Sheet FCFF ValuationSheet EVA ValuationINPUTS FOR VALUATION.docx

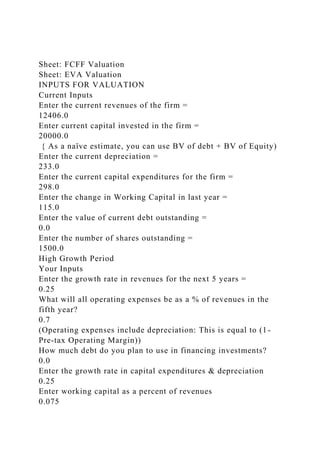

- 1. Sheet: FCFF Valuation Sheet: EVA Valuation INPUTS FOR VALUATION Current Inputs Enter the current revenues of the firm = 12406.0 Enter current capital invested in the firm = 20000.0 { As a naïve estimate, you can use BV of debt + BV of Equity) Enter the current depreciation = 233.0 Enter the current capital expenditures for the firm = 298.0 Enter the change in Working Capital in last year = 115.0 Enter the value of current debt outstanding = 0.0 Enter the number of shares outstanding = 1500.0 High Growth Period Your Inputs Enter the growth rate in revenues for the next 5 years = 0.25 What will all operating expenses be as a % of revenues in the fifth year? 0.7 (Operating expenses include depreciation: This is equal to (1- Pre-tax Operating Margin)) How much debt do you plan to use in financing investments? 0.0 Enter the growth rate in capital expenditures & depreciation 0.25 Enter working capital as a percent of revenues 0.075

- 2. Enter the tax rate that you have on corporate income 0.36 What beta do you want to use to calculate cost of equity = 1.25 Enter the current long term bond rate = 0.065 Enter the market risk premium you want to use = 0.055 Enter your cost of borrowing money = 0.085 Stable Period Enter the growth rate in revenues = 0.06 Enter operating expenses as a % of revenues in stable period = 0.75 Enter capital expenditures as a percent of depreciation in this period 2.0 See capital expenditure worksheet (capex.xls) for details. How much debt do you plan to use in financing investments? 0.05 Enter interest rate of debt in stable period = 0.075 What beta do you want to use in the stable period = 1.1 ESTIMATED CASHFLOWS Base Growth in Revenue 0.25 0.25 0.25 0.25 0.25 0.212 0.174

- 3. 0.136 0.098 0.06 Growth in Deprec'n 0.25 0.25 0.25 0.25 0.25 0.212 0.174 0.136 0.098 0.06 Revenues 12406.0 15507.5 19384.375 24230.46875 30288.0859375 37860.107421875 45886.4501953125 53870.69252929687 61197.10671328125 67194.42317118282 71226.08856145378 Operating Expenses % of Revenues 0.7 0.7 0.7 0.7 0.7 0.7 0.71 0.72

- 4. 0.73 0.74 0.75 - $ Operating Expenses 8684.199999999999 10855.25 13569.0625 16961.328125 21201.66015625 26502.0751953125 32579.379638671875 38786.89862109375 44673.887900695314 49723.87314667529 53419.566421090334 EBIT 3721.800000000001 4652.25 5815.3125 7269.140625 9086.42578125 11358.0322265625 13307.070556640625 15083.793908203123 16523.21881258594 17470.55002450753 17806.52214036345 Tax Rate 0.36 0.36 0.36 0.36 0.36 0.36 0.36 0.36

- 5. 0.36 0.36 0.36 EBIT (1-t) 2381.9520000000007 2977.44 3721.8 4652.25 5815.3125 7269.140625 8516.52515625 9653.628101249999 10574.860040055002 11181.15201568482 11396.174169832608 + Depreciation 233.0 291.25 364.0625 455.078125 568.84765625 711.0595703125 861.80419921875 1011.7581298828125 1149.357235546875 1261.9942446304688 1337.713899308297 - Capital Expenditures 298.0 372.5 465.625 582.03125 727.5390625 909.423828125 1262.6246222233187 1615.8254163216375

