New base special 10 september 2014

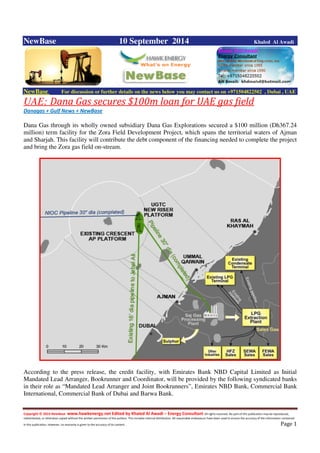

- 1. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 1 NewBase 10 September 2014 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE UAE: Dana Gas secures $100m loan for UAE gas field Danagas + Gulf News + NewBase Dana Gas through its wholly owned subsidiary Dana Gas Explorations secured a $100 million (Dh367.24 million) term facility for the Zora Field Development Project, which spans the territorial waters of Ajman and Sharjah. This facility will contribute the debt component of the financing needed to complete the project and bring the Zora gas field on-stream. According to the press release, the credit facility, with Emirates Bank NBD Capital Limited as Initial Mandated Lead Arranger, Bookrunner and Coordinator, will be provided by the following syndicated banks in their role as “Mandated Lead Arranger and Joint Bookrunners”, Emirates NBD Bank, Commercial Bank International, Commercial Bank of Dubai and Barwa Bank.

- 2. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 2 The repayment for the term facility is over a period of 15 quarterly investments, the press release said. Once on-stream, Zora will provide an additional source of gas for local power generation in the Emirate of Sharjah by 150 MW ( 10 % of the emirate peak demand this year ) per day . It is expected production capacity of 40 million metric standard cubic feet per day (mmscfd) piped to Sharjah Hamriyah Gas treatment plant .

- 3. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 3 Qatar account surplus set to narrow on ‘lower oil prices, higher imports’ Q Gulf Times , By Pratap John Qatar’s current account surplus will narrow over the medium term on lower oil prices and strong import growth, QNB said even as the bank expects Brent crude oil prices to average $108 for a barrel in 2014. High crude oil prices would help sustain strong hydrocarbon export receipts despite the moratorium on further gas developments and the expected stabilisation in oil production, QNB said. Import growth will accelerate on higher investment spending and consumption. Consequently, the current account surplus is forecast to narrow gradually to 21.6% of gross domestic product (GDP) by 2016 on continued strong import demand. Much of the current account surplus is likely to be invested abroad, resulting in large capital outflows. As a result, international reserves will remain broadly stable in 2015-16 at about eight months of import cover. In its latest Qatar Economic Insight QNB said it expects the fiscal surplus to narrow as capital spending rises and hydrocarbon revenue falls on lower oil prices. Overall, it projects a fiscal surplus of 8.5% of GDP in 2014-15, falling to 5.3% in 2016-17. The government intends to increase investment spending on major projects, but this will be offset by restraint on current expenditure. While the wage bill is expected to rise, other current expenditures are projected to be reduced. Total expenditures are expected to grow in line with nominal GDP over the medium term. The corresponding fiscal surpluses are projected to result in a gradual decline in public debt from 34.7% in 2013-14 to 23.8% of GDP by 2016-17. QNB also expects bank lending growth to continue on project financing and the growing population. Growth in domestic credit facilities and investments will support asset growth over the medium term. Lending should be underpinned by rapid deposit growth, reflecting the large fiscal surplus and population growth. Qatar’s loan-to-deposit ratio is expected to decline gradually to reach about 100% by 2016 as it will take time for banks to comply with the new Qatar Central Bank regulation mandating a ratio below 100% by end-2014. NPLs are forecast to remain low during 2014-16 as asset quality is supported by the strong economic environment. Going forward, low provisioning requirements and efficient cost bases will continue to support banks’ profitability, the QNB report said.

