Microsoft word new base 664 special 13 august 2015

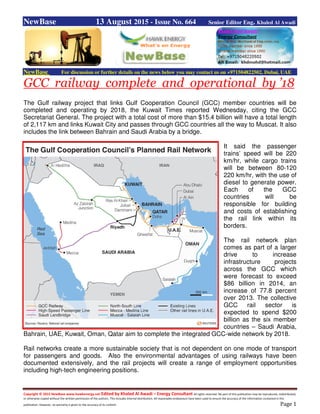

- 1. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase 13 August 2015 - Issue No. 664 Senior Editor Eng. Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE GCC railway complete and operational by ’18 The Gulf railway project that links Gulf Cooperation Council (GCC) member countries will be completed and operating by 2018, the Kuwait Times reported Wednesday, citing the GCC Secretariat General. The project with a total cost of more than $15.4 billion will have a total length of 2,117 km and links Kuwait City and passes through GCC countries all the way to Muscat. It also includes the link between Bahrain and Saudi Arabia by a bridge. It said the passenger trains’ speed will be 220 km/hr, while cargo trains will be between 80-120 220 km/hr, with the use of diesel to generate power. Each of the GCC countries will be responsible for building and costs of establishing the rail link within its borders. The rail network plan comes as part of a larger drive to increase infrastructure projects across the GCC which were forecast to exceed $86 billion in 2014, an increase of 77.8 percent over 2013. The collective GCC rail sector is expected to spend $200 billion as the six member countries – Saudi Arabia, Bahrain, UAE, Kuwait, Oman, Qatar aim to complete the integrated GCC-wide network by 2018. Rail networks create a more sustainable society that is not dependent on one mode of transport for passengers and goods. Also the environmental advantages of using railways have been documented extensively, and the rail projects will create a range of employment opportunities including high-tech engineering positions.

- 2. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 Globe Express Services (GES) entered into a Memorandum of Understanding (MoU) with Etihad Rail late last year, the developer and operator of the UAE’s national railway network. Once completed, Etihad Rail network will extend across the UAE, connecting the Emirates to the Kingdom of Saudi Arabia and Oman. It will be part of the larger GCC rail network, which will connect the country with the Kingdom of Saudi Arabia through Ghuwaifat from the west and with the Sultanate of Oman through Al Ain from the east. — SG

- 3. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 Egypt to seek bids for solar and wind-power projectsThe Natinal Egypt will begin accepting bids for 500 megawatts of renewable energy projects this month. The government yesterday said it would open the tenders for the three projects – two solar and one wind – as it tries to achieve its target of using renewable energy for 20 per cent of its energy needs in five years’ time. One investor involved in the first round of solar photovoltaic (PV) tenders said the first phase of the government’s feed-in tariff programme, a subsidy scheme, had yet to be concluded, and none of the 1,800MW PV projects the government had awarded had reached financial close. Financial close occurs when all the project and financing agreements have been signed and all the contractual conditions have been met. “The timing for these new tenders is premature because the serious companies are already involved and want to get across the finish line before they take a bigger chunk out of the market,” said the investor, adding that his company would not be interested until its existing projects have closed financially. Egypt has to date awarded 1,800MW of PV projects that drew attention from interested companies. The country has also put 1,200MW of wind energy projects up for tender, but they are off to a slower start. Eversheds, a British law firm and clean energy consultancy, has released a report that details the latest tenders: a 250MW wind project, a 200MW PV project, and a 50MW concentrated solar power (CSP) plant. According to Eversheds, the government requires the firms participating in the projects to have relatively high levels of clean energy experience. To qualify, a company must have completed three projects, each with a minimum capacity of 50MW for the wind and PV tenders, and 30MW for CSP. Only a handful of companies have such levels of experience. “If the reports are true, I think it will be a relatively small group of top international developers, due to the high criteria the Egyptian government is requiring,” said Cornelius Matthes, managing director for the Middle East and North Africa at Building Energy, an Italian firm. One investor said the “feedback from the market will be very lukewarm” because of the projects’ financial complications and Egypt’s high requirements.

