Course content on ca final exams nov 2019 - PPT

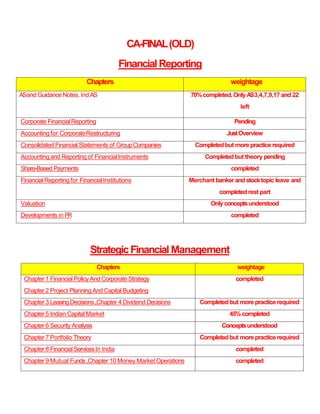

- 1. CA-FINAL(OLD) FinancialReporting Chapters weightage ASand GuidanceNotes, Ind AS 70%completed,OnlyAS3,4,7,9,17 and 22 left Corporate FinancialReporting Pending Accounting for CorporateRestructuring JustOverview Consolidated FinancialStatements of GroupCompanies Completedbut morepractice required Accounting and Reporting of FinancialInstruments Completedbut theory pending Share-Based Payments completed Financial Reporting for FinancialInstitutions Merchant bankerand stocktopic leave and completed rest part Valuation Only conceptsunderstood Developments in FR completed StrategicFinancial Management Chapters weightage Chapter1 FinancialPolicyAnd Corporate Strategy Chapter2 Project PlanningAnd Capital Budgeting completed Chapter3 LeasingDecisions ,Chapter 4 Dividend Decisions Completedbut morepracticerequired Chapter5 Indian CapitalMarket 45%completed Chapter6 Security Analysis Conceptsunderstood Chapter7 Portfolio Theory Completedbut morepracticerequired Chapter8 FinancialServicesIn India completed Chapter9 Mutual Funds,Chapter 10 Money Market Operations completed

- 2. Chapter11 FDI,Foreign Institutional Investment (FII) And International FinancialManagement Pending Chapter12 Foreign ExchangeExposure AndRisk Management Completedbut theory pending Chapter13 Mergers, Acquisitions & Restructuring Pending AdvancedAuditingandProfessional Ethics Chapters weightage Chapter1 AS,Statements and GuidanceNotes – AnOverview SA200, 300seriescompleted, other pending Chapter2 Audit Strategy, PlanningandProgramming Chapter3 RiskAssessmentandInternal Control Pending Chapter4 Audit under CISEnvironment ,Chapter 5 SpecialAudit Techniques Completed Chapter6 TheCompanyAudit ,Chapter 7 Liabilities of Auditors, Chapter9 Audit Committee and CorporateGovernance Completedbut morecasestudy practicerequired Chapter8 Audit Report , Chapter 10 Audit of Consolidated Financial Statements Pending Chapter11 Audit of Banks Completed Chapter12 Audit of GeneralInsuranceCompanies Chapter13 Audit of Co-OperativeSocieties Chapter14 Audit of Non BankingFinancialCompanies Completedbut NBFCoverviewed Chapter15 Audit under FiscalLaws Completedbut morepracticerequired Chapter16 CostAudit ,Chapter 17 SpecialAudit Assignments, Chapter18 Audit of Public SectorUndertakings pending Chapter19 Internal Audit, Management andOperationalAudit Chapter20 Investigations and DueDiligence ,Chp-21 Peer Review completed Chapter22 Professional Ethics 62%completed,Schedule2 left

- 3. Daily22 MCQ’s CorporateandAllied Laws Chapters weightage Chapter1 - Declaration and Payment of Dividend, Chapter2 -Accounts and Audit Pending Chapter3 - Appointment and Qualification of Directors Chapter4 - Appointment and Remuneration of Managerial Personnel Chapter5 - Meetings of Boardand ItsPowers Understood, learning ispending Chapter6 - Inspection Inquiry andInvestigation Chapter7 - Compromises,Arrangements andAmalgamations Chapter8 - Prevention of OppressionandMismanagement Completed Chapter10 - Winding Up , Chapter11 - ProducerCompanies 78%completed Chapter12 - CompaniesIncorporated Outside India, Chapter17 - Miscellaneous Provisions Completedbut practice required Chapter13 - Offencesand Penalties , Chapter16 - SpecialCourts Chapter15 - NCLTand AppellateTribunal Justoverviewed Chapter14 - E-Governance Pending Chapter18 - Corporate Secretarial Practice-Drafting Of Resolution, Minutes, Notices And Reports, Chapter 19 – IBC,2016 Completedbut not practiced Chapter20 - (SEBI)Act, 1992, Chapter 21 - TheSecuritiesContracts (Regulation) Act, 1956 Completed Chapter22 -TheForeign ExchangeManagement Act, 1999 Chapter24- Overview of BankingRegulation Act, 1949, the Insurance Act, 1938, the InsuranceRegulatory and Development AuthorityAct, Onemorereading required

