New base special 28 august 2014

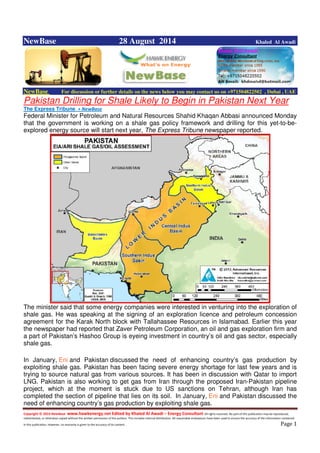

- 1. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 1 NewBase 28 August 2014 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Pakistan Drilling for Shale Likely to Begin in Pakistan Next Year The Express Tribune + NewBase Federal Minister for Petroleum and Natural Resources Shahid Khaqan Abbasi announced Monday that the government is working on a shale gas policy framework and drilling for this yet-to-be- explored energy source will start next year, The Express Tribune newspaper reported. The minister said that some energy companies were interested in venturing into the exploration of shale gas. He was speaking at the signing of an exploration licence and petroleum concession agreement for the Karak North block with Tallahassee Resources in Islamabad. Earlier this year the newspaper had reported that Zaver Petroleum Corporation, an oil and gas exploration firm and a part of Pakistan’s Hashoo Group is eyeing investment in country’s oil and gas sector, especially shale gas. In January, Eni and Pakistan discussed the need of enhancing country’s gas production by exploiting shale gas. Pakistan has been facing severe energy shortage for last few years and is trying to source natural gas from various sources. It has been in discussion with Qatar to import LNG. Pakistan is also working to get gas from Iran through the proposed Iran-Pakistan pipeline project, which at the moment is stuck due to US sanctions on Tehran, although Iran has completed the section of pipeline that lies on its soil. In January, Eni and Pakistan discussed the need of enhancing country’s gas production by exploiting shale gas.

- 2. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 2 Oman Gov asks PDO to raise oil production to 600,000bpd TMES OF OMAN + NEWBASE Oman government has asked the majority state-owned Petroleum Development Oman (PDO) to raise its crude production to 600,000 barrels per day (bpd), from its long-term plateau of 500,000-550,000bpd annual production set by the company more than three years ago. The growth in crude production will be achieved by applying state-of-the-art drilling technology and focusing on boosting output from several small areas and with sour gas injection, Salim Nasser Said Al Aufi, undersecretary at the Ministry of Oil and Gas, told journalists on the sidelines of launching the Oil and Gas Year Oman 2014 energy report. "We, from the government, put a challenge to PDO trying to understand what would it take for the company to increase its production up to 600,000bpd. We need to understand the time-frame, cost, it is not going to be cheap and dominated by a lot of drilling activities," Al Aufi said, adding that PDO's production has been growing slightly and this year, the company is producing 570,000 bpd so far . However, he noted that the company is not discovering major fields. "It is still more of traditional exploration activities, probably in areas where PDO did not pay too much attention. Al Aufi said the country's oil production target is set at 950,000 bpd and so far the average production is 945,000 bpd. "Now we have a mix of several companies that compensate each other. The undersecretary pointed out that with the new drilling technology, PDO will be able to drill wells faster. "We can steer drilling in thin oil wells. In the past, we were able to stay steady in a thing oil well. New fracking techniques have also been developed outside Oman. We need to adopt that expertise locally as well as services associated with it. Referring to the growing cost of average oil production, Al Aufi said the cost of production using enhanced oil recovery technique is high. Enhanced oil recovery fields constitute 14-15 per cent of total oil production in the country and this will go up to 30 per in the next ten years, which will jack up the cost for bringing crude oil above the ground. "Our challenge is to keep the cost of oil production at the present level and offset inflation and cost escalation. He also said that the government is watching the recent fluctuation in the international market for crude oil prices and will prepare next year's budget accordingly.

