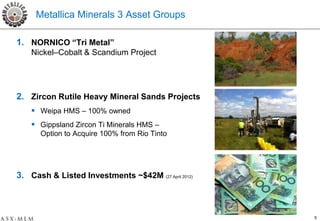

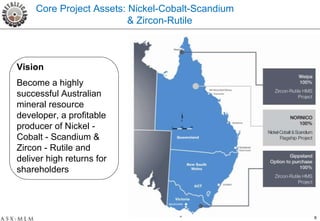

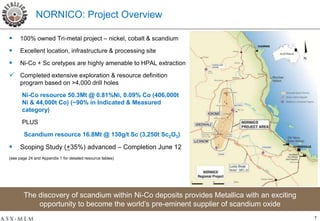

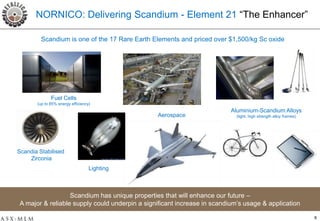

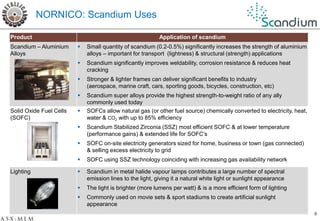

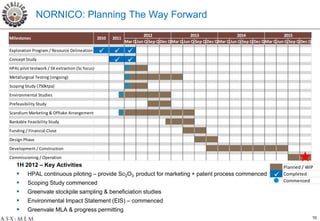

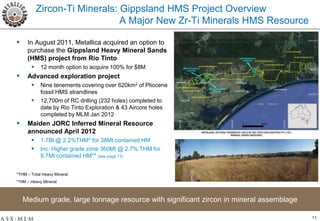

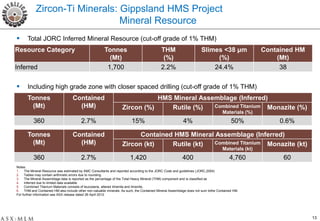

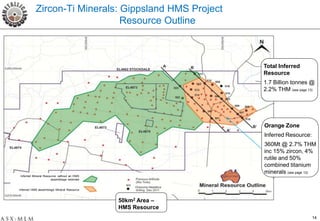

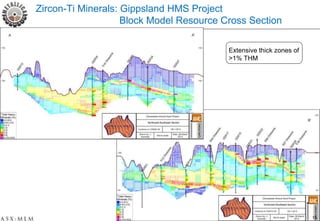

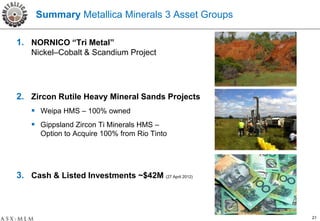

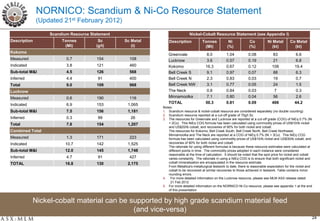

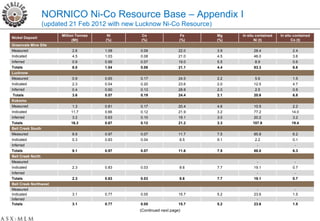

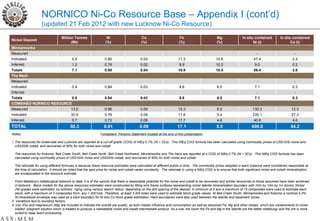

Metallica Minerals is an Australian resource development company focused on nickel-cobalt-scandium and zircon-rutile projects. Its core project is the NORNICO nickel-cobalt-scandium project in Queensland, which has completed extensive exploration defining over 50 million tonnes of nickel-cobalt resources containing over 400,000 tonnes of nickel and 44,000 tonnes of cobalt, as well as a scandium resource containing over 3,000 tonnes of scandium oxide. Metallica also holds the option to acquire the large Gippsland zircon-titanium minerals project in Victoria with an initial inferred resource of 1.7 billion tonnes at 2.2