- 4. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 4 Qatar's gas reserves 'set to last 156 years' © Gulf Times 2014 + NewBAse In 2013, Qatar had raw gas reserves totalling 872tn cubic feet, giving it the third largest proven reserves of natural gas in the world after Russia and Iran, QNB says in its latest Qatar Economic Insight. Qatar's gas reserves would last at least another 156 years at current production rates, a new report has shown. In 2013, Qatar had raw gas reserves totalling 872tn cubic feet, giving it the third largest proven reserves of natural gas in the world after Russia and Iran, said QNB in its latest Qatar Economic Insight. "It is therefore likely that Qatar will continue extracting gas well into the 22nd century," QNB said. Qatar discovered the extent of its natural gas reserves in 1971 when the offshore North Field was discovered. The North Field is now known to be the largest non-associated gas field in the world, accounting for around 99% of Qatar's gas reserves. Gas production grew on average 15.4% annually during 2009-13 as additional LNG export facilities became operational. Large-scale LNG projects led to major increases in gas production. Qatar ranks fourth globally for gas production. In 2013, around 52.6% of gas production was allocated to LNG exports, but the expansion programme is now complete and LNG production is expected to plateau. Qatar also exports around 11.7% of gas production by pipeline to the UAE. Remaining production goes towards domestic uses, including power generation and water desalination, feedstock for GTLs, petrochemical and fertiliser plants, and household cooking gas.

- 5. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 5 The Barzan project is a $10.3bn North Field gas development to increase production for domestic use. Initial production is expected in 2015 with incremental growth until 2023. Barzan is an exception to a moratorium on new production from the North Field. According to QNB, Qatar is likely to benefit from robust global LNG demand over the next few years. Continued strong Asian demand and slow supply growth are likely to support LNG prices over the medium term. Qatar, it said, had benefited from rising prices in Asia where demand has been strong owing to robust GDP growth and the switch to cleaner energy, notably in China. Qatar has, therefore, increased exports to Asia (71% of exports in 2013), mainly to Japan, South Korea and India. Weaker growth in Europe has led to a divergence in prices. However, tensions with Russia could boost European LNG demand as an alternative to Russian pipeline gas. Going forward, robust economic growth in Asia and an increasing reliance on LNG may drive demand. A recent $400bn deal for Russia to supply 38bn cubic meters a year of gas to China for 30 years could bring down Asian prices and boost European prices, leading to price convergence. Major export projects in Australia, Papua New Guinea and the US are not expected to be completed until the 2020s, so demand growth is likely to outpace supply growth. As a result, Qatar is likely to benefit from higher LNG prices for years to come, QNB said.

- 6. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 6 US shale boom ‘hurting Mideast petchem industry’ TradeArabia News + NewBase The increased competitiveness of the US petrochemical industry due to the discovery of large reserves of shale gas has impacted the Middle East, which is already grappling with reduced natural gas supplies, a report said. The adverse effects of these developments have been particularly felt by the GCC countries, added the study Impact of US Shale Gas Boom on Middle East Petrochemical Feedstocks from Frost & Sullivan, a growth partnership company. Once the exporting hub for natural gas, the region has now transformed into an import destination as the demand for fossil fuel exceeds its supply. This demand-supply gap across most parts of the Middle East has changed the competitive dynamics in the global energy market and demands quick remedial measures. The analysis has found that the assessment of shale gas resources in the Middle East has assumed critical importance since yields from conventional natural gas sources are fast declining. New unconventional energy discoveries are essential to ensure sustainable gas supplies and to reenergise the region’s petrochemical industry. “It will be prudent to unearth and tap the large volumes of shale gas believed to be trapped in various countries across the region,” said Frost & Sullivan Chemicals, Materials & Food Research Analyst. “Saudi Arabia alone is likely to hold reserves close to 650 trillion cu ft. While it might not be economically viable to retrieve all these reserves, significant volumes can certainly be exploited.” Despite these available courses of action, regional governments have taken a hands-off approach and not responded adequately to the decline in conventional natural gas production. The longer governments in the Middle East delay implementing restorative measures, the more drastic future corrective measures will have to be, the Analyst added. “As such, the buck ends with the governments to launch short-term and long-term initiatives to renew the region’s competitive advantage in the global petrochemical industry,” noted the Analyst. “Undertaking surveys of unconventional energy sources would be a good start as it often takes several years before

