Laws and rules applicable to start up companies

•

0 likes•854 views

All Laws, act, rules which are applicable to a start-up company. Many a time it is being observed that lot of startup are not aware of extact laws and rules applicable to their entity.

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

INFO PEMESANAN [ 085176963835 ] Jual Obat Aborsi Cytotec Pasuruan, Obat Aborsi Pasuruan, jual aborsi obat cytotec di pasuruan, jawa timur, jual aborsi cytotec di pasuruan, jawa timur, harga obat cytotec di pasuruan, jawa timur, apotik yang jual cytotec di pasuruan, jawa timur, klinik obat aborsi cytotec pasuruan, jawa timur, toko obat aborsi cytotec asli pasuruan, jawa timur, jual obat gastrul di pasuruan, jawa timur, obat aborsi pasuruan, jawa timur, jual cytotec asli pasuruan, jawa timur, harga obat aborsi di pasuruan, jawa timur, apotik yang jual bebas cytotec di pasuruan, jawa timur, toko obat aborsi cytotec asli pasuruan, jawa timur, alamat jual obat aborsi di pasuruan, jawa timur, harga obat cytotec, jual obat aborsi cytotec asli di pasuruan, jawa timur makassar palembang batam pekanbaru sulawesi utara, tempat jual obat aborsi di pasuruan, jawa timur, obat aborsi di pasuruan, jawa timur, apotik yang menjual obat aborsi di pasuruan, jawa timur, jual obat cytotec di pasuruan, jawa timur, harga obat gastrul di apotik pasuruan, jawa timur jual gastrul, alamat jual obat cytotec di pasuruan, jawa timur, harga gastrul per biji, harga obat aborsi di pasuruan, jawa timur, klinik jual obat aborsi di pasuruan, jawa timur, bidan jual obat aborsi di pasuruan, jawa timur, klinik obat aborsi ilegal di pasuruan, jawa timur, klinik jual obat aborsi kandungan pasuruan, jawa timur, klinik obat aborsi cytotec pasuruan, jawa timur, obat aborsi pasuruan, jawa timur, klinik jual obat aborsi kandungan pasuruan, jawa timur, jual gastrul di pasuruan, jawa timur, cara mendapatkan cytotec pasuruan, jawa timur, klinik obat aborsi cytotec pasuruan, jawa timur, klinik obat aborsi di pasuruan, jawa timur, obat aborsi, apotik yang jual bebas cytotec di pasuruan, jawa timur, cara mendapatkan cytotec pasuruan, jawa timur, harga obat gastrul di apotik, jual obat cytotec, obat aborsi, klinik obat aborsi cytotec pasuruan, jawa timur, jual cytotec asli pasuruan, jawa timur, toko obat aborsi cytotec asli pasuruan, jawa timur, apotik yang jual bebas cytotec di pasuruan, jawa timur, alamat jual obat cytotec di pasuruan, jawa timur, klinik obat aborsi cytotec pasuruan, jawa timur, jual obat aborsi cytotec penggugur kandungan di pasuruan, jawa timur, harga cytotec, jual gastrul di pasuruan, jawa timur, toko obat aborsi cytotec asli pasuruan, jawa timur, harga cytotec di apotik k24, toko obat aborsi cytotec asli pasuruan, jawa timur, jual obat aborsi cytotec penggugur kandungan di pasuruan, jawa timur, apotik yang jual bebas cytotec di pasuruan, jawa timur, alamat jual obat cytotec di pasuruan, jawa timur, cara mendapatkan cytotec pasuruan, jawa timur, obat aborsi, jual gastrul di pasuruan, jawa timur, cara mendapatkan cytotec pasuruan, jawa timur, klinik obat aborsi cytotec pasuruan, jawa timur, apotik yang jual bebas cytotec di pasuruan, jawa timur, jual obat aborsi cytotec penggugur kandungan di pasuruan, jawa timur, harga cytotec, jual gastrul di pasuruan, jawa timur, cytotec asliObat Aborsi Pasuruan 0851\7696\3835 Jual Obat Cytotec Di Pasuruan

Obat Aborsi Pasuruan 0851\7696\3835 Jual Obat Cytotec Di PasuruanObat Aborsi Jakarta Wa 085176963835 Apotek Jual Obat Cytotec Di Jakarta

""wsp;+971581248768 "/BUY%$ AbORTION PILLS ORIGNAL%In DUBAI ))%3 ((+971_58*124*8768((#Abortion Pills in Dubai#)Abu Dhabi#. #UAE# DUBAI #| SHARJAH#UAE💉💊+971581248768>> SAFE AND ORIGINAL ABORTION PILLS FOR SALE IN DUBAI AND ABUDHABI}}+971581248768

