Benefits Of Filling Income Tax Returns/Pension Income Taxable/Notice-Khanna & Associates LLP

KHANNA & ASSOCIATES is a full service Law Firm handling all legal matters on Civil, Criminal, Business, Commercial, Corporate, Arbitration , Labor & Service subjects in law, in all courts as well as Tribunals. An individualized service by members with decades of experience to ensures total satisfaction to the clients. We Provide services are: Accounting Services Auditing & Assurance Services Advisory Services Business Services Corporate Services International Services Financial & Corporate Services Foriegn Exchange Services STPI Services Taxation Services Trademark & Copyright Related Services NRI Related Services Corporate Governance Services Service Tax Contact Us: http://www.khannaandassociates.com http://www.cafirm.khannaandassociates.com http://www.bestdivorcelawyer.in http://www.domesticviolence.co.in IN-+91-946160007 US-+1-80151-20200 info@khannaandassociates.com cafirm.khannaandassociates@gmail.com

Recommended

More Related Content

Viewers also liked

Viewers also liked (18)

More from Khanna Asssociates

More from Khanna Asssociates (8)

Recently uploaded

Recently uploaded (20)

Benefits Of Filling Income Tax Returns/Pension Income Taxable/Notice-Khanna & Associates LLP

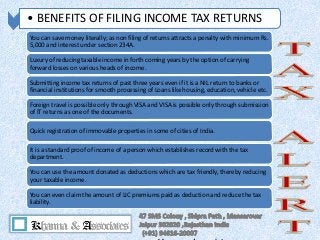

- 1. • BENEFITS OF FILING INCOME TAX RETURNS You can save money literally; as non filing of returns attracts a penalty with minimum Rs. 5,000 and interest under section 234A. Luxury of reducing taxable income in forth coming years by the option of carrying forward losses on various heads of income. Submitting income tax returns of past three years even if it is a NIL return to banks or financial institutions for smooth processing of Loans like housing, education, vehicle etc. Foreign travel is possible only through VISA and VISA is possible only through submission of IT returns as one of the documents. Quick registration of immovable properties in some of cities of India. It is a standard proof of income of a person which establishes record with the tax department. You can use the amount donated as deductions which are tax friendly, thereby reducing your taxable income. You can even claim the amount of LIC premiums paid as deduction and reduce the tax liability.

- 2. WE PLAN YOUR TAX …YOUR BENEFIT IS OUR AIM • Our primary goal in managing your wealth is to help you achieve your financial goals, which is why tax planning is so important. Tax planning considers the implications of individual, investment, and business decisions, usually with the goal of minimizing tax liability. While decisions are rarely made based solely on their taxable impact, we are always cognizant of the income, capital gains, estate, and business tax issues involved in any particular situation. Attention to taxes often influences the timing of investment purchases and sales, and it can have a great influence on estate planning. We undertake gift and estate tax planning, life event planning, business tax planning, income tax planning, and investment tax planning. • The taxable consequences of any action we take are carefully weighed. While financial professionals can perform many functions of the tax planning process, some activities require the expertise of an accountant or a CPA. We have taxation specialist to focus on your tax planning. Tax planning is a critical component of wealth management, and a good taxation strategy will be well- coordinated with your overall plans for business,Investments, risk management, estate, and retirement. www.khannaandassociates.com

- 3. PENSION IS TAXABLE!! As a thumb rule pension is always taxable. It is taxed under the head ‘income from salary’ in your income tax returns. Sometimes a taxpayer may choose to ‘commute’ a portion of their pension. When pension is paid as a lump sum it is called commuted pension. • Commuted pension or lump sum received may be exempt in certain cases. • For a government employee, commuted pension is fully exempt. • For a non-government employee, it is partially exempt. • Uncommuted pension or any periodical payment of pension is fully taxable like salary • Uncommuted pension or any periodical payment of pension is fully taxable like salary • Pension that is received from UNO by its employees or their family is exempt from tax. Pension received by family members of Armed Forces is also exempt. LAW & TAX CONSULTANTS since1948 www.khannaandassociates.com

- 4. What to do when you get an Income Tax Notice??? LAW & TAX CONSULTANTS since1948 www.khannaandassociates.com