New base 14 june 2021 energy news issue 1438 by khaled al awad-compressed

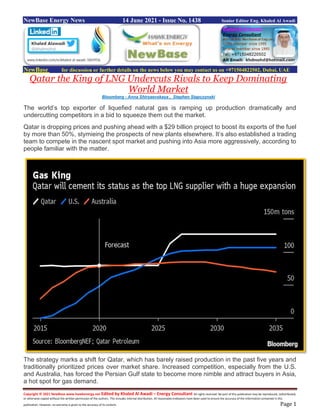

- 1. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase Energy News 14 June 2021 - Issue No. 1438 Senior Editor Eng. Khaled Al Awadi NewBase for discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Qatar the King of LNG Undercuts Rivals to Keep Dominating World Market Bloomberg - Anna Shiryaevskaya , Stephen Stapczynski The world’s top exporter of liquefied natural gas is ramping up production dramatically and undercutting competitors in a bid to squeeze them out the market. Qatar is dropping prices and pushing ahead with a $29 billion project to boost its exports of the fuel by more than 50%, stymieing the prospects of new plants elsewhere. It’s also established a trading team to compete in the nascent spot market and pushing into Asia more aggressively, according to people familiar with the matter. The strategy marks a shift for Qatar, which has barely raised production in the past five years and traditionally prioritized prices over market share. Increased competition, especially from the U.S. and Australia, has forced the Persian Gulf state to become more nimble and attract buyers in Asia, a hot spot for gas demand.

- 2. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 The global transition to renewable energy is adding to the country’s sense of urgency. While LNG was until recently touted as a bridge from coal and oil to the likes of solar and wind power, it’s falling out of favor with some governments as they step up efforts to slow climate change. “Qatar’s expansion plan is so huge that there are questions on the need for other supply options,” said Julien Hoarau, head of EnergyScan, the analytics unit of the French utility Engie SA. “It’s still the number one, but the U.S. has never been so close, so Qatar needed to move if it wanted to keep its leading position.” The U.S. came close to overtaking Qatar’s monthly exports for the first time in April, while Australia has been neck-in-neck with the Middle Eastern nation for the last year, according to ship-tracking data compiled by Bloomberg. As Gulf Coast projects develop, the U.S. is slated to briefly become the world’s top supplier by 2024, before Qatar regains that status later in the decade, according to BloombergNEF. Several factors are playing into Qatar’s hands. China, one of the fastest growing LNG markets, has been reluctant to import more from the U.S. or Australia due to trade and geopolitical tensions. But Qatar’s main advantage is that it has the world’s lowest production costs thanks to an abundance of easy-to-extract gas, most of it contained in the giant North Field that extends into Iran. Bonds Coming Qatar’s state energy company, which may soon sell up to $10 billion of bonds to fund the gas expansion, said the project will be viable even with oil at $20 a barrel, 70% less than current levels. LNG contracts are typically linked to oil. That’s enabling Qatar Petroleum to set pricing below what other exporters can manage, according to traders. The firm has sold LNG in recent months at around 10% of Brent crude prices, including to China and Pakistan, whereas it used to set the level at 15%. “Nobody can compete with Qatari costs,” said Jonathan Stern, a senior research fellow at the Oxford Institute of Energy Studies. “They can do whatever they like and everybody will have to respond the way they can. And, especially when the market is in surplus and prices are low, that will impact the competition’s profits.”