- 4. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 UK: Britain changes rules to fast-track shale gas permits Source: Reuters + NewBase The British government will give i ts communities minister the power to directly approve shale gas permits, taking away decision-making from local politicians who have in the past months blocked the progress of Britain's first shale gas wells. In late June, local government officials in northwest England rejected two applications to carry out hydraulic fracturing -- or fracking, saying the projects would be too noisy and blight the landscape. New rules, applicable immediately, will allow government intervention to approve or reject permits and will also mean appeals involving shale gas projects will be given priority. Shale gas developer Cuadrilla Resources, whose applications were rejected in June, has already decided to appeal against its permit refusals. 'Today's measures will prevent the long delays that mean uncertainty both for business and for local residents,' the energy and communities departments said in a joint press release. The government also said it would present proposals later this year to create a sovereign wealth fund from returns generated from shale gas production. Britain is estimated to have substantial amounts of shale gas trapped in underground rocks and the government has been supportive of developing these reserves to counter declining North Sea oil and gas output. However, progress has been slow because of opposition by local residents and environmental campaigners. Some are concerned about groundwater contamination from chemicals used in the process, while others fear the potential impact on property prices or tourism. 'The UK government seems intent on overriding the democratic safeguards of the English planning system and shutting out local voices from crucial decisions,' said Flick Monk, unconventional gas campaigner at Friends of the Earth Scotland. Pro-business groups welcomed the decision, saying the change would help get shale gas projects up and running.

- 5. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 Norway: Lundin receives consent to drill exploration well 7220/6-2 in Barents Sea. Source: Petroleum Safety Authority Norway Lundin Norway has received consent to drill exploration well 7220/6-2 in the Barents Sea. Lundin is the operator for production licence PL 609 which covers Block 7220/6 in the Barents Sea. Exploration well 7220/6-2 is to be drilled on the Neiden Prospect. The coordinates of the well will be: 72° 34' 13.13" N 20° 58' 19.97" E. Drilling is scheduled to begin in mid-August 2015 at the earliest and estimated to last 40 days. The well is to be drilled by the Island Innovator mobile drilling facility. This is a semi-submersible mobile drilling facility of the GM4000-WI type, built in 2012 at Cosco Zhoushan Shipyard in China. The facility is operated by Odfjell Drilling. It is registered in Norway and classified by DNV GL. Island Innovator was issued with an Acknowledgement of Compliance (AoC) by the PSA in August 2013. Neiden Prospect According to information on the Lundin web site, the Neiden Prospect is a shallow four-way dip closure with main target in the Triassic Snadd Fm comprising a stacked alluvial channel system. Good hydrocarbon indicators have been identified. Net unrisked prospective resources are estimated at 82 MMboe and chance of geological success at 30%. Partners in the licence are Lundin Norway 40%; Idemitsu Petroleum Norge 30%; RWE Dea 30%.

- 6. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 Japan restarts first nuclear reactor under new safety rules Source: Kyushu Electric Power Co. + US EIA On August 11, Kyushu Electric Power Company's 846 megawatt (MW) Sendai Nuclear Power Station Unit 1 became the first reactor to restart after nearly two years with no generation from nuclear power plants in Japan. Following the disaster at Fukushima in 2011, Japan began a temporary shutdown of all nuclear power plants as each reactor entered scheduled maintenance and refueling outages. By September 2013, all 54 reactors in Japan's nuclear fleet were shut down. Following its restart, Sendai Unit 1 will begin generating electricity within days and return to normal operation in early September. The restart of Japan's nuclear power plants requires the approval of both Japan's Nuclear Regulation Authority (NRA) and the central government, as well as consent from governments of the local prefectures. In July 2013, the NRA issued more stringent safety regulations to address issues dealing with tsunamis and seismic events, complete loss of station power, and emergency preparedness. Currently, the NRA has approved the restart of five reactors: Sendai Units 1 and 2, Kansai Electric Power Company's (KEPCO) Takahama Units 3 and 4, and Shikoku Electric Power Company's Ikata Unit 3. Sendai Unit 2 will likely be the second reactor to restart, with an anticipated restart date in October. Although the Kagoshima Prefecture approved the restart of Sendai Units 1 and 2, the Fukui Prefecture continues to oppose the restart of Takahama Units 3 and 4. Ikata Unit 3 could restart in early 2016 if approval is received from Ehime Prefecture. Beyond these 5 reactors, 19 of Japan's remaining 38 operable reactors have filed restart applications with the NRA that are in different stages of the review process. The total capacity of reactors under review is about 18,400 MW. There is still some uncertainty about whether some of these reactors can meet the new NRA regulations, particularly with respect to the ability to withstand severe earthquakes.

