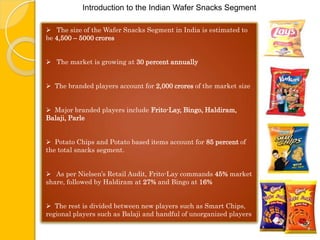

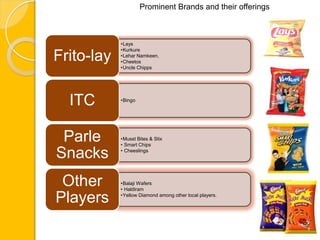

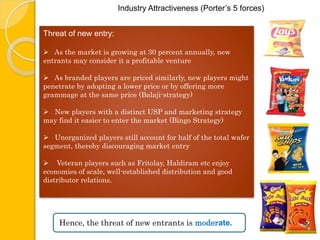

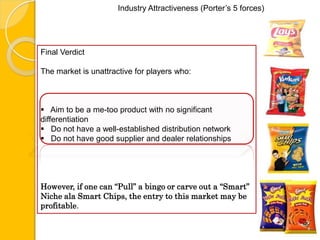

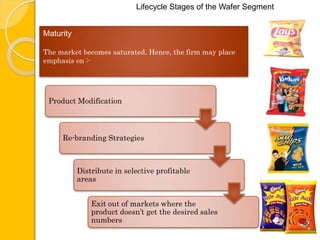

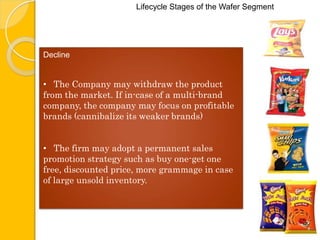

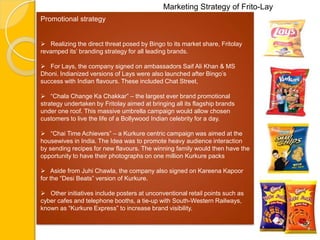

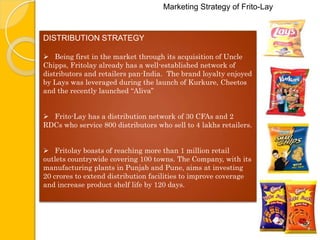

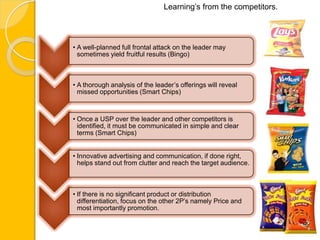

The document provides an overview of the Indian wafer snacks market. It discusses the market size of approximately Rs. 4,500-5,000 crores annually and growth rate of 30%. Major players include Frito-Lay, Bingo, Haldiram, and Balaji. Frito-Lay commands 45% market share. The document then analyzes the industry attractiveness using Porter's 5 forces model, finding the threat of new entrants and competitive rivalry to be moderate and high respectively. Finally, it summarizes the marketing strategies of leaders Frito-Lay and Bingo, and challenger Smart Chips.