1 Hedging with Futures (13p) (a) Table 1 shows historica.docx

- 1. 1 Hedging with Futures (13p) (a) Table 1 shows historical futures prices for crude oil traded on the NYMEX for the firstWednesday of each month in 2015. Prices are given for different contract maturities ranging from January 2015 to December 2015.1 Prices are quoted in USD per barrel and each contract is for 1000 barrels. Give an intuitive explanation of varying price patterns in the table. (Hint: Given the current dynamics of crude oil prices, what are your expectations about the size of the convenience yield and teh storage costs? On which months is the term structure of futures prices in contango or backwardation? Is this consistent with your initial expectation of the convenience yield?) (b) Suppose that crude oil is currently priced at $37 per barrel and that the crude oil futuresprice with 4-month delivery is $38.88 per barrel. Assuming a continuously compounded interest rate of 4.5% and a convenience yield of 5.5%, what are the current implied annualized storage costs? (c) Assume, as an exporter of crude oil, that you would like to lock in the price for alarge

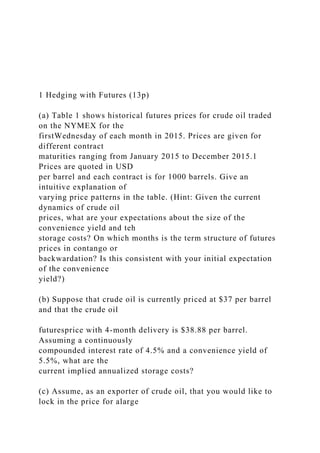

- 2. quantity of crude oil which you will produce 18 months from now. You discover Date Delivery Month Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 07-Jan-15 *48.77 48.65 49.08 49.72 50.48 51.23 51.95 52.61 53.25 53.87 54.51 55.15 04-Feb-15 *48.70 48.45 49.30 50.58 51.89 53.18 54.38 55.40 56.25 57.03 57.78 04-Mar-15 *51.60 51.53 53.23 54.55 55.74 56.83 57.76 58.46 59.07 59.64 01-Apr-15 *49.55 50.09 51.75 53.06 53.98 54.74 55.44 56.11 56.74 06-May-15 *60.7 60.93 62.00 62.56 62.93 63.28 63.66 64.01 03-Jun-15 *59.61 59.64 59.93 60.14 60.31 60.59 60.93 01-Jul-15 *56.87 56.96 57.37 57.70 58.12 58.55 05-Aug-15 *45.11 45.15 45.55 46.18 46.84 02-Sep-15 *45.11 46.25 46.86 47.52 07-Oct-15 *48.13 47.81 48.40 04-Nov-15 *46.58 46.32 1 Thus, a column corresponds to one contract with prices given on different dates. A row corresponds to

- 3. prices given on a particular date for different contract maturities. 2 02-Dec-15 *40.10 Table 1: NYMEX Futures prices for crude oil for the first Wednesday of each month in 2015. A * implies the spot price in the corresponding month. Source: Futures data from U.S. Energy Information Administration that the NYMEX futures crude oil contract for a 18-month delivery currently trades at $45.81 per barrel. Using the same assumptions and calculations made in (b), is there anything you would propose to do in this situation? (d) On Feb 6, 2015, as an airline company, you are concerned about a possible decreasein supply of oil over the next 6 months (i.e., August) due to tensions in the Middle East. Explain how you can use futures contracts to hedge your exposure to oil price risk. Assume the company would like to enter a position that is worth USD $3,500,000. How many contracts do you need to buy/sell? (e) Go to the web site of CME Group2 and find the historical margin requirements for Light Sweet Crude Oil (WTI) on Feb 6, 2015 for the contract maturity traded in part (d). Assuming the airline company is a hedger, what is the total

- 4. initial margin required for this position? What is the total maintenance margin? 2 Duration Hedging with Futures (16p) Liability-driven investment policies (LDI) have come to prominence in the UK and the U.S. as a result of recent changes in the regulatory and accounting frameworks. As a result, the Office of the Superintendent of Financial Institutions of Canada decided to implement LDI policies in its federal pension plan. LDI aims to address the duration mismatch between assets and liabilities, which has become a non-negligible risk to the funding status of pension plans around the world. Assume that the Canada Pension Plan Investment Board (CPPIB) has the balance sheet illustrated in Table 2, in which all numbers are expressed in million $CAD. Assets Liabilities Equity 600 Liabilities 1,050 Fixed Income 400 Liabilities 1,050 Total 1,000 Total 1,050 Table 2: Balance Sheet of Canada Pension Plan Investment Board. 2 http://www.cmegroup.com/clearing/risk- management/historical-margins.html

