CMT Level III Sample Exam Guide

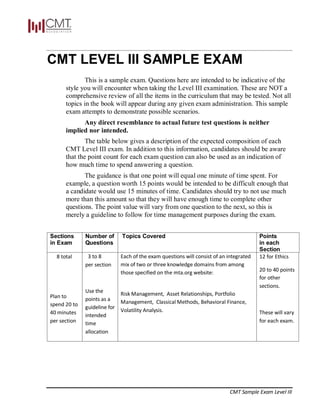

- 1. CMT Sample Exam Level III CMT LEVEL III SAMPLE EXAM This is a sample exam. Questions here are intended to be indicative of the style you will encounter when taking the Level III examination. These are NOT a comprehensive review of all the items in the curriculum that may be tested. Not all topics in the book will appear during any given exam administration. This sample exam attempts to demonstrate possible scenarios. Any direct resemblance to actual future test questions is neither implied nor intended. The table below gives a description of the expected composition of each CMT Level III exam. In addition to this information, candidates should be aware that the point count for each exam question can also be used as an indication of how much time to spend answering a question. The guidance is that one point will equal one minute of time spent. For example, a question worth 15 points would be intended to be difficult enough that a candidate would use 15 minutes of time. Candidates should try to not use much more than this amount so that they will have enough time to complete other questions. The point value will vary from one question to the next, so this is merely a guideline to follow for time management purposes during the exam. Sections in Exam Number of Questions Topics Covered Points in each Section 8 total Plan to spend 20 to 40 minutes per section 3 to 8 per section Use the points as a guideline for intended time allocation Each of the exam questions will consist of an integrated mix of two or three knowledge domains from among those specified on the mta.org website: Risk Management, Asset Relationships, Portfolio Management, Classical Methods, Behavioral Finance, Volatility Analysis. 12 for Ethics 20 to 40 points for other sections. These will vary for each exam.

- 2. CMT Sample Exam Level III SECTION #1: ETHICS (12 POINTS) 1. Jorge Salvador, CMT, is a technical analyst for a buy-side firm. He works researching developing countries with rapidly modernizing economies. Securities laws in these countries are not as extensive as elsewhere. When Salvador is approached by a corporate owner within one of these countries, which of the following is correct? (2 points) A) Salvador does not to worry about violating rules and laws governing insider information. B) Salvador must write a report of all his communications and inform management periodically. C) Salvador does not need to be concerned about U.S. rules since he is researching a developing country. D) Salvador may be required to abide by the requirements of the Code and Standards even if there is a distinction between rules of the code and developing country.

- 3. CMT Sample Exam Level III 2. Bobby Guyer, CMT, manages several discretionary accounts for clients as a Registered Investment Advisor. Bobby has begun to use twitter messages to communicate new ideas he is looking at as possible short-term trades in his client portfolios. His clients love getting the information because they feel he is keeping them up to the minute. The problem is that about half of his client accounts are not suitable for such trades. Bobby has not communicated with these clients about the difference in the trades he sends out on twitter. Some of the clients he has have begun to ask for more information about how they can participate in such trades, which is Bobby’s intent. Which of the following is most accurate regarding Bobby’s de facto marketing behavior? (2 points) A) Bobby is in violation of Standard III(C.2) because his recommendations are not consistent with the original mandate given him for half of his clients. B) Bobby is not in violation Standard III(C) because he does not force any trades on his clients. C) Bobby is not in violation Standard III(C.2) because his communications comply with the existing guidance and regulation governing use of social media. D) Bobby is in violation of Standard III(C) because he manages discretionary accounts.