- 7. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 Before the 2011 earthquake and tsunami, Japan had 54 operating reactors. Following the disaster at Fukushima, all six Fukushima reactors, totaling about 4,500 MW, were permanently shut down. In April 2015, five additional relatively old, small reactors, totaling about 2,100 MW, were permanently shut down. Japan was the world's third-largest producer of nuclear power (after the United States and France) before the disaster at Fukushima, and Japan's nuclear power plants historically accounted for about 30% of the country's total electricity generation. The gradual displacement of all of Japan's nuclear generation as the country's nuclear fleet was shut down resulted in increased dependence on liquefied natural gas, oil, and coal to make up the difference. The replacement of nuclear generation led to higher electricity prices for consumers, higher government debt levels, and revenue losses for electric utilities. As part of Japan's long-term energy policy, the central government has called for the nuclear share of total electricity generation to be 20–22% by 2030.

- 8. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 Exxon's $40 Billion Oil Discovery in offshore Guyana Sparks a Nasty Feud , Bloomberg - NewBase E-mail For generations, Venezuela has formally laid claim to most of its tiny neighbor, Guyana. Many dismissed the case, given Venezuela’s oil wealth and Guyana’s penury. Hugo Chavez, longstanding president of Venezuela, even let it slide, referring to the Guyanese as his brothers. Then in May, Exxon Mobil Corp. revealed that under contract from Guyana it had found massive offshore oil and gas deposits. Chavez’s successor, Nicolas Maduro, demanded that the drilling stop because the area was Venezuela’s. He dismissed Guyana’s president as a tool of Big Oil, declared his statements “nauseating” and Guyana’s actions likely to “bring war to our border.” He withdrew his ambassador, and Guyana announced the end to a long-time rice-for-oil deal.For Guyana -- which produces no oil and whose 800,000 inhabitants live with unpaved flooded roads and power outages -- the estimated offshore find of 700 million barrels promises a revolution, a shift from negligible food exporter to global energy dealer. The combined oil and natural-gas deposits appear to be worth $40 billion, at least 10 times the country’s gross domestic product. “We’ve gone through suffering for many decades and our time is due,” Raphael Trotman, minister of governance, said in an interview in his office on an unassuming road in the capital, Georgetown. The discovery is “transformational,” he said. “For us, there is no going back.” Ordinary Guyanese, who rely on Venezuelan oil, are giddy with anticipation. Staring at a potential jackpot, they also are livid with Maduro, accusing him of trying to evade his economic and political woes by coveting what belongs to them. Vendors head to the market in Georgetown, Guyana.