- 3. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 3 Philippines: Nido Petroleum Report on Galoc reserves and activities Source: Nido Petroleum Highlights: • Strong production performance since Phase II start-up in December 2013 to 31 July 2014 of over 2.0 MMbbls (gross); 1.8MMbbls since 1 January 2014 (gross). • Independent reserves assessment by GCA at 31 July 2014, estimates Galoc oil field 1P Developed Reserves at 9.2 MMstb on a gross basis (1.8MMbbls on a net entitlement to Nido basis). • 2P and 3P Developed Reserves are estimated at 11.9MMstb and 15.6MMstb respectively on a gross basis (2.3MMstb and 3.1MMstb on a net entitlement to Nido basis). • Field expansion studies being considered by the SC 14C1 Operator. • Decision of further drilling activities expected in late 2014 or early 2015. • Nido has a 22.88% working interest in SC 14C1 and the Galoc oil field. Nido Petroleum has provided an update regarding the Galoc oil field in SC 14 C1, Republic of the Philippines: Production Performance Production performance from Galoc field has remained strong since start- up of Phase II in December 2013. The field has produced in excess of 2 MMbbls (gross) in the first eight months of Phase II production to end July 2014. Production between 1 January and 31 July 2014 has been 1.8 MMbbls (gross). Nido expects a total of ten (10) cargos will be delivered from the field during 2014, with the seven cargos already sold this year going to local South East Asian refineries. Further Expansion Studies During the year, Galoc field Operator Otto Energy has progressed technical studies which have provided a greater understanding of the Galoc main field area (currently being developed with four wells) and the exploration potential recognised in the Galoc Mid and Galoc North Areas. Although no firm proposals are under consideration by the SC 14 C1 Joint Venture at this time,the Operator considers that the results of the current technical studies may lead to furtheractivities to unlock the upside potential of the Galoc Mid Area and/or to undertake additionaldrilling and infill activities to complement existing productions at the Central Field Area.

- 4. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 4 GCA Reserves Update GCA has completed an Independent Reserves Update of the Galoc field as at 31 July 2014 in accordance with the SPE/WPC/AAPG/SPEE Petroleum Resource System (SPE PRMS) Definitions and Guidelines and the ASX Listing Rules including recently implemented Listing Rules 5.25 to 5.44 where applicable. The updated assessment was prepared using deterministic methods and is based on an updated decline analysis of field production history to 31 July 2014 from the Phase 1 and Phase II development wells. Production performance since the year-end 2013 Reserves assessment has been on trend with Gaffney, Cline and Associates 1P forecast as at 31 December 2013. The 2P and 3P estimated ultimate recoveries at 31 July 2014 are approximately 2% and 4% lower than the previous estimates, respectively. These differences, after accounting for recent production, are within acceptable uncertainty limits for reserves estimation and are not considered a material change. The Galoc Phase 1 wells Galoc-3ST1 and Galoc-4 continue to perform close to previous forecasts. As at 31 July 2014, Galoc-4 was producing at an oil rate of 2,560 stbd (approx. 32% of field rate); cumulative production from the well was 10.3 million barrels (MMstb). The Galoc Phase II wells Galoc-5 and Galoc-6 have made a significant contribution to the field production since the successful commissioning of Galoc Phase II in December 2013. As at 31 July 2014, they were producing at a combined oil rate of 4,680 stbd (approx. 58% of field rate); cumulative production from the two wells was 1.3 MMstb. The reserves position for the Galoc Oil Field as at 31 July 2014 is as follows: Notes: 1. Net Entitlement Reserves are Nido’s net economic entitlement under the Service Contract that governs the asset, i.e. Company’s share of cost oil and profit oil. 2. No account has been taken of any losses for fuel or shrinkage. 3. The reference point for the purpose of measuring and assessing the estimated oil reserves is at the metering point on the FPSO. 4. No oil produced from the Galoc field is used as fuel. Nido’s Galoc Reserves have been assessed on a net entitlement basis through an Economic Limit Test which incorporates the applicable SC 14C1 fiscal terms. Table 2 compares GCA’s Independent Reserves assessment for the Galoc oil field at 31 July 2014 with the Reserves position at 31 December 2013, on a gross (100%) field basis.

