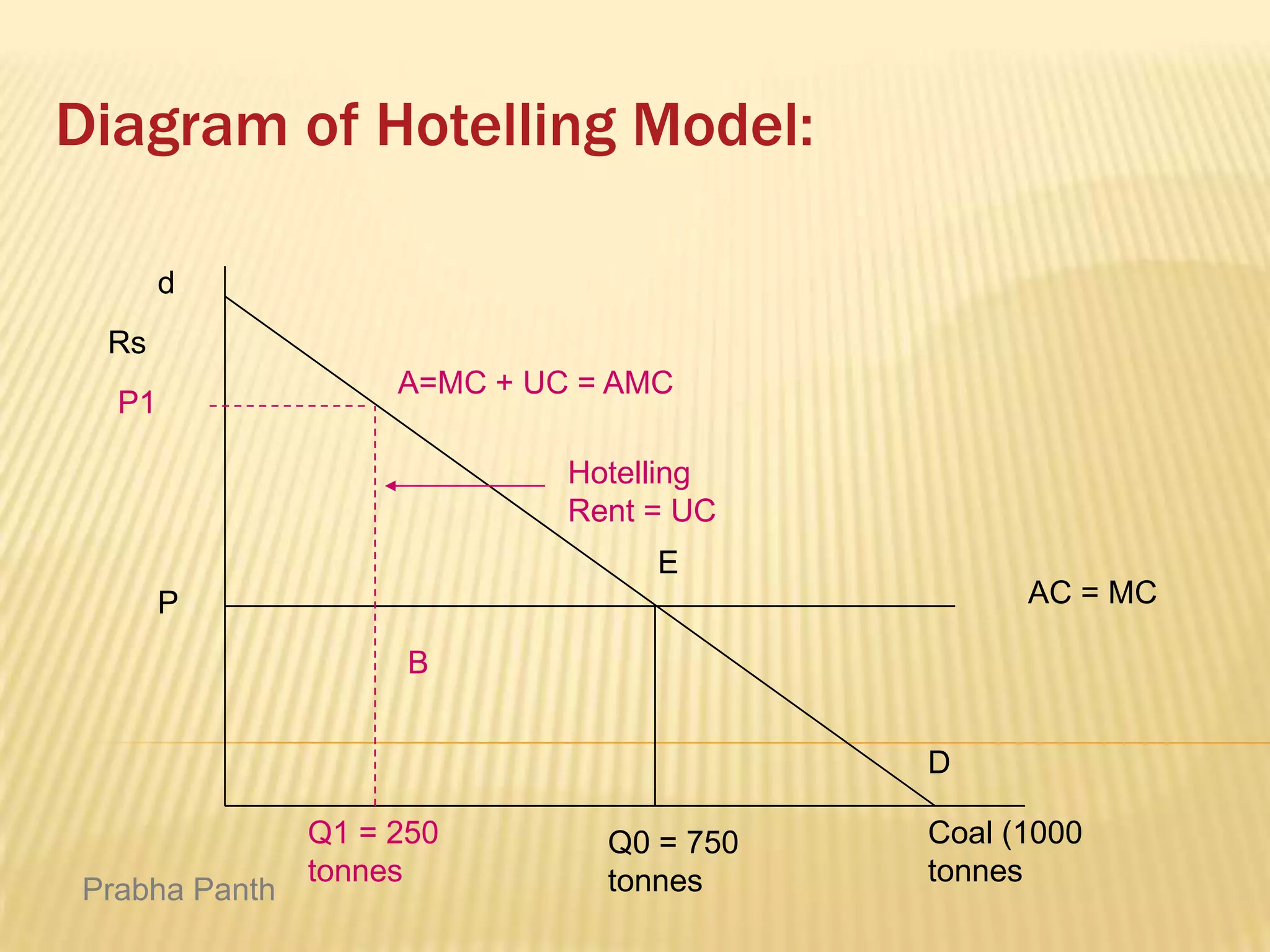

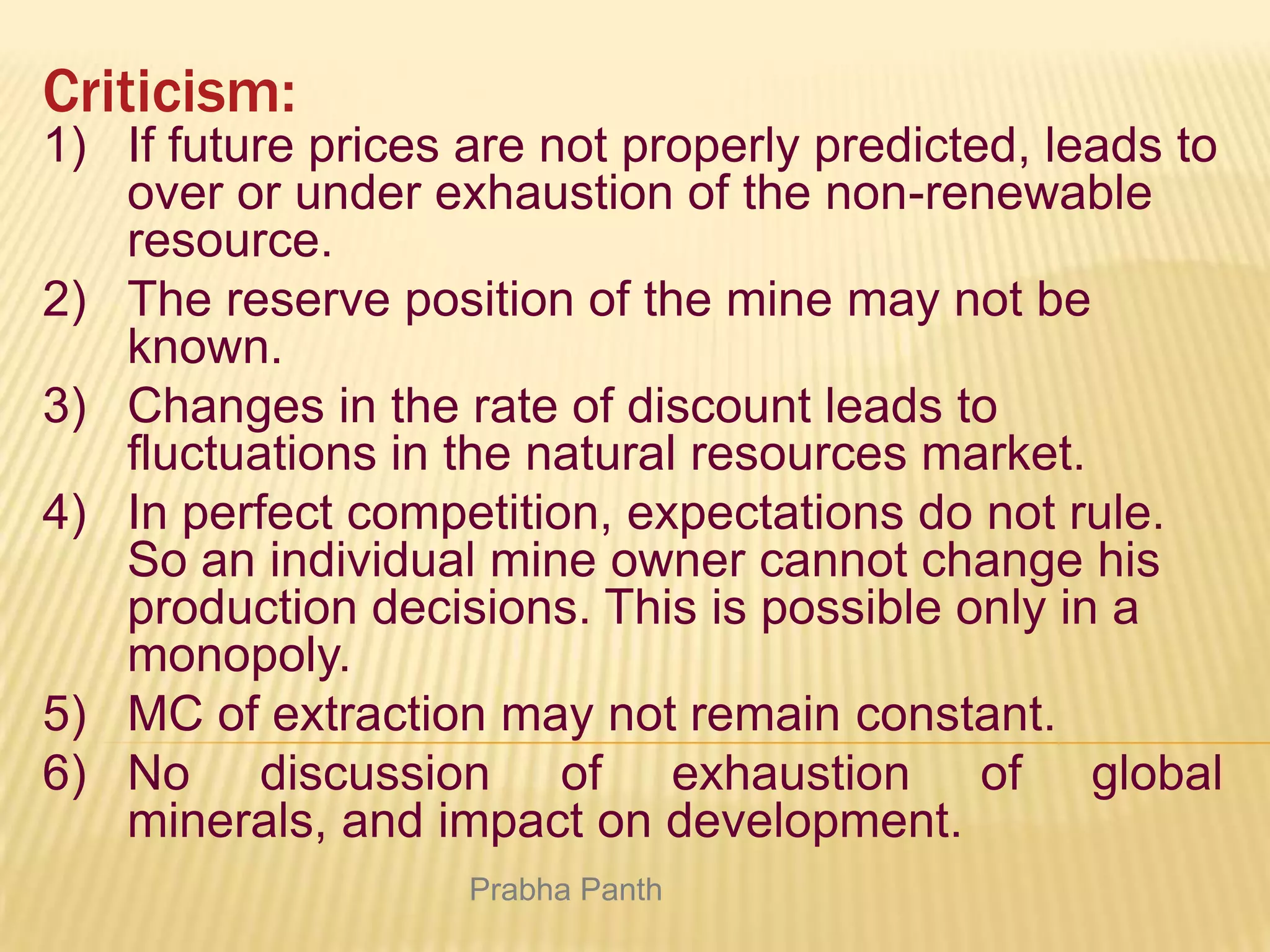

Hotelling's theory focuses on the optimal extraction of non-renewable resources, emphasizing the trade-off between current profits and future availability. Mine owners must consider opportunity costs and the expected future price of the resource to determine how much to extract over time. Critiques of the theory highlight issues like uncertainty in future prices, changes in resource reserves, and the assumption of constant extraction costs.