- 7. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 7 Ovia to invest $1.5 billion in Nigeria Quantum Petrochemical Complex The Nigerian Quantum Petrochemical Company Limited (Quantum) has decided to invest $1.5 billion capital expenditure in a world-scale petrochemical and methanol complex at Ibeno in the Akwa Ibom State of the southern Nigeria on the Gulf of Guinea. Quantum was recently founded by the Nigeria banker Jim Ovia, ranked by Forbes among to top twenty richest man in Africa. Until now, Jim Ovia was famous in Africa for having founded the Zenith Bank and for running the local telecommunication company Visafone. Jumping in the footprints left by the Nigerian and Africa richest man Aliko Dangote, Jim Ovia has identified the opportunity to develop the downstream sector of the local oil and gas industry in Nigeria. For years now Nigeria is exporting natural gas and crude oil while importing refined products, petrochemicals and fertilizers, therefore Nigeria is offering significant opportunities to monetize locally its natural resources. Unfortunately the permanent instability and insecurity on all onshore installations prevent the foreign companies to contribute directly to this effort, for now the major companies are selling most of their onshore assets. Anyway Nigeria undertook a large campaign to capture the flared gas which contributes to increase the local production in a context of lowering prices. In this context, the Nigerian businessmen such as Dangote and Ovia have detected the opportunity to provide a local response to the domestic market needs with the full support of the Government Gas Master Plan. For his Quantum Petrochemical and methanol project Jim Ovia selected Ibeno as located at the mouth of the Qua Iboe River on the Gulf of Guinea in order to facilitate the deep water harbor access for the large carrier or offshore pipelines. As a banker, Jim Ovia analyzes the profitability of the investment as a petrochemical complex but also in the opportunities it will open to develop the manufacturing sector to produce tyres, plastics, construction materials, textiles fibers, packaging, pharmaceuticals, cosmetics. In this perspective the Quantum Petrochemical Complex will include world-scale ethane cracker and methanol plant to produce: - Polyethylene - Polypropylene - Derivatives In producing locally these building blocks of the industry, Jim Ovia is already looking a step further with the Quantum Petrochemical project to attract in the Akwa Ibom State number of manufacturing activities that could find there competitive feedstock and looking for financing. In this scheme, Jim Ovia is willing to proceed on fast track and has already started the ground work in parallel to the front end engineering and design (FEED) of the Quantum Petrochemical and methanol complex

- 8. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 8 UK: Premier Oil announces installation of Solan field facilities offshore Source: Premier Oil Premier Oil has announced that the Solan subsea oil storage tank, jacket and topsides have been successfully installed. The offshore hook up and commissioning programme will now commence. Precise timing of first oil from the Solan field will depend upon the progress of this next phase. Tony Durrant, CEO, commented: 'We are very pleased to have successfully installed the Solan facilities within two and a half years of receiving approval from the UK government. This achievement was only made possible by the co-operation and skills of the teams and contractors involved.' Solan field (Premier 60% operated interest) The Solan oil field was discovered in 1991 by Hess and relinquished. The discovery was further appraised by Chrysaor with two wells in 2008 and 2009. In May 2011, Premier acquired a 60% equity interest in the Solan field (see press release) and, in April 2012 approval of the Solan Field Development Plan was granted from DECC (see press release). Drilling of the four development wells - two producers and two water injectors - commenced in April 2013 with the first pair completed in the summer of 2014. Onshore construction of the subsea storage tank, jacket and topsides was completed in 2014 with the facilities installed during August and September 2014 (see press release). The offshore hook up and commissioning programme has commenced. Precise timing of first oil from the Solan field will depend upon the progress of this next phase. The field is expected to produce approximately 40 mmbbls. Chrysaor is Premier's partner in the field with an equity stake of 40%.

- 9. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 9 UK: Xcite Energy in Collaboration Agreement with Statoil and EnQuest for Kraken, Bentley and Bressay fields. Source: Xcite Energy Xcite Energy has announced that its 100% owned subsidiary, Xcite Energy Resources (XER), has entered into a Collaboration Agreement with Statoil (U.K.) and EnQuest Heather, in order to share field-specific technical and operational information to evaluate the potential utilisation of common gas import infrastructure between the Kraken, Bentley and Bressay fields. A joint XER, Statoil and EnQuest team will work together to analyse the current available information and develop a number of proposals to assess the potential benefits of installing a shared gas import pipeline in conjunction with the development of the Kraken, Bentley and Bressay fields. Rupert Cole, CEO of Xcite Energy, commented: 'We are pleased to continue to work with Statoil and extend this to include EnQuest in the assessment of this shared infrastructure. This new collaboration with Statoil and EnQuest to assess this shared infrastructure is an important initiative, which highlights the scope of potential opportunities available to our respective projects.I believe that today's announcement further demonstrates that additional value can be created by companies collaborating in key development activities and it reinforces our commitment to "Maximising Economic Recovery" from the area immediately surrounding the Bentley field.' Xcite Energy Resources is Operator of the Bentley field and holds a 100% working interest in the Bentley licence. The Bressay field is operated by Statoil, with an 81.625% working interest. Shell holds an 18.375% working interest. The Kraken field is operated by EnQuest, with a 60% working interest. Cairn Energy and First Oil hold the balance of 25% and 15% working interests respectively.