- 5. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 5 Nigeria: Shell sells Nigeria oil fields Source: Reuters + NewBase Royal Dutch Shell has sold some of four oil fields up for grabs in Nigeria, it said on Wednesday, as the oil and gas company pushes ahead with global asset sales to cut costs. Shell last year put up for sale its 30 percent shares in four oil blocks in the Niger Delta -- Oil Mining Licence (OML) 18, 24, 25, 29 -- as well as a key pipeline, the Nembe Creek Trunk Line. 'We have signed sales & purchase agreements for some of the Oil Mining Leases, but not all that we are seeking to divest,' a Shell spokesman said. No details were available on the value of the deals signed, nor when the full process will be completed. France's Total and Italy's Eni are also set to raise revenue from the sale of their 10 percent and 5 percent shares in the assets. The Nigerian National Petroleum Corporation (NNPC) owns the remaining 55 percent. The Financial Times on Wednesday reported that Shell is close to selling the assets for about $5 billion to domestic buyers. In March, Reuters reported that Nigerian firms Taleveras and Aiteo made the highest bid of $2.85 billion for the biggest of the four oil fields, OML 29. Shell, along with many other oil majors, is undergoing a broad process of asset sales across the world in an effort to cut costs and boost profits. Other companies, including Total, Eni, Chevron and ConocoPhillips have sought to pull out of the oil-rich West African country which has been plagued by oil theft.

- 6. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 6 U.S. liquid fuels production growth more than offsets unplanned supply disruptions. Source: U.S. Energy Information Administration, Record-setting liquid fuels production growth in the United States has more than offset the rise in unplanned global supply disruptions over the past few years, although differences in quality and location suggest that the substitution may not be exactly 1-for-1. U.S. liquid fuels production, which includes crude oil, hydrocarbon gas liquids, biofuels, and refinery processing gain, grew by more than 4.0 million barrels per day (bbl/d) from January 2011 to July 2014, of which 3.0 million bbl/d was crude oil production growth. During that same period, global unplanned supply disruptions grew by 2.8 million bbl/d. U.S. production growth, the main factor counterbalancing the supply disruptions on the global oil market, has contributed to a decrease in crude oil price volatility since 2011. Over the past 13 months, the monthly average Brent price has moved within a narrow $5 per barrel range, between $107 per barrel and $112 per barrel. In contrast, the range of monthly average Brent prices over the prior 13-month period (June 2012- June 2013) was $21 per barrel. Global unplanned supply disruptions averaged 3.2 million bbl/d during the first seven months of 2014 and peaked at 3.5 million bb/d in May 2014. The current level of supply disruptions is the highest since the Iraq- Kuwait War (1990-91), when supply disruptions peaked at 4.3 million bbl/d, based on data from the International Energy Agency

- 7. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 7 DNV GL’s map shows risks of offshore activities in the Arctic Source DNV GL The world’s need for energy is driving interest in further industrial activity in the Arctic, yet the region’s conditions are highly variable depending on the type of activity, location and time of year. This creates a complex risk picture, DNV GL writes. DNV GL has therefore developed an interactive Arctic Risk Map to present the risks associated with offshore and maritime activities in the Arctic. The map aims to provide stakeholders with a comprehensive tool for decision-making and transparent communications, DNV GL has explained. “The Arctic is not a monolithic area and the risk picture varies accordingly. Stakeholders therefore need a sound decision basis for understanding the risks associated with Arctic development and transportation. The DNV GL Arctic Risk Map can help facilitate transparent discussions to address the many dilemmas related to activity in the region,” says Børre Paaske, project manager at DNV GL – Oil & Gas. The map presents multiple dimensions, such as the seasonal distribution of ice, metocean (physical environment) conditions, sea-ice concentrations, biological assets, shipping traffic and oil and gas resources, in a user-friendly, single layout. It also includes a Safety and Operability Index, showing the variation in different factors that impact the risk level depending on the season and their location in the Arctic. In addition, a location- and season-specific index has been developed showing the environmental vulnerability of marine resources with respect to oil spill as an external stressor. In general, DNV GL’s analysis shows that the Arctic environment is characterised by seasonal variations in vulnerability, and that this vulnerability increases in the summer months along with the level of industrial activity. However, this differs greatly between regions. Some areas, for example, are particularly vulnerable in winter, when they are used by birds for wintering or as spawning grounds for fish. Severe consequences DNV GL says that as a result, the consequences of an accident in the Arctic would likely be more severe in some areas than others. The map is a useful tool to identify regions that require special attention when it comes to planning activities and for imposing mitigation measures throughout the year. The map can also

- 8. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 8 provide input to decisions-makers about restricting certain types of activities in specific areas at different times of the year. “The risk level in the Arctic must be equivalent to – or better than – the best performance in the industry today. The Arctic’s varied and complex conditions require the industry to take a stepwise approach in which learning and technology are developed progressively regarding the more challenging Arctic areas,” says Elisabeth Tørstad, CEO of Oil & Gas, DNV GL. “As an independent body, DNV GL takes an active role in ensuring that any increase in industrial activity has a strong focus on safeguarding life, property and the environment. This Arctic Risk Map is a great example of our vision in action,” she adds.