- 4. 1999, the Securitisation and Reconstruction of FinancialAssetsand Enforcement of Security Interest Act,2002 Chapter23 - TheCompetition Act, 2002 overviewed Chapter25 - Prevention of Money LaunderingAct,2002 Chapter26 - Interpretation of Statutes, DeedsandDocuments completed 18 MCQ’sDaily Practice AdvancedManagementAccounting Chapters weightage Chapter1 Developments in the BusinessEnvironment Pending Chapter2 DecisionMaking usingCostConceptsandCVPAnalysis completed Chapter3 Pricing Decisions Chapter6 Costing of ServiceSector 71%completed Chapter4 Budget & BudgetaryControl Completedbut theory pending Chapter5 Standard Costing Justoverviewed Chapter7 Transfer Pricing completed Chapter8 Uniform Costing and Inter FirmComparison Chapter9 Profitability Analysis – Product Wise/ SegmentWise/ CustomerWise Completedbut more practicerequired Chapter10 LinearProgramming Completedbut more practicerequired Chapter11 TheTransportation Problem completed Chapter12 TheAssignment Problem completed Chapter13 Critical PathAnalysis pending Chapter14 ProgramEvaluation andReview Technique Completedbut theory

- 5. pending Chapter15 Simulation 90%completed Chapter16 LearningCurve Theory Only conceptsunderstood Information SystemsControland Audit Chapters weightage Chapter1 Conceptsof GovernanceandManagement of Information Systems completed Chapter2 Information SystemsConcepts 28%completed Chapter3 Protection of InformationSystems Completedbut more practicerequired Chapter4 BusinessContinuity Planning andDisaster Recovery Planning completed Chapter 5 Acquisition, Development and Implementation of Information Systems Only concepts understood Chapter6 Auditing of InformationSystems pending Chapter7 Information TechnologyRegulatoryIssues Justoverviewed Chapter8 EmergingTechnologies Understood, learning required Daily14 MCQ’sPractice Direct TaxLaws Chapters weightage

- 6. Part I: DirectTaxLaws Chapter1: BasicConcepts,Chapter 2: ResidenceandScopeof Total Income Chapter3: Incomes which do not form part of Total Income Pending All Headsof income Chapter9: Income of Other Personsincluded in assessee'sTotalIncome 65%completed but more practiceis required Chapter10: Aggregation of Income, Set-Off and CarryForward of Losses Chapter11: Deductions Just overview Chapter12: Assessment of VariousEntities Understood, learning required Chapter13: Assessment of Charitable or ReligiousTrustsorInstitutions, Political Parties andElectoralTrusts Pending Chapter14: TaxPlanning, TaxAvoidance & TaxEvasion completed Chapter15: Deduction, Collection andRecoveryof Tax completed Chapter16: Income-tax Authorities, Chapter 17: AssessmentProcedure Chapter18: Appealsand Revision ,Chapter 19: Settlement of TaxCases Chapter20: Penalties,Chapter 21: Offencesand Prosecution completed Chapter22: Liability in SpecialCases, Chapter23: Misc. Provisions pending Part II: InternationalTaxation Chapter1: Non-residentTaxation pending Chapter2: Double Taxation Relief , Chapter4: AdvanceRulings Chapter5: Equalisation Levy Completed but morepractice required Chapter3: TransferPricing & Other Anti-AvoidanceMeasures Completed but theorypending Daily 22 MCQ’s Indirect TaxLaws Chapters weightage Part-I GoodsandServicesTax

