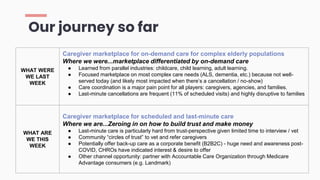

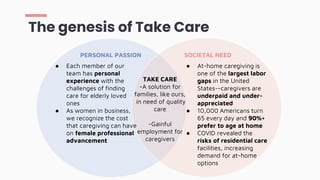

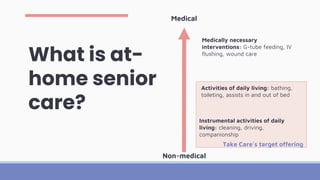

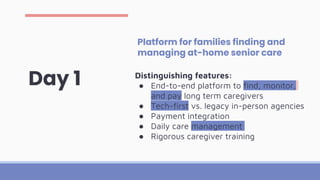

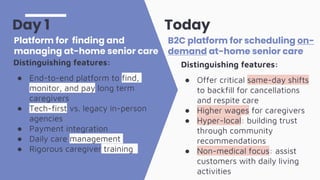

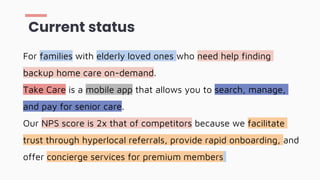

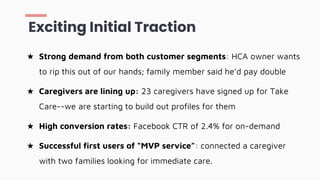

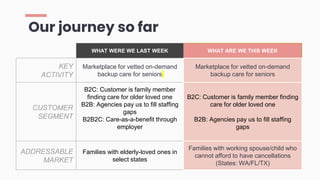

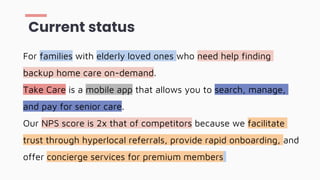

This document provides an overview of Take Care, a platform for on-demand at-home senior care. The team developing Take Care has experience in business, engineering, medicine, and education. They aim to address the challenges families face finding quality senior care and the lack of good jobs for caregivers. Initially, Take Care will focus on non-medical care like cleaning and companionship. It will use a mobile app to connect families needing care with vetted caregivers who can be managed and paid through the platform. The founders have identified unmet demand and pain points through customer interviews. Their business model focuses on filling scheduling gaps for agencies to improve customer satisfaction while offering caregivers higher wages for last-minute shifts.

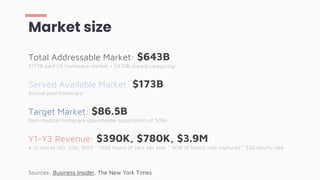

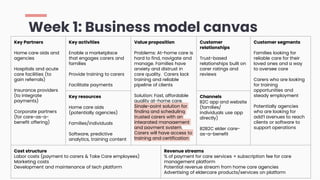

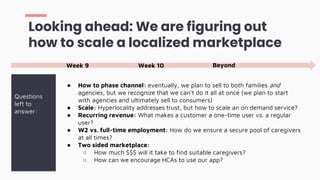

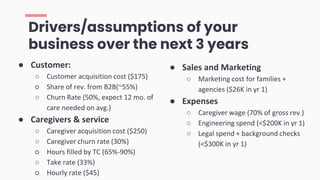

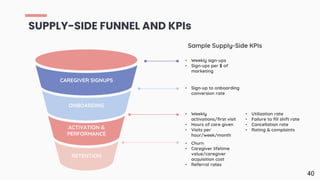

![Week 6-8: B2C and B2B are the most

promising channels

What We

Expected

What We

Found

Care-as-a-benefit

could accelerate

demand-side of

market

Last minute

cancellation is the

“achilles heel” of the

industry

Payors could include

employees or health

insurers

Week 6 - 8 Week 9

B2B2C: Employee care-as-a-benefit

and insurance payors are promising

customers

Employee benefits are focused on

childcare and fertility.

Home care agencies struggle to fill

gaps, leading to customer churn

“[S]ales cycles are long and hard. If you

want you could start talking to brokers

now--it’ll be a 2 to 3 year conversation”

-Chief HR Officer

“Let me know when the company is up

and running. This type of last-minute

staffing solution is exactly what we

need” -Home Care Agency Owner

Week 6 - 8 pivots

B2C → B2B2C → B2C & B2B (selling to

home care agencies)](https://image.slidesharecdn.com/takecarew10vf-210604054844/85/Takecare-Engr245-2021-Lean-Launchpad-15-320.jpg)

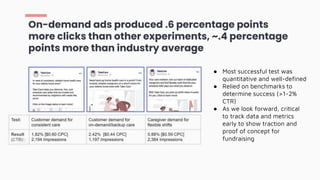

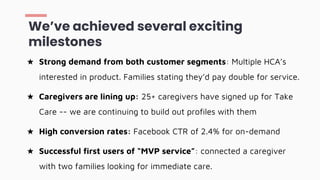

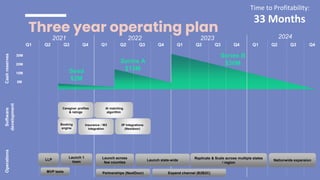

![We are testing demand for

consistent care and backup care

Test: Customer demand for

consistent care

Customer demand for on-

demand/backup care

Caregiver demand for

flexible shifts

Result

(CTR):

1.82% [$0.60 CPC]

2,194 Impressions

2.42% [$0.44 CPC]

1,197 Impressions

0.88% [$0.59 CPC]

2,384 Impressions](https://image.slidesharecdn.com/takecarew10vf-210604054844/85/Takecare-Engr245-2021-Lean-Launchpad-44-320.jpg)