+971581248768 Mtp-Kit (500MG) Prices » Dubai [(+971581248768**)] Abortion Pills For Sale In Dubai, UAE, Mifepristone and Misoprostol Tablets Available In Dubai, UAE CONTACT DR.Maya Whatsapp +971581248768 We Have Abortion Pills / Cytotec Tablets /Mifegest Kit Available in Dubai, Sharjah, Abudhabi, Ajman, Alain, Fujairah, Ras Al Khaimah, Umm Al Quwain, UAE, Buy cytotec in Dubai +971581248768''''Abortion Pills near me DUBAI | ABU DHABI|UAE. Price of Misoprostol, Cytotec” +971581248768' Dr.DEEM ''BUY ABORTION PILLS MIFEGEST KIT, MISOPROTONE, CYTOTEC PILLS IN DUBAI, ABU DHABI,UAE'' Contact me now via What's App…… abortion Pills Cytotec also available Oman Qatar Doha Saudi Arabia Bahrain Above all, Cytotec Abortion Pills are Available In Dubai / UAE, you will be very happy to do abortion in Dubai we are providing cytotec 200mg abortion pill in Dubai, UAE. Medication abortion offers an alternative to Surgical Abortion for women in the early weeks of pregnancy. We only offer abortion pills from 1 week-6 Months. We then advise you to use surgery if its beyond 6 months. Our Abu Dhabi, Ajman, Al Ain, Dubai, Fujairah, Ras Al Khaimah (RAK), Sharjah, Umm Al Quwain (UAQ) United Arab Emirates Abortion Clinic provides the safest and most advanced techniques for providing non-surgical, medical and surgical abortion methods for early through late second trimester, including the Abortion By Pill Procedure (RU 486, Mifeprex, Mifepristone, early options French Abortion Pill), Tamoxifen, Methotrexate and Cytotec (Misoprostol). The Abu Dhabi, United Arab Emirates Abortion Clinic performs Same Day Abortion Procedure using medications that are taken on the first day of the office visit and will cause the abortion to occur generally within 4 to 6 hours (as early as 30 minutes) for patients who are 3 to 12 weeks pregnant. When Mifepristone and Misoprostol are used, 50% of patients complete in 4 to 6 hours; 75% to 80% in 12 hours; and 90% in 24 hours. We use a regimen that allows for completion without the need for surgery 99% of the time. All advanced second trimester and late term pregnancies at our Tampa clinic (17 to 24 weeks or greater) can be completed within 24 hours or less 99% of the time without the need surgery. The procedure is completed with minimal to no complications. Our Women's Health Center located in Abu Dhabi, United Arab Emirates, uses the latest medications for medical abortions (RU-486, Mifeprex, Mifegyne, Mifepristone, early options French abortion pill), Methotrexate and Cytotec (Misoprostol). The safety standards of our Abu Dhabi, United Arab Emirates Abortion Doctors remain unparalleled. They consistently maintain the lowest complication rates throughout the nation.Contact +971581248768 for 100% original and safe abortion pills available for...

Contact +971581248768 for 100% original and safe abortion pills available for...DUBAI (+971)581248768 BUY ABORTION PILLS IN ABU dhabi...Qatar

INFO PEMESANAN [ 085176963835 ] Cytotec Jual Obat Aborsi Surabaya, Obat Aborsi Surabaya, Jual obat aborsi cytotec di Surabaya, Jual obat cytotec di Surabaya kota jawa timur, obat cytotec di Surabaya jawa timur, Obat aborsi klinik Surabaya kota sby, jawa timur, jual obat aborsi malang, Penjual obat aborsi cytotec di Surabaya, Penjual obat cytotec di Surabaya, jual obat aborsi Surabaya, apotik jual obat aborsi di Surabaya kota Surabaya jawa timur, cytotec Surabaya, jual obat aborsi embong kaliasin, kota Surabaya jawa timur, jual obat aborsi embong kaliasin kota Surabaya jawa timur, jual cytotec Surabaya, obat aborsi klinik Surabaya kota jawa timur, jual obat penggugur kandungan di Surabaya, harga cytotec di apotik k24 Surabaya, harga obat penggugur kandungan di Surabaya, griya obat aborsi kota Surabaya jawa timur, cytotec Surabaya, klinik jual obat aborsi Surabaya, klinik obat aborsi Surabaya jawa timur, biaya obat aborsi Surabaya, cytotec Surabaya, obat cytotec kota Surabaya jawa timur, jual cytotec eceran Surabaya, toko obat aborsi cytotec di Surabaya kota sby, jawa timur, harga cytotec, jual obat cytotec di Surabaya kota Surabaya jawa timur, apotik jual cytotec kota Surabaya jawa timur, obat aborsi cytotec asli area Surabaya kota Surabaya jawa timur, harga cytotec di apotik k24 Surabaya, toko obat aborsi cytotec di Surabaya kota jawa timur, obat cytotec Surabaya timur, jual cytotec eceran Surabaya, jual obat cytotec di Surabaya kota Surabaya jawa timur, obat penggugur janin Surabaya kota sby, jawa timur, cytotec asli Surabaya kota Surabaya jawa timur, obat aborsi cytotec asli area Surabaya kota Surabaya jawa timur, obat penggugur janin Surabaya jawa timur, cytotec Surabaya, apotik jual cytotec kota Surabaya jawa timur, obat aborsi penggugur kandungan cytotec asli di Surabaya jawa timur, harga obat cytotec, gastrul kota Surabaya jawa timur, toko obat telat bulan manjur kota Surabaya jawa timur, jual obat aborsi obat penggugur kandungan cytotec asli di Surabaya kota Surabaya jawa timur, harga cytotec di apotik k24 Surabaya, cytotec Surabaya, apotik jual cytotec kota Surabaya jawa timur, obat cytotec Surabaya kota Surabaya jawa timur, jual obat cytotec di Surabaya kota Surabaya jawa timur, toko obat aborsi cytotec di Surabaya kota sby, jawa timur, harga obat cytotec per butir di apotik, obat aborsi cytotec asli cod area Surabaya kota Surabaya jawa timur, obat cytotec Surabaya, obat cytotec Surabaya kota Surabaya jawa timur, toko obat telat bulan manjur kota Surabaya jawa timur, apotik jual cytotec kota Surabaya jawa timur, obat penggugur janin Surabaya kota sby, jawa timur, jual obat aborsi obat penggugur kandungan cytotec asli di Surabaya kota Surabaya jawa timur, jual cytotec eceran Surabaya, jual cytotec Surabaya, cytotec Surabaya, obat cytotec Surabaya, obat penggugur janin Surabaya, apotik jual cytotec kota Surabaya jawa timur, harga obat cytotec, harga obat cytotec per butir di apotik, toko obat telat bulan manjur kota Surabaya jawa timur, Obat Aborsi Surabaya 0851\7696\3835 Jual Obat Cytotec Di Surabaya

