1. Gift taxes paid on post-1976 gifts are generally allowed as a c.docx

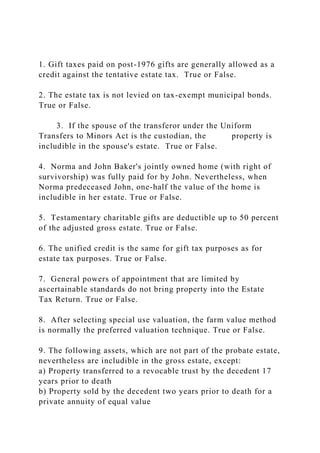

1. Gift taxes paid on post-1976 gifts are generally allowed as a credit against the tentative estate tax. True or False. 2. The estate tax is not levied on tax-exempt municipal bonds. True or False. 3. If the spouse of the transferor under the Uniform Transfers to Minors Act is the custodian, the property is includible in the spouse's estate. True or False. 4. Norma and John Baker's jointly owned home (with right of survivorship) was fully paid for by John. Nevertheless, when Norma predeceased John, one-half the value of the home is includible in her estate. True or False. 5. Testamentary charitable gifts are deductible up to 50 percent of the adjusted gross estate. True or False. 6. The unified credit is the same for gift tax purposes as for estate tax purposes. True or False. 7. General powers of appointment that are limited by ascertainable standards do not bring property into the Estate Tax Return. True or False. 8. After selecting special use valuation, the farm value method is normally the preferred valuation technique. True or False. 9. The following assets, which are not part of the probate estate, nevertheless are includible in the gross estate, except: a) Property transferred to a revocable trust by the decedent 17 years prior to death b) Property sold by the decedent two years prior to death for a private annuity of equal value c) Property transferred to decedent's wife for life, then to their son if the son survives his mother, to the extent of the reversion d) A life insurance policy transferred two and a half years ago on the decedent's life 10. Which of the following retained powers is not an "incident of ownership" in a life insurance policy? a) A power to use the policy as collateral for loans not to exceed one-half its cash value. b) A power to select a settlement option spelled out in the policy. c) The power to cancel a group policy indirectly by resigning a position. d) A power to veto a change of beneficiary after the transfer of the policy to the current beneficiary. 11. The following statements about "Qualified Terminable Interest Property" (QTIP) trusts are true, except: a) The QTIP trust is a "simple" trust and anyone, including a charity, may be the remainderman. b) A QTIP trust may not be implemented prior to the grantor's death. c) Only the grantor's spouse may be the income beneficiary, but may refuse to accept the bequest and elect against the will d) If a trust otherwise qualifies, QTIP treatment may be elected for an undivided portion of the trust, such as 78 percent 12. John Marigold's estate incurred the following payments during administration: (1.) Charitable contributions of $15,000 (2.) Funeral expenses of $4,000 (3.) Mortgage payments of $5,000 (4.) Attorney's fees of $10,000 Which of the above amounts offer the executor an option to deduct the payments? a) (1), (2), (3), and (4) b) (1) and (2) c) (1) and (3) d) (4) 13. W.

Recommended

Recommended

More Related Content

Similar to 1. Gift taxes paid on post-1976 gifts are generally allowed as a c.docx

Similar to 1. Gift taxes paid on post-1976 gifts are generally allowed as a c.docx (20)

More from keturahhazelhurst

More from keturahhazelhurst (20)

Recently uploaded

Recently uploaded (20)

1. Gift taxes paid on post-1976 gifts are generally allowed as a c.docx

- 1. 1. Gift taxes paid on post-1976 gifts are generally allowed as a credit against the tentative estate tax. True or False. 2. The estate tax is not levied on tax-exempt municipal bonds. True or False. 3. If the spouse of the transferor under the Uniform Transfers to Minors Act is the custodian, the property is includible in the spouse's estate. True or False. 4. Norma and John Baker's jointly owned home (with right of survivorship) was fully paid for by John. Nevertheless, when Norma predeceased John, one-half the value of the home is includible in her estate. True or False. 5. Testamentary charitable gifts are deductible up to 50 percent of the adjusted gross estate. True or False. 6. The unified credit is the same for gift tax purposes as for estate tax purposes. True or False. 7. General powers of appointment that are limited by ascertainable standards do not bring property into the Estate Tax Return. True or False. 8. After selecting special use valuation, the farm value method is normally the preferred valuation technique. True or False. 9. The following assets, which are not part of the probate estate, nevertheless are includible in the gross estate, except: a) Property transferred to a revocable trust by the decedent 17 years prior to death b) Property sold by the decedent two years prior to death for a private annuity of equal value

