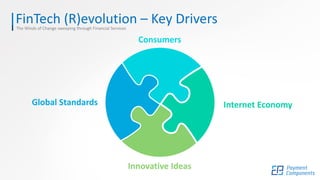

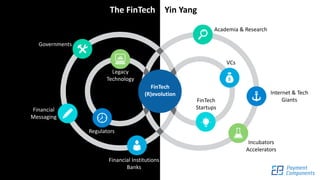

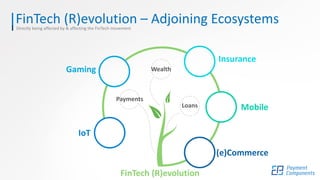

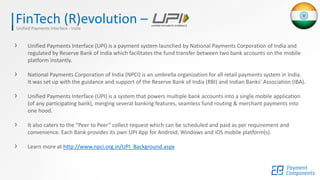

The document discusses the ongoing fintech (r)evolution characterized by a collaboration between legacy financial services and fintech startups. It highlights key examples such as India's Unified Payments Interface, China's Alipay, and the European Union's PSD2 directive, emphasizing the innovation and regulatory changes shaping the industry. Best practices for digital transformation and the importance of collaboration across sectors are also outlined.