The document discusses the accounting requirements and financial statements for partnerships. It covers:

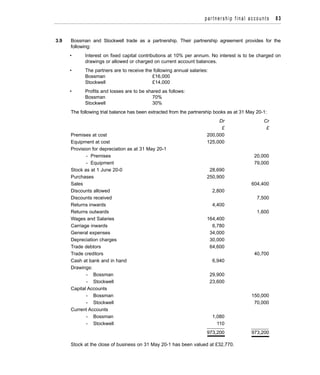

- Partnerships must follow rules in the Partnership Act 1890 or rules agreed in a partnership agreement.

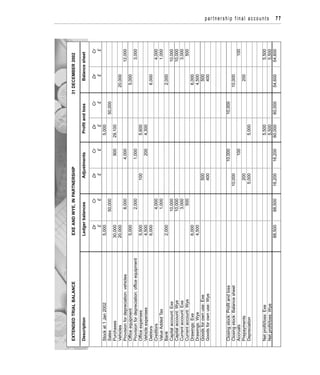

- A partnership prepares year-end accounts including a profit and loss account and balance sheet. It also includes an appropriation section showing how profit is shared among partners based on the partnership agreement.

- Partnership agreements typically specify how profits and losses are shared, whether partners receive salaries/interest on capital, and if interest is charged on partner drawings.