- 3. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 QP executives have jetted across Asia over the past few months to ink export deals. Their efforts led in March to a 10-year contract with Beijing-based Sinopec, signed at 10%-10.19% of Brent. Qatar’s Ministry of Energy and QP didn’t respond to requests for comment. A few years ago, demand for LNG was projected to rise steeply over the coming decades. Gas emits less carbon dioxide than most other fossil fuels when it’s burned, while renewable-energy projects were still too expensive to power electricity grids, factories and transport on a mass scale. But solar and wind technology is improving faster than expected, helped in part by massive government green-spending programs triggered by the coronavirus pandemic. We’re Not Afraid Even as Qatar seeks to make the most of its assets, there are obstacles to it reaching total domination. Many buyers want a diverse group of suppliers. Russia’s Yamal LNG project and the planned Arctic LNG 2 plant, led by Novatek PJSC, are among those that will remain competitive as Qatar ramps up exports, according to analysts at Citigroup Inc. The biggest U.S. LNG exporter, Cheniere Energy Inc., said it’s unperturbed by Qatar’s moves. Some importers are attracted by American firms offering more flexible delivery terms and pricing that’s not tied to oil, which has soared almost 30% this year. “We’re not afraid,” Cheniere’s Chief Commercial Officer Anatol Feygin told investors this month. “We’re part of a sort of diversification of the supply and contracting structure along with Qatar Petroleum and our friends at Novatek.” Yet U.S. projects are among those most likely to struggle. At least 10, five of them in Texas and four in Louisiana, probably won’t secure enough financing to be completed, according to analysis from BloombergNEF. Feedstock costs are part of the problem. American companies have to buy gas at around $2.50 per million British thermal units, way above Qatar’s wellhead prices of $0.30 or lower. Projects At Risk At least 10 U.S. LNG plants are unlikely to secure financing, according to BNEF New suppliers in the U.S. need spot LNG prices to be at least $7.80 per million Btu in Asia and $6.80 in Europe, said David Thomas, an independent adviser and former head of LNG at Vitol, the world’s largest independent oil trader. For comparison, Asian rates have averaged about $6.80 over the last five years. The economics for producers in Australia and Africa are similar, Thomas said. The lack of new supply from other countries will benefit Qatar, Energy Minister Saad Al-Kaabi, who is also chief executive officer of QP, said in an interview with Bloomberg in February. “Our expansion is very timely,” he said. “The Qatari strategy appears to be maintaining its global market share and also maximizing sales, before the gas market starts to shrink,” OIES’s Stern said. “It is a competitive and strategic rush. They recognize LNG demand will eventually decline as the world moves forward in the energy transition.”

- 4. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 U.A.E: Dubai to add 600MW of clean energy capacity in 2021 The National - Fareed Rahman Emirate aims to generate 75% of its total power from clean energy sources by 2050, Dubai is planning to add 600 megawatts of clean energy capacity in 2021 through new solar installations amid plans to boost its renewable energy capacity. The emirate will also commission the first stage of the 300MW fifth phase of the Mohammed bin Rashid Al Maktoum Solar Park in July, Dubai Media Office said on Sunday, citing a statement from Dubai Electricity and Water Authority. The entity will also commission the world's tallest concentrated solar power tower at 262.44 metres with a capacity of 100MW in September and 200MW from the parabolic trough as part of the fourth phase of the solar park by the end of 2021. The Mohammed bin Rashid Al Maktoum Solar Park is located about 50 kilometres south of Dubai. With the addition of new plants, Dewa’s total clean energy capacity will increase to 1,613MW from 1,013MW currently. Clean energy capacity in Dubai's energy mix will be about 10 per cent in July and 12 per cent by the end of the year. “The Mohammed bin Rashid Al Maktoum Solar Park is one of Dewa’s key projects to achieve this vision and increase the share of clean and renewable energy capacity in Dubai’s energy mix,” said Saeed Al Tayer, managing director & chief executive of Dewa. “This supports the Dubai Clean Energy Strategy 2050, which aims to provide 75 per cent of Dubai’s total power capacity from clean energy sources by 2050.” Many countries across the world are building new, renewable energy projects to reduce emissions. Costs have also come down, prompting countries to take up new projects. Dewa's major projects, which are based on the independent power producer model, attracted about Dh40 billion ($10.8bn) in investment, Mr Al Tayer said.