- 4. CMT Sample Exam Level III 3. Scott Fielding, CMT, is a strategist for a firm that manages high-net- worth portfolios at a large global bank. The Director of sales has asked him for some figures to help launch a new specialized fund offering based on one of his strategies. The Director is looking for a 5-year track record. Scott only has one year of out-of-sample data trading the system; the other four years are a back test. The Director persuades him that the firm should publish all five years of data. Which of the following statements is most likely correct? (2 points) A) Fielding and the Director have solid data on the strategy so they are not misrepresenting the performance over the past five years. B) Fielding and the Director have violated Standard II(A) by sharing material nonpublic information. C) Fielding and the Director have violated Standard I(C) by misrepresenting their data as actual performance data instead of theoretical modeling and backtesting. D) Fielding and the Director have violated Standard III by not dealing fairly with the clients.

- 5. CMT Sample Exam Level III 4. Shelly Ulsterlow, CMT, is a senior technical analyst for an investment banking firm. She is frequently asked to make media appearances on market conditions. In the course of a recent appearance, her interviewer asked her about a sizable position her bank was rumored to have purchased in a pre-IPO company. Although Ulsterlow didn’t know anything about this situation, she did not want to appear uninformed about her own company so she acknowledged the rumor and began to articulate information she assumed would be correct. Which of the following statements is most accurate? (2 points) A) Ulsterlow is protected by the First Amendment of the U.S. constitution and can say whatever she wants as part of journalistic license. B) Ulsterlow is not in violation of any of the CFA Standards of Professional Conduct. C) Ulsterlow is in violation of multiple standards listed in the CFA Standards of Professional Conduct. D) Ulsterlow is in violation of only Standard II(B) because her statements may manipulate the perceived market value of the pre-IPO company.

- 6. CMT Sample Exam Level III 5. Ren Griswold, CMT, manages a portfolio of managed futures accounts for several institutional clients. He invests in various spread strategies involving a number of commodities. Griswold has a hunch that Gold prices are about to soar higher. In the past his hunches have been highly profitable investments, so he asks his technical analyst to draft up a bullish outlook for gold that he can use to help persuade his clients to allocate more money toward gold than his mandate normally allows. Which of the following statements about Griswold is the most accurate? (2 points) A) Griswold should do the analysis himself so that is not likely to be in violation of Standard III(A) by not acting with prudence and care. B) Griswold should do the analysis himself because the data is likely to be misrepresented otherwise. C) Griswold’s associate is not likely to be objective with his report and sharing that information would be in violation of Standard I(B). D) Griswold’s associate is not likely to be objective with his report and sharing that information would be in violation of Standard II(D).

- 7. CMT Sample Exam Level III 6. James Bunson, CMT, is a proprietary trader who has been trading a system he has developed and refined over the past five years. His firm intends to soon use the system in an automated fashion as part of their CTA business. Bunson finds one day that his performance data has inadvertently been overstated for the past year by about a third. Because the firm is only two weeks away from launching their offering, Bunson decides to say nothing. Which of the following statements is most likely to be accurate? (2 points) A) Bunson is not yet in violation of any standards. B) Bunson is in violation of Standard III(D) by not ensuring that the data is accurate. C) Bunson’s system still makes money even if the performance is slightly overstated, so it really doesn’t matter that he may be off the mark just a little. D) Bunson is in violation of Standard IV(A) by being disloyal to his employer.

- 8. CMT Sample Exam Level III SECTION #2: BEHAVIORAL FINANCE (20 POINTS) 7. Identify which five of the following are phases of an asset bubble as Montier describes them (5 points, 2 point each), A) Lethargy—markets going nowhere B) Displacement—exogenous shock triggers profit opportunity in some sectors but not in others C) Credit creation—boom and monetary expansion D) Debt consolidation—consumer confidence dissipates E) Euphoria—overestimate of returns F) Critical stage—financial distress as insiders cash out and firms consider defaulting G) Revulsion—investors stop participating, paralyzed by fear H) Capitalization—traders take advantage of market moves I) Recovery—markets begin to rebound J) Transition—capital markets become more liquid 8. Investment committees are standard in the investment world and in some cases are legislated. Groupthink can be a big problem when it comes to investing. We often see conflicting opinions from the same firm on market direction. State two conditions where group decisions are statistically useful. (6 points) State three potential strategies to reduce group biases. (9 points)