- 6. 1969.0262104199564 2322.227004518275 2675.427798616594 - Change in WC 115.0 232.61249999999998 290.765625 363.45703125 454.3212890625 567.901611328125 601.9757080078125 598.818175048828 549.4810637988285 449.79873434261737 302.3749042703224 = FCFF 2201.9520000000007 2663.5775 3329.471875 4161.83984375 5202.2998046875 6502.874755859375 7513.729025237619 8450.742639762346 9205.710001383091 9671.120521454395 9756.085366253988 Terminal Value (in '05) 167812.58398749254 COSTS OF EQUITY AND CAPITAL 1.0 2.0 3.0 4.0 5.0 6.0

- 7. 7.0 8.0 9.0 10.0 Cost of Equity 0.13375 0.13375 0.13375 0.13375 0.13375 0.1321 0.13045 0.1288 0.12715 0.1255 Proportion of Equity 1.0 1.0 1.0 1.0 1.0 0.99 0.98 0.97 0.96 0.95 After-tax Cost of Debt 0.054400000000000004 0.054400000000000004 0.054400000000000004 0.054400000000000004 0.054400000000000004 0.05312 0.051840000000000004 0.05056 0.04928

- 8. 0.048 Proportion of Debt 0.0 0.0 0.0 0.0 0.0 0.010000000000000009 0.020000000000000018 0.030000000000000027 0.040000000000000036 0.050000000000000044 Cost of Capital 0.13375 0.13375 0.13375 0.13375 0.13375 0.13131020000000002 0.12887780000000001 0.1264528 0.12403520000000001 0.121625 Cumulative WACC 1.13375 1.2853890625000002 1.4573098496093753 1.6522250419946292 1.8732101413614108 2.119181739665606 2.392297220073882 2.6948099019844407 3.029061187139061 3.39747075402485 Present Value 2349.35170893054

- 9. 2590.2444420402867 2855.8373120620577 3148.6629680948818 3471.5137465213693 3545.5802985652567 3532.480232327219 3416.0888286049662 3192.778198907477 52264.958909031935 FIRM VALUATION Value of Firm 80367.496645086 - Value of Debt 0.0 Value of Equity 80367.496645086 Value of Equity per Share 53.57833109672399 Value of Firm by year 80367.496645086 88453.07182136623 96954.19830247399 105759.98248167988 114703.08033391708 123541.7425727191 132250.30447305375 140843.69012310874 149448.0591001251 158313.7584787665 $ Value of Debt 0.0 0.0 0.0 0.0 0.0 1235.417425727192

- 10. 2645.0060894610774 4225.310703693266 5977.9223640050095 7915.6879239383325 Base 1.0 2.0 3.0 4.0 5.0 6.0 7.0 8.0 9.0 10.0 Terminal Year EBIT (1-t) 2381.9520000000007 2977.44 3721.8 4652.25 5815.3125 7269.140625 8516.52515625 9653.628101249999 10574.860040055002 11181.15201568482 11396.174169832608 12079.944620022565 - WACC (CI) 2675.0 2716.979109375 2769.4529960937502 2835.0453544921875 2917.0358024902343 2964.443232060147

- 11. 3038.767822353046 3133.697769006417 3243.6086661588956 3364.2378030482064 3524.0724796560758 EVA 302.44000000000005 1004.8208906250002 1882.7970039062498 2980.2671455078125 4352.104822509766 5552.081924189853 6614.860278896953 7441.162271048585 7937.543349525924 8031.936366784401 8555.87214036649 Terminal EVA 138837.68179093694 PV 266.76074972436606 781.725097824224 1291.9675279837875 1803.7900829235225 2323.3404124893027 2619.9177825427746 2765.066239843168 2761.293947142231 2620.463192763336 43229.10446947356 PV of EVA 60463.42950271027 + Capital Invested 20000.0 + PV of Chg Capital in Yr 10 -95.93285762427642

- 12. This reconciles the assumptions on stable growth, ROC and Capital Invested = Firm Value 80367.496645086 WACC 0.13375 0.13375 0.13375 0.13375 0.13375 0.13131020000000002 0.12887780000000001 0.1264528 0.12403520000000001 0.121625 0.121625 ROC 0.148872 0.18321478743887334 0.22467918335413278 0.27435118300402606 0.3332998373772976 0.37724001913001687 0.4094219843172778 0.42672291977188725 0.427565890104183 0.4119981299033129 0.41691062624047676 Capital Invested 20000.0 20313.8625 20706.190625 21196.60078125 21809.6134765625 22575.879345703124 23578.675476715507