Obat Aborsi Surabaya 0851\7696\3835 Jual Obat Cytotec Di SurabayaObat Aborsi Jakarta Wa 085176963835 Apotek Jual Obat Cytotec Di Jakarta

INFO PEMESANAN [ 085176963835 ] Jual Obat Aborsi Cytotec Malang, Obat Aborsi Malang, Jual obat aborsi malang, jual cytotec malang, obat aborsi malang, klinik penjual obat aborsi cytotec di malang kota malang, jawa timur, jual obat aborsi penggugur janin malang malang jawa timur, gastrul malang, harga obat cytotec, dokter cytotec malang, jual cytotec malang, jual obat aborsi malang, klinik penjual obat aborsi cytotec di malang kota malang, jawa timur, obat penggugur kandungan murah malang, obat aborsi malang, jual obat aborsi penggugur janin malang malang jawa timur, harga obat cytotec, dokter cytotec malang, obat cytotec malang, obat cytotec di malang, jual obat cytotec malang, harga obat cytotec malang, obat cytotec kota malang jawa timur, jual beli obat cytotec malang, harga obat cytotec di malang, penjual obat cytotec di malang, jual obat cytotec area malang, jual obat cytotec daerah malang, obat cytotec malang, cytotec malang, cytotec malang, klinik penjual obat aborsi cytotec di malang kota malang jawa timur, obat cytotec di malang, agen obat cytotec asli malang kota malang jawa timur, harga obat cytotec di apotik malang, obat cytotec kota malang jawa timur, harga obat cytotec di malang, apotik yang menjual obat cytotec di malang, klinik penjual obat aborsi cytotec di malang kota malang, jawa timur, harga cytotec di apotik k24 malang, obat gastrul di malang, obat cytotec kota malang jawa timur, jual cytotec malang, dokter cytotec malang, jual obat cytotec surabaya,obat aborsi cod, jual gastrul malang, harga obat gastrul di apotik malang, obat aborsi cytotec dan gastrul, harga obat maag gastrul, obat aborsi, harga obat g astrul per butir di apotik, harga gastrul di apotik, klinik penjual obat aborsi cytotec di malang kota malang jawa timur, klinik penjual obat aborsi cytotec di malang kota malang, jawa timur, jual cytotec malang, harga cytotec, obat gastrul di malang, jual obat cytotec surabaya, harga cytotec di apotik k24 malang, obat penggugur kandungan, jual gastrul, harga cytotec di apotik k24 malang, harga cytotec di malang, harga cytotec di apotik malang, harga cytotec malang, harga obat cytotec di apotik malang, harga obat cytotec malang, harga obat cytotec di malang, harga cytotec di apotik k24 surabaya, jual cytotec malang, obat cytotec malang, jual obat cytotec malang, harga cytotec malang, jual cytotec malang, dokter cytotec malang, apotik jual cytotec malang, harga obat cytotec malang, penjual cytotec malang, jual beli obat cytotec malang, harga cytotec di apotik k24 malang, klinik penjual obat aborsi cytotec di malang kota malang, jawa timur, dokter jual cytotec malang, obat cytotec kota malang jawa timur, jual obat gastrul malang, bidan jual obat aborsi di malang, klinik penjual obat aborsi cytotec di malang kota malang, jawa timur, harga cytotec di apotik k24 malang, obat cytotec di malang, harga obat cytotec, obat gastrul di malang, obat aborsi, bidan jual obat aborsi di malang, jual obat aborsi di malang kota malang,Obat Aborsi Malang 0851\7696\3835 Jual Obat Cytotec Di Malang

Obat Aborsi Malang 0851\7696\3835 Jual Obat Cytotec Di MalangObat Aborsi Jakarta Wa 085176963835 Apotek Jual Obat Cytotec Di Jakarta