- 9. CMT Sample Exam Level III SECTION #3: ASSET RELATIONSHIPS (31 POINTS) You are a large-cap portfolio manager. Despite your large-cap mandate, you like to monitor the relative strength ratio of the small-cap stock index divided by the large-cap stock. After a nine-month downtrend this relative strength ratio has put in a bottom and has started to move higher. 9. What sector should you consider adding exposure to? (3 points) A) Staples B) Tech C) Telecom D) Utilities 10. Give two reasons why small-cap relative strength suggests you should add to this sector? (6 points) 11. Copper has been selling off for the past month on an absolute basis and relative to other currencies. As an emerging markets equity manager, which country should you consider reducing exposure in? (3 points) A) China B) India C) Mexico D) Russia 12. Explain one reason why weakness in copper would cause you to consider reducing exposure to this country? (3 points)

- 10. CMT Sample Exam Level III Wayne Garthrow, CMT, is a Junior Portfolio Manager for a $3B large-cap equity fund at Illinois Investment Services Inc. Wayne is part of a team that also consists of a Portfolio Assistant, 2 Client Portfolio Managers and a Senior Portfolio Manager. Wayne was recently added to the team because of his experience in fusing technical market analysis with economic indicators. One of the Conference Board’s economic indicators that Wayne finds especially useful is the 4- Week Moving Average of Initial Jobless Claims. Recently, Wayne noticed that this indicator has broken higher out of a multi-month base. Chart 3-1

- 11. CMT Sample Exam Level III Chart 3-2 Chart 3-3

- 12. CMT Sample Exam Level III 13. Compare Chart 3-1 with Chart 3-2 and Chart 3-3. Which of the RRG chart options is more likely to be an actual snapshot of S&P sector rotation taking place around the timeframe marked by the letter X on Chart 3-1 above? (5 points) A. Chart 3-2 B. Chart 3-3 C. Neither D. Both 14. Briefly explain the reasons for your choice. Be sure to focus your comments on sector rotation and the possible implications for the economy, describe the logic behind your answer. (6 points) 15. Which one of the following lists contains a mix of leading and lagging indicators? (5 points) A. ISM New Orders Index, Consumer Sentiment, Interest Rate Spread B. Building Permits (New Private Housing), Displaced Moving Average, Manufacturers New Orders C. Commitment of Traders Report, Odd-Lot Sales, MACD D. Short Interest Ratio, Forecast EPS growth, Return on Assets

- 13. CMT Sample Exam Level III SECTION #4: SYSTEM DEVELOPMENT (35 POINTS) 16. Risk control can involve complex mathematics, but there are a number of commonsense principles the investment professional can follow to reduce the risk of ruin. List 3 of the most important commonsense risk-control rules. (12 points) 17. You work for a CTA firm and have worked hard to develop several viable trading systems covering a diversified variety of market instruments. You have taken care to properly test these systems, avoiding data snooping, or curve-fitting them to in-sample data. Next, you merged these several systems into an overall portfolio model. What method might you use to test your hypothesis and determine the probability of your trading system succeeding? (4 points) Briefly describe that testing method and its meaning. (6 points) 18. List three steps that, when added to a trading plan, would limit the major disadvantage of a simple trend-following system. (6 points total, 2 per answer)