- 13. 24781.56093820316 26150.710976875074 27660.7424711055 28974.90219655561 (Adjusted to reflect terminal ROC) Calculation of Capital Invested Initial 20000.0 20000.0 20313.8625 20706.190625 21196.60078125 21809.6134765625 22575.879345703124 23578.675476715507 24781.56093820316 26150.710976875074 27660.7424711055 + Net Cap Ex 81.25 101.5625 126.953125 158.69140625 198.3642578125 400.82042300456874 604.067286438825 819.6689748730814 1060.2327598878062 1337.713899308297 + Chg in WC 232.61249999999998 290.765625 363.45703125 454.3212890625 567.901611328125 601.9757080078125

- 14. 598.818175048828 549.4810637988285 449.79873434261737 302.3749042703224 Ending 20000.0 20313.8625 20706.190625 21196.60078125 21809.6134765625 22575.879345703124 23578.675476715507 24781.56093820316 26150.710976875074 27660.7424711055 29300.83127468412 Cumulated WACC 1.13375 1.2853890625000002 1.4573098496093753 1.6522250419946292 1.8732101413614108 2.119181739665606 2.392297220073882 2.6948099019844407 3.029061187139061 3.39747075402485 Finding StocksFinding Stocks the Warren Buffett Wayby John BajkowskiLike most successful stockpickers, Warren Buffett thinks that the efficient market theory isabsolute rubbish. Buffett has backed up his beliefs with a successful track record throughBerkshire Hathaway, his publicly traded holding company.Maria Crawford Scott examined Warren Buffett's approach in the January 1998 issue of the AAIIJournal. Table 1 below provides a summary of Buffett's investment style. In this

- 15. article, wedevelop a screen to identify promising businesses and then use valuation models to measurethe attractiveness of stocks passing the preliminary screen.Buffett has never expounded extensively on his investment approach, although it can begleaned from his writings in the Berkshire Hathaway annual reports. Many books by outsidershave attempted to explain Buffett's investment approach. One recently published book thatdiscusses his approach in an interesting and methodical fashion is "Buffettology: The PreviouslyUnexplained Techniques That Have Made Warren Buffett the World's Most Famous Investor," byMary Buffett, a former daughter-in-law of Buffett's, and David Clark, a family friend andportfolio manager [published by Simon & Schuster, 800-223-2336; $27.00]. This book was usedas the basis for this article.Monopolies vs. CommoditiesWarren Buffett seeks first to identify an excellent business and then to acquire the firm if theprice is right. Buffett is a buy-and-hold investor who prefers to hold the stock of a goodcompany earning 15% year after year over jumping from investment to investment with thehope of a quick 25% gain. Once a good company is identified and purchased at an attractiveprice, it is held for the long-term until the business loses its attractiveness or until a moreattractive alternative investment becomes available.Buffett seeks businesses whose product or service will be in constant and growing demand. Inhis view, businesses can be divided into two basic types:Commodity-based firms, selling products where price is the single most important factordetermining purchase. Buffett avoids commodity-based firms. They are characterized with highlevels of competition in which the low-cost producer wins because of the freedom to establishprices. Management is key for the long-term success of these types of firms.Consumer monopolies, selling products where there is no effective competitor, either due to apatent or brand name or similar intangible that makes the product or service unique.While Buffett is considered a value investor, he passes up the stocks of commodity-based firmseven if they can be purchased at a