- 7. Chapter1: GSTin India - AnIntroduction ,Chapter 2: TaxableEvent -Supply Chapter3: Chargeof GST, Chapter 4: Exemptionsfrom GST Chapter5: Placeof Supply, Chapter 6: Time of Supply Chapter7: Value of Supply, Chapter 8: Input TaxCredit 55%completed only basicsareleft Chapter9: Registration completed Chapter10: TaxInvoice, Credit and Debit Notes completed Chapter11: Accountsand Records completed Chapter12: Payment of Tax, Chapter 13:Returns completed Chapter14–Import And Export UnderGst completed Chapter15–refunds Completedbut morepracticeis required Chapter16–job Work , Chapter17- AssessmentAnd Audit Chapter18- Inspection, Search,Seizure AndArrest Chapter24- Miscellaneous Provisions Jutsoverviewed Chapter19- DemandsAndRecovery, Chapter23: AdvanceRuling Chapter20: Liability to PayTaxin CertainCases Chapter21- OffencesAnd Penalties , Chapter22- AppealsAnd Revisions Only conceptsunderstood Part-II Customs&FTP Chapter1: Levyof andExemptions from CustomsDuty Chapter2: Typesof Duty Chapter3: Classification of Imported and ExportGoods Chapter4: Valuation under the Customs Act,1962 Theory pending Chapter5: Importation, Exportation andTransportation ofGoods Chapter6: Warehousing, Chapter7: Duty Drawback Chapter8: DemandandRecovery, Chapter9: Refund Chapter10: Provisions Relating to Illegal Import, Export, Confiscation & Allied Provisions 68%completed but more practice required Chapter11: Appealsand Revision , Chapter12: Settlement Commission Chapter13: AdvanceRuling, Chapter14: Miscellaneous Provisions Chapter15: Foreign TradePolicy pending CA-FINAL(NEW) FinancialReporting Chapters weightage

- 8. Chapter1: Application of AccountingStandards (AS15,25,28,21,23,27) Consolidation pending Chapter2: Application of GuidanceNotes Completed Chapter3: Framework for Preparation and Presentationof FinancialStatements Leave Chapter4: Ind ASon Presentation of Items in the Financial Statements (Ind AS1,34,7) pending Chapter5: Ind ASon Recognition of Revenuein the Financial Statements Completedbut more practicerequired Chapter6: Ind ASon Measurement basedon AccountingPolicies (Ind AS8,10,113) Lessfocused Chapter7: Ind AS20 “Accounting for Government Grantsand Disclosure of GovernmentAssistance” completed Chapter8: Ind AS101"First-time Adoption of IndianAccounting Standards" Lessfocused Chapter9: Ind ASon Assetsof the FinancialStatements (Ind 2,16,17,23,36,38,40,105) 65%completed but more practicerequired Chapter10: Ind AS41“Agriculture” completed Chapter11: Ind ASon Liabilities of the FinancialStatements (ind AS19,37) Pending Chapter12: Ind ASon Items impacting the FinancialStatements (Ind AS12,21) Only conceptunderstood Chapter13: Ind ASon Disclosures in the FinancialStatements (Ind AS24,33,108) Justoverviewed Chapter14: Accounting and Reporting of FinancialInstruments Completedbut theory pending Chapter15: Accounting for ShareBasedPayment completed Chapter16: BusinessCombinations and Corporate Restructuring Conceptsoverviewed Chapter17: Consolidated andSeparateFinancial Statements pending Chapter18: Analysis of FinancialStatements completed Chapter19: Accounting of CarbonCredits completed Chapter20: Accounting for e-CommerceBusiness completed Chapter21: Integrated Reporting completed

