Report

Share

Recommended

Recommended

More Related Content

Similar to Lewis G Larsen - CV - June 2013

Similar to Lewis G Larsen - CV - June 2013 (20)

The Making of a Serial Entrepreneur / Technopreneur by Lawrence Hughes

The Making of a Serial Entrepreneur / Technopreneur by Lawrence Hughes

Using DBpedia for Thesaurus Management and Linked Open Data Integration

Using DBpedia for Thesaurus Management and Linked Open Data Integration

Energy Essay. Save energy essay writing - educationcoursework.x.fc2.com

Energy Essay. Save energy essay writing - educationcoursework.x.fc2.com

Foundations of FinanceThe Logic and Practice of Financia.docx

Foundations of FinanceThe Logic and Practice of Financia.docx

7. (TCOs E and F) Answer Parts A, B, and C completely. (40 points).docx

7. (TCOs E and F) Answer Parts A, B, and C completely. (40 points).docx

2017 Vietnam Symposium in Banking and Finance - Sciencesconf

2017 Vietnam Symposium in Banking and Finance - Sciencesconf

More from Lewis Larsen

More from Lewis Larsen (20)

Lattice Energy LLC - Strategic importance of accelerating commercialization o...

Lattice Energy LLC - Strategic importance of accelerating commercialization o...

Lattice Energy LLC - Green hard-radiation-free len rs could provide game-chan...

Lattice Energy LLC - Green hard-radiation-free len rs could provide game-chan...

Lattice Energy LLC - LENRs enable green radiation-free nuclear power and prop...

Lattice Energy LLC - LENRs enable green radiation-free nuclear power and prop...

Lewis Larsen - DJIA approaches previous all-time record high close of 26828 -...

Lewis Larsen - DJIA approaches previous all-time record high close of 26828 -...

Lattice Energy LLC - Microbial radiation resistance transmutation of elements...

Lattice Energy LLC - Microbial radiation resistance transmutation of elements...

Lattice Energy LLC - Korean scientists use bacteria to reduce concentration o...

Lattice Energy LLC - Korean scientists use bacteria to reduce concentration o...

Lattice Energy LLC - Widom-Larsen theory reveals surprising similarities and ...

Lattice Energy LLC - Widom-Larsen theory reveals surprising similarities and ...

Lattice energy LLC - Chinese chemists report photochemical triggering of LENR...

Lattice energy LLC - Chinese chemists report photochemical triggering of LENR...

Lattice Energy LLC - LENR experiment conducted by The Aerospace Corporation r...

Lattice Energy LLC - LENR experiment conducted by The Aerospace Corporation r...

Lattice Energy LLC - LENRs are revolutionary disruptive energy technology for...

Lattice Energy LLC - LENRs are revolutionary disruptive energy technology for...

Lattice Energy LLC - Revolutionary LENRs for power generation - accelerating ...

Lattice Energy LLC - Revolutionary LENRs for power generation - accelerating ...

Lattice Energy LLC - March 2 Technova seminar in Tokyo released more info re ...

Lattice Energy LLC - March 2 Technova seminar in Tokyo released more info re ...

Lattice Energy LLC - Russia announces nuclear fission-powered cruise missile ...

Lattice Energy LLC - Russia announces nuclear fission-powered cruise missile ...

Lattice Energy LLC - Japanese NEDO industry-academia-government project - nan...

Lattice Energy LLC - Japanese NEDO industry-academia-government project - nan...

Lattice Energy LLC - Japanese NEDO LENR project reported reasonably reproduci...

Lattice Energy LLC - Japanese NEDO LENR project reported reasonably reproduci...

Lattice Energy LLC - Japanese NEDO LENR project reported good progress in exc...

Lattice Energy LLC - Japanese NEDO LENR project reported good progress in exc...

Lewis Larsen - Dow-Jones Industrial Average reaches 26000 - what happens next...

Lewis Larsen - Dow-Jones Industrial Average reaches 26000 - what happens next...

Lattice Energy LLC - Polar vortex cold wave in USA has potential for lower te...

Lattice Energy LLC - Polar vortex cold wave in USA has potential for lower te...

Lattice Energy LLC - Fossil fuels and nuclear vs renewables for powering elec...

Lattice Energy LLC - Fossil fuels and nuclear vs renewables for powering elec...

