S LAST “AID” FOR MONGOLIA, USD 2.3 BN FOR NEW HEALTH SCIENCES UNIVERSITY

Japan will grant USD 2.3 billion as its last form of development aid to Mongolia for the construction

of a health sciences university, Japanese Ambassador Takenori Shimizu said at a press conference

[Source provides no date when press conference was held -ed]. Construction is set to begin next

year.

Source: Undesnii Shuudan

ULAANBAATAR TO SELL MONTHLY BUS PASSES

Ulaanbaatar will sell monthly bus passes for MNT 30,000, beginning in September. The order for the

launch of the monthly passes came from Ulaanbaatar's Specialized Inspection Agency and Public

Transportation Department.

Source: Udriin Sonin

WATER SCARCITY AND RISING ENERGY COSTS THREATEN MINING INDUSTRY

Access to water has become one of the most significant business risks for miners, says a report that

also highlights the threat to the sector from rising energy costs in some resource-rich areas. The

greatest risks were seen in Chile, Peru, South Africa and Mongolia in Ernst & Young‘s report

―Business risks facing mining and metal 2014-2015.‖

EY, the consultancy, said affordable water and energy should now be viewed as one of the 10

biggest problems for miners. Spending by mining companies on water infrastructure amounted to

almost USD 12 billion last year, compared with USD 3.4 billion in 2009, EY said. BHP Billiton Ltd.

and Rio Tinto PLC, the two largest miners in the world by market capitalization, are investing USD 3

billion to build a desalination plant at Escondido, the Chilean copper mine that is the world‘s

largest by output.

The EY report underscores how water resources are becoming an increasingly important concern

across business. Peter Brabeck, chairman of Nestlé, said water scarcity presented a more urgent

challenge than climate change. EY said large companies such as Rio, BHP and Anglo American PLC

had the expertise and financial strength to build complex water procurement systems for large

projects and were therefore ―likely to emerge as the partners of choice in water-scarce countries](https://image.slidesharecdn.com/nw336-160215022025/85/01-08-2014-NEWSWIRE-Issue-336-14-320.jpg)

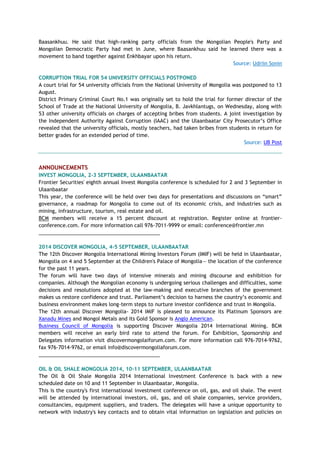

![INFLATION

Year 2006 6.0% [source: National Statistical Office of Mongolia (NSOM)]

Year 2007 *15.1% [source: NSOM]

Year 2008 *22.1% [source: NSOM]

Year 2009 *4.2% [source: NSOM]

Year 2010 *13.0% [source: NSOM]

Year 2011 *10.2% [source: NSOM]

Year 2012 *14.0% [source: NSOM]

Year 2013 *12.5% [source: NSOM]

June 30, 2014 *14.6% [source: NSOM]

*Year-over-year (y-o-y), nationwide

Note: 15.1% y-o-y, Ulaanbaatar city, June 30, 2014

CENTRAL BANK POLICY LOAN RATE

December 31, 2008 9.75% [source: IMF]

March 11, 2009 14.00% [source: IMF]

May 12, 2009 12.75% [source: IMF]

June 12, 2009 11.50% [source: IMF]

September 30, 2009 10.00% [source: IMF]

May 12, 2010 11.00% [source: IMF]

April 28, 2011 11.50% [source: IMF]

August 25, 2011 11.75% [source: IMF]

October 25, 2011 12.25% [source: IMF]

March 19, 2012 12.75% [source: Mongol Bank]

April 18, 2012 13.25% [source: Mongol Bank]

January 25, 2013 12.50% [source: Mongol Bank]

April 8, 2013 11.50% [source: Mongol Bank]

June 25, 2013 10.50% [source: Mongol Bank]

July 30, 2014 12.00% {source: Mongol Bank}

CURRENCY RATES – 31 JULY 2014

Currency Name Currency Rate

US Dollar USD 1,870.92

Euro EUR 2,506.28

Japanese yen JPY 18.19

British pound GBP 3,161.48

Hong Kong dollar HKD 241.41

Chinese Yuan CNY 303.14

Russian Ruble RUB 52.70

South Korean won KRW 1.82

Disclaimer: Except for reporting on BCM‘s activities, all information in the BCM NewsWire is

selected from various news sources. Opinions are those of the respective news sources.](https://image.slidesharecdn.com/nw336-160215022025/85/01-08-2014-NEWSWIRE-Issue-336-26-320.jpg)