- 9. Chapter22: Corporate SocialResponsibility completed Chapter23: HumanResourceReporting completed Chapter24: ValueAddedStatement completed StrategicFinancial Management Chapters weightage Chapter1: Financial Policy and CorporateStrategy Chapter2: Indian FinancialSystem Chapter3: RiskManagement Chapter4: Security Analysis Chapter5: Security Valuation Chapter6: Portfolio Management Chapter7: Securitization Chapter8: MutualFunds Chapter9: Derivatives Analysis andValuation Chapter10: Foreign ExchangeExposure andRiskManagement Chapter11: International FinancialManagement Chapter12: Interest RateRiskManagement Chapter13: Corporate Valuation Chapter14: Mergers, Acquisitions and CorporateRestructuring Chapter15: International FinancialCentre (IFC) Chapter16: StartupFinance Chapter17: SmallandMedium Enterprises AdvancedAuditingandProfessional Ethics Chapters weightage Chapter1: Auditing Standards, Statements and GuidanceNotes - An Overview Chapter-2: Audit Planning, Strategy andExecution Chapter3: RiskAssessmentand Internal Control Chapter 4: SpecialAspectsof Auditing in anAutomated Environment

- 10. Chapter6: Audit Reports Chapter9: Audit of Consolidated FinancialStatements Chapter5: Audit of LimitedCompanies Chapter7: Audit Reports & Certificate forSpecialPurpose Engagement Chapter8: Audit Committee andCorporateGovernance Chapter-10: Audit of Banks Chapter11: Audit of InsuranceCompanies Chapter12: Audit of Non-Banking FinancialCompanies Chapter15: Audit of Public SectorUndertakings Chapter13: Audit under FiscalLaws Chapter16: Liabilities of Auditor Chapter14: SpecialAudit Assignments Unit 1: EnvironmentalAuditing Unit 2: EnergyAudit Unit 3: Audit of Accountsof Non-Corporate Entities(Bank Borrowers) Unit 4: Audit of Stock and Debtors/ Unit Inspection(Audit of Borrower Accounts) Unit 5: Audit of Members ofStockExchanges Unit 6: Audit of MutualFunds Unit 7: Audit ofDepositories

- 11. Chapter17: Internal Audit, Management andOperationalAudit Chapter18: DueDiligence, Investigation andForensic Audit Unit 1: DueDiligence Unit 2: Investigation Unit 3: ForensicAudit Chapter19: PeerReview and Quality Review Unit 1: PeerReview Unit 2: QualityReview Chapter20: ProfessionalEthics CorporateandEconomicLaws Chapters weightage Part-I: CorporateLaws Section-A:CompanyLaw Chapter1: Appointment and Qualifications of Directors Chapter2: Appointment and Remuneration of Managerial Personnel Chapter3: Meetings of Boardandits Powers Chapter4: Inspection, Inquiry andInvestigation Chapter5: Compromises, Arrangements andAmalgamations Chapter6: Prevention of OppressionandMismanagement Chapter7: WindingUp Chapter8: ProducerCompanies

- 12. Chapter9: Companiesincorporated outsideIndia Chapter10: Miscellaneous Provisions Chapter11: Compoundingof Offences, Adjudication, Special Courts Chapter12: National CompanyLawTribunal and Appellate Tribunal Chapter13: Corporate Secretarial Practice – Drafting of Notices, Resolutions, Minutes andReports Section-B:SecuritiesLaws Chapter1: TheSecurities Contract (Regulation) Act, 1956and the Securities Contract (Regulation) Rules,1957 Chapter2: TheSecurities ExchangeBoardof India Act, 1992, SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2009 and SEBI(Listing Obligations andDisclosureRequirement) Regulations,2015 Part-II: EconomicLaws Chapter1: TheForeign ExchangeManagement Act, 1999 Chapter 2: TheSecuritisation and Reconstruction of Financial Assetsand Enforcement of Security Interest Act,2002 Chapter3: ThePrevention of Money LaunderingAct,2002 Chapter4: Foreign Contribution Regulation Act, 2010 Chapter5: TheArbitration and Conciliation Act, 1996 Chapter6: TheInsolvency and Bankruptcy Code,2016 StrategicCostManagement andPerformance Evaluation Chapters weightage Part-A: StrategicCostManagement andDecision Making SubPart-I: StrategicCostManagement Chapter1: Introduction to Strategic CostManagement Chapter2: Modern BusinessEnvironment