- 14. CMT Sample Exam Level III NOTE TO CANDIDATES: QUESTION 16 IS A NEW QUESTION TYPE TO BE USED BEGINNING OCTOBER 2017. The following sample question represents a new type of question you will encounter during the October 2017 exam. This question includes the use of an interactive spreadsheet table built in to the examination platform. The purpose of the question is to test a candidate in the way an analyst on the job may need to perform. For this question a candidate will be expected to edit the cells of the spreadsheet to determine proper references or calculation of formulae. This is a way of testing the candidate’s ability to recognize accurate information and to determine its significance. The actual exam question will include a similar testing methodology to the one described as follows. 19. In reviewing a performance analysis of your firm’s two trading systems, your colleague believes that there is an error in one or more of the ratio formulas in the spreadsheet below. Your colleague points out that the entry called “composite score” shows System 1 has a much higher number than System 2—which seems incorrect to him. The composite score is an average of the Sharpe Ratio, Treynor Ratio, and Calmar Ratio, so if a value among the composite scores is wrong, there may be something wrong with one or more ratio formulas. To answer this question you will need to activate the spreadsheet and identify the error(s) in the formulas, if any, and fix them to determine the proper Composite scores. Note: the actual exam will provide instructions on how to activate the spreadsheet functions in the table.” Review the following table of information to determine if the calculations for the performance ratios contain any errors.

- 15. CMT Sample Exam Level III System 1 System 2 Starting Equity Value 10,000,000.00 $ 10,000,000.00 $ Trailing 3-year ROR 12.5% 13.5% Peak Equity Value 16,258,300.00 17,855,600.00 Maximum Drawdown 25% 32% Std. Dev. Annual 15.5% 22.6% Largest Loss 8.5% 10.7% Benchmark Perf. 8.50% 8.5% Benchmark Std. Dev. 10.50% 10.5% Risk Free rate 0.25% 0.25% Sharpe Ratio 0.79 0.59 Treynor Ratio 0.18 0.29 Calmar Ratio 0.50 0.42 Composite score 0.49 0.43 When you activate this spreadsheet table, you’ll see something similar to this: This allows you to edit the spreadsheet/table in the question. If you click on the cell for the Sharpe Ratio for System 1, you can see the formula construction and which cells the formula is referring to. This gives you the ability to check for errors. Activating the spreadsheet and working within it are a part of answering the exam question.

- 16. CMT Sample Exam Level III (19 continued) Once you have fixed any errors you have found, select which of the following pairs of composite score reflects the correct values. (11 points) Answer System 1 System 2 A .79 .59 B .41 .49 C .39 .41 D .28 .59 (See answer key for this question since you cannot replicate the answer on a paper test. This explanation and sample question id not intended for practice examination, but only for informational purposes.)

- 17. CMT Sample Exam Level III SECTION #5: CLASSICAL METHODS (40 POINTS) Chart 5-1 20. You are newly hired on to XRHO Capital Management, a CTA firm. Last year the firm took a long position in Coffee futures (KC). The position is profitable and has met its objectives, and you are tasked with recommending whether the current conditions suggest it would be most favorable to sell now or to wait. Select either decision but explain at least four points of evidence to correctly support your decision from among the applicable signals on Chart 5-1. (16 points, 4 for each of the four points of evidence) Answer (either sell now or hold):

- 18. CMT Sample Exam Level III Chart 5-2 21. Your predecessor recommended the firm initiate a short position on MMM, but failed to leave any explanation for this chart. Describe the three signals the analyst likely observed using available detail on Chart 5-2. (12 points) 22. Your predecessor recommended the firm enter the short position at $125 and set a stop-loss at $130. If the firm had a fund of 5 million dollars and wanted to take the trade and put only 1.5% of that amount at risk, how many shares could be traded (assuming no loss to gaps or slippage)? (12 points)

- 19. CMT Sample Exam Level III QUESTION #6: CLASSICAL METHODS (20 POINTS) Examine Chart 6-1 (10-Year U.S. Treasury Prices). Chart 6-1 23. Identify which circle contains the candle (1, 2, 3, or 4) that was most significant in forecasting a break above the resistance line. (4 points) 24. Explain two reasons for your selection in question 21. (6 points) 25. What is your short-term forecast for U.S. Treasury bond prices based on this chart? (10 points)