- 9. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 9 World’s existing power plants on track to pour 300b tons of carbon dioxide into atmosphere . Saudi Gazette + NewBase The drive to meet the world’s ever-growing energy demand means that global power sector commitments – the projected lifetime carbon emissions of currently working power plants – have not declined in a single year since 1950. These so-called committed emissions are growing at about 4 percent a year, according to the study, and in 2012 reached 307 billion tons of carbon dioxide, a new study from Princeton University and the University of California-Irvine published Aug. 26 in the journal Environmental Research Letters revealed. The world’s existing power plants are on track to pour more than 300 billion tons of carbon dioxide into the atmosphere, and current monitoring standards often fail to take these long-term emissions into account, the new research by scientists at UC Irvine and Princeton University noted. The paper is the first to estimate the lifetime carbon emissions of power plants globally over multiple years. The study comes as the United States is attempting for the first time to regulate emissions from existing power plants, a proposal the Environmental Protection Agency (EPA) announced several weeks ago and aims to finalize by next June. The researchers suggest that current United Nations accounting methods, which chart annual carbon dioxide discharge, should also tally the projected lifetime emissions of power plants to

- 10. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 10 provide a more accurate picture of their impact on global warming. “International efforts all center on what we emit every year, but that misses the point,” said Steven Davis, an earth system scientist at the University of California, Irvine, and the study’s co-author. “We have information about what is coming in the future.” Davis wrote the paper with Robert Socolow of Princeton, known for his theory that a series of environmental steps that cut greenhouse gas, which he called wedges, could together flatline carbon emissions. The study reflects international trends in investment in coal-burning power plants, with construction of coal-fired power plants slowing in the West since the 1980s but increasing in China, India, and other areas of the developing world. “There is a global effort to reduce carbon dioxide, but it is actually increasing at a shocking rate,” Davis said. “When you build a power plant, it is going to stick around for 40 to 50 years and emit a lot of CO2.” In 2012, China’s power sector represented 42 percent of worldwide committed emissions, 98 percent of which were tied to coal, the authors found. Plants in the United States and Europe together accounted for 20 percent. That share of lifetime carbon emissions has declined in the United States since the late 1980s, in part due to the shift from coal-burning power plants to plants fueled by natural gas, but also because the power infrastructure is not expanding. Levels remained steady in Europe.

- 11. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 11 The study found that lifetime emissions from China’s power plants have experienced a less rapid increase since the country’s 2006 peak. Although China continues to build power plants, they are not being built as rapidly as in the recent past, Davis said. However, China is “passing the torch” to other industrializing countries—including Indonesia, Russia, Saudi Arabia, and Iran—which are ramping up their power sectors, often by building new coal plants. The study presents a bleak look at international efforts to prevent global warming while it questions the accounting used to tally emissions to meet climate treaties. The authors found that lifetime carbon emissions from currently operating power plants represent a substantial portion of what is allowed for in climate models to prevent global temperatures from warming more than 2 degrees Celsius from the preindustrial era—the current international target. The emissions from existing power plants in China and the United States, for example, represent 53 and 21 percent, respectively, of each nation’s carbon budget to meet its carbon target from all sources, according to the study. In the paper, Robert Socolow, a Princeton professor, emeritus, of mechanical and aerospace engineering, and co-author Steven Davis, a professor of earth system science at the UC-Irvine, develop a “commitment accounting” that assigns all the future emissions of a facility to the year when it begins working. This method reveals that the fossil-fuel-burning power plants built worldwide in 2012 alone will produce roughly 19 billion tons of the global-warming gas carbon dioxide (CO2) over their lifetime, assuming the plants operate for 40 years. This is considerably more than the 14 billion tons of CO2 emissions produced by all the plants operating worldwide in 2012. “We are flying a plane that is missing a crucial dial on the instrument panel,” Socolow said. “The needed dial would report committed emissions. Right now, as far as emissions are concerned, the only dial on our plane tells us about current emissions, not the emissions that current capital investments will bring about in future years.” Further findings from the study show that the plants that were operating around the world in 2012, before they are shut down, will emit more than 300 billion tons of CO2. The number of new power plants is rapidly growing and very few old ones are being retired. In fact, total remaining commitments in the global power sector have not declined in a single year since 1950. These commitments grew at an average rate of 4 percent per year between 2000 and 2012. The authors said the increases in global commitments reflect the rapid expansion of China’s power sector since 1995, as well as new power plants built in developing countries such as India, Indonesia, Saudi Arabia and Iran. Plants in China and India now respectively represent 42 percent and 8 percent of committed future emissions, while plants operating in the United States and Europe represent roughly 11 percent and 9 percent, respectively. The share of commitments related to natural gas-fired plants has increased from roughly 15 percent in 1980 to 27 percent in 2012, but aside from the Middle East, almost the entire developing world is relying on coal its industrialization. “A high-carbon future is being locked in by the world’s capital investments in power plants and other infrastructure,” Socolow said. “Finding paths to low-carbon industrialization must become a global priority.”