- 9. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 “Just Being Greedy” “Chavez never fought and now Maduro?” said Otis Adams, a 42-year-old heavy-machine operator in the destitute border town of Mabaruma. “He’s a nobody, trying to pass off the worry of his people from all that killing and suffering -- he’s just being greedy.” Venezuela has the world’s highest inflation, chronic shortages of consumer basics, including medicine and toilet paper, and a murder rate that surpasses Iraq’s. Parliamentary elections are in December, and Maduro’s socialist coalition may lose its majority for the first time in 16 years. “Why so suddenly?” asked Charlie Bees, about the renewed claim to large swathes of his country. “Maduro is losing votes!” explained the 52-year-old currency trader working near Georgetown’s port. It may seem to the Guyanese like a mere political diversion, but their president, David Granger, says Venezuela is causing real trouble. “Investors have been intimidated, development has been derailed, projects have been obstructed,” he said in a speech in Washington last month. “It is too much to bear for a country that has less than a million people.” Doubling Down Rather than halt its exploration activities, Guyana is moving forward, Guyana’s foreign minister, Carl Greenidge, said in an interview. The government expects it will take five to seven years for the first production. “We call upon the international community to help us develop within the internationally recognized borders, peacefully and without the burden of a neighbor whose actions serve to impoverish us and whose claim is based on what happened 200 years ago.” Edward Glab, who teaches at Florida International University in Miami and worked at Exxon for 25 years, said the find was clearly of major significance for Guyana, even with oil down to $50 a barrel. “You could have investors trying to get ahead of the curve because they figure at some point there is going to be huge wealth in the country,” he said. “They might be able to take risks, counting on the fact that the country will be able to pay its bills.” Former British Colony Venezuela’s claim on Guyana’s land a century ago had a very different feel. It was a British colony until 1966; its citizens speak English and are descendants of African slaves, indentured Indian laborers and native peoples. In 1899, an international tribunal in Paris granted the disputed region,

- 10. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 known as the Essequibo, to Guyana; Venezuela rejected the ruling. It amounts to two-thirds of Guyana which has been developing it with occasional outbursts from Venezuela. To be sure, gaining possession of Essequibo has long been a matter of national pride for Venezuelans, whose maps denote the area a “reclamation zone” drawn with dashed lines. And despite having the world’s largest oil reserves, Venezuela has struggled to increase production, with output falling. There is an additional issue: Exxon is trying to collect a $1.6 billion award from Venezuela granted by a World Bank tribunal after Chavez nationalized a number of its assets. So there is also no love lost between Exxon and the Maduro government. Seeking Backers Last month, Maduro met with United Nations Secretary General Ban Ki Moon to ask for help. The Association of Caribbean States has sided with Guyana, as has Britain and the rest of the Commonwealth. Venezuela has been seeking backers for a negotiated settlement that could take a long time. Sadio Garavini di Turno, a former ambassador to Guyana and an advisor to the opposition, said Venezuela is not in a strong position, given international sentiment. Moreover, he said, an international court seems unlikely to rule for Venezuela. “In the international community in general, and therefore in the international tribunals, there’s a profound antipathy towards changing national borders because of historical injustice,” he said. “Think of how many borders around the world are unjust and how many borders would have to be changed.” Guyana has “strong international support, said Carlos Romero, professor of international relations at the Central University of Venezuela. While Venezuela wants mediated negotiations, Guyana prefers a tribunal where it probably will find a sympathetic hearing. Maduro insists military action is out of the question. As a result, Romero said, ‘‘Maduro is against the wall.’’

- 11. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 Oil Price Drop Special Coverage Oil prices steady after US stock draw & China outlook drags Reuters + NewBase Oil prices steadied on Thursday, supported by lower U.S. stockpiles and a firm demand outlook, but worries over China's economy continued to weigh. A 1.7-million barrel drop in U.S. stockpiles last week helped to at least temporarily halt a price slide that has lasted since May and seen WTI and Brent lose over a quarter of their value. A relatively bullish outlook by the International Energy Agency (IEA) on Wednesday also supported prices. U.S. crude CLc1 was trading at $43.35 per barrel at 0410 GMT, up 5 cents from Wednesday's close. Brent futures LCOc1 were 12 cents higher at $49.78 a barrel. "Prices recovered overnight after initial declines, supported by an IEA announcement and a weaker dollar," ANZ bank said on Thursday. The IEA said global oil demand growth in 2015 would be the strongest in five years, although it added that global oversupply would last through 2016. But analysts said there were some doubts around a bullish demand forecast, especially in Asia where China's economy is showing increasing signs of weakness, with the devaluation of its yuan currency potentially denting demand for imports of fuel. "All is not well with the Chinese economy," Howie Lee, investment analyst at brokerage Phillip Futures, told the Reuters Global Oil Forum on Thursday. "There is just so much pessimism attached to this move (yuan devaluation). For China to emerge and start a fresh currency war when they previously didn't, smacks of desperation," he added.