- 20. CMT Sample Exam Level III QUESTION #7: CLASSICAL METHODS (40 POINTS) Chart 7-1 You are a recently hired analyst. Your portfolio manager wants your short- term recommendation on GDX, a gold-mining ETF. You must make the best recommend whether it be a LONG or SHORT position, and you must provide evidence to support your conclusion. Examine Chart 7-1: GDX. Do you recommend a LONG or SHORT position in this security? (2 points) 26. Name and discuss the implication of the 2 most recent multi-day candlestick patterns that support your conclusion (4 points each). For each candle, comment if there is anything significant in the chart that increases the strength of each candle pattern? (3 points each, 6 points total, 16 points total for question) 27. In Chart 7-1 how do the indicators Williams %R and ATR factor into your analysis? (5 pts)

- 21. CMT Sample Exam Level III 28. Determine how many shares can be traded (long or short), rounded to the nearest 100 shares. Use Chart 7-1 and assume the following conditions and demonstrate how you arrived at your answer: Trade entry price of $24.50 (long or short). Position risk limited to $15,000. Use ATR to calculate your stop price. Assume the last ATR reading is .86. Use a factor of 1.5 in your ATR stop calculation. (4 points) Chart 7-2 29. Examine the four labeled circles in Chart 7-2. In each circle there is a multi-day candlestick pattern. Which circles contain formations that are among those Bulkowski tested as most reliable? (2 points) A) Circle 1 and 2 B) Circle 2 and 3 C) Circle 2 and 4 D) Circle 3 and 4 1 2 3 4

- 22. CMT Sample Exam Level III 30. What is the name of the pattern you selected in question 7D? (2 points) 31. Having examined the fundamentals of the security in Chart 7-2, a research firm just released an official “sell” recommendation on it today. Comment on whether the provided indicators, MACD and money flow, are “overbought” at their current levels. In your opinion, do these indicators support the firm’s conclusion to sell the stock today? In your answer, provide a brief definition of how each indicator works. (11 points)

- 23. CMT Sample Exam Level III QUESTION #8: RISK MANAGEMENT (31 POINTS) All technical analysis–based trading systems have a random component as well as a predictive component. To make a trading system as robust as possible, we must reduce the random component where possible during the back-test-and-development phase, or what Aronson calls the data mining bias. He defines the data mining bias as the expected difference between the returns observed during the data mining phase (back testing) and its true expected performance trading live in the future. Aronson defines five factors that determine the magnitude of the data mining bias (Aronson, David R., Evidence-Based Technical Analysis, Chapters 5 and 6). Answer the following questions regarding each of them. 32. The number of rules back tested. As the number of rules increases, does the data mining bias increase or decrease? Explain one reason why. (5 points) 33. The number of observations (the number of trades in the back test) used to compute the performance statistics. Does more observations (trades) increase the bias or decrease the bias? Explain one reason why. (5 points) 34. Correlation among rule returns. Will five uncorrelated rules increase or decrease the bias when compared to five highly correlated rules? Explain one reason why. (5 points) 35. Percentage of positive outlier returns. Will return samples with fat tails comprised of several extreme values increase or decrease the data mining bias? Explain one reason why. (5 points) 36. Variation in expected returns among the various rules. If the variation in return among the expected rules is low, is the data mining bias lower or higher? Explain one reason why. (6 points) 37. Which of the five factors (above) is the most important in reducing the data mining bias (randomness)? (5 points)

- 24. CMT Sample Exam Level III

- 25. CMT Sample Exam Level III ANSWERS TO SECTION 1 - ETHICS 1. (D) 2. (A) 3. (C) 4. (C) 5. (C) 6. (B) These questions reference the CFA Code of Ethics and Standards of Professional Conduct found at this link: http://www.cfapubs.org/doi/pdf/10.2469/ccb.v2014.n6.1