Recently uploaded

💉💊+971581248768>> SAFE AND ORIGINAL ABORTION PILLS FOR SALE IN DUBAI AND ABUDHABI}}+971581248768

+971581248768 Mtp-Kit (500MG) Prices » Dubai [(+971581248768**)] Abortion Pills For Sale In Dubai, UAE, Mifepristone and Misoprostol Tablets Available In Dubai, UAE CONTACT DR.Maya Whatsapp +971581248768 We Have Abortion Pills / Cytotec Tablets /Mifegest Kit Available in Dubai, Sharjah, Abudhabi, Ajman, Alain, Fujairah, Ras Al Khaimah, Umm Al Quwain, UAE, Buy cytotec in Dubai +971581248768''''Abortion Pills near me DUBAI | ABU DHABI|UAE. Price of Misoprostol, Cytotec” +971581248768' Dr.DEEM ''BUY ABORTION PILLS MIFEGEST KIT, MISOPROTONE, CYTOTEC PILLS IN DUBAI, ABU DHABI,UAE'' Contact me now via What's App…… abortion Pills Cytotec also available Oman Qatar Doha Saudi Arabia Bahrain Above all, Cytotec Abortion Pills are Available In Dubai / UAE, you will be very happy to do abortion in Dubai we are providing cytotec 200mg abortion pill in Dubai, UAE. Medication abortion offers an alternative to Surgical Abortion for women in the early weeks of pregnancy. We only offer abortion pills from 1 week-6 Months. We then advise you to use surgery if its beyond 6 months. Our Abu Dhabi, Ajman, Al Ain, Dubai, Fujairah, Ras Al Khaimah (RAK), Sharjah, Umm Al Quwain (UAQ) United Arab Emirates Abortion Clinic provides the safest and most advanced techniques for providing non-surgical, medical and surgical abortion methods for early through late second trimester, including the Abortion By Pill Procedure (RU 486, Mifeprex, Mifepristone, early options French Abortion Pill), Tamoxifen, Methotrexate and Cytotec (Misoprostol). The Abu Dhabi, United Arab Emirates Abortion Clinic performs Same Day Abortion Procedure using medications that are taken on the first day of the office visit and will cause the abortion to occur generally within 4 to 6 hours (as early as 30 minutes) for patients who are 3 to 12 weeks pregnant. When Mifepristone and Misoprostol are used, 50% of patients complete in 4 to 6 hours; 75% to 80% in 12 hours; and 90% in 24 hours. We use a regimen that allows for completion without the need for surgery 99% of the time. All advanced second trimester and late term pregnancies at our Tampa clinic (17 to 24 weeks or greater) can be completed within 24 hours or less 99% of the time without the need surgery. The procedure is completed with minimal to no complications. Our Women's Health Center located in Abu Dhabi, United Arab Emirates, uses the latest medications for medical abortions (RU-486, Mifeprex, Mifegyne, Mifepristone, early options French abortion pill), Methotrexate and Cytotec (Misoprostol). The safety standards of our Abu Dhabi, United Arab Emirates Abortion Doctors remain unparalleled. They consistently maintain the lowest complication rates throughout the nation. Our Physicians and staff are always available to answer questions and care for women in one of the most difficult times in their lives. The decision to have an abortion at the Abortion Cl+971581248768>> SAFE AND ORIGINAL ABORTION PILLS FOR SALE IN DUBAI AND ABUDHA...

+971581248768>> SAFE AND ORIGINAL ABORTION PILLS FOR SALE IN DUBAI AND ABUDHA...?#DUbAI#??##{{(☎️+971_581248768%)**%*]'#abortion pills for sale in dubai@

Recently uploaded (20)

Strategies for Landing an Oracle DBA Job as a Fresher

Strategies for Landing an Oracle DBA Job as a Fresher

AWS Community Day CPH - Three problems of Terraform

AWS Community Day CPH - Three problems of Terraform

2024: Domino Containers - The Next Step. News from the Domino Container commu...

2024: Domino Containers - The Next Step. News from the Domino Container commu...

Apidays New York 2024 - Passkeys: Developing APIs to enable passwordless auth...

Apidays New York 2024 - Passkeys: Developing APIs to enable passwordless auth...

ICT role in 21st century education and its challenges

ICT role in 21st century education and its challenges

+971581248768>> SAFE AND ORIGINAL ABORTION PILLS FOR SALE IN DUBAI AND ABUDHA...

+971581248768>> SAFE AND ORIGINAL ABORTION PILLS FOR SALE IN DUBAI AND ABUDHA...

"I see eyes in my soup": How Delivery Hero implemented the safety system for ...

"I see eyes in my soup": How Delivery Hero implemented the safety system for ...

Strategize a Smooth Tenant-to-tenant Migration and Copilot Takeoff

Strategize a Smooth Tenant-to-tenant Migration and Copilot Takeoff

Boost Fertility New Invention Ups Success Rates.pdf

Boost Fertility New Invention Ups Success Rates.pdf

How to Troubleshoot Apps for the Modern Connected Worker

How to Troubleshoot Apps for the Modern Connected Worker

Why Teams call analytics are critical to your entire business

Why Teams call analytics are critical to your entire business

Biography Of Angeliki Cooney | Senior Vice President Life Sciences | Albany, ...

Biography Of Angeliki Cooney | Senior Vice President Life Sciences | Albany, ...

Cloud Frontiers: A Deep Dive into Serverless Spatial Data and FME

Cloud Frontiers: A Deep Dive into Serverless Spatial Data and FME

Web Form Automation for Bonterra Impact Management (fka Social Solutions Apri...

Web Form Automation for Bonterra Impact Management (fka Social Solutions Apri...