- 16. price below the intrinsic value of the firm. An enterprisewith poor inherent economics often remains that way. The stock of a mediocre business treadswater.How do you spot a commodity- based company? Buffett looks for these characteristics:The firm has low profit margins (net income divided by sales);The firm has low return on equity (earnings per share divided by book value per share);Absence of any brand-name loyalty for its products;The presence of multiple producers;The existence of substantial excess capacity;Profits tend to be erratic; andThe firm's profitability depends upon management's ability to optimize the use of tangible assets.Buffett seeks out consumer monopolies. These are companies that have managed to create aproduct or service that is somehow unique and difficult to reproduce by competitors, eitherdue to brand-name loyalty, a particular niche that only a limited number companies can enter,or an unregulated but legal monopoly such as a patent.Consumer monopolies can be businesses that sell products or services. Buffett reveals threetypes of monopolies:Businesses that make products that wear out fast or are used up quickly and have brand-nameappeal that merchants must carry to attract customers. Nike is a good example of a firm with astrong brand name demanded by customers. Any store selling athletic shoes must carry Nikeproducts to remain competitive. Other examples include leading newspapers, drug companieswith patents, and popular brand-name restaurants such as McDonald's.Communications firms that provide a repetitive service that manufacturers must use topersuade the public to buy the manufacturer's products. All businesses must advertise theiritems, and many of the available media face little competition. These include worldwideadvertising agencies, magazine publishers, newspapers, and telecommunications networks.Businesses that provide repetitive consumer services that people and businesses are in constantneed of. Examples include tax preparers, insurance companies, and investment firms.Mary Buffett suggests going to your local 7-Eleven or White Hen Pantry to identify many ofthese "must-have"

- 17. products. These stores typically carry a very limited line of must-haveproducts such as Marlboro cigarettes and Wrigley's gum. However, with the guidance of thefactors used to identify attractive companies, we can establish a basic screen to identifypotential investments worthy of further analysis.The rules used for our Buffett screen are identified and discussed in Table 2. AAII's StockInvestor Professional was used to perform the screen. Consumer monopolies typically have highprofit margins because of their unique niche; however, a simple screen for high margins mayhighlight weak firms in industries with traditionally high margins, but low turnover levels.Our first screening filters looked for firms with both gross operating and net profit marginsabove the median for their industry. The operating margin concerns itself with the costsdirectly associated with production of the goods and services, while the net margin takes all ofthe company activities and actions into account.Understand How It WorksAs is common with successful investors, Buffett only invests in companies he can understand.Individuals should try to invest in areas where they possess some specialized knowledge andcan more effectively judge a company, its industry, and its competitive environment. While itis difficult to construct a quantitative filter, an investor should be able to identify areas ofinterest. An investor should only consider analyzing those firms operating in areas that they canclearly grasp.Conservative FinancingConsumer monopolies tend to have strong cash flows, with little need for long-term debt.Buffett does not object to the use of debt for a good purpose--for example, if a company usesdebt to finance the purchase of another consumer monopoly. However, he does object if theadded debt is used in a way that will produce mediocre results--such as expanding into acommodity line of business.Appropriate levels of debt vary from industry to industry, so it is best to construct a relativefilter against industry norms. We screened out firms that had higher levels of total liabilities tototal assets than their industry median. The ratio of total liabilities to total assets is moreencompassing than

- 18. just looking at ratios based upon long-term debt such as the debt-equityratio.Strong & Improving EarningsBuffett invests only in a business whose future earnings are predictable to a high degree ofcertainty. Companies with predictable earnings have good business economics and producecash that can be reinvested or paid out to shareholders. Earnings levels are critical invaluation. As earnings increase, the stock price will eventually reflect this growth.Buffett looks for strong long-term growth as well as an indication of an upward trend. In thebook, Mary Buffett looks at both the 10- and five-year growth rates. Stock Investor Professionalcontains only seven years of data, so we examined the seven-year growth rate as the long-termgrowth rate and the three-year growth rate for the intermediate-term growth rate.For our screen, we first required that a company's seven-year earnings growth rate be higherthan that of 75% of the stocks in the overall database. Stock Investor Professional includespercentile ranks for growth rates, so we specified a percentile rank greater than 75.It is best if the earnings also show an upward trend. Buffett compares the intermediate- termgrowth rate to the long-term growth rate and looks for an expanding level. For our next filter,we required that the three- year growth rate in earnings be greater than the seven-year growthrate. This further reduced the number of passing companies to 213. Not surprisingly, thecompanies passing the Buffett screen have very high growth rates--as a group, nearly threetimes the median for the whole database.Consumer monopolies should show both strong and consistent earnings. Wild swings in earningsare characteristic of commodity businesses. A examination of year-by-year earnings should beperformed as part of the valuation. The earnings per share for Nike are displayed in the Buffettvaluation spreadsheet. Note that earnings per share growth has been strong and consistent withonly one year in which earnings did not increase from the previous period.A screen requiring an increase in earnings for each of the last seven years would be toostringent and not be in keeping with the Buffett philosophy. However, a filter requiring