- 12. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 12 NewBase Special Report Covering Mozambique Key Projects and Business Highlights 2014 Mozambique appears as one of the most promising country for natural gas exploration production and could become one of the largest exporter of liquefied natural gas (LNG) under the lead of companies such as Anadarko Petroleum Company (Anadarko) from USA, Eni from Italy, Mitsui E&P from Japan, China national Petroleum Corporation (CNPC or PetroChina), Kogas from South Korea, Galp Energia from Portugal, BPRL and Emprecia Nacional de Hidrocarbonetos ENH from Mozambique. Since Mozambique is not willing to depend exclusively from the natural gas exploration and production, it initiated projects on the downstream side with companies such as Royal Dutch Shell (Shell) from Europe and Sasol from South Africa to monetize locally the resources with projects such as Gas-To-Liquid. Benchmarking Brazil and Nigeria, Mozambique is attentive to maximize the local added value. In this perspective Mozambique is working on its new regulation regarding the local content to be considered by the companies to develop all the upstream, midstream and downstream projects, This regulation generate intense discussion between the local authorities and the companies putting on hold final investment decisions in the meantime to know what shall be the final contractual obligations. Anyway all the companies are taking this temporary period to explore all the scenario to explore these giant and unexpected resources in the optimized way combining onshore LNG train and floating LNG solutions. 1- Gas-To-Liquid projects to queue behind LNG Plants The Royal Dutch Shell (Shell) on one side and the tandem Sasol-Eni on another side signed these last weeks agreement with the national oil company (NOC) Empresa Nacional de Hidrocarbonetos (ENH) to start feasibility studies on Gas-To-liquid (GTL) projects in Mozambique. During the last two years Mozambique emerged as one of the potential key players of the natural gas market with the discoveries performed in the Rovuma Basin, offshore Mozambique on the east of coast of Africa.

- 13. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 13 Pioneered by Anadarko on the Area 1 and Eni on the Area 4, the Rovuma basin exploration has proven to be one of the most prolific opportunity in the world for non-associated gas over the last ten years. Although Anadarko and Eni have not completed yet the evaluation of the reserves in their respective Area, their estimations of recoverable reserves in the Rovuma Basin fluctuate between 70 trillion and 100 trillion cubic feet (tcf). With these gigantic reserves, the Mozambique Government required Anadarko and Eni to align on onshore development in order to optimize the infrastructures required to support the production and exportation of liquefied natural gas (LNG) while both operators will develop the offshore part of their projects in the Area 1 and Area 4 on their own. At this stage Anadarko and Eni consider conventional concept, based on offshore platform and export pipeline to shore, as well as floating LNG vessels. Anyway in both cases, exporting LNG from Mozambique will face tougher competition in coming years because of similar export projects in Tanzania, Australia, Russia and North America. After the spiraling costs experiences in Australia, all the companies such as Anadarko, Shell or Eni are assessing carefully all multi-$billion LNG projects and investigate solutions to mitigate risks. Mozambique GTL projects to leverage LNG projects Among the solutions, the conversion of natural gas into liquids has proven to be pertinent in a context of wide spread between the low gas prices and the high crude oil prices. From the evidences accumulated these last years, this wide spread between energy prices appears sustainable enough to consider GTL projects in Mozambique. In Mozambique these GTL projects would provide all parties with solid benefits for all parties. For the Government, the Mozambique GTL projects should reduce the import of expensive crude oil for the distribution of transportation fuels. Through ENH they should also increase the local monetization of the Rovuma Basin resources. For the companies such as Shell, Sasol, Anadarko and Eni, the integration of GTL projects in the development of large non- associated gas projects will leverage their added value while mitigating reliance on gas markets. Because of their experience in world-scale GTL projects in Africa, Asia and Middle-East, Shell and Sasol appear as the best partners for Eni and ENH to develop these Mozambique GTL projects.