- 5. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 The amount of power generated from renewable energy in the UAE will increase to 21 per cent in 2030 and 44 per cent by 2050, from 7 per cent last year, as more new projects come online, according to Rystad Energy. Abu Dhabi is also developing new, renewable energy projects including the world’s largest solar plant at Al Dhafra with a total capacity of 2 gigawatts as part of the UAE's efforts to increase clean energy capacity. A consortium led by Abu Dhabi National Energy Company, or Taqa, and Masdar, in partnership with France’s EDF Renewables and China's JinkoPower, is building the new plant that is expected to be fully operational next year. UAE’s renewable energy capacity set to increase to 9GW by 2025 The UAE’s renewable energy capacity is set to increase four-fold to about 9 gigawatts (GW) by the end of 2025 as the country starts new projects to diversify its energy mix, according to Rystad Energy. “Solar PV (photo voltaic) additions are going to pile up, especially from 2022, and drive the country’s total renewable capacity to an impressive 9GW by the end of 2025,” the Oslo-based consultancy said in a new report. The UAE's total renewable capacity reached 2.3GW at the end of 2020. Four new projects, which are in various stages of development, will drive this growth, the report said. The biggest is the 2GW Al Dhafra solar scheme in Abu Dhabi as well as new projects in Dubai and the Northern Emirates. A consortium led by Abu Dhabi National Energy Company (Taqa) and Masdar, in partnership with France’s EDF Renewables and China's JinkoPower, is building the Al Dhafra plant, which is the world's largest solar power project. Taqa will own 40 per cent of the Al Dhafra project, while Masdar, EDF Renewables and JinkoPower will each have a 20 per cent stake. The plant is expected to become fully operational in 2022 and will generate enough electricity for about 160,000 homes across the UAE. Dubai currently has more than 1GW of installed capacity, all of which comes from the Mohammed Bin Rashid Solar Park’s three existing phases. Two more – a 200MW concentrated solar power and a 900MW solar photovoltaic scheme, are currently in development. Dubai exceeded a long-term green energy target for 2020 in June, increasing the share of renewables in the emirate’s energy mix to nearly 9 per cent, according to the report. Abu Dhabi, on the other hand, has set a target of 5.6GW of solar PV capacity by 2026 and its current installed capacity stands at 1.3GW, with the Noor Abu Dhabi and Shams solar projects contributing most to the emirate’s renewable energy capacity. “Despite the Covid-19 shock, the government has provided a reasonable amount of investment to continue ongoing projects,” Gaurav Metkar, senior analyst at Rystad Energy, said. “[The] UAE has already attracted big international players in the renewable sector, a healthy sign for future business.” The UAE is also home to one of the lowest tariffs in the world, with solar prices declining by more than 76 per cent in the past four years.

- 6. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 GCC gas demand for power generation on the rise, says report Trade Arabia + NewBase Gas demand for power generation consumed above 13 billion cubic feet per day (bcfd) in 2020, representing almost 50% of the total demand in the Gulf countries. It is expected that this demand will increase by 14% by 2029, according a report by GlobalData, a leading data and analytics company. According to GlobalData, the transition from oil to gas for less carbon-intensive power generation has begun in the region. In Saudi Arabia and Kuwait, gas demand for power is set to increase by 15% and 19% respectively by 2030. The UAE relies on non-hydrocarbon sources of power for its generation growth. The country is expected to supply over 20% of its energy demand with nuclear and renewable sources by the end of the decade, it stated. While key countries in the GCC, such as Saudi Arabia and Kuwait, choose to exploit their large gas reserves as a strategy for supplying future demand, others such as the UAE have commenced their transition to a less carbon-intensive energy strategy, adopting nuclear and renewables over gas to fuel power demand growth, according to GlobalData. With a share of almost 50%, power generation clearly drives the demand for gas in the GCC and with an expected increase of above 14% in gas demand by the end of the decade, there is nothing to indicate that this trend will change in the coming years, it stated.

- 7. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 It is expected that countries that have had oil as their main source of power generation will see continued switching to gas for less carbon-intensive power generation. This is true for Saudi Arabia and Kuwait as both countries expect increases in gas demand for power generation of 15% and 19%, respectively, by 2030, the report added. Santiago Varela, Oil & Gas Analyst at GlobalData, said: "With a forecast increase of 10% in market share, gas continues to consolidate in the power mix of Saudi Arabia and that share is expected to reach 60% by 2030." "However, further upstream gas developments may support faster switching to gas, providing additional demand growth," he noted. "However, not all members of the GCC share the same strategy to fulfil their growing power demand. The UAE is close to achieving gas self-sufficiency and is investing in alternative energy sources to support the increasing power demand in the long term," stated Varela. Despite a growing trend in power demand, major nuclear and renewable energy projects may limit gas demand for power over the coming decade, he pointed out. In this regard, the first nuclear plant in the UAE came online after nine years of construction and three more are under construction, each one will have a capacity of 1.4 GWh, he added. Until April 2021, the UAE was the country with the largest nuclear capacity under construction after China. Varela said: "This strategy will undoubtedly have immediate implications on several fronts. In the short term, it calls into question the gas projects in the country that await the green light. While in the long term, it also puts at risk the contract of pipeline gas with Qatar." "Even though within the GCC countries the strategies on their future power mix may vary, the global tendency to less carbon-intensive power generation does not escape the region. With large gas reserves, each country evaluates how to exploit them with major new projects," he noted. "However, for those countries which lack significant export capacity, the potential to maximize their use is likely to depend significantly on internal demand, mainly from the power sector," he added.-

