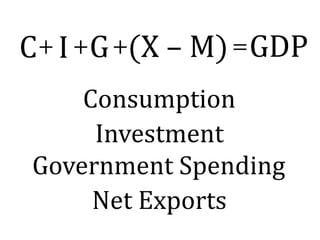

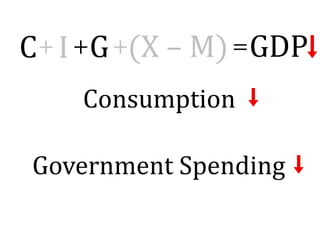

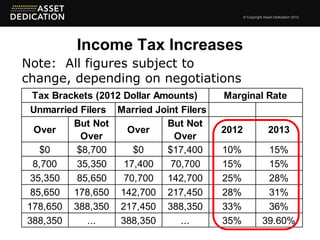

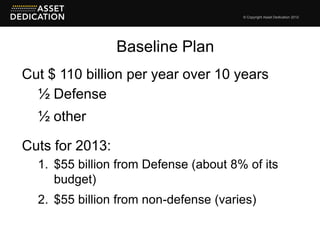

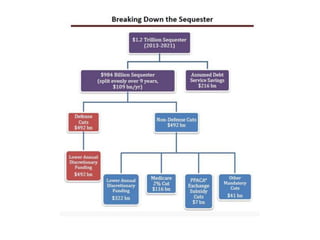

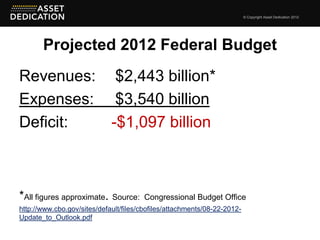

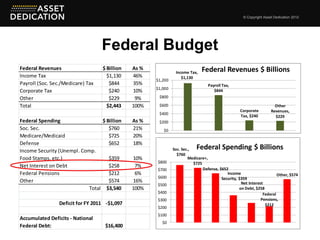

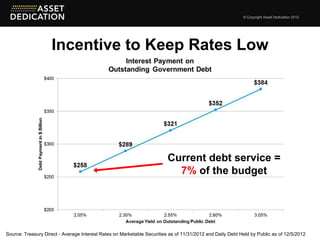

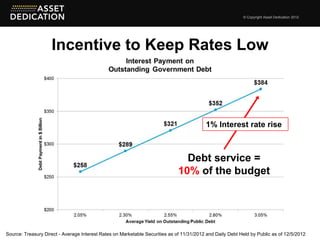

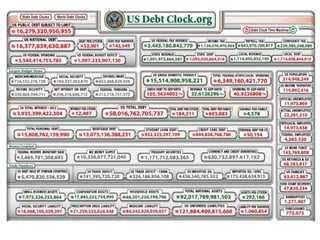

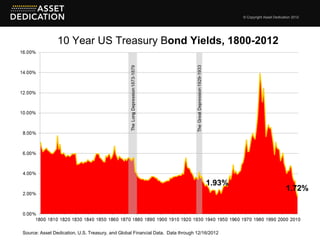

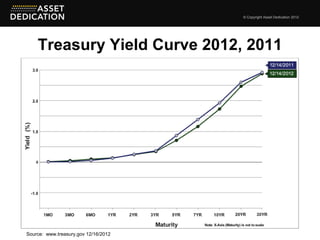

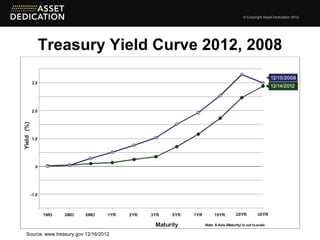

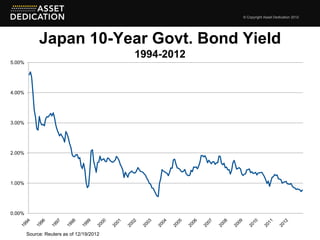

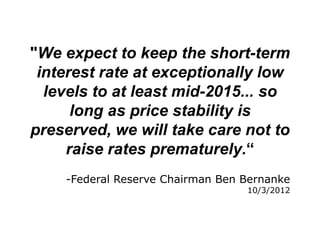

The document discusses the implications of the upcoming "Fiscal Cliff" for financial advisors and their clients. It notes that if Congress fails to act, taxes will rise substantially in 2013 which will negatively impact the economy. Spending cuts will also take effect that will further slow economic growth. Interest rates are expected to remain low to help stimulate the economy. The document provides details on how the higher taxes and spending cuts could impact individuals and families. It also discusses the federal budget situation and debt levels that create incentives to keep interest rates low.