- 2. c) Property transferred to decedent's wife for life, then to their son if the son survives his mother, to the extent of the reversion d) A life insurance policy transferred two and a half years ago on the decedent's life 10. Which of the following retained powers is not an "incident of ownership" in a life insurance policy? a) A power to use the policy as collateral for loans not to exceed one-half its cash value. b) A power to select a settlement option spelled out in the policy. c) The power to cancel a group policy indirectly by resigning a position. d) A power to veto a change of beneficiary after the transfer of the policy to the current beneficiary. 11. The following statements about "Qualified Terminable Interest Property" (QTIP) trusts are true, except: a) The QTIP trust is a "simple" trust and anyone, including a charity, may be the remainderman. b) A QTIP trust may not be implemented prior to the grantor's death. c) Only the grantor's spouse may be the income beneficiary, but may refuse to accept the bequest and elect against the will d) If a trust otherwise qualifies, QTIP treatment may be elected for an undivided portion of the trust, such as 78 percent 12. John Marigold's estate incurred the following payments during administration: (1.) Charitable contributions of $15,000 (2.) Funeral expenses of $4,000 (3.) Mortgage payments of $5,000 (4.) Attorney's fees of $10,000

- 3. Which of the above amounts offer the executor an option to deduct the payments? a) (1), (2), (3), and (4) b) (1) and (2) c) (1) and (3) d) (4) 13. Which of the following is not deductible in arriving at the taxable estate? a) Administration expenses b) Casualty losses c) Adjusted taxable gifts after 1976 d) All of the above. 14. Which of the following statements is true under current law: a) All gifts made within three years of the decedent's death are brought back into the estate and taxed. b) The "three-year" rule no longer applies to any lifetime gifts c) The "three-year" rule now applies mainly to gifts of life insurance. d) All of the above. 15. By which of these forms of ownership does the share of a deceased owner pass automatically to the surviving owners without being subject to the decedent's creditors: a) Community property b) Tenancy-in-common c) Joint tenancy d) All of the above 16. The decedent's final income tax return is due four months after the date of death. True or False. 17. A decedent is allowed a full personal exemption on a final income tax return regardless of date of death. True or False.

- 4. 18. An estate is entitled to the standard deduction. True or False. 19. In determining what is income to a trust, federal laws always take precedence over laws of the state in which the trust is created. True or False. 20. A simple trust must distribute all of its taxable income each year. True or False. 21. A trust agreement may provide explicit instructions on how trust property is to be managed, invested, and paid out. Thus, a grantor may control from the grave what he could have controlled while he was alive. True or False. 22. When an estate or trust terminates all tax credits are lost. True or False. 23. Estates and trusts operate under a three tier system of taxation for their beneficiaries. True or False. 24. Business losses or capital losses incurred by a decedent prior to death: a) Can be carried over to an estate's income tax return. b) Can be deducted by estate beneficiaries on their income tax returns c) End with the decedent's final income tax return. d) Are not deductible on a decedent's final income tax return. 25. A trust created by a grantor during his own lifetime is called a: a) Grantor trust b) Inter vivos trust c) Testamentary trust d) Simple trust

- 5. 26. Income distributions from an estate to estate beneficiaries are recognized as income by beneficiaries on their tax returns for the year in which the: a) Distribution is received. b) Estate's tax year ends c) Income distribution was earned by the estate. d) Income distribution was received by the estate. 27. The income distribution system used to determine the taxation of estate income distributions to beneficiaries is a: a) One-tier system b) Two-tier system c) Three-tier system d) Four-tier system 28. Which of the following items is not normally in accounting income (State Law Income) for a trust? a) Rental income b) Capital gains c) Dividends d) All of the above 29. How much is an S-corporation taxed on? a) $6,000 c) $12,000 b) $8,000 d) $0 30. When an estate or trust terminates, a number of tax attributes flow out to the beneficiaries. Which of the following does not go out to the beneficiaries? a) Passive losses b) Net operating losses c) Capital losses d) Excess deductions