More Related Content

Recently uploaded

INFO PEMESANAN [ 085176963835 ] Jual Obat Aborsi Cytotec Pasuruan, Obat Aborsi Pasuruan, jual aborsi obat cytotec di pasuruan, jawa timur, jual aborsi cytotec di pasuruan, jawa timur, harga obat cytotec di pasuruan, jawa timur, apotik yang jual cytotec di pasuruan, jawa timur, klinik obat aborsi cytotec pasuruan, jawa timur, toko obat aborsi cytotec asli pasuruan, jawa timur, jual obat gastrul di pasuruan, jawa timur, obat aborsi pasuruan, jawa timur, jual cytotec asli pasuruan, jawa timur, harga obat aborsi di pasuruan, jawa timur, apotik yang jual bebas cytotec di pasuruan, jawa timur, toko obat aborsi cytotec asli pasuruan, jawa timur, alamat jual obat aborsi di pasuruan, jawa timur, harga obat cytotec, jual obat aborsi cytotec asli di pasuruan, jawa timur makassar palembang batam pekanbaru sulawesi utara, tempat jual obat aborsi di pasuruan, jawa timur, obat aborsi di pasuruan, jawa timur, apotik yang menjual obat aborsi di pasuruan, jawa timur, jual obat cytotec di pasuruan, jawa timur, harga obat gastrul di apotik pasuruan, jawa timur jual gastrul, alamat jual obat cytotec di pasuruan, jawa timur, harga gastrul per biji, harga obat aborsi di pasuruan, jawa timur, klinik jual obat aborsi di pasuruan, jawa timur, bidan jual obat aborsi di pasuruan, jawa timur, klinik obat aborsi ilegal di pasuruan, jawa timur, klinik jual obat aborsi kandungan pasuruan, jawa timur, klinik obat aborsi cytotec pasuruan, jawa timur, obat aborsi pasuruan, jawa timur, klinik jual obat aborsi kandungan pasuruan, jawa timur, jual gastrul di pasuruan, jawa timur, cara mendapatkan cytotec pasuruan, jawa timur, klinik obat aborsi cytotec pasuruan, jawa timur, klinik obat aborsi di pasuruan, jawa timur, obat aborsi, apotik yang jual bebas cytotec di pasuruan, jawa timur, cara mendapatkan cytotec pasuruan, jawa timur, harga obat gastrul di apotik, jual obat cytotec, obat aborsi, klinik obat aborsi cytotec pasuruan, jawa timur, jual cytotec asli pasuruan, jawa timur, toko obat aborsi cytotec asli pasuruan, jawa timur, apotik yang jual bebas cytotec di pasuruan, jawa timur, alamat jual obat cytotec di pasuruan, jawa timur, klinik obat aborsi cytotec pasuruan, jawa timur, jual obat aborsi cytotec penggugur kandungan di pasuruan, jawa timur, harga cytotec, jual gastrul di pasuruan, jawa timur, toko obat aborsi cytotec asli pasuruan, jawa timur, harga cytotec di apotik k24, toko obat aborsi cytotec asli pasuruan, jawa timur, jual obat aborsi cytotec penggugur kandungan di pasuruan, jawa timur, apotik yang jual bebas cytotec di pasuruan, jawa timur, alamat jual obat cytotec di pasuruan, jawa timur, cara mendapatkan cytotec pasuruan, jawa timur, obat aborsi, jual gastrul di pasuruan, jawa timur, cara mendapatkan cytotec pasuruan, jawa timur, klinik obat aborsi cytotec pasuruan, jawa timur, apotik yang jual bebas cytotec di pasuruan, jawa timur, jual obat aborsi cytotec penggugur kandungan di pasuruan, jawa timur, harga cytotec, jual gastrul di pasuruan, jawa timur, cytotec asliObat Aborsi Pasuruan 0851\7696\3835 Jual Obat Cytotec Di Pasuruan

Obat Aborsi Pasuruan 0851\7696\3835 Jual Obat Cytotec Di PasuruanObat Aborsi Jakarta Wa 085176963835 Apotek Jual Obat Cytotec Di Jakarta

""wsp;+971581248768 "/BUY%$ AbORTION PILLS ORIGNAL%In DUBAI ))%3 ((+971_58*124*8768((#Abortion Pills in Dubai#)Abu Dhabi#. #UAE# DUBAI #| SHARJAH#UAE💉💊+971581248768>> SAFE AND ORIGINAL ABORTION PILLS FOR SALE IN DUBAI AND ABUDHABI}}+971581248768

+971581248768 Mtp-Kit (500MG) Prices » Dubai [(+971581248768**)] Abortion Pills For Sale In Dubai, UAE, Mifepristone and Misoprostol Tablets Available In Dubai, UAE CONTACT DR.Maya Whatsapp +971581248768 We Have Abortion Pills / Cytotec Tablets /Mifegest Kit Available in Dubai, Sharjah, Abudhabi, Ajman, Alain, Fujairah, Ras Al Khaimah, Umm Al Quwain, UAE, Buy cytotec in Dubai +971581248768''''Abortion Pills near me DUBAI | ABU DHABI|UAE. Price of Misoprostol, Cytotec” +971581248768' Dr.DEEM ''BUY ABORTION PILLS MIFEGEST KIT, MISOPROTONE, CYTOTEC PILLS IN DUBAI, ABU DHABI,UAE'' Contact me now via What's App…… abortion Pills Cytotec also available Oman Qatar Doha Saudi Arabia Bahrain Above all, Cytotec Abortion Pills are Available In Dubai / UAE, you will be very happy to do abortion in Dubai we are providing cytotec 200mg abortion pill in Dubai, UAE. Medication abortion offers an alternative to Surgical Abortion for women in the early weeks of pregnancy. We only offer abortion pills from 1 week-6 Months. We then advise you to use surgery if its beyond 6 months. Our Abu Dhabi, Ajman, Al Ain, Dubai, Fujairah, Ras Al Khaimah (RAK), Sharjah, Umm Al Quwain (UAQ) United Arab Emirates Abortion Clinic provides the safest and most advanced techniques for providing non-surgical, medical and surgical abortion methods for early through late second trimester, including the Abortion By Pill Procedure (RU 486, Mifeprex, Mifepristone, early options French Abortion Pill), Tamoxifen, Methotrexate and Cytotec (Misoprostol). The Abu Dhabi, United Arab Emirates Abortion Clinic performs Same Day Abortion Procedure using medications that are taken on the first day of the office visit and will cause the abortion to occur generally within 4 to 6 hours (as early as 30 minutes) for patients who are 3 to 12 weeks pregnant. When Mifepristone and Misoprostol are used, 50% of patients complete in 4 to 6 hours; 75% to 80% in 12 hours; and 90% in 24 hours. We use a regimen that allows for completion without the need for surgery 99% of the time. All advanced second trimester and late term pregnancies at our Tampa clinic (17 to 24 weeks or greater) can be completed within 24 hours or less 99% of the time without the need surgery. The procedure is completed with minimal to no complications. Our Women's Health Center located in Abu Dhabi, United Arab Emirates, uses the latest medications for medical abortions (RU-486, Mifeprex, Mifegyne, Mifepristone, early options French abortion pill), Methotrexate and Cytotec (Misoprostol). The safety standards of our Abu Dhabi, United Arab Emirates Abortion Doctors remain unparalleled. They consistently maintain the lowest complication rates throughout the nation.Contact +971581248768 for 100% original and safe abortion pills available for...