- 26. CMT Sample Exam Level III ANSWERS TO SECTION #2: BEHAVIORAL FINANCE (25 POINTS) 7. (B)(C)(E)(F)(G) (CMT III, Chapter 29) 8. If these conditions are broken, the group advantage is quickly lost: 1. People must be unaffected by others’ decisions (errors must be uncorrelated). 2. Probability of being correct must be independent of the probability of everyone else being correct. 3. Participants must be unaffected by their own vote possibly being decisive. 1. Secret ballots Reduces risk of social pressure. Come to meetings with views prewritten or preference for asset allocation. 2. Devil’s advocate It is a nice idea, but in order to be effective, the person needs to actually believe the counterview. 3. Respect for other group members Understand that other members are acknowledged experts in their field. However, people tend to believe they know more than others in almost every subject. This is especially prevalent in financial services. CMT III, p. 683

- 27. CMT Sample Exam Level III ANSWERS TO SECTION #3: ASSET RELATIONSHIPS (31 POINTS) 9. (B) 10. Small-caps tend to lead large-caps coming out of bear markets. (5 points) Tech is typically an early cycle leader. 11. (A) 12. China is the world’s largest producer and consumer of copper. 13. (B) Chart 3-3 14. First, when the economy is weakening, filings for unemployment insurance increase. (2 points) Second the Chart 3-1 breakout shows this measure is undergoing a meaningful trend adjustment. Economy may be transitioning from the “full expansion” phase to the “early recession” phase of the business cycle (2 points) Utilities, Consumer Staples and Healthcare leading (Chart 3-1) imply fundamental deterioration in business cycle. (2 point) 15. (B) Building Permits (New Private Housing), Displaced Moving Average, Manufacturers New Orders References for this section: Learning Objectives: Identify leading, coincident and lagging indicators of economic activity. CMT Level III 2017- Chapters 14, 17, 18, 19 and 21

- 28. CMT Sample Exam Level III ANSWERS TO SECTION #4: RISK MANAGEMENT (35 POINTS) 16. Possible answers (4 points each for any answer specified below): 1. Only risk a small amount of total capital on any one trade: no more than 5%. 2.Determine the maximum loss for the current trade in advance. 3. Exit a trade quickly. 4. Don't meet margin calls. 5. Liquidate your worst position first when lightening up. 6. Be consistent in your trading philosophy. 7. Be sure the trading profile is compatible with your risk preference. 8. Plan for contingencies. Be prepared for exceptions. (CMT Level III, Chapter 12) 17. This method estimates the sampling distribution’s shape by randomly resampling the original sample of observations so as to produce new computer-generated samples. This in turn generates the P&L trade data from a system from 100 to 2,000 times and generates an equity curve for each simulation. If the great majority of the equity lines of these 100 to 2,000 simulations are without substantial drawdowns (beyond your acceptable threshold) and meet your profitability requirements, then your portfolio system is probably robust. It is more likely to be profitable and less likely to fail going forward. (CMT Level III, Chapter 2) 18. 1. We can reduce the size of our trades or stop trading trend- following systems completely if we use one of a variety of methods designed to identify non-trending markets, such as ADX. (CMT Level III, Chapter 12) 2. We can cut back on trading or stop trading trend-following systems completely when our equity curve declines by a predefined amount. Kirkpatrick and Dahlquist in CMT Level III Chapter 2 page 48, wrote that a standard for closing the entire portfolio model is a percentage stop, usually around 20%.

- 29. CMT Sample Exam Level III 3. We can cut back on trading or stop trading trend-following systems completely when our equity curve itself enters a quantified and predefined downtrend. (CMT Level III, Chapter 12) 19. In this question the error would be in the cells being referenced. This graphic shows the CORRECT reference so you can know what it SHOULD have looked like once it was fixed. The starting state of that formula might have had, for example, the formula pointing to cell B7 instead of B6, which would through off the numbers. Once the numbers were properly configured, the correct answer among the choices was (B) .41 and .49. References: (CMT Level III, Chapter 10, 12, and 23)