- 12. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 China's yuan opened slightly weaker on Thursday but the gap between the guidance rate and the traded rate closed sharply as the central bank tried to slow a sharp selloff that saw the currency lose around 4 percent in just two days.China's implied oil demand fell in July from the previous month amid a continuing drop in the nation's vehicle sales that could mute growth further in the second half of 2015. China consumed roughly 10.12 million barrels per day (bpd) of oil in July, down more than 4 percent from June, although the implied use was up from 9.72 million bpd a year ago, according to calculations based on preliminary government data. The month-on-month fall came as Chinese auto sales dropped 7.1 percent in July from a year earlier, the fourth straight monthly decline and biggest since February 2013. BP plc and Royal Dutch Shell Plc Will Have To Survive Without $100 Oil By Harvey Jones Low oil prices have sunk share prices at BP (LSE: BP) and Royal Dutch Shell and there is no sign of immediate respite. There was a flicker of hope as Brent crude climbed to nearly $68 a barrel in May, but it has now slid below $50 again, and worse could follow. The notion that lower prices would put the skids on supply, especially from US shale rigs, has been discredited. Shale technology is coming on in leaps and bounds, driving constant cost savings for drillers. US frackers continue to add an extra million barrels of oil a day to global supply, even before Iran floods the market with its stockpiles. Pump It Up Talk that oil could hit $100 a barrel for the first time since September last year has proved to be idle. China continues to slow, with exports and imports both down more than 8% in July. US data has been underwhelming, even as the Federal Reserve edges towards a rate hike, while Europe continues to struggle. So as global supply gushes, growth remains tongue-tied. Need I go on? Even former Fed chief Alan

- 13. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 Greenspan reckons oil has further to fall, as shale rig count climbs again. The question is what this means for the FTSE 100's dominant oil giants. Pay As You Earn As large vertically integrated companies, they have some in-built protection against oil price swings. But BP is still down 15% in the last three months, and Shell is down 8%. Long-term investors have been losing money on the stocks for years, particularly on BP, as Deepwater after-shocks rumble on. Both are still making money, only less than before. BP's underlying replacement cost profits fell to $1.3 in the second quarter, just one third of the $3.6bn it earned in the same quarter last year. Shell's Q2 earnings were $3.4bn on a current cost of supplies basis, down one third from $5.1bn one year ago. Strong downstream earnings helped to offset a sharp fall upstream caused by falling oil and gas prices, and reduced production. Reversal Ahead? I don't see much scope for share price recovery while oil is cheap and global growth is stuck in first gear. The big question is how long their dividends can survive. Both yields are quite spectacular now, with BP on 6.44% and Shell offering 6.26%. Who needs growth when you have that kind of income stream? Both companies remain committed to the dividends, Bob Dudley at BP names this as his priority, and won't want the embarrassment of going back on his pledge. Shell has never cut its dividend since the war, but history shows us that nothing lasts forever. To keep the cash flowing, both are cutting capital expenditure, but there is only so much you can cut before you damage production. Shell's reserve replacement ratio looks low at just 47% for 2014, BP is better at 63% (but down from 129% in 2013). The pressure on both dividends can only build. Investors can't expect much dividend growth over the next year or two, and given current high yields, they can't complain too much either. But with $100 oil increasingly a mirage, and some analysts talking it down to $30 a barrel, the pressure for a dividend cut may eventually prove irresistible. Juicy dividend stocks like BP and Royal Dutch Shell remain a great way to fund your income in retirement. And there are plenty more to choose from on the FTSE 100. The stocks listed in this special wealth creation report, top FTSE 100 stocks that could help you retire in comfort, are all ideally placed to deliver long-term wealth over the years ahead.