- 13. Chapter3: LeanSystemand Innovation Chapter4: CostManagement Techniques Chapter5: CostManagement for SpecificSector SubPart-II: StrategicDecisionMaking Chapter6: DecisionMaking Chapter7: PricingDecision Part-B:PerformanceEvaluationand Control SubPart-I: PerformanceEvaluationandReporting Chapter8: Performance Measurement andEvaluation Chapter9: Divisional TransferPricing Chapter10: Strategic Analysis of OperatingIncome SubPart-II: ManagerialControl Chapter11: Budgetary Control Chapter12: StandardCosting Part-C:CaseStudy Chapter13: CaseStudy Direct TaxLawsandInternationalTaxation Chapters weightage Part I: DirectTaxLaws Chapter1: BasicConcepts Chapter2: ResidenceandScopeof Total Income Chapter3: Incomes which do not form part of Total Income Chapter4: Salaries Chapter5: Income from HouseProperty Chapter6: Profits and Gainsof Businessor Profession Chapter7: Capital Gains Chapter8: Income from OtherSources Chapter9: Income of Other Personsincluded in assessee'sTotal Income

- 14. Chapter10: Aggregation of Income, Set-Off and Carry Forwardof Losses Chapter11: Deductions from GrossTotalIncome Chapter12: Assessment of VariousEntities Chapter13: Assessment of Charitable or ReligiousTrustsor Institutions, Political Parties and ElectoralTrusts Chapter14: TaxPlanning, TaxAvoidance & TaxEvasion Chapter15: Deduction, Collection andRecoveryof Tax Chapter16: Income-taxAuthorities Chapter17: Assessment Procedure Chapter18: AppealsandRevision Chapter19: Settlement of TaxCases Chapter20: Penalties Chapter21: Offencesand Prosecution Chapter22: Liability in SpecialCases Chapter23: Miscellaneous Provisions Part II: InternationalTaxation Chapter1: Non-residentTaxation Chapter2: Double Taxation Relief Chapter4: AdvanceRulings Chapter5: Equalisation Levy Chapter3: TransferPricing & Other Anti-AvoidanceMeasures Chapter6: Overview of Model TaxConventions Chapter7: Application and Interpretation of TaxTreaties Chapter8: Fundamentalsof BaseErosionandProfit Shifting Indirect TaxLaws Chapters weightage Part-I GoodsandServicesTax

- 15. Chapter1: GSTin India - AnIntroduction Chapter2: TaxableEvent - Supply Chapter3: Chargeof GSTChapter 4: Exemptions from GSTChapter 5: Placeof Supply Chapter 6: Time of Supply Chapter 7: Value of Supply Chapter8: Input TaxCredit Chapter9: Registration Chapter10: TaxInvoice, Credit and Debit Notes Chapter11: AccountsandRecords Chapter12: Payment of Tax Chapter13: Returns Chapter14–Import And Export UnderGst Chapter15–refunds Chapter16–job Work Chapter17- AssessmentAnd Audit Chapter18- Inspection, Search,Seizure AndArrest Chapter24- Miscellaneous Provisions Chapter19- DemandsAndRecovery Chapter20: Liability to PayTaxin Certain Cases Chapter21- OffencesAnd Penalties Chapter22- AppealsAndRevisions Chapter23: AdvanceRuling Part-II Customs&FTP Chapter1: Levyof andExemptionsfrom CustomsDuty Chapter2: Typesof Duty Chapter3: Classification of Imported and ExportGoods Chapter4: Valuation under the CustomsAct,1962

- 16. Chapter5: Importation, Exportation andTransportation of Goods Chapter6: Warehousing Chapter7: DutyDrawback Chapter8: DemandandRecovery Chapter9: Refund Chapter10: ProvisionsRelatingto Illegal Import, Export, Confiscation & AlliedProvisions Chapter11: Appealsand Revision Chapter12: Settlement Commission Chapter13: AdvanceRuling Chapter14: Miscellaneous Provisions Chapter15: Foreign TradePolicy