Contact +971581248768 for 100% original and safe abortion pills available for...DUBAI (+971)581248768 BUY ABORTION PILLS IN ABU dhabi...Qatar

INFO PEMESANAN [ 085176963835 ] Cytotec Jual Obat Aborsi Surabaya, Obat Aborsi Surabaya, Jual obat aborsi cytotec di Surabaya, Jual obat cytotec di Surabaya kota jawa timur, obat cytotec di Surabaya jawa timur, Obat aborsi klinik Surabaya kota sby, jawa timur, jual obat aborsi malang, Penjual obat aborsi cytotec di Surabaya, Penjual obat cytotec di Surabaya, jual obat aborsi Surabaya, apotik jual obat aborsi di Surabaya kota Surabaya jawa timur, cytotec Surabaya, jual obat aborsi embong kaliasin, kota Surabaya jawa timur, jual obat aborsi embong kaliasin kota Surabaya jawa timur, jual cytotec Surabaya, obat aborsi klinik Surabaya kota jawa timur, jual obat penggugur kandungan di Surabaya, harga cytotec di apotik k24 Surabaya, harga obat penggugur kandungan di Surabaya, griya obat aborsi kota Surabaya jawa timur, cytotec Surabaya, klinik jual obat aborsi Surabaya, klinik obat aborsi Surabaya jawa timur, biaya obat aborsi Surabaya, cytotec Surabaya, obat cytotec kota Surabaya jawa timur, jual cytotec eceran Surabaya, toko obat aborsi cytotec di Surabaya kota sby, jawa timur, harga cytotec, jual obat cytotec di Surabaya kota Surabaya jawa timur, apotik jual cytotec kota Surabaya jawa timur, obat aborsi cytotec asli area Surabaya kota Surabaya jawa timur, harga cytotec di apotik k24 Surabaya, toko obat aborsi cytotec di Surabaya kota jawa timur, obat cytotec Surabaya timur, jual cytotec eceran Surabaya, jual obat cytotec di Surabaya kota Surabaya jawa timur, obat penggugur janin Surabaya kota sby, jawa timur, cytotec asli Surabaya kota Surabaya jawa timur, obat aborsi cytotec asli area Surabaya kota Surabaya jawa timur, obat penggugur janin Surabaya jawa timur, cytotec Surabaya, apotik jual cytotec kota Surabaya jawa timur, obat aborsi penggugur kandungan cytotec asli di Surabaya jawa timur, harga obat cytotec, gastrul kota Surabaya jawa timur, toko obat telat bulan manjur kota Surabaya jawa timur, jual obat aborsi obat penggugur kandungan cytotec asli di Surabaya kota Surabaya jawa timur, harga cytotec di apotik k24 Surabaya, cytotec Surabaya, apotik jual cytotec kota Surabaya jawa timur, obat cytotec Surabaya kota Surabaya jawa timur, jual obat cytotec di Surabaya kota Surabaya jawa timur, toko obat aborsi cytotec di Surabaya kota sby, jawa timur, harga obat cytotec per butir di apotik, obat aborsi cytotec asli cod area Surabaya kota Surabaya jawa timur, obat cytotec Surabaya, obat cytotec Surabaya kota Surabaya jawa timur, toko obat telat bulan manjur kota Surabaya jawa timur, apotik jual cytotec kota Surabaya jawa timur, obat penggugur janin Surabaya kota sby, jawa timur, jual obat aborsi obat penggugur kandungan cytotec asli di Surabaya kota Surabaya jawa timur, jual cytotec eceran Surabaya, jual cytotec Surabaya, cytotec Surabaya, obat cytotec Surabaya, obat penggugur janin Surabaya, apotik jual cytotec kota Surabaya jawa timur, harga obat cytotec, harga obat cytotec per butir di apotik, toko obat telat bulan manjur kota Surabaya jawa timur, Obat Aborsi Surabaya 0851\7696\3835 Jual Obat Cytotec Di Surabaya

Obat Aborsi Surabaya 0851\7696\3835 Jual Obat Cytotec Di SurabayaObat Aborsi Jakarta Wa 085176963835 Apotek Jual Obat Cytotec Di Jakarta