- 8. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 India: Vestas secures 101 MW order to extend wind project Source: Vestas Vestas has secured a 101 MW order from ReNew Power, one of India’s leading Renewable Energy Independent Power Producers (IPP). The order is an extension of ReNew’s existing project in Kutch, Gujarat, where Vestas had previously supplied turbines totalling to 250 MW. Vestas has also supplied turbines of 100 MW to another one of ReNew’s projects in Taralkatti, Karnataka. The contract includes supply and supervision of 46 V120-2.2 MW turbines as well as a 10-year Active Output Management (AOM) 5000 service agreement, designed to maximise energy production for the project. With a yield-based availability guarantee, Vestas will provide ReNew Power with (long-term) business case certainty. 'We are very happy to place a another order on Vestas for the extension of our existing project”, says Balram Mehta, COO, ReNew Power. 'Vestas is one of the most reliable players in the wind OEM space, we hope that yield-based availability guarantee will ensure greater efficiency in operating the wind turbines and ensure that any downtime is reduced to a minimum.' 'ReNew has always preferred reliable and financially strong partners, which is reflected in their successful record of accomplishing the largest fleet of operating wind turbines in India', says Vickram Jadhav, Vice President of Sales for Vestas India. 'We take this opportunity to thank ReNew for selecting Vestas as their partner in this project. This order helps Vestas to participate in the sustainable growth of the Indian wind market which is going to be one of the largest wind energy markets in the world.' Deliveries are expected to begin in the last quarter of 2021, while commissioning is planned to take place between December 2021 and first quarter of 2022.

- 9. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 India’s $7 Billion Bet to Turn a Fifth of Its Gasoline Green Bloomberg - Debjit Chakraborty India is set to spend almost $7 billion to boost ethanol production as it prepares to roll out a greener mix of gasoline that may cut its dependence on foreign oil. About 10 billion liters of ethanol will be required each year to meet the 20% ethanol-blended fuel standard by 2025, India’s Oil Secretary Tarun Kapoor said in an interview with Bloomberg Television on Friday. That’s triple the amount of ethanol that’ll go into the mix as compared to the year ending November 2021, when ethanol constitutes 9% of blended gasoline, he said. The move will require about 500 billion rupees of investment to build new bio-refineries. Earlier this month, Prime Minister Narendra Modi advanced the nation’s target of making gasoline with 20% ethanol by five years to 2025 in a move that’s expected to save $4 billion annually. It’ll also expand the use of renewable energy in the world’s third-biggest oil importer and help turn the nation’s surplus rice and damaged food grains into ethanol. While most of India’s ethanol output is currently made from sugarcane molasses, the South Asian nation is pushing for greater production from non-sugar sources that make up less than 10% of current supplies, Kapoor said. Its government is offering financial assistance for setting up distillation units that rely on molasses and grains as raw material. “Moving along, we will have to reach a stage where 50% is sugar-based and 50% grained based,” he said.—

- 10. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 NewBase June 14-2021 Khaled Al Awadi NewBase for discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Oil prices climb as demand outlook improves, supplies tighten Reuters + NewBase Oil prices rose on Monday, extending three weeks of gains that have been underpinned by an improved outlook for fuel demand as increased COVID-19 vaccinations help lift travel curbs, along with tightness in supply. Brent crude was up 65 cents, or 0.89%, at $73.34 a barrel by 08.34 GMT, the highest since May 2019. Oil price special coverage