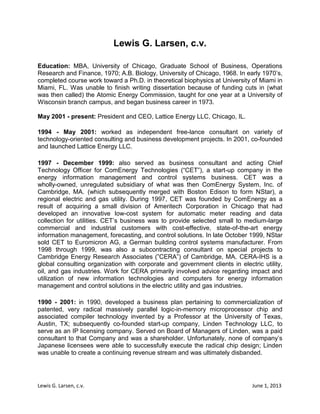

Lewis G Larsen - CV - June 2013

- 1. 1 Lewis G. Larsen c.v. 1-312-861-0115 lewisglarsen@gmail.com Education: Early 1970’s completed course work toward Ph.D. in theoretical biophysics at University of Miami, Miami, FL. - unable to finish writing dissertation as result of funding cuts in (then called) the US Atomic Energy Commission, then taught for one year at University of Wisconsin branch campus. Began business career in 1973; also self-published finished dissertation as “φ-max theory of energy flows in living systems” MBA - University of Chicago, Booth School of Business, Operations Research and Finance (1970) A.B. Biology - University of Chicago (1968) Career: May 2001 - present: President and CEO, Lattice Energy LLC, Chicago, IL. 1994 - May 2001: worked as independent free-lance consultant - on a variety of technology-oriented consulting and business development projects. 2001: co-founded and launched Lattice Energy LLC as a Delaware corporation headquartered in Chicago 1997 - December 1999: served as part-time business consultant and acting Chief Technology Officer for ComEnergy Technologies (“CET”) - start-up company in the energy information management and control systems business. CET was wholly- owned, unregulated subsidiary of what was then ComEnergy System, Inc., Cambridge, MA. (later merged with Boston Edison to form NSTAR), local US electric and gas utility October 1999: helped NSTAR divest CET to Euromicron AG, a German building control systems integrator. During 1997 CET was founded by ComEnergy as a result of acquiring a small division of Ameritech Corporation in Chicago that had developed an innovative low-cost system for automatic meter reading and data collection for utilities. CET’s business model was to provide selected small to medium-large commercial and industrial customers with cost-effective, state-of-the-art energy information management, forecasting, and control system solutions From 1998 through 1999: also served as subcontracting consultant on special projects to Cambridge Energy Research Associates (now IHS-CERA), Cambridge, MA., a global consulting organization with corporate and government clients in the electric utility and oil & gas industries. Work for IHS-CERA primarily involved advice regarding impact and utilization of new information technologies and smart grids for energy information management and control system solutions in the electric utility and gas industries

- 2. 2 1990 - 2001: in 1990, while working full-time at Hayes & Griffith developed a business plan pertaining to commercialization of patented, very radical massively parallel logic-in- memory microprocessor chip and associated compiler technology invented by a Professor at the University of Texas, Austin, TX; subsequently co-founded start-up company, Linden Technology LLC, to serve as an IP licensing company. Served on Board of Managers of Linden, was a paid consultant to that Company and was a shareholder. Unfortunately, none of company’s Japanese licensees were able to successfully execute the radical chip design; Linden was thus unable to create a continuing revenue stream and was ultimately disbanded 1987 - 1994: began as a consultant to Chicago boutique investment banking firm of Hayes & Griffith, Inc. during 1987; then joined the firm as full-time employee in 1988 - during time at H&G, published investment research reports pertaining to U.S. manufacturing sector and provided strategic planning advice to manufacturing, marketing and distribution, and technology-oriented businesses. Also served as business development specialist pertaining to variety of marketing and distribution businesses; involved in a number of technology-oriented commercialization projects 1984 - 1988: owner and President of TransGlobal Investment Services, Barrington, IL -. Conducted research in macroeconomics, stock analysis, and industry studies for commission dollars with small to medium-sized institutions; also managed assets for individual investors. Sept. 1986: Larsen’s research on financial markets and macroeconomics was featured in a Barron’s magazine cover story; they published two follow-up stories in 1988 and a mention in Jan. 1999; also provided consulting services to Hayes & Griffith, Inc., Heinold Securities, Inc., and The Financial Research Center. 1982 - 1984: Executive Vice President & Principal, LaSalle Commodities, Chicago, IL - Futures and derivative instruments portfolio management company; originated and implemented international tax-advantaged hedge fund for individual investors; designed and installed fully automated risk management system; and managed the high-risk fund 1979 - 1982: Vice President, Commodities Corporation, Princeton, NJ - functioned as an international trader/researcher quant in commodity futures, derivative financial instruments, stocks, and interbank currencies. Also participated in management of an agricultural economics research group based in Brussels, Belgium, that provided consulting services mainly to international companies (e.g., what was then Nabisco) and some government organizations such as the European Economic Commission 1975 - 1979: Merchandiser, Louis-Dreyfus Corporation, Wilton, CT (US subsidiary of French commodities trading company) - dealt in cash/futures international arbitrage as a trader quant in physical commodities; had responsibility for international export programs in grain sorghum, vegetable oils (soybean oil, cottonseed oil, and some palm oil), oats and rye; also conducted extensive quantitative price arbitrage research in parallel with and in support of Larsen’s physical commodity merchandising activities 1973 - 1975: Systems Analyst, A.O. Smith Corporation, Milwaukee, WI - mainly worked on computerized financial planning, consolidation, and forecasting systems used by corporate top management and the Board