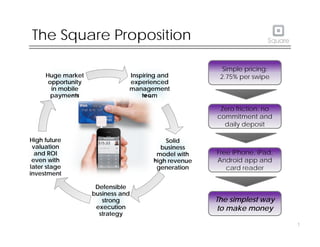

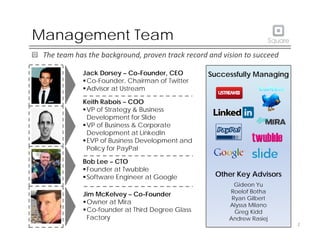

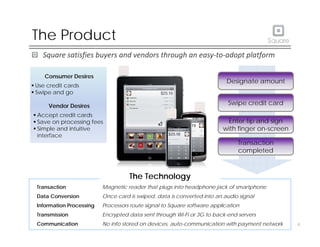

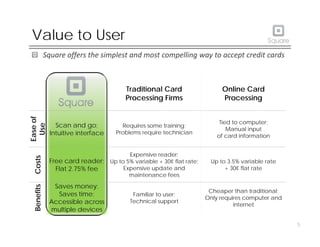

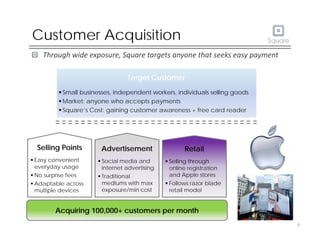

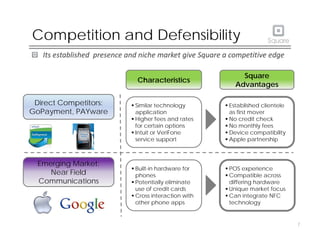

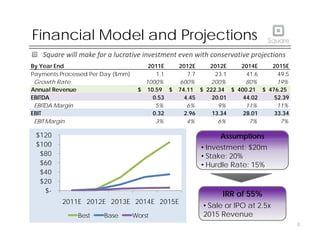

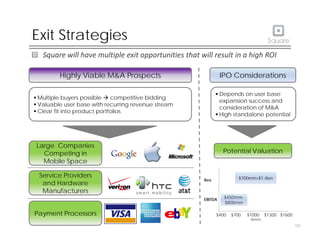

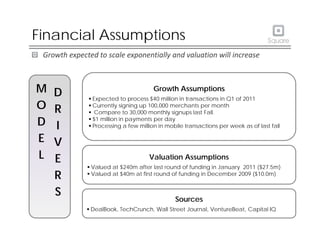

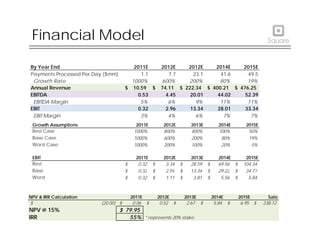

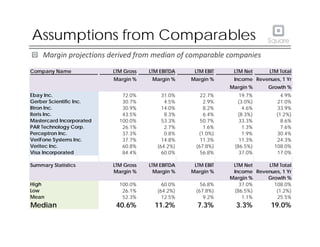

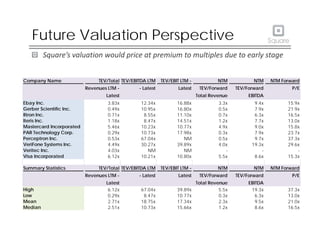

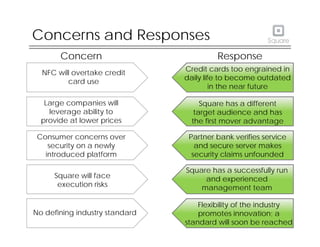

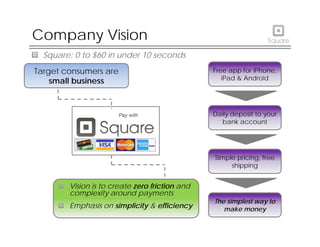

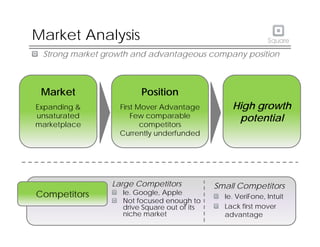

The document summarizes Square, a mobile payments startup. Square provides merchants with a free card reader that plugs into smartphones and tablets, allowing them to accept credit card payments with low fees of 2.75% per transaction. Square has a simple pricing model and signup process with no long-term commitments. The management team has successful experience in payments and technology. Square sees a large market opportunity in mobile payments given traditional card readers are expensive and inconvenient for small businesses. Square aims to acquire customers through wide exposure on social media and in stores. It has a first-mover advantage and plans to defend its position through brand recognition and compatibility across devices. Financial projections estimate high revenue growth and profitability that would generate strong returns for new