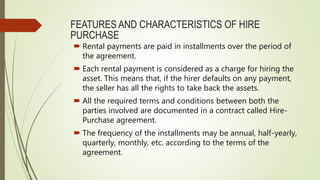

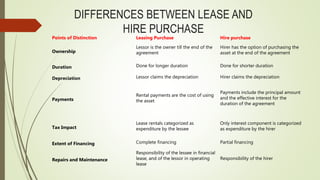

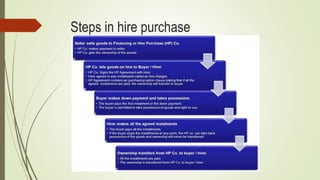

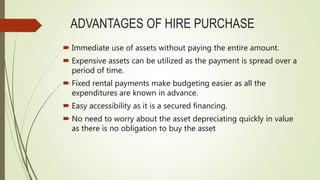

Hire purchase is a method of financing large purchases by making installment payments over time. The ownership of the purchased item is not transferred to the buyer until all payments are made. Companies offer hire purchase to earn a profit from interest charged on the monthly payments. Key features include installment payments, retention of ownership by the seller until final payment, and an option for the buyer to either purchase the item or return it. Hire purchase allows buyers immediate use of expensive assets by spreading costs over time, but the total amount paid is higher than the upfront cost and the buyer cannot resell the item until owning it outright.