INFO PEMESANAN [ 085176963835 ] Jual Obat Aborsi Cytotec Malang, Obat Aborsi Malang, Jual obat aborsi malang, jual cytotec malang, obat aborsi malang, klinik penjual obat aborsi cytotec di malang kota malang, jawa timur, jual obat aborsi penggugur janin malang malang jawa timur, gastrul malang, harga obat cytotec, dokter cytotec malang, jual cytotec malang, jual obat aborsi malang, klinik penjual obat aborsi cytotec di malang kota malang, jawa timur, obat penggugur kandungan murah malang, obat aborsi malang, jual obat aborsi penggugur janin malang malang jawa timur, harga obat cytotec, dokter cytotec malang, obat cytotec malang, obat cytotec di malang, jual obat cytotec malang, harga obat cytotec malang, obat cytotec kota malang jawa timur, jual beli obat cytotec malang, harga obat cytotec di malang, penjual obat cytotec di malang, jual obat cytotec area malang, jual obat cytotec daerah malang, obat cytotec malang, cytotec malang, cytotec malang, klinik penjual obat aborsi cytotec di malang kota malang jawa timur, obat cytotec di malang, agen obat cytotec asli malang kota malang jawa timur, harga obat cytotec di apotik malang, obat cytotec kota malang jawa timur, harga obat cytotec di malang, apotik yang menjual obat cytotec di malang, klinik penjual obat aborsi cytotec di malang kota malang, jawa timur, harga cytotec di apotik k24 malang, obat gastrul di malang, obat cytotec kota malang jawa timur, jual cytotec malang, dokter cytotec malang, jual obat cytotec surabaya,obat aborsi cod, jual gastrul malang, harga obat gastrul di apotik malang, obat aborsi cytotec dan gastrul, harga obat maag gastrul, obat aborsi, harga obat g astrul per butir di apotik, harga gastrul di apotik, klinik penjual obat aborsi cytotec di malang kota malang jawa timur, klinik penjual obat aborsi cytotec di malang kota malang, jawa timur, jual cytotec malang, harga cytotec, obat gastrul di malang, jual obat cytotec surabaya, harga cytotec di apotik k24 malang, obat penggugur kandungan, jual gastrul, harga cytotec di apotik k24 malang, harga cytotec di malang, harga cytotec di apotik malang, harga cytotec malang, harga obat cytotec di apotik malang, harga obat cytotec malang, harga obat cytotec di malang, harga cytotec di apotik k24 surabaya, jual cytotec malang, obat cytotec malang, jual obat cytotec malang, harga cytotec malang, jual cytotec malang, dokter cytotec malang, apotik jual cytotec malang, harga obat cytotec malang, penjual cytotec malang, jual beli obat cytotec malang, harga cytotec di apotik k24 malang, klinik penjual obat aborsi cytotec di malang kota malang, jawa timur, dokter jual cytotec malang, obat cytotec kota malang jawa timur, jual obat gastrul malang, bidan jual obat aborsi di malang, klinik penjual obat aborsi cytotec di malang kota malang, jawa timur, harga cytotec di apotik k24 malang, obat cytotec di malang, harga obat cytotec, obat gastrul di malang, obat aborsi, bidan jual obat aborsi di malang, jual obat aborsi di malang kota malang,Obat Aborsi Malang 0851\7696\3835 Jual Obat Cytotec Di Malang

Obat Aborsi Malang 0851\7696\3835 Jual Obat Cytotec Di MalangObat Aborsi Jakarta Wa 085176963835 Apotek Jual Obat Cytotec Di Jakarta

Recently uploaded (20)

Progress Report - UKG Analyst Summit 2024 - A lot to do - Good Progress1-1.pdf

Progress Report - UKG Analyst Summit 2024 - A lot to do - Good Progress1-1.pdf

Obat Aborsi Pasuruan 0851\7696\3835 Jual Obat Cytotec Di Pasuruan

Obat Aborsi Pasuruan 0851\7696\3835 Jual Obat Cytotec Di Pasuruan

Toyota Kata Coaching for Agile Teams & Transformations

Toyota Kata Coaching for Agile Teams & Transformations

Contact +971581248768 for 100% original and safe abortion pills available for...

Contact +971581248768 for 100% original and safe abortion pills available for...

Pay after result spell caster (,$+27834335081)@ bring back lost lover same da...

Pay after result spell caster (,$+27834335081)@ bring back lost lover same da...

NewBase 17 May 2024 Energy News issue - 1725 by Khaled Al Awadi_compresse...

NewBase 17 May 2024 Energy News issue - 1725 by Khaled Al Awadi_compresse...

Presentation4 (2) survey responses clearly labelled

Presentation4 (2) survey responses clearly labelled

HAL Financial Performance Analysis and Future Prospects

HAL Financial Performance Analysis and Future Prospects

Home Furnishings Ecommerce Platform Short Pitch 2024

Home Furnishings Ecommerce Platform Short Pitch 2024

00971508021841 حبوب الإجهاض في دبي | أبوظبي | الشارقة | السطوة |❇ ❈ ((

00971508021841 حبوب الإجهاض في دبي | أبوظبي | الشارقة | السطوة |❇ ❈ ((

What is paper chromatography, principal, procedure,types, diagram, advantages...

Obat Aborsi Surabaya 0851\7696\3835 Jual Obat Cytotec Di Surabaya

Obat Aborsi Surabaya 0851\7696\3835 Jual Obat Cytotec Di Surabaya

Top^Clinic ^%[+27785538335__Safe*Women's clinic//Abortion Pills In Harare

Top^Clinic ^%[+27785538335__Safe*Women's clinic//Abortion Pills In Harare

Obat Aborsi Malang 0851\7696\3835 Jual Obat Cytotec Di Malang

Obat Aborsi Malang 0851\7696\3835 Jual Obat Cytotec Di Malang

10 Easiest Ways To Buy Verified TransferWise Accounts

10 Easiest Ways To Buy Verified TransferWise Accounts

Featured

More than Just Lines on a Map: Best Practices for U.S Bike Routes

This session highlights best practices and lessons learned for U.S. Bike Route System designation, as well as how and why these routes should be integrated into bicycle planning at the local and regional level.