- 19. positiveearnings for each of the last seven years should help to eliminate some of the commodity-based businesses with wild earnings swings.A Consistent FocusCompanies that stray too far from their base of operation often end up in trouble. Peter Lynchalso avoided profitable companies diversifying into other areas. Lynch termed thesediworseifications. Quaker Oats' purchase and subsequent sale of Snapple is a good example ofthis common mistake.Companies should expand into related areas that offer high return potential. Nike's pastdevelopment of a line of athletic clothing to complement its athletic shoe business is anexample of a extension that makes sense. This factor is clearly a qualitative screen that cannotbe done with the computer.Buyback of SharesBuffett views share repurchases favorably since they cause per share earnings increases forthose who don't sell, resulting in an increase in the stock's market price. This is a difficultvariable to screen as most data services do not indicate this variable. You can screen for adecreasing number of outstanding shares, but this factor is best analyzed during the valuationprocess.Investing Retained EarningsA company should retain its earnings if its rate of return on its investment is higher than theinvestor could earn on his own. Dividends should only be paid if they would be better employedin other companies. If the earnings are properly reinvested in the company, earnings shouldrise over time and stock price valuation will also rise to reflect the increasing value of thebusiness.An important factor in the desire to reinvest earnings is that the earnings are not subject topersonal income taxes unless they are paid out in the form of dividends. The use of retainedearnings delays personal income taxes until the stock is sold.Buffett examines management's use of retained earnings, looking for management that haveproven it is able to employ retained earnings in the new moneymaking ventures, or for stockbuybacks when they offer a greater return.Good Return on EquityBuffett seeks companies with above average return on equity. Mary Buffett indicates that theaverage return on equity over the last 30 years has been around 12%.We created a custom

- 20. field that averaged the return on equity for the last seven years toprovide a better indication of the normal profitability for the company. During the valuationprocess, this average should be checked against more current figures to assure that the past isstill indicative of the future direction of the company. Our screen looks for average return onequity of 12% or greater.Inflation AdjustmentsConsumer monopolies can typically adjust their prices quickly to inflation without significantreductions in unit sales since there is little price competition to keep prices in check. Thisfactor is best applied through a qualitative examination of a company during the valuationstage.Reinvesting CapitalIn Buffett's view, the real value of consumer monopolies is in their intangibles--for instance,brand-name loyalty, regulatory licenses, and patents. They do not have to rely heavily oninvestments in land, plant, and equipment, and often produce products that are low tech.Therefore they tend to have large free cash flows (operating cash flow less dividends andcapital expenditures) and low debt. Retained earnings must first go toward maintaining currentoperations at competitive levels. This is a factor that is also best examined at the time of thecompany valuation although a screen for relative levels of free cash flow might help to confirma company's status.The above basic questions help to indicate whether the company is potentially a consumermonopoly and worthy of further analysis. However, stocks passing the screensare not automatic buys. The next test revolves around the issue of value.The Price is Right(Using the Spreadsheet)The price that you pay for a stock determines the rate of return--the higher the initial price,the lower the overall return. The lower the initial price paid, the higher the return. Buffettfirst picks the business, and then lets the price of the company determine when to purchasethe firm. The goal is to buy an excellent business at a price that makes business sense.Valuation equates a company's stock price to a relative benchmark. A $500 dollar per sharestock may be cheap, while a $2 per share stock may be expensive.Buffett uses a number of