- 10. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 10 Senex, QGC JV Swap Gas Assets N.Gas Asia + NewBAse Senex Energy on Wednesday announced it has agreed a Surat Basin gas asset swap with the PL 171 and ATP 574P joint venture partners QGC JV. Under the terms of the agreement, Senex will transfer its minority interest in eastern Surat Basin permits PL 171 and ATP 574P to the QGC JV and the QGC JV will transfer its 100% interest in, and operatorship of, western Surat Basin permits ATP 795, ATP 767 and ATP 889 to Senex. No cash consideration is payable by any party in respect of the tenement transfers, Senex said.The QGC JV permits are adjacent to Senex’s existing western Surat Basin assets ATP 771P and ATP 593P and form the basis of the Western Surat Gas Project. On completion of the transaction, Senex will hold net 2P gas reserves of 488 petajoules (PJ). Commenting on the transaction, Senex Managing Director Ian Davies said the asset swap was mutually beneficial and positioned Senex as part of the solution to the looming gas shortage in domestic and export markets. “This is a win-win transaction. Combining the QGC JV’s western Surat Basin assets with our own western Surat Basin acreage gives Senex the scale required to build a material Surat Basin gas business on our own terms. The arrangement also enables QGC and its partners to focus on the eastern Surat assets to the benefit of the greater QCLNG project,” he said. Davis added that Senex will invest up to $40 million from existing financial resources in the Western Surat Gas Project over the next three years, targeting commencement of pilot testing in 2015-16 and moving to an investment decision on commercial production as soon as appraisal results support it.

- 11. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 11 KrisEnergy Kicks Off Seismic Programs in Sakti PSC Offshore Indonesia Source : KrisEnergy + NewBase KrisEnergy on Monday announced start of acquisition of 1,200 km 2D seismic data in the Sakti production sharing contract (PSC) offshore East Java, Indonesia. “KrisEnergy was awarded operatorship of the Sakti PSC in February this year and we are pleased to be able to commence exploration work in a timely fashion. Sakti is adjacent to the Bulu PSC, where we have submitted a development plan for the Lengo gas field, and will form part of our gas aggregation plans into the gas-hungry East Java market,” Chris Gibson-Robinson, Director Exploration & Production commented. Immediately following the completion of the 2D seismic program, 400 sq km of 3D seismic data is scheduled to be acquired by PT. CGG Services Indonesia. The 3D seismic acquisition program is expected to commence at the end of September, KrisEnergy said. The acquisition program was awarded to PT. Alamjaya Makmur Sejahtera in consortium with PT. Bahari Lines Indonesia. The Sakti exploration block covers 4,974 sq km in the East Java Sea over the western margin of the East Java Basin, Bawean Arch and the Muriah Trough. Water depths in the area range between 50metres and 60 metres. KrisEnergy holds a 95% operated working interest in the Sakti PSC and the other participant is Golden Haven Jaya Ltd. with 5%.