- 11. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 U.S. West Texas Intermediate gained 47 cents, or 0.7%, to $71.38 a barrel, the highest since October 2018. Motor vehicle traffic is returning to pre-pandemic levels in North America and much of Europe, and more planes are in the air as anti-coronavirus lockdowns and other restrictions are being eased, driving three weeks of increases for the oil benchmarks. "In the short term the oil market may be volatile with frequent pull-backs as crude prices are beginning to struggle as demand in Europe and India faces headwinds," said Avtar Sandu, senior manager commodities at Phillip Futures in Singapore. "The major trend is, however, still intact and deep pullbacks would provide opportunities for buying the dips," he said. The Organization of the Petroleum Exporting Countries (OPEC) and allies, known as OPEC+, need to increase output to meet recovering demand, the International Energy Agency (IEA) said in its monthly report on Friday. The OPEC+ group has been restraining production to support prices after the pandemic wiped out demand in 2020, maintaining strong compliance with agreed targets in May. read more "OPEC+ needs to open the taps to keep the world oil markets adequately supplied," the IEA said. Goldman Sachs said last week it expects Brent to rise to $80 per barrel this summer as the rollout of inoculations boosts economic activity around the world. read more U.S. oil rigs in operation rose by six to 365, the highest since April 2020, energy services company Baker Hughes Co said in its weekly report. It was the biggest weekly increase of oil rigs in a month, as drilling companies sought to benefit from rising demand.

- 12. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 NewBase Special Coverage The Energy world – June - 14- -2021 Is Your Gas Stove Destroying the Planet? Cooking over a flame is a tiny contributor to climate change, but supplying homes and businesses with natural gas is a big one. By Justin Fox Of the natural gas burned in American homes, just 2.8% is used for cooking, according to a 2015 survey by the U.S. Energy Information Administration. Gas Stoves Don’t Use a Lot of Gas U.S. residential natural gas consumption by end use, 2015

- 13. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 Residential natural-gas use in turn makes up just 15% of total U.S. consumption, a percentage that has fallen over the past decade as (1) natural gas passed coal to become the country’s main power- plant fuel and (2) residential gas use held more or less steady, as it has since the mid-1970s. Home kitchens thus account for about 0.4% of U.S. natural gas use. Burning natural gas was responsible for an estimated 36% of U.S. carbon-dioxide emissions in 2020, so residential natural- gas cooking’s share of those emissions comes in at less than 0.2%. That’s not a lot! Gas cooking does, however, seem likely to be the biggest obstacle to the effort to electrify the American home in the name of slowing climate change. Why’s that? Mainly because people (myself included) like cooking with gas! It’s one of the few energy uses that inspires brand loyalty to the fuel consumed. A 2019 survey by E Source, a utility- consulting firm spun off from the decarbonization-focused Rocky Mountain Institute, found that only 21% of those with gas cooking equipment would consider replacing it with electric. Americans appear to be much less attached to their natural-gas space heaters and water heaters. Because these heaters are responsible for more than 90% of home natural gas use, replacing them with electric heaters and heat pumps really could have a significant impact on global warming. It would also leave little economic rationale for maintaining a vast distribution network to pipe natural gas into homes just for cooking. For gas utilities fretting about the future, gas stoves are thus a wedge issue to galvanize opposition to the electrification of everything else. How Gas Went From Clean to Dirty Until quite recently, natural gas was seen mainly as an ally in the fight against climate change. It was the cleaner-burning, lower-carbon transition fuel that could keep the economy running as coal and oil faded but before renewables-generated electricity and perhaps hydrogen were ready to take over.

- 14. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 To some extent this is exactly what has happened. The transition from coal to gas in electric power generation has been the single biggest cause of the 15% drop in estimated U.S. C02 emissions since 2007. Meanwhile, gas appliances may actually produce lower C02 emissions than electric ones right now in much of the country, because 60% of U.S. electricity is still generated by burning gas and coal, and gas-fired power plants are less efficient at converting fuel into energy than gas-powered home heaters are. This last advantage will disappear as the share of electricity generated by emission-free wind and solar continues to grow. Research in recent years has also revealed much leakage of methane — the main component of natural gas and a more potent, albeit shorter-lived, greenhouse gas than C02 — from drilling operations, distribution networks and home uses, tarnishing natural gas’s reputation as a clean fuel. Plus, it’s in the nature of a “transition fuel” that some people will immediately start looking to transition away from it. One of the first big steps in this direction came in the gas-rich Netherlands, where in 2018 the government announced plans to rapidly phase out natural gas production and use. In the U.S. the action has so far been more modest and mainly local, with the city of Berkeley, California, banning gas hookups in July 2019 for most new buildings, and several other heavily Democratic cities following suit or considering it. In response, some majority-Republican state legislatures have passed laws banning such local bans. Who Cooks With Gas The battle over gas stoves may not play out along standard blue-state, red-state lines, though. About 35% of U.S. homes used natural gas for cooking in 2019, according to the Census Bureau’s biennial American Housing Survey. While the survey’s geographical coverage is too spotty to allow for definitive pronouncements about regional differences, its breakdown for the 15 biggest metropolitan areas shows a lot more gas cooking going on in blue states than in red or purple ones.