- 30. CMT Sample Exam Level III ANSWERS TO QUESTION #5: CLASSICAL METHODS (40 POINTS) 20. Sell now. 1) Falling wedge pattern failure. Coffee prices failed to meet the formulated price target of $220 (from the $220–$160 range where $60 is height of the wedge). The high of the trend from the subsequent pattern breakout was around $208. Bearish. (CMT Level III, pg 1177) 2) The last day of Coffee price action traded below the PSAR indicator, which is bearish. (Kaufman, p. 790, CMT Level III pg 229) 3) The slow stochastic is still bearish from the last overbought reading above 80 when the %K line crossed the %D line. (CMT Level III pg 6) 4) Potential short-term double top. Coffee prices failed to rally above the recent high at $208. Bearish. (CMT Level III pg 1040) Hold (wait). Recent coffee price action is converging at four major support levels: 1) At the lower Bollinger band level 2) At the Fibonacci 38.2% retracement level 3) At the MVWAP level 4) At the $175 price, which is short-term price consolidation support between the recent two highs (CMT Level III pg175)

- 31. CMT Sample Exam Level III 21. Two signals that are supportive of a short position are 1. Rising prices on declining trade volume divergence. 2. Rising prices and declining RSI momentum divergence Others may be possibly noted. (CMT Level III pgs 5, 47, 48, 271) 22. Your predecessor recommended the firm enter the short position at $125 and set a stop-loss at $130. If the firm had a fund of 5 million dollars and wanted to take the trade and put only 1.5% of that amount at risk, how many shares could be traded (assuming no loss to gaps or slippage)? (12 points) 1.5% of $5MM is $75,000; therefore in order to contain your risk of loss to that amount, the position size in 3M (MMM) should be set at 15,000 shares sold short at the $125 price target level. (CMT Level III 473—Method of trades with equal initial position risk)

- 32. CMT Sample Exam Level III ANSWERS TO QUESTION #6: CLASSICAL METHODS (20 POINTS) Examine Chart 6-1 (10-Year U.S. Treasury Prices). 23. Circle 4 (CMT Level III 932) 24. The very small body of the candle closed at the high point, well above the lows earlier in the day. (4 points) A named price pattern here such as long lower shadow, hammer, or even dragonfly doji or any other bullish pattern would be awarded extra. (5 points) (CMT Level III 932–934) 25. Based on the fact the resistance line was broken and both closed near the high (2 white candles above it) it is more likely that U.S. bond prices will rise in the short term. (CMT Level III 946)

- 33. CMT Sample Exam Level III ANSWERS TO QUESTION #7: CLASSICAL METHODS (40 POINTS) 26. Long. (2 points, but if candidate selects “short,” 0 points) Separating lines is the most recent pattern. (4 points) For separating lines, one of the following counts: This is a continuation pattern. (3 points) Given the fact a window occurred before it and price action has now crossed the moving average line, this increases the strength of this bullish signal. (3 points) Bullish engulfing is the next-most-recent pattern occurring around Oct 15. (4 points) For bullish engulfing, one of the following counts: This is also reversal pattern, occurring near the bottom. (3 points) The bullish engulfing candle engulfs two prior (small-body) candles, increasing its significance. (3 points) (Optional) Some candidates may suggest that a harami is present on Oct 15. However, a bullish harami reversal needs to have a solid black candle followed by a smaller candle (the second candle can be white or black). (4 points) (CMT Level III Chapter 32)

- 34. CMT Sample Exam Level III 27. Williams is a momentum oscillator, like RSI or stochastics, but its scale is inverted. It is at an extreme overbought reading of 10 right now, and may be flattening out. (1 pt) (CMT Level III 549) However, this extreme reading does not always mean “sell.” If this is the start of a new trend, since price action is now above the moving average, a momentum oscillator can stay overbought for a period of time as the trend continues. This occurred two prior times in the chart. (2 pts) (CMT Level III 549) ATR helps to measure volatility. Volatility has been declining as the security declined (in the last downtrend). There are a couple of acceptable responses here: 1. Typically after a period of low volatility, volatility tends to increase. Based on this chart, ATR is at its lowest range. Since the security just broke above its moving average line, it is possible that we will see increased volatility (but not confirmed yet). 2. ATR can be used as a breakout filter. If the breakout exceeds the ATR level, it helps to confirm the breakout. In this case, the recent break above the moving average with the gap is more than 86 cents, helping to add validity to the breakout. (2 pts) (CMT Level III 259–260)