- 14. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 IEA sees oil glut persisting despite soaring demand Reuters World oil demand is expanding at its fastest pace in five years thanks to rebounding economic growth and low prices, but global oversupply will last through 2016, the West’s energy watchdog said yesterday. The International Energy Agency said in a monthly report that it was steeply raising its demand growth outlook for this year and 2016, and expected non-Opec supply growth to decline next year, with US producers hardest hit. “While a rebalancing has clearly begun, the process is likely to be prolonged as a supply overhang is expected to persist through 2016 — suggesting global inventories will pile up further,” the Paris- based IEA said. The view from the IEA chimes with that of the US government, which on Tuesday lowered US production forecasts, signalling that a 60% rout in benchmark prices since last summer may finally be weighing on shale output. Oil prices have fallen to below $50 per barrel, pressured by an abundance of supply and a strong dollar. The views from the IEA are more bullish than those of Opec, which on Tuesday raised its forecast of oil supplies from non- member countries. The IEA said it saw global oil demand rising by 1.6mn barrels per day (bpd) in 2015, up 260,000 bpd from its forecast last month, citing solid economic growth and consumers responding to lower prices. “That’s the biggest growth spurt in five years and a dramatic uptick on a demand increase of just 0.7mn bpd in 2014,” it said. It added that persistent macroeconomic strength will support above-trend growth at 1.4mn bpd in 2016, up 410,000 bpd from its previous forecast. The decline in crude prices has prompted oil companies to cut their investment plans. “While a drop in costs and efficiency improvements will help to offset some of the spending cuts, output is likely to take a hit soon,” the IEA said. The IEA said it saw non-Opec supply growth slowing sharply from a 2014 record of 2.4mn bpd to 1.1mn bpd this year and then contracting by 200,000 in 2016 — with the US hardest hit. The prediction signals that Opec’s strategy of not cutting output, and hurting rival producers instead with lower prices, might be finally working. However, the strategy, introduced in November last year, has created such global oversupply that it will take another year and a half to absorb the glut.

- 15. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 “Our latest balances show that while the overhang will ease from a staggering 3.0mn bpd in the second quarter of 2015, its highest since 1998, the projected oversupply persists through the first half of 2016,” the IEA said. Assuming Opec production continues at around 31.7mn bpd — its recent three-month average — through 2016, the second half of 2015 will see supply exceeding demand by 1.4mn bpd, testing storage limits worldwide, the IEA said. The surplus will drain down to about 850,000 in 2016, with the final three months of 2016 marking the first quarter of a potential stock draw. “This outlook does not include potentially higher Iranian output in the case of sanctions being lifted,” the IEA said. It said a stronger demand outlook and slower non-Opec growth have raised the call on Opec crude for 2016 to 30.8mn bpd, 1.4mn bpd higher year-on-year and up 600,000 bpd from the IEA’s forecasts in its previous report. But the new, higher call on Opec is still far below the group’s current production volumes, which are holding steady near a three-year high due to robust pumping from Saudi Arabia and record- high Iraqi production. As a result of huge global oversupply, OECD inventories increased counter-seasonally by 9.9mn barrels to an all-time high of 2.916bn barrels in June, the IEA said. Oil prices rose yesterday after the IEA’s upbeat report outweighed the bearish impact of a further weakening of China’s currency and disappointing Chinese industrial data, with Brent crude up 18¢ at $49.36 a barrel by 1317 GMT.

- 16. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 Mobile: +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 25 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years, he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation, operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally, via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase 13 August 2015 K. Al Awadi

- 17. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17

- 18. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 18