- 12. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 12 US & EU Sanctions-hit Rosneft struggles to grow Reuters & NewBase THE Kremlin’s prized oil firm Rosneft is cutting staff and production and selling stakes in Siberian fields in the strongest evidence to date that Western sanctions are hurting what was the world’s fastest growing oil firm in recent years. The sanctions imposed on Russia by the United States and Europe in response to its military action in Ukraine have cut Rosneft’s access to Western financing and technology, complicating the servicing of its $55 billion debt and closing the way to cutting-edge industrial science it needs to keep developing its energy resources. Few doubt that Rosneft will be able to withstand the pressure medium-term — its earnings amount to $30 billion a year and billions more are still available via Chinese credit lines and Russian state coffers in case of emergency. But the world’s biggest listed oil producer — which produces more oil than Opec members Iraq or Iran — faces unprecedented challenges to its long-term expansion and modernisation plans. Last week Rosneft said it would cut staff to reduce costs: Kommersant business daily said Rosneft’s Moscow headquarters would see cuts of up to 25 per cent from the current 4,000. These would be the first significant job losses at a company that swelled via the acquisition of rivals such as YUKOS, pushed into bankruptcy some ten years ago by the government of President Vladimir Putin. Since then Rosneft’s output has risen 10-fold to exceed 4 million barrels per day or four per cent of global supply. But last week it reported a 1.3 per cent production drop in August, as production in West Siberia regions declines.The firm, which alongside gas monopoly Gazprom is a top contributor to the Russian budget, needs to invest heavily to bring new east Siberian fields online — a costly endeavour now made more difficult by the sanctions squeeze. In a sign of the challenge such a project now presents, Putin said last week Rosneft would welcome China buying a stake in the prized Siberian Vankor field. It was a major about-turn given the Kremlin’s long resistance to allowing its powerful neighbour access to such deposits. “Rosneft’s decision to offer China a stake in the mega Vankor oil field in East Siberia signals that Moscow’s bargaining position has been further weakened by sanctions and that it needs the capital infusion,” said Emily Stromquist, analyst at Eurasia. Rosneft needs to invest more than $21 billion annually until 2017 to launch new fields and upgrade refineries. It also needs to repay $12 billion by year-end and another $17 billion next year, after it borrowed heavily to buy rival TNK-BP for $55 billion last year — a deal that included BP taking a 20 per cent stake in Rosneft.

- 13. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 13 Rosneft should be able to access some of the money it needs from short-term credit lines via Western banks as the United States sanctions only prohibits them from providing loans with maturity longer than 90 days. But with the European Union expected to impose similar lending bans soon, Rosneft boss Igor Sechin under personal sanctions owing to his closeness to Putin and any resolution to the Ukraine crisis a long way off, all Western lending to Rosneft has in fact stopped, finance and industry insiders say. “The credit has stopped. All conversation has become purely theoretical. People fear everything is following the patterns of the Iranian (sanctions) scenario when credit and then oil flows were getting progressively hurt,” said an executive with a Western trading house and a major buyer of oil from Rosneft. Over the past year, BP and trading houses Vitol, Glencore and Trafigura provided Rosneft with $20 billion worth of loans syndicated by banks and guaranteed by oil exports.But Rosneft’s

- 14. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 14 attempts to borrow more from them in recent months have stalled or been drastically curtailed because the banks refused to syndicate new deals. Rosneft CEO Sechin was forced to ask for $40 billion in state help from one of Russia’s sovereign wealth funds and Prime Minister Dmitry Medvedev said the company could get it. “The company needs to maintain its production levels, because Rosneft is a major source of tax revenue,” Medvedev told Vedomosti business daily on Monday. “As such, we should help it maintain its level of investment”. A Rosneft source said the company had no plans to borrow for the next 12-18 months and that credit lines offered by China’s state oil firm CNPC meant the company had enough liquidity to see it through. “We are planning to cut debt further without reducing capex. We need to maintain huge investments to launch new East Siberian fields. After 2017 capex will drop,” the source said. Though the Russian state and Chinese allies may keep money flowing to Rosneft, they cannot supply vital technology. Rosneft said last week it planned to replace all equipment and technology imports from the West as the US and EU sanctions halted all trade with the firms upon which it usually relies for such essentials. In the meantime however it will struggle to find what it needs to develop shale and deep water Arctic oil because Russia has made little progress in building its own services sector.

