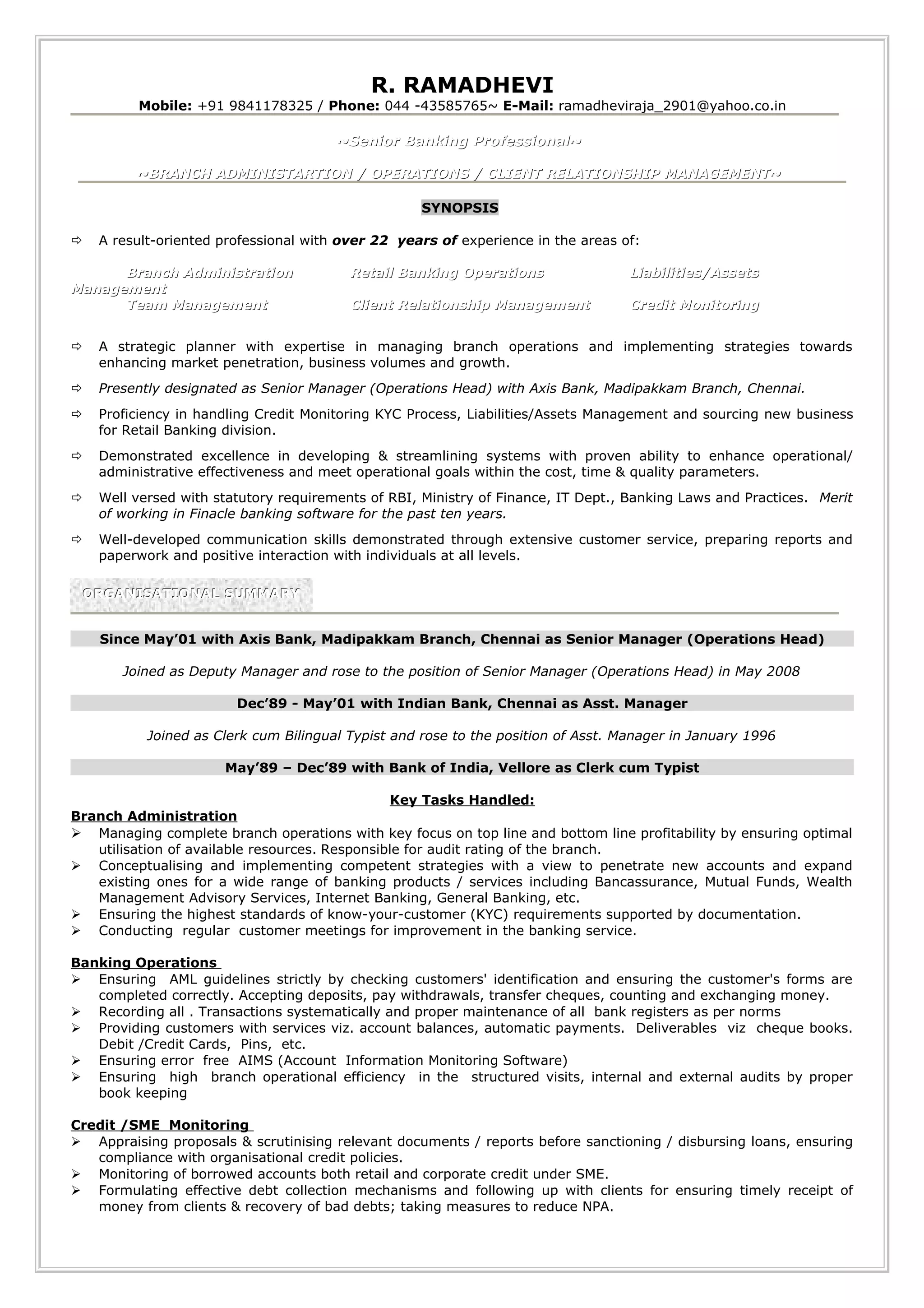

R. Ramadhevi has over 22 years of experience in banking operations and administration. She currently works as the Senior Manager and Operations Head at Axis Bank in Chennai, India. She has a proven track record of managing branch operations, developing customer relationships, and implementing strategies to increase business volumes and profits. Ramadhevi is well-versed in banking regulations and has experience with the Finacle banking software.