- 35. CMT Sample Exam Level III 28. 1.5 times an ATR of 86 cents = $1.29. The stop would be placed $1.29 below the long entry price, at $23.21. (2 pts for correct explanation of stop price). Thus, rounding to the nearest hundred, a total of 11,600 shares could be purchased at 24.50. (2 pts for correct number of shares) (CMT Level III 293–303) 29. (D) Circle 3 contains a doji star, or a morning star, formation and Circle 4 contains a deliberation pattern, or more finely identified as an advance block pattern, which consists of 3 successively smaller white-bodied candles during an uptrend. Both are in the list of thop 15 Bullish Continuation patterns CMT III, Chapter 32 p. 770 30. Advance block or deliberation (either is acceptable) 31. MACD cannot be “overbought” as it is not bound to a 0–100 scale, like a typical oscillator. (2 pts) It does not support the “sell” recommendation. (1 pt) The 12- and 26-day moving averages continue to trend upward above the zero (signal) line, with the faster average staying above the slower one. There are no immediate signs of those two averages crossing, showing continued upward strength. (2 pts) The Money Flow Index is considered “overbought,” as it is above 80. (2 pts) This index is confined to a range between 0 and 100. However, despite its high levels, it does not warrant an immediate “sell” recommendation. Oscillators can stay in overbought territory for some time in strong uptrends. (2 pts) This oscillator accounts for the up days vs. the down days, multiplied by daily volume. If a day’s average price is higher than the previous day’s, then there is positive money flow. In this case we see a continued uptrend in the Money Flow Index (we don’t see a move back below the overbought line), signifying that volume is also following the advances. (2 pts) (CMT Level III 5)

- 36. CMT Sample Exam Level III ANSWERS TO QUESTION #8: RISK MANAGEMENT (31 POINTS) The general idea behind these questions is to address the idea of randomness—less is good, and more is bad. Acceptable answers can use any combination of random, randomness, predictable, predictability, unpredictable, good luck, bad luck, data mining bias, and other similar words. 32. Increases (2 pts) As the number of rules increases, the chance that one set of rules will give extraordinary results increases, increasing the odds of randomness. The smaller the number of rules, the lower the odds that one set of rules will stand out. (3 pts) 33. Decreases (2 pts) The greater the number of observations (trades) used to compute the performance statistics, the smaller the dispersion of the statistic's sampling distribution. The more observations (trades) that are in the sample, the lower the odds that a lucky few will result in a high mean return. (3 pts) 34. Increase. (2 pts) Note: Uncorrelated rules will increase bias; correlated rules will decrease bias. Both statements are acceptable. A higher correlation among the rules has the effect of reducing the number of rules, whereas a lower correlation has the effect of increasing the rules. The more dissimilar the rules, the greater the opportunity to have a great coincidental fit to the historical data, and therefore very high performance due to good luck. (3 pts)

- 37. CMT Sample Exam Level III 35. Increase. (2pts) Within a constant sample size, a greater number of extreme values can create a large data mining bias. The size of the bias will depend on how extreme the values are and how many observations (trades) are in the sample. With a small sample size, even one or two extreme positive values can dramatically boost the sample mean. (3 pts) 36. Higher. (2 pts) If the rules have approximately the same merit, the difference in performance will be due primarily to luck. However, if one rule begins to stand out statistically, it will be selected most of the time since its predictive power is greater than the other rules, and therefore its data mining bias is lower. (4pts) 37. The number of observations (trades) is the single most important factor in reducing randomness. (5 points) Acceptable references: law of large numbers, greater amount of testing under variety of conditions, robustness in backtesting, etc.