- 15. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 15 US crude export prospects expand niche for oilfield stabilisers Reuters + NewBase The units, known as stabilisers, process that type of crude, known as condensate, just enough to qualify it for export as a refined product, allowing oil producers to ship it abroad without violating a decades-old ban. Dozens of companies that build stabilisers, ranging from small private firms to pipeline and logistics leader Kinder Morgan Energy Partners, stand to benefit from new orders. Oil producers in condensate-heavy shale crude plays like the Eagle Ford and the western Permian Basin in Texas also could fetch better condensate prices if exported, as US refiners have limited demand for it. Stabilisers are simpler and cheaper than more complex splitters and refineries, which process oil into gasoline, diesel, naphtha and other products.A new 10,000 bpd stabiliser and 21 storage tanks in Live Oak County, Texas, had a combined $100 million price tag, while a/s50,000 bpd splitter costs about $250 million. A special unit at a refinery to shave light ends from crude runs up to $400 million. More of these so-called condensate stabilisers are being constructed in Texas, where output and coastal export capability is snowballing.“I have seen a significant increase in inquiries and demand for stabilisers, pretty much all the sizes we build,” said Danny Kennedy, president of Joule Processing in Houston, a privately-held engineering firm that builds oilfield processing and treating infrastructure, including stabilisers. That interest stems from US Department of Commerce approvals that allowed producer Pioneer Natural Resources and pipeline and logistics company Enterprise Products Partners to export condensate, a very light form of crude oil, after it has been minimally processed in a stabiliser. Bill Bowers, vice president of production equipment for Valerus, said he expects more interest in its stabilisers from midstream companies, as more seek clarity from the Commerce Department on the two approvals. A stabiliser is a relatively simple tower that removes volatile natural gas liquids and other contaminants from crude and condensate so they meet pipeline specifications. Before the Commerce rulings emerged, the oil industry believed more distillation was necessary to turn crude into an exportable product, which meant processing in a splitter or refinery. Dozens of stabilisers dot the Eagle Ford, ranging in capacity from 500 barrels per day to the largest, Plains All American’s 80,000

- 16. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 16 bpd Gardendale stabiliser that will expand to 120,000 bpd next year. Others are in the Permian Basin in West Texas and Ohio’s Utica shale. Agencies that track US oil data do not keep track of the number of operating stabilisers, because the equipment is considered standard. Joule, Kennedy’s relatively small company, has about six stabilisers on the books to build this year — compared with two a year ago — with more to come in the early planning stages. Kinder Morgan sees opportunity for its division that builds stabilisers, including at least one of Pioneer’s. Chief Executive Rich Kinder told analysts this summer that the Pioneer ruling showed the company’s stabilisers “fit the bill” to qualify condensate for export. That did not change Kinder Morgan’s plan to start up a $370 million pair of 50,000-bpd condensate splitters at its Houston Ship Channel complex later this year, because BP Plc has a long-term contract to buy all the output. The same goes for splitter deals by Magellan Midstream Partners and Targa Resources However, Martin Midstream Partners has veered from splitter talk with a customer to a “conceptual stabilisation unit to process condensate to the government’s exportable standard” through the Corpus Christi market, the company’s CEO Joel McCreery, told analysts in July. McCreery said the company’s focus was changing to building stabilisers instead of splitters because of the Pioneer and Enterprise deals. Confusion still lingers over what distinguishes condensate from other light crudes, and what the timeline will be for more export approvals. In addition, it is not yet clear that the rush to order stabilisers from companies like Joule and Valerus is significant enough to fan the backlash from refiners who are resisting the export push by oil producers.

- 17. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 17 US solar industry nears 16GW of installed capacity: Survey US EIA + NewBase The United States’ solar market hit a major milestone in the second quarter of this year, with more than a half-million homes and businesses now generating solar energy. According to GTM Research and the Solar Energy Industries Association’s (SEIA) Q2 2014 US Solar Market Insight report, the US installed 1,133 megawatts of solar photovoltaics (PV) in the second quarter of this year. The residential and commercial segments accounted for nearly half of all solar PV installations in the quarter. The residential market has seen the most consistent growth of any segment for years, and its momentum shows no signs of slowing down. Across the US, cumulative PV and concentrating solar power (CSP) operating capacity has exceeded 15.9 gigawatts, enough to power more than 3.2 million homes. “Solar continues to soar, providing more and more homes, businesses, schools and government entities across the United States with clean, reliable and affordable electricity,” said SEIA President and CEO Rhone Resch. “Today, the solar industry employs 143,000 Americans and pumps nearly $15 billion a year into our economy. This remarkable growth is due in large part to smart and effective public policies, such as the solar Investment Tax Credit (ITC), net energy metering (NEM) and renewable portfolio standards (RPS). By any measure, these policies are paying huge dividends for both the US economy and the environment, and they should be maintained, if not expanded, given their tremendous success, as well as their importance to America’s future.” Showing continued strength, the utility PV segment made up 55 percent of US solar installations in the second quarter of the year. It has accounted for more than half of national PV installations for the fifth straight quarter. In just two years, the utility segment has quadrupled its cumulative size, growing from 1,784 megawatts in the first half of 2012 to 7,308 megawatts today. “Solar continues to be a primary source of new electric generation capacity in the US,” said Shayle Kann, Senior Vice President of GTM Research. “With new sources of capital being unlocked, design and engineering innovations reducing system prices, and sales channels rapidly diversifying, the solar market is quickly gaining steam to drive significant growth for the next few years.”