- 14. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 14 In starting feasibility studies now, the Shell GTL and Sasol GTL projects in Mozambique with ENH and Eni should run into commercial operations by 2021 – 2022. 2- Eni strategy in good progress with Area-4 FLNG projects The Italian national oil company (NOC) Eni is currently proceeding to the pre-qualification of the engineering companies and shipyards to be invited to bid (ITB) for the front end engineering and design (FEED) of the first floating liquefied natural gas (FLNG) vessel to be moored in the Area-4 in the Strait of Mozambique on the East Coast of Africa. Together with the Texas-based Anadarko Petroleum Corporation (Anadarko), Eni is leading the development of the huge reserves of gas discovered these last five years in the Rovuma Basin offshore Mozambique and Tanzania. Anadarko is leading the exploration and production of the Rovuma Basin Area-1 while Eni is prospecting the Area-4. In the Area-1 Anadarko is the operator with 26.5% of the joint venture shared with Mitsui E&P (20%), BPRL Ventures Mozambique (10%), Videocon (10%), PTTEP (8.5%), ONGC Videsh (OVL) (10%) and the local Empresa Nacional de Hidrocarbonetos (ENH) holding the remaining (15%). In the Area-4, the working interests are more concentrated since Eni holds 50% shares of the joint venture with China National Petroleum Corporation (PetroChina or CNPC) (20%), Galp Energia (10%), Kogas (10%) and ENH (10%). So far, Anadarko and Eni have identified more than 100 trillion cubic feet (tcf) and 70tcf in the Area-1 and Area-4 respectively. With such reserves the Mozambique Government required Anadarko and Eni to unitize the development of the onshore part of their respective projects. As a consequence, Anadarko and Eni have organized a competitive FEED to build series of 10 liquefied natural gas (LNG) trains at the Afungi LNG industrial Park to be developed in the Cabo Delgado Province in the north of Mozambique. In addition to this first Afungi onshore LNG project, Eni is prospecting other locations upper north of Mozambique, close to the boarder with Tanzania, to install its own onshore facilities. So far Quionga, seems to be Eni preferred choice for future Mozambique onshore LNG plants. Anyway since the Australian experience, all the companies have experienced that building large onshore LNG facilities carries on number of uncertainties related to the local acceptance and the costs of such greenfield giant projects. In this context, the risks associated to the innovative concept of FLNG look much more manageable for on- time deliveries. Therefore in parallel to the onshore projects, Eni has defined its strategy to deploy of fleet of three FLNG in the Area-4 that could run into production regardless the actual planning of the onshore projects. In order to design and build the first FLNG on fast track, Eni is planning to organize a competitive FEED based on the pre-FEED completed by the tandem Saipem – Hyundai Heavy Industries (HHI).

- 15. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 15 During the pre-qualification process, Eni invited interested engineering companies to team up with shipyards in order to present a complete offer combining both expertises. From the four or five qualified tandems of engineering companies and shipyards, Eni should select only two to perform the FEED of the first FLNG. Then the tandem returning best FEED conclusions and submitting the best technical and commercial offer for the engineering, procurement and construction (EPC) contract will be sanctioned the execution of the construction in following its FEED. With this strategy, Eni and its partners , PetroChina, Galp Energia, Kogas and ENH, are expecting to offload the first shipment from the first Rovuma Basin Area-1 Mozambique FLNG by 2019. 3- Eni considers own LNG Plant to secure 2018 shipment The Italian national oil company Eni and its partners China National Petroleum Corporation (CNPC or PetroChina), Kogas from South Korea, Galp Energia from Portugal and Mozambique Emprecia Nacional de Hidrocarbonetos (ENH) are evaluating alternative solutions to develop its Mozambique liquefied natural gas (LNG) project on fast track in order to load the first shipments in 2018. Together with the Texas-based Anadarko Petroleum Corporation (Anadarko), Eni managed to unveil the gigantic resources of natural gas lying in the deep offshore water Mozambique. While Anadarko was leading the exploration on the Area-1 of the Rovuma Basin, Eni was confirming the potential of the region in the Area-4. On the Area-1, Anadarko expect to accumulate 100 trillion cubic feet (tcf) of natural gas and Eni more than 70 tcf. Geographically, Mozambique is perfectly located on the Africa East Coast to export LNG to Asia. In that perspective, the Mozambique Government motivated the two teams leaders Anadarko and Eni to sign, end of 2012, a memorandum of understanding (MOU) to develop jointly the onshore part of the Mozambique LNG projects and coordinate their efforts regarding the offshore part where fields are linked between the Area-1 and Area-4. As a result, Eni and Anadarko have started the feasibility study to build the Afungi LNG Park in the Cabo Delgado Province on the northeast coast of Mozambique. According to the reserves consolidated by Eni and Anadarko, this onshore of the Mozambique LNG project is planned to be developed jointly in five different phases of two trains per each phase.

