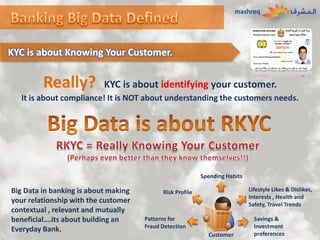

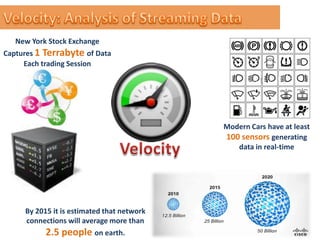

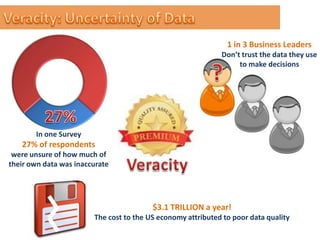

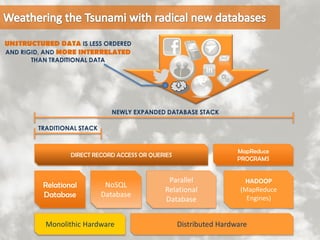

Big data in banking allows banks to build contextual and mutually beneficial relationships with customers by understanding their spending habits, lifestyle preferences, risk profiles, and savings goals. However, poor data quality costs the US economy trillions each year, with many business leaders and individuals unsure of how accurate the data they use really is. The amount of data being created is growing exponentially across industries like healthcare, social media, the internet of things, and on the stock exchange, but making sense of this unstructured data requires new database architectures beyond traditional relational databases.