- 18. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 18 GTM Research and SEIA forecast 6.5 gigawatts of PV will be installed in the United States by the end of this year, up 36 percent over 2013. Key Findings • The US installed 1,133 MW of solar PV in Q2 2014, up 21 percent over Q2 2013, making it the fourth-largest quarter for solar installations in the history of the market. • Cumulative operating PV capacity has now eclipsed the 15 GW mark, thanks to three consecutive quarters of more than 1 GW installed. • As of the first half of 2014, more than a half-million homeowners and commercial customers have installed solar PV. • For the first time ever, more than 100 MW of residential PV came on-line without any state incentive. • 53 percent of new electric generating capacity in the US in the first half of 2014 came from solar. • Growth remains driven primarily by the utility solar PV market, which installed 625 MW in Q2 2014, up from 543 MW in Q2 2013. • PV installations will reach 6.5 GW in 2014, up 36 percent over 2013 and more than three times the market size just three years ago. • Q1 2014 was the largest quarter ever for concentrating solar power, due to the completion of the 392 megawatts (AC) Ivanpah project and Genesis Solar project’s second 125 megawatt (AC) phase. While Q2 2014 was dormant for CSP, a total of 857 megawatts (AC) is expected to be completed by year’s end, making 2014 the largest year ever for CSP NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Your partner in Energy Services NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE

- 19. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 19 NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Your partner in Energy Services Khaled Malallah Al Awadi, Energy Consultant MSc. & BSc. Mechanical Engineering (HON), USA ASME member since 1995 Emarat member since 1990 Mobile : +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 24 yearsKhaled Al Awadi is a UAE National with a total of 24 yearsKhaled Al Awadi is a UAE National with a total of 24 yearsKhaled Al Awadi is a UAE National with a total of 24 years of experience in theof experience in theof experience in theof experience in the Oil & Gas sector. Currently working as Technical AffairsOil & Gas sector. Currently working as Technical AffairsOil & Gas sector. Currently working as Technical AffairsOil & Gas sector. Currently working as Technical Affairs Specialist for EmiratesSpecialist for EmiratesSpecialist for EmiratesSpecialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service asGeneral Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service asGeneral Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service asGeneral Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most ofa UAE operations base , Most ofa UAE operations base , Most ofa UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , respothe experience were spent as the Gas Operations Manager in Emarat , respothe experience were spent as the Gas Operations Manager in Emarat , respothe experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Throughnsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Throughnsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Throughnsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years , he has developed great experiences in the designing & constructingthe years , he has developed great experiences in the designing & constructingthe years , he has developed great experiences in the designing & constructingthe years , he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routof gas pipelines, gas metering & regulating stations and in the engineering of supply routof gas pipelines, gas metering & regulating stations and in the engineering of supply routof gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Manyes. Manyes. Manyes. Many years were spent drafting, & compiling gas transportation , operation & maintenance agreements along with many MOUs for the lyears were spent drafting, & compiling gas transportation , operation & maintenance agreements along with many MOUs for the lyears were spent drafting, & compiling gas transportation , operation & maintenance agreements along with many MOUs for the lyears were spent drafting, & compiling gas transportation , operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference forocal authorities. He has become a reference forocal authorities. He has become a reference forocal authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE andmany of the Oil & Gas Conferences held in the UAE andmany of the Oil & Gas Conferences held in the UAE andmany of the Oil & Gas Conferences held in the UAE and Energy program bEnergy program bEnergy program bEnergy program broadcasted internationally , via GCC leading satellite Channels .roadcasted internationally , via GCC leading satellite Channels .roadcasted internationally , via GCC leading satellite Channels .roadcasted internationally , via GCC leading satellite Channels . NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase 10 September 2014 K. Al Awadi