- 5. 3 (a) Is the CPPIB currently under- or overfunded? By how much? (b) What is the total asset duration of CPPIB’s investment portfolio, assuming that equityhas a duration of zero years, and the fixed income portfolio a duration of 5 years? (c) Assume a 10% decrease in global equity markets. How will this affect CPPIB’s fundingratio? (d) Assume that the liabilities have a duration of 12 years. Given an independent decreasein interest rates of 100 basis points (i.e., a decrease by one percentage point), how will CPPIB’s funding ratio change? Explain duration risk in relation to your findings. (Hint: By independent, I mean that you should ignore your answer from question (c)). (e) Assume that CPPIB wants to hedge 70% of its liabilities against interest rate fluctuations over the following year. It therefore decides to hedge its exposure by investing into bond futures contracts as the LDI solution. If the bond futures is currently priced at 109.4823 percent, and the underlying bond has a duration of 22 years and a par value of $CAD 1 million, how many contracts are needed in order to be fully immunized? You need indicate whether the fund needs to

- 6. buy or to sell the futures contracts. (f) Once the LDI duration hedging solution is implemented, will the plan remain immunized against changes in interest rates? Why or why not? Explain. 3 Swap Pricing (18p) A Brazilian Software company (KondZilla) plans to expand its business to the U.S. market and requires USD$15 million to fund the expansion. The Brazilian company faces the following borrowing opportunities: obtain a 11.25% Brazilian real (BRL)-denominated loan in Brazil, or a 8.5% USD-denominated loan in the U.S. Meanwhile, a U.S. based minerals extraction company plans to expand its operations to Brazil and requires 60 million BRL to finance its project. The U.S. based company can secure either a 10.75% BRL-denominated loan in Brazil or a 7.5% USD-denominated loan in the U.S. (a) Which company has an absolute borrowing advantage, which company has a comparative borrowing advantage (and in which market)? Why? Which company would you consider to have a higher credit risk? (b) As an alternative option to paying fixed rate loans, both companies approach DeutscheBank, who acts as an intermediary by suggesting to broker a currency swap between the two companies. Essentially, Deutsche Bank engages into a 4-year fixed-

- 7. for-fixed currency-swap with both companies: 4 • The Brazilian company borrows 60 million BRL at 11.25% and swaps it with Deutsche Bank for a $15 million USD loan at 8.25%. • The U.S. based company borrows $15 million USD at 7.5% and swaps it with Deutsche Bank for $60 million BRL at 10.5%. Assuming a flat term structure of interest rates in both countries, 4% in the U.S. and 8% in the Brazil and the spot exchange rate of 4 BRL per USD. All interest rates are expressed in continuous compounding. Draw a sketch of the cash flows for the three stages in the transaction: initial cash flow, annual interest cash flow, principal payment at maturity. How much does Deutsche Bank make in USD from the annual exchange of interest cash flows (annual profit)? (c) Calculate the present value of the swap from the perspective of the U.S. based andBrazilian companies in USD. Explain whether entering into the swap contract is beneficial to both companies compared to directly borrowing in the financial markets? (d) Calculate the duration of the swap from the perspective of the Brazilian company.(Use continuous discounting!)

- 8. (e) How would your answer to (d) change if Deutsche Bank were to use the floating annualrate of 4%+LIBOR instead of the fixed rate of 8.25% in its swap with the Brazilian Company? (f) On January 8, 2016, almost 2 years into the swap contract, the inflation rate shoots upto 10% in Brazil as Standard & Poor’s downgraded Brazil’s credit rating to junk earlier in September. Being concerned about the Brazilian company ability to honor the swap contract, Deutsche Bank decides to cancel the Brazilian leg of the swap transaction. How would this affect Deutsche Bank’s overall risk profile? Give a qualitative answer. (g) In the above situation, what would happen if the spot exchange rate increases to 4.5 BRL per USD after Deutsche Bank cancels the contract of the Brazilian leg of the swap transaction? Do you think the cancellation of the contract was a good idea? (Hint: think about the credit risk and market risk of Deutsche Bank, and how the remaining cash flows would change with the new exchange rate.) 4 Currencies and Forward Pricing (19p) Table 3 lists the daily spot and forward quotes for the Euro/USD exchange rates in December 2015. The currency is quoted as the number of USD per Euro.