- 15. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 Much of this is historical contingency. The neighboring Los Angeles and Riverside metropolitan areas have the highest share of natural gas cooking in part because Southern California is riddled with giant oil fields that produced natural gas as an at-first-useless byproduct. Older cities in the East and Midwest have a lot of housing stock that predates the post-World War II triumph of the electric stove. The South has far more all-electric homes than anywhere else in the country because the housing stock is newer and milder winter temperatures made electric heat pumps a more economical choice than natural-gas furnaces (advances in heat-pump technology are starting to make them a viable alternative in colder climes as well, but that’s a recent development). Still, consumer preferences are a factor too. I haven’t found data to back this up, but my impression from personal experience is that affluent, educated suburbanites are the people most likely to have large, expensive gas ranges. They’re also becoming more likely to vote Democratic, meaning that the people most emotionally attached to gas cooking have been voting for the politicians most likely to ban gas hookups. It will be fascinating to see how this sorts itself out in coming years. Will people change their cooking preferences to match their political allegiances, or the other way around? Environmental groups are doing what they can to sour their affluent liberal constituencies on gas. The Rocky Mountain Institute, Physicians for Social Responsibility, Mothers Out Front and the Sierra Club put out a report last year on the dangers of indoor air pollution from gas cooking. Appearing on TBS’s “Full Frontal With Samantha Bee” this month, lead author Brady Seals of RMI summed up: “Gas stoves emit a lot of the same pollutants that come from your car tailpipe.” She also put in a plug for electric induction stoves: “It’s sort of like the Tesla of cooking, because you’re boiling water in half the time.” Mixed Signals From Utilities In response to that report, the American Gas Association, which represents gas utilities, put out a fact sheet asserting that, among other things, “switching to electrical appliances is not a useful strategy to address indoor air quality because the emissions of concern are dominated by the smoke and grease that comes from cooking, regardless of the energy source.” My own experience with burning things in the kitchen leads me to believe that there is truth to this, although certain indoor pollutants — nitrogen dioxide, carbon monoxide and formaldehyde — are in fact linked mainly to gas cooking. While the AGA has been vociferous in its opposition to the home-electrification movement, not all of its members are so committed. A recent Wall Street Journal article on the local gas-hookup bans featured an eyebrow-raising quote from Jan Berman, director of energy strategy and innovation at Northern California’s PG&E Corp.: “We welcome the opportunity to avoid investments in new gas assets that might later prove to be underutilized as decarbonization efforts progress here in California.” The E in PG&E stands for electric, and for utilities like it that deliver both electricity and gas, home electrification isn’t necessarily a bad thing. In fact, an all-electric network might be a lot easier to manage. Southern California Gas, the Sempra Energy division that is the nation’s largest gas utility, reported spending nearly three times as much on operations and maintenance in 2020 as on buying natural gas. By contrast, electric utility Southern California Edison, a division of Edison International, spent about a third less on operations and maintenance than on power and fuel. This difference doesn’t really have an effect on the companies’ bottom lines, since regulators allow them to pass both fuel and maintenance costs on to consumers. But with safety demands on gas utilities being ratcheted up every time there’s a major explosion or leak, and residential gas demand

- 16. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 flat even before the new electrification push, it does seem conceivable that the time will come when society is no longer willing to pay the cost of maintaining vast urban networks of aging pipes filled with explosive gas. Then again, SoCalGas is hoping we’ll just fill them with another explosive gas. The company has proposed experimenting with conveying hydrogen through its pipes, as well as building an “H2 Hydrogen Home” with an electrolyzer to convert solar energy into hydrogen, a fuel cell to convert the hydrogen back to electricity and appliances that run on a blend of hydrogen and natural gas. Hydrogen emits water when burned, not greenhouse gases, and holds promise as a way to store power for long periods. It will also require stronger pipes and more careful monitoring than natural gas to prevent leaks and explosions. Regulators seem unsure as to whether the investment would be worthwhile. Cooking With Something Other Than Natural Gas So hydrogen cooking may or may not be an option in the future. A simpler alternative for those committed to cooking over flames could be the propane canisters used in gas grills and inside nearly six million American homes, although that will be problematic in cities such as New York where fire codes ban their use in most buildings, and would certainly be less convenient than piped natural gas. The bigger question may be whether gas really does cook better, or whether consumer loyalty to it is based mainly on less-tangible factors. Electric ranges reached their peak market share in the U.S. in the 1970s and 1980s, and the subsequent renaissance of gas was probably at least partly a backlash against electric’s suburban-subdivision ubiquity.