- 16. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 16 Since the feasibility study has been completed for this onshore Mozambique LNG project, three teams of engineering companies are bidding for the front end engineering and design (FEED) contract. Eni and Anadarko had decided to call for tender on the base of a competitive FEED in order to save time on the engineering, procurement and construction (EPC) phase of the project with already the target to ship first LNGto Asia in 2018. If it is clear that Anadarko is the operator of the Area-1 and Eni of the Area-4, the question is still pending on the name of the operator of the jointly developed Afungi LNG Park. This question will need to be answered before the final investment decision (FID) required to sanction the competitive FEED to the winning engineering companies team. On Area-1, the Anadarko holds 36.5% with Mitsui E&P 20%, BPRL Ventures Mozambique 10%, Videocon 10%, PTTEP 8.5% and ENH 15%. On Area-4, the Italian leader Eni concentrates 50% through the joint venture Eni East Africa by which PetroChina holds 20%, with the remaining shares being split between Kogas 10%, Galp Energia 10%, and ENH 10%. With their deep pockets and 70% interests in the project, Eni and PetroChina do not intend to lose time in the development of Mozambique LNG project. In the same way as they are studying a floating liquefied natural gas (FLNG) solution to speed up the development of the offshore part in Mamba , they are now considering to build their own LNG plant in Quionga, close to Tanzania boarder. In respect with the reserves in places in the Rovuma basin, Mozambique holds enough gas to feed the Afungi LNG Park, Mamba FLNG and an additional Quionga LNG plant, that would secure first LNG shipment for Eni and PetroChina from Mozambique LNG by 2018.

- 17. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 17 NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Your partner in Energy Services Khaled Malallah Al Awadi, MSc. & BSc. Mechanical Engineering (HON), USA ASME member since 1995 Emarat member since 1990 Energy Services & Consultants Mobile : +97150-4822502 khalid_malallah@emarat.ae khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 24 yearsKhaled Al Awadi is a UAE National with a total of 24 yearsKhaled Al Awadi is a UAE National with a total of 24 yearsKhaled Al Awadi is a UAE National with a total of 24 years of experience in theof experience in theof experience in theof experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for EmiratesOil & Gas sector. Currently working as Technical Affairs Specialist for EmiratesOil & Gas sector. Currently working as Technical Affairs Specialist for EmiratesOil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with externalGeneral Petroleum Corp. “Emarat“ with externalGeneral Petroleum Corp. “Emarat“ with externalGeneral Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most ofvoluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most ofvoluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most ofvoluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility &the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility &the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility &the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor statgas compressor statgas compressor statgas compressor stations . Throughions . Throughions . Throughions . Through the years , he has developed great experiences in the designing & constructingthe years , he has developed great experiences in the designing & constructingthe years , he has developed great experiences in the designing & constructingthe years , he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Manyof gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Manyof gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Manyof gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation , opyears were spent drafting, & compiling gas transportation , opyears were spent drafting, & compiling gas transportation , opyears were spent drafting, & compiling gas transportation , operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference foreration & maintenance agreements along with many MOUs for the local authorities. He has become a reference foreration & maintenance agreements along with many MOUs for the local authorities. He has become a reference foreration & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE andmany of the Oil & Gas Conferences held in the UAE andmany of the Oil & Gas Conferences held in the UAE andmany of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally , via GCC leading satellite Channels .Energy program broadcasted internationally , via GCC leading satellite Channels .Energy program broadcasted internationally , via GCC leading satellite Channels .Energy program broadcasted internationally , via GCC leading satellite Channels . NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase 28 August 2014 K. Al Awadi