- 9. (a) December 3 and December 17 represent the two days with the largest price movementsin December 2015, measured by the percentage change in spot prices. Go to the website of the European Central Bank (ECB, https://www.ecb.europa.eu/press) 5 and the U.S. Federal Reserve Bank (FED, http://www.federalreserve.gov/monetarypolicy) to see whether there were any major monetary policy changes responsible for the price movements on these days. (b) The spot EUR/USD exchange rate has fallen to around 1.09 by the end of 2015 from1.20 at the beginning of 2015. What is the intuition behind the exchange rate movement? After the news of an interest rate hike has been released, assuming that no further interest rate hike is expected in the United States, and assuming that uncovered interest rate parity holds, in what direction would you expect the future spot exchange rate to move? (c) Given your findings in (a), was the subsequent price movement consistent with thechange in monetary policy news? Do you think the monetary policy change surprised the market? (d) Describe the currency forward patterns across different

- 10. maturities. Are the forwardcontracts trading at a premium or a discount? Are the patterns consistent with the theory of covered interest rate parity? (e) Given the spot, 1-month, 3-month, 6-month and 1-year forward rates for the Euroagainst the USD on December 30, 2015, compute the annualized interest rate differential implied by each forward contract. (f) Repeat part (e) for December 2 and December 3. Compute and contrast the impliedinterest rate differentials before and after the news is released. How are the implied interest rate differentials related to actual interest rate differentials? Briefly Comment. (g) Go to Bloomberg’s website and look up the level of the German stock index (DAX) on December 16, 2015. What is the level of the DAX 30 futures contract with March 2016 delivery on the same day? Hint: Bloomberg’s website does not have historical data; but you can read the data from the historical data plot.3 (i) The March 2016 contract of the three-month Euribor futures traded at 100.165 onDecember 16, 2015. Given the spot and futures prices in (g), what was the annualized implied dividend yield on December 16, 2015? (j) Global markets fell in response to turmoil in the Chinese market on January 4, 2016.

- 11. The DAX index fell more than 4%. Find the closing level of the DAX on January 4, 2016. Assuming the same interest rate and dividend yield as in (i), what should be the new price of a DAX futures price with March 2016 delivery? 3 You will find information for the spot price at http://www.bloomberg.com/quote/DAX:IND, and information for the futures price at http://www.bloomberg.com/quote/GX1:IND. 6 Spot 1 month 3 month 6 month 1 year 01/12/2015 1.0608 1.0619 1.0636 1.0668 1.0748 02/12/2015 1.0573 1.0584 1.0602 1.0635 1.0716 03/12/2015 1.0852 1.0861 1.0877 1.0908 1.0984 04/12/2015 1.0889 1.0898 1.0914 1.0943 1.1017 07/12/2015 1.0853 1.0863 1.0878 1.0908 1.0985 08/12/2015 1.0871 1.0881 1.0897 1.0927 1.1005 09/12/2015 1.0963 1.0973 1.0988 1.1020 1.1098 10/12/2015 1.0937 1.0948 1.0965 1.0996 1.1074 11/12/2015 1.0997 1.1009 1.1025 1.1056 1.1134

- 12. 14/12/2015 1.1028 1.1040 1.1056 1.1087 1.1166 15/12/2015 1.0921 1.0934 1.0950 1.0981 1.1060 16/12/2015 1.0944 1.0956 1.0972 1.1004 1.1081 17/12/2015 1.0834 1.0846 1.0862 1.0893 1.0972 18/12/2015 1.0845 1.0856 1.0872 1.0903 1.0982 21/12/2015 1.0918 1.0930 1.0946 1.0977 1.1057 22/12/2015 1.0967 1.0979 1.0995 1.1027 1.1108 23/12/2015 1.0880 1.0890 1.0907 1.0939 1.1018 24/12/2015 1.0959 1.0969 1.0986 1.1018 1.1098 25/12/2015 1.0959 1.0969 1.0986 1.1018 1.1098 28/12/2015 1.0972 1.0982 1.0999 1.1031 1.1113 29/12/2015 1.0906 1.0915 1.0933 1.0965 1.1047 30/12/2015 1.0914 1.0922 1.0939 1.0972 1.1057 31/12/2015 1.0863 1.0871 1.0889 1.0921 1.1004 Source: Datastream. Table 3: Euro/USD Spot and Forward Rates, December 2015. 5 Futures Arbitrage (12p) Anheuser-Busch InBev NV, the Belgium giant for beverages and

- 13. brewing products, issued a mammoth $46bn bond on January 15, 2016 to fund its acquisition of the UK’s SAB-Miller. The company received a record subscription of $110 billion from investors, allowing it to tap the bond market at a fairly low yield, thereby reducing its annual interest costs. This bond issue is the second-largest corporate debt sale on record and proves the strong demand for high-quality corporate bonds in light of the current weak performance in global equity markets. One of the issued bonds has a maturity of 10 years, a yield of 1.6 percentage points above the benchmark U.S. Treasury rate. Hint: you can ignore the accrued interest rate. 7 (a) Suppose the 10-year benchmark Treasury bond yield is 2.07% on January 15, 2016. The bond of AB InBev has a coupon rate of 5%, and the coupon is paid semi-annually. What is the cash price of the AB Inbev bond for a notional value of $10,000? (b) The interest rate curve is upward sloping, with a 6-month USD interest rate of 0.4%,and a 9-month USD interest rate of 0.6%. What is the fair value of a futures contract on AB Inbev’s bond with delivery on October 15, 2016, assuming no default risk? Hint: the futures price is quoted with a notional value of 100.