- 21. different methods to evaluate share price. Three techniques arehighlighted in the book with specific examples and are used in the buffet spreadsheettemplate.Buffett prefers to concentrate his investments in a few strong companies that are priced well.He feels that diversification is performed by investors to protect themselves from theirstupidity.Earnings YieldBuffett treats earnings per share as the return on his investment, much like how a businessowner views these types of profits. Buffett likes to compute the earnings yield (earnings pershare divided by share price) because it presents a rate of return that can be compared quicklyto other investments.Buffett goes as far as to view stocks as bonds with variable yields, and their yields equate tothe firm's underlying earnings. The analysis is completely dependent upon the predictabilityand stability of the earnings, which explains the emphasis on earnings strength within thepreliminary screens.Nike has an earnings yield of 5.7% (cell C13, computed by dividing earnings per share of $2.77(cell C9) by the price $48.25 (cell C8)). Buffett likes to compare the company earnings yield tothe long-term government bond yield. An earnings yield near the government bond yield isconsidered attractive. With government bonds yielding around 6% currently (cell C17), Nikecompares very favorably. By paying $48 dollars per share for Nike, an investor gets an earningsyield return equal to the interest yield on bonds. The bond interest is cash in hand but it isstatic, while the earnings of Nike should grow over time and push the stock price up.Historical Earnings GrowthAnother approach Buffett uses is to project the annual compound rate of return based onhistorical earnings per share increases. For example, earnings per share at Nike have increasedat a compound annual growth rate of 18.9% over the last seven years (cell B32). If earnings pershare increase for the next 10 years at this same growth rate of 18.9%, earnings per share inyear 10 will be $15.58. [$2.77 x ((1 + 0.189)^10)]. (Note this value is found in cells B49 andE39) This estimated earnings per share figure can then be multiplied by the average price-earnings ratio of 14.0 (cell H10) to provide an

- 22. estimate of price [$15.58 x 14.0=$217.43]. (Notethis value is found in cell E42) If dividends are paid, an estimate of the amount of dividendspaid over the 10-year period should also be added to the year 10 price [$217.43 + $13.29 =$230.72]. (Note this value is found in cell E43)Once this future price is estimated, projected rates of return can be determined over the 10-year period based on the current selling price of the stock. Buffett requires areturn of at least 15%. For Nike, comparing the projected total gain of $230.72 to the currentprice of $48.25 leads projected rate of return of 16.9% [($230.72/$48.25) ^(1/10) - 1]. (Note this value is found in cell E45)Sustainable GrowthThe third approach detailed in "Buffettology" is based upon the sustainable growth rate model.Buffett uses the average rate of return on equity and average retention ratio (1 average payoutratio) to calculate the sustainable growth rate [ ROE x ( 1 - payout ratio)]. The sustainablegrowth rate is used to calculate the book value per share in year 10 [BVPS ((1 + sustainablegrowth rate )^10)]. Earnings per share can be estimated in year 10 by multiplying the averagereturn on equity by the projected book value per share [ROE x BVPS]. To estimate the futureprice, you multiply the earnings by the average price-earnings ratio [EPS x P/E]. If dividendsare paid, they can be added to the projected price to compute the total gain.For example, Nike's sustainable growth rate is 19.2% [22.8% x (1 - 0.159)].(Sustainable growthrate is found in cell H11) Thus, book value per share should grow at this rate to roughly $65.94in 10 years [$11.38 x ((1 + 0.192)^10)]. (Note this value is found in cell B64) If return on equityremains 22.8% (cell H6) in the tenth year, earnings per share that year would be $15.06 [ 0.228x $65.94]. (Note this value is found in cell E54) The estimated earnings per share can then bemultiplied by the average price-earnings ratio to project the price of $210.23 [$15.06 x 14.0].(Note this value is located in cell E56) Since dividends are paid, use an estimate of the amountof dividends paid over the 10-year period to project the rate of return of 16.5% [(($210.23 +$12.72)/ $48.25) ^ (1/10) -