Presenters:

Presenter: Kevin Luecke Toole Design Group

Co-Presenter: Virginia Sullivan Adventure Cycling AssociationMore than Just Lines on a Map: Best Practices for U.S Bike Routes

More than Just Lines on a Map: Best Practices for U.S Bike RoutesProject for Public Spaces & National Center for Biking and Walking

Featured (20)

Content Methodology: A Best Practices Report (Webinar)

Content Methodology: A Best Practices Report (Webinar)

How to Prepare For a Successful Job Search for 2024

How to Prepare For a Successful Job Search for 2024

Social Media Marketing Trends 2024 // The Global Indie Insights

Social Media Marketing Trends 2024 // The Global Indie Insights

Trends In Paid Search: Navigating The Digital Landscape In 2024

Trends In Paid Search: Navigating The Digital Landscape In 2024

5 Public speaking tips from TED - Visualized summary

5 Public speaking tips from TED - Visualized summary

Google's Just Not That Into You: Understanding Core Updates & Search Intent

Google's Just Not That Into You: Understanding Core Updates & Search Intent

The six step guide to practical project management

The six step guide to practical project management

Beginners Guide to TikTok for Search - Rachel Pearson - We are Tilt __ Bright...

Beginners Guide to TikTok for Search - Rachel Pearson - We are Tilt __ Bright...

Unlocking the Power of ChatGPT and AI in Testing - A Real-World Look, present...

Unlocking the Power of ChatGPT and AI in Testing - A Real-World Look, present...

More than Just Lines on a Map: Best Practices for U.S Bike Routes

More than Just Lines on a Map: Best Practices for U.S Bike Routes

Ride the Storm: Navigating Through Unstable Periods / Katerina Rudko (Belka G...

Ride the Storm: Navigating Through Unstable Periods / Katerina Rudko (Belka G...

Good Stuff Happens in 1:1 Meetings: Why you need them and how to do them well

Good Stuff Happens in 1:1 Meetings: Why you need them and how to do them well

Laws and rules applicable to start up companies

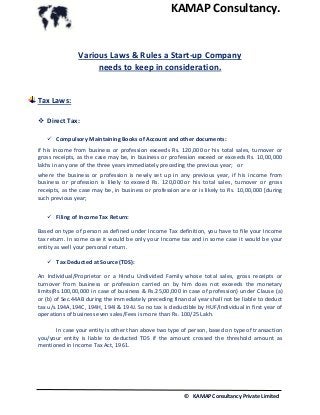

- 1. KAMAP Consultancy. © KAMAP Consultancy Private Limited Various Laws & Rules a Start-up Company needs to keep in consideration. Tax Laws: Direct Tax: Compulsory Maintaining Books of Account and other documents: if his income from business or profession exceeds Rs. 120,000 or his total sales, turnover or gross receipts, as the case may be, in business or profession exceed or exceeds Rs. 10,00,000 lakhs in any one of the three years immediately preceding the previous year; or where the business or profession is newly set up in any previous year, if his income from business or profession is likely to exceed Rs. 120,000 or his total sales, turnover or gross receipts, as the case may be, in business or profession are or is likely to Rs. 10,00,000 [during such previous year; Filing of Income Tax Return: Based on type of person as defined under Income Tax definition, you have to file your Income tax return. In some case it would be only your Income tax and in some case it would be your entity as well your personal return. Tax Deducted at Source (TDS): An Individual/Proprietor or a Hindu Undivided Family whose total sales, gross receipts or turnover from business or profession carried on by him does not exceeds the monetary limits(Rs.100,00,000 in case of business & Rs.25,00,000 in case of profession) under Clause (a) or (b) of Sec.44AB during the immediately preceding financial year shall not be liable to deduct tax u/s.194A,194C, 194H, 194I & 194J. So no tax is deductible by HUF/Individual in first year of operations of business even sales/Fees is more than Rs. 100/25 Lakh. In case your entity is other than above two type of person, based on type of transaction you/your entity is liable to deducted TDS if the amount crossed the threshold amount as mentioned in Income Tax Act, 1961.

- 2. KAMAP Consultancy. © KAMAP Consultancy Private Limited Indirect Taxes Service Tax: Service Tax is an indirect tax imposed on services provided However post Finance Budget 2013 service tax is also imposed on service received by reverse charge mechanism. The registration under ST is based on gross turnover/Top line of your entity. Where the turnover of your entity crosses Rs 9 lacs, the service provider is required to get it registered under the law, and is liable to charge service tax on services provided once the turnover crosses Rs.10 lacs. The rules pertaining to payment of service tax and filing of service tax return is based on your various factors and type of entity. Value Added Tax(VAT) VAT is another type of indirect tax imposed on goods sold. This act is based at state level and each state has various rules for VAT.The registration under VAT is compulsory for dealer(your entity is termed as dealer) having turnover exceeding Rs 5 lacs (or increased limit of Rs 10 lacs in some states).On registration, such dealer is allotted a unique 11 digit TIN (Taxpayer’s Identification Number). The registration can also be sorted on voluntary basis. The rate of VAT depends on type of goods and as defined under VAT schedules. The payment of VAT, filing of returns etc is based on type of entity. Central Sales Tax(CST) CST is a form of indirect tax imposed only on goods sold from one state to another state, which particularly takes into account that the buyer and the seller needs to be in two different states. CST registration is not dependent on amount of turnover. Simply put, registration of dealer becomes compulsory once he affects an inter-state sale. Excise Act The Central Excise is a tax on the ‘act of manufacture or production’ on all excisable goods which are manufactured or produced in India. It comprises of Basic duty in addition to Education Cess is a duty of excise which is to be levied @ 2% of the aggregate duty of excise and Secondary and Higher Education cess is payable at the rate of 1% on excise duty payable. A manufacturer can enjoy SMALL SCALE BENEFIT which provides exemption to small scale manufacturer from whole of duty leviable on goods specified in annexure where the aggregate value of clearance of goods is up to Rs. 1,50,00,000. The person is defined as small scale manufacture whose value of clearance in the previous financial year has not exceed Rs. 4,00,00,000