- 17. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17 Gas stoves were also closely identified with the American culinary renaissance that began in the 1960s. Julia Child cooked with gas, and while her good friend James Beard did not, it was her example that has been followed by just about every television chef since. Mississippi-based Viking Range Corp. built its first stove in 1986, and before long Vikings and similar luxury gas stoves became must-haves for well-off foodies. I’ve left restaurants out of this account so far, but gas has of course long been the default in professional kitchens. Going by the EIA’s most recent survey of energy consumption in commercial buildings, they use more than four times as much natural gas as home kitchens. (Put commercial and residential cooking together and it adds up to just over 2% of U.S. natural gas consumption.) If the pros use gas it must be better, right? Well … when Consumer Reports looked through its range reviews in 2019, it concluded that, “in most cases, electric ranges outperform their gas counterparts.” Electric stovetops were better than gas for both high-heat and low-heat cooking, while electric ovens were better for broiling and gas ones better for baking. Not exactly what you’d expect! The most obvious strength of gas burners is that they respond instantaneously when you adjust the heat, a quality not evaluated in that particular Consumer Reports article. The article also ignored “the Tesla of cooking,” the induction stove, because its market share remains tiny. But induction stoves, which work by transferring energy directly to cookware via a magnetic field, offer instantaneous response too. “No other cooking technology that we’ve tested is faster than the fastest induction elements,” Consumer Reports concluded elsewhere. Induction also uses less energy than other cooking technologies. Cooking on an induction stove, which I’ve done a few times, is disconcerting at first. The “burners” don’t get hot, and while the responsiveness is great you don’t get the same visual cues as with gas. Still, I’m pretty sure my next stove will be induction. Climate change and cooking quality are secondary considerations: I have a penchant for leaving burners on and forgetting about it that certainly isn’t going to get better as I get older, and with an induction stove that’s far less likely to lead to disaster.

- 18. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 18 NewBase Energy News 14 June 2021 - Issue No. 1438 call on +971504822502, UAE The Editor:” Khaled Al Awadi” Your partner in Energy Services NewBase energy news is produced Twice a week and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscriptions, please email us. About: Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 www.linkedin.com/in/khaled-al-awadi-38b995b Mobile: +971504822502 khdmohd@hawkenergy.net or khdmohd@hotmail.com Khaled Al Awadi is a UAE National with over 30 years of experience in the Oil & Gas sector. Has Mechanical Engineering BSc. & MSc. Degrees from leading U.S. Universities. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat “with external voluntary Energy consultation for the GCC area via Hawk Energy Service, as the UAE operations base. Khaled is the Founder of NewBase Energy news articles issues, an international consultant, advisor, ecopreneur and journalist with expertise in Gas & Oil pipeline Networks, waste management, waste-to-energy, renewable energy, environment protection and sustainable development. His geographical areas of focus include Middle East, Africa and Asia. Khaled has successfully accomplished a wide range of projects in the areas of Gas & Oil with extensive works on Gas Pipeline Network Facilities & gas compressor stations. Executed projects in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of gas/oil supply routes. Has drafted & finalized many contracts/agreements in products sale, transportation, operation & maintenance agreements. Along with many MOUs & JVs for organizations & governments authorities. Currently dealing for biomass energy, biogas, waste-to-energy, recycling and waste management. He has participated in numerous conferences and workshops as chairman, session chair, keynote speaker and panelist. Khaled is the Editor- in-Chief of NewBase Energy News and is a professional environmental writer with more than 1400 popular articles to his credit. He is proactively engaged in creating mass awareness on renewable energy, waste management and environmental sustainability in different parts of the world. Khaled has become a reference for many of the Oil & Gas Conferences and for many Energy program broadcasted internationally, via GCC leading satellite Channels. Khaled can be reached at any time, see contact details above.

- 19. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 19 Oil and Gas Upstream

- 20. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 20

- 21. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 21

- 22. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 22

- 23. Copyright © 2021 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 23 For Your Recruitments needs and Top Talents, please seek our approved agents below