- 23. 1]. (Note this return estimate is found in cell E60)ConclusionThe Warren Buffett approach to investing makes use of "folly and discipline": the discipline ofthe investor to identify excellent businesses and wait for the folly of the market to buy thesebusinesses at attractive prices. Most investors have little trouble understanding Buffett'sphilosophy. The approach encompasses many widely held investment principles. Its successfulimplementation is dependent upon the dedication of the investor to learn and follow theprinciples.John Bajkowski is editor of Computerized Investing and senior financial analyst of AAII.(c) Computerized Investing - January/February 1998, Volume XVII, No.1 Table 1Table 1. The Warren Buffett ApproachPhilosophy and styleInvestment in stocks based on their intrinsic value, where value is measured by the ability togenerate earnings and dividends over the years. Buffett targets successful businesses-- thosewith expanding intrinsic values, which he seeks to buy at a price that makes economic sense,defined as earning an annual rate of return of at least 15% for at least five or 10 years.Universe of stocksNo limitation on stock size, but analysis requires that the company has been in existence for aconsiderable period of time.Criteria for initial considerationConsumer monopolies, selling products in which there is no effective competitor, either due toa patent or brand name or similar intangible that makes the product unique. In addition, heprefers companies that are in businesses that are relatively easy to understand and analyze,and that have the ability to adjust their prices for inflation.Other factorsA strong upward trend in earningsConservative financingA consistently high return on shareholder's equityA high level of retained earningsLow level of spending needed to maintain current operationsProfitable use of retained earningsValuing a StockBuffett uses several approaches, including:Determining firm's initial rate of return and its value relative to government bonds: Earningsper share for the year divided by the long-term government bond interest rate. The resultingfigure is the

- 24. relative value-the price that would result in an initial return equal to the returnpaid on government bonds.Projecting an annual compounding rate of return based on historical earnings per shareincreases: Current earnings per share figure and the average growth in earnings per share overthe past 10 years are used to determine the earnings per share in year 10; this figure is thenmultiplied by the average high and low price-earnings ratios for the stock over the past 10years to provide an estimated price range in year 10. If dividends are paid, an estimate of theamount of dividends paid over the 10-year period should also be added to the year 10 pricesStock monitoring and when to sellDoes not favor diversification; prefers investment in a small number of companies that aninvestor can know and understand extensively. Favors holding for the long term as long as thecompany remains "excellent"--it is consistently growing and has quality management thatoperates for the benefit of shareholders. Sell if those circumstances change, or if analternative investment offers a better return. Table 2Table 2. Translating the Buffett Style Into ScreeningQuestions to determine the attractiveness of the business:Consumer monopoly or commodity?Buffett seeks out consumer monopolies selling products in which there is no effectivecompetitor, either due to a patent or brand name or similar intangible that makes the productunique. Investors can seek these companies by identifying the manufacturers of products thatseem indispensable. Consumer monopolies typically have high profit margins because of theirunique niche; however, simple screens for high margins may simply highlight firms withinindustries with traditionally high margins. For our screen, we looked for companies withoperating margins and net profit margins above their industry norms. Additional screens forstrong earnings and high return on equity will also help to identify consumer monopolies.Follow-up examinations should include a detailed study of the firm's position in the industryand how it might change over time.Do you understand how it works?Buffett only invests in industries that he can grasp.

- 25. While you cannot screen for this factor, youshould only further analyze the companies passing all screening criteria that operate in areasyou understand.Is the company conservatively financed?Buffett seeks out companies with conservative financing. Consumer monopolies tend to havestrong cash flows, with little need for long-term debt. We screened for companies with totalliabilities below the median for their respective industry. Alternative screens might look forlow debt to capitalization or to equity.Are earnings strong and do they show an upward trend?Buffett looks for companies with strong, consistent, and expanding earnings. We screened forcompanies with seven-year earnings per share growth greater than 75% of all firms. To helpindicate that earnings growth is still strong, we also required that the three-year earningsgrowth rate be higher than the seven-year growth rate. Buffett seeks out firms with consistentearnings. Follow-up examinations should include careful examination of the year-by-yearearnings per share figures. As a simple screen to exclude companies with more volatileearnings, we screened for companies with positive earnings for each of the last seven years andlatest 12 months.Does the company stick with what it knows?A company should invest capital only in those businesses within its area of expertise. This is adifficult factor to screen for on a quantitative level. Before investing in a company, look at thecompany's past pattern of acquisitions and new directions. They should fit within the primaryrange of operation for the firm.Has the company been buying back its shares?Buffett prefers that firms reinvest their earnings within the company, provided that profitableopportunities exist. When companies have excess cash flow, Buffett favors shareholder-enhancing maneuvers such as share buybacks. While we did not screen for this factor, a follow-up examination of a company would reveal if it has a share buyback plan in place.Have retained earnings been invested well?Earnings should rise as the level of retained earnings increase from profitable operations. Otherscreens for strong and consistent earnings and strong return on equity help