- 3. KAMAP Consultancy. © KAMAP Consultancy Private Limited Customs Act The Customs Act, 1962 which provides for levy of duty on imports as well as on exports at the rates which are prescribed under the Customs Tariff Act, 1975 read along with the relevant exemption notification. The taxable event to attract customs duty is import into or export from India. The export duties are applicable to a handful of commodities. The duties are of broadly of two types, Basic Duty and Additional Custom Duty. The rate of duty and tariff valuation shall be as applicable on (a) In the case of goods directly cleared for home consumption the date of the presentation of the bill of entry. (b) In case of goods cleared from warehouse, the date when bill of entry is presented for home clearance of such goods from the warehouse. In case, bill of entry is submitted prior to arrival of the vessel or the aircraft, the date would be the later of the date of submission of the bill of entry and the grant of entry inward to the vessel. Corporate Laws: Where your entity is having corporate status i.e. being private or public limited, then it would have to comply with rules of Companies Act 1956. Few of the compliance to be followed by a corporate entity: Appointment of Statutory Auditor, opening of Bank account in name of Company, conducting minimum number of board meeting in a year, maintain of books of account, maintenance of statutory register, appropriate notice for AGM, finalization of Financial statement, conducting Annual general meeting and various other compliance based on various factor applicable to your company. Law governing your Employee’s Profession tax Act An employer organization is required to get registered under the Profession Tax Act and obtain a Registration Certificate under which the payment in respect of taxes deducted from employees’ salaries can be made.Also as a firm, the organization is required to obtain Enrolment Certificate and pay Profession tax on its behalf. The employer is liable to deduct profession tax from employee’s salary as per the rate defined under respective states of India and same needs to be deposit with State government. The periodicity of payment and filing of profession Tax return depends on profession tax liability.

- 4. KAMAP Consultancy. © KAMAP Consultancy Private Limited Employee’s Provident Fund & Miscellaneous Provision Act, 1952 Applicable to every establishment which is a factory engaged in any industry specified in Schedule I and in which 20(twenty) or more persons are employed. Where contribution by employee stands to be 12% of his/her Basic pay + DA and equal contribution of Employer is bifurcated into Pension fund & provident fund. Where pension fund is calculated @ 8.33% on Basic pay + DA and balance fund is towards provident fund of employee. Employees’ Deposit Linked Insurance Scheme, 1976 (EDLI) EDLI is basically an Life Insurance for all covered employees. Here where an employee dies while in service, his/her family will get compensation based on deposit in EPF account. In order to comply with this act, the employer has to contribute 0.5% of employee’s Basic pay + DA as monthly premium The Payment of Gratuity Act 1972: The act is applicable to following category of establishment: o Employees engaged in factories, mines, oilfields, plantations, ports, railway companies, shops or other establishments and for matters connected therewith or incidental with. o Every shop or establishment within the meaning of any law for the time being in force in relation to shops and establishments in a State, in which ten or more persons are employed, or were employed, on any day of the preceding twelve months; o Such other establishments or class of establishments, in which ten or more employees are employed, or were employed, on any day of the preceding twelve months, as the Central Government may, by notification, specify in this behalf Determination of Gratuity Amount o For every completed year of service or part thereof in excess of six months, the employer shall pay gratuity to an employee at the rate of fifteen days’ wages based on the rate of wages last drawn by the employee concerned. o To formulate the above explanation, it would be “Basic + DA (Wages Last drawn)* 15days * number of years of continuous service (six months or less to be ignored and more than six months to be counted as full year)”

- 5. KAMAP Consultancy. © KAMAP Consultancy Private Limited CONTACT DETAILS: KAMAP CONSULTANCY PRIVATE LIMITED Address: Sai dham Arcade, 1st Flr, No. 34, P. K. Road, Near St. Mary School, Mulund(W) – 400080, Maharashtra, India. Tel: +91-22- 6710-6795 Website: www.kamapconsultancy.com Email: info@kamapconsultancy.com Social Tag: Linkedin Twitter Facebook Blog: KAMAP CONSULTANCY Disclaimer: This material and the information contained herein prepared by KAMAP Consultancy Private Limited and are intended to provide general information on a particular subject or subjects and is not an exhaustive treatment of such subject(s). The information is not intended to be relied upon as the sole basis for any decision which may affect you or your business. Before making any decision or taking any action that might affect your personal finances or business, you should consult a qualified professional adviser. KAMAP Consultancy Private Limited shall not be responsible for any loss whatsoever sustained by any person who relies on this material.