- 14. (c) If the futures contract on AB Inbev’s bond is trading at $109, is there an arbitrageopportunity? If yes, what is the portfolio strategy to exploit this arbitrage opportunity? (d) If one institutional investor faces a flat (same rate for all maturities) borrowing cost of0.8%, and a flat lending rate of 0.6%, what is range of futures prices that provide no arbitrage opportunity? 6 Futures Pricing, Hedging and Margin Requirements (22p) Go to the web site of the Montreal Exchange (TMX) (https://www.m-x.ca/accueil en.php) and find information related to the Five-Year Government of Canada Bond Futures contract, commonly referred to as the “CGF” contract. (a) What are the standardized contract terms of the CGF futures contract (Underlying,Contract size, tick size, initial margin ...)? Describe the contract! (b) Table 4 shows daily settlement prices, open interest and volume, for CGF contractswith delivery in March 2016, as well as P&L of an existing margin account that was entered on Dec. 1, 2015. Does the counterparty to the clearing house have a long or a short position in the CGF futures? How many contracts are held by the counterparty? Does

- 15. the existing margin account belong to a speculator or hedger? What is the percentage of the maintenance margin over the initial margin? Hint: you can find historical margin requirements for speculators and hedgers from the website of the TMX. (c) Calculate the daily P&L and the value at the end of each day for this margin accountfrom December 1 to December 7. You can assume the initial margin and maintenance margin are constant and given by the requirements on Dec. 1, 2015. How many margin calls are made? (d) Which of the margin requirements for hedgers and speculators is higher? Why? Sincemargin requirements change on a daily basis, could you think of at least two determinants of margin requirements? 8 (e) Examine the relationship between volume and open interest? What does this tell youabout the liquidity in this market? Is it possible that volume is greater than open interest? (f) Go to the website of the TMX (https://www.m-x.ca/nego fin jour en.php) and find the daily settlement price of the CGF contract in December, 2015

- 16. (the TMX website only allows for downloading data of 5 days; but you could change the initial date several times to access the whole December data.) At the same time, go the web site of Bank of Canada (www.bankofcanada.ca/rates/interest-rates/lookup-bond- yields/) and find the benchmark 5-year bond yields (selling at par) in December, 2015. In excel, compute the underlying prices of 5-year Canadian deliverable bonds (you should check the definition of the underlying in CGF’s contract specification; for simplicity, you can treat the coupon rate as an annual payment). Calculate the optimal hedge ratio! (Note that for this question, you need to have the Data Analysis ToolPak installed in Excel: open Excel, go to “Files,” choose “Options,” then choose “Add-ins,” click on “Analysis ToolPak,” then click on the “Go” button next to Manage Excel Add-ins). The Data Analysis icon should now show on your Excel Toolbar. (g) How can you determine the hedge effectiveness? (h) Compare the cash prices and futures prices in (f). Which one is higher? Given that thetheoretical futures price is determined by the cash price multiplied by the cost of carry as S0er−c, explain how the shape of yield (interest rate) curve influences the futures price. (i) Consider the spot and the futures prices on December 15, 2015. If futures prices

- 17. aredetermined according to S0er−c, what is the implied financing rate? (j) Go back to the web site of the Montreal Exchange and browse the available CGFcontracts with different maturities. Assume you would like to hedge a 5-year Canadian Government bond with nominal amount of $1,000,000, which comes due in August 2016. Which contract maturity would you choose to hedge your exposure? Why? How many contracts would you buy/sell? (k) The delivery standard of CGF contract requires 5-year Government of Canada Bondswhich have an outstanding amount of at least C$3.5 billion nominal value. Explain the intuition behind this requirement. Settl. price Open int. Vol. Daily P&L Initial Margin Maitainence Margin Dec-01 124.81 4,810 100 38040 34236 Dec-02 124.72 4,571 103 -3600 Dec-03 124.20 4,521 259 9 Dec-04 124.49 4,643 263 Dec-07 124.85 4,634 250

- 18. Table 4: Margin Account