- 26. to the capture thisfactor.Is the company's return on equity above average?Buffett considers it a positive sign when a company is able to earn above-average returns onequity. Marry Buffett indicates that the average return on equity for over the last 30 years isapproximately 12%. We created a custom field that calculated the average return on equityover the last seven years. We then filtered for companies with average return on equity above12%.Is the company free to adjust prices to inflation?True consumer monopolies are able to adjust prices to inflation without the risk of losingsignificant unit sales. This factor is best applied through a qualitative examination of thecompanies and industries passing all the screens.Does company need to constantly reinvest in capital?Retained earnings must first go toward maintaining current operations at competitive levels, sothe lower the amount needed to maintain current operations, the better. This factor is bestapplied through a qualitative examination of the company and its industry. However, a screenfor high relative levels of free cash flow may also help to capture this factor. buffett valuationBuffett Valuation Worksheet (January/February 1998, Computerized Investing, www.aaii.com)Enter values into shaded cellsDate of Analysis:12/31/97Current Stock DataSeven Year AveragesCompany:Nike, Inc.Return on Equity:22.8%Ticker:NKEPayout Ratio:15.9%Price:$48.25P/E Ratio-High:18.4EPS:$2.77P/E Ratio-Low:9.5DPS:$0.48P/E Ratio:14.0BVPS:$11.38Sustainable Growth19.2%P/E:17.4(ROE * (1 - Payout Ratio))Earnings Yield:5.7%Dividend Yield:1.0%P/BV:4.2Gv't Bond Yield:6.0%Historical Company DataPriceP/E RatioPayoutYearEPSDPSBVPSHighLowHighLowROERatioYea r 80.800.092.628.703.2010.94.030.5%11.3%Year 70.940.133.3911.986.0012.76.427.7%13.8%Year 61.070.154.3518.948.7817.78.224.6%14.0%Year 51.180.195.3322.5613.7519.111.722.1%16.1%Year 40.990.205.7722.3110.7822.510.917.2%20.2%Year 31.360.246.6819.1311.5614.18.520.4%17.6%Year

- 27. 21.880.298.2835.1917.1918.79.122.7%15.4%Year 12.680.3810.6364.0031.7523.911.825.2%14.2%EPSDPSBVPSHi gh PriceLow PriceAnnually Compounded Rates of Growth (7 year)[(Year 1 / Year 8) ^ (1/7)] - 118.9%22.8%22.1%33.0%38.8%Annually Compounded Rates of Growth (3 year)[(Year 1 / Year 4) ^ (1/3)] - 139.4%23.9%22.6%42.1%43.3%Projected Company Data Using Historical Earnings Growth RateYearEPSDPSCurrent$2.770.4415.58Earnings after 10 yearsYear 13.290.5213.29Sum of dividends paid over 10 yearsYear 23.910.62Year 34.650.74$217.43Projected price (Average P/E * EPS)Year 45.530.88$230.72Total gain (Projected Price + Dividends)Year 56.571.05Year 67.811.2416.9%Projected return using historical EPS growth rateYear 79.281.48[(Total Gain / Current Price) ^ (1/10)] - 1Year 811.031.76Year 913.112.09Year 1015.582.48Projected Company Data Using Sustainable Growth RateYearBVPSEPSDPSCurrent$11.382.600.4115.06Earnings after 10 years (BVPS * ROE)Year 113.573.100.4912.72Sum of dividends paid over 10 yearsYear 216.173.690.59Year 319.284.400.70$210.23Projected price (Average P/E * EPS)Year 422.985.250.84$222.96Total gain (Projected Price + Dividends)Year 527.396.261.00Year 632.667.461.1916.5%Projected return using sustainable growth rateYear 738.938.891.42[(Total Gain / Current Price) ^ (1/10)] - 1Year 846.4110.601.69Year 955.3212.642.01Year 1065.9415.062.40 Using Average ROE Using Average Dividend Payout Ratio