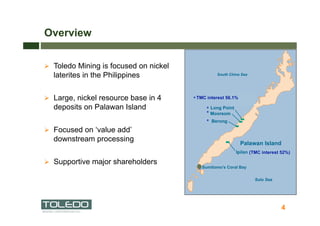

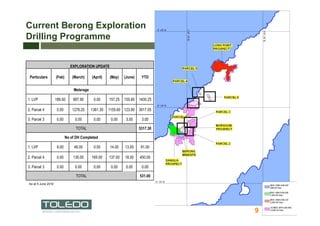

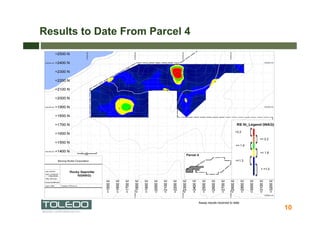

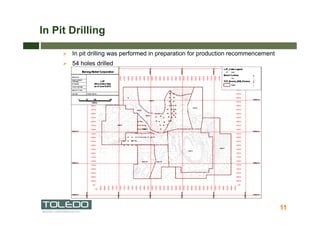

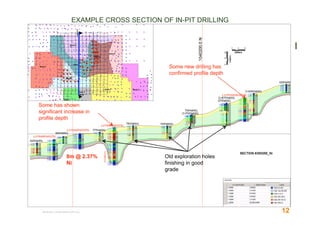

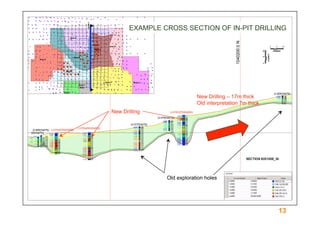

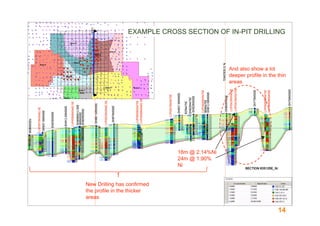

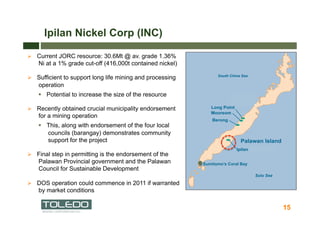

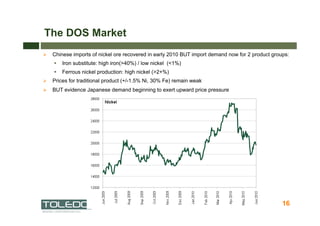

Toledo Mining provided an investor update in June 2010. It has a large nickel resource base in the Philippines and is focused on downstream processing to add value. The company's Berong Nickel Corporation has a 10Mt JORC resource and is conducting an exploration program to prove up additional resources for future mining and processing operations. Drilling results to date from the Parcel 4 area show zones of nickel mineralization above 1.3% nickel.