Business Case Template Excel

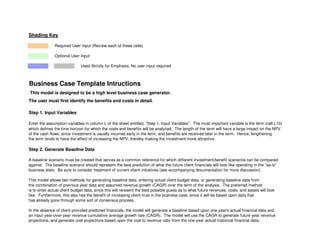

- 1. Shading Key Required User Input (Review each of these cells) Optional User Input Used Strictly for Emphasis; No user input required This model is designed to be a high level business case generator. The user must first identify the benefits and costs in detail. Step 1. Input Variables Enter the assumption variables in column L of the sheet entitled, "Step 1. Input Variables". The most important variable is the term (cell L10) which defines the time horizon for which the costs and benefits will be analyzed. The length of the term will have a large impact on the NPV of the cash flows, since investment is usually incurred early in the term, and benefits are received later in the term. Hence, lengthening the term tends to have the effect of increasing the NPV, thereby making the investment more attractive. Step 2. Generate Baseline Data A baseline scenario must be created that serves as a common reference for which different investment/benefit scenarios can be compared against. The baseline scenario should represent the best prediction of what the future client financials will look like operating in the "as-is" business state. Be sure to consider treatment of current client initiatives (see accompanying documentation for more discussion). This model allows two methods for generating baseline data: entering actual client budget data, or generating baseline data from the combination of previous year data and assumed revenue growth (CAGR) over the term of the analysis. The preferred method is to enter actual client budget data, since this will reresent the best possible guess as to what future revenues, costs, and assets will look like. Furthermore, this also has the benefit of increasing client trust in the business case, since it will be based upon data that has already gone through some sort of consensus process. In the absence of client provided predicted financials, the model will generate a baseline based upon one year's actual financial data and an input year-over-year revenue cumulative average growth rate (CAGR). The model will use the CAGR to generate future year revenue projections, and generate cost projections based upon the cost to revenue ratio from the one-year actual historical financial data. Business Case Template Intructions

- 2. For example, in order to generate baseline data for the period 2003 to 2008, actual data for 2002 should be entered in column F ("Step 2. Generate Baseline Data"), and a revenue growth CAGR entered in cell L41 of the "Step 1. Input Variables" sheet. Additional Notes 1. Attention should be paid to projections of long-term assets (rows 40 and 42, "Step 2. Generate Baeline Data") if the business case involves adding or divesting facilities. Currently, the model projects that long-term assets remain constant, irrespective of revenue growth. This is a fairly weak assumption that should be adjusted for each particular analysis. 2. The model will accept input of projected financial data for a shorter time period than the term entered in cell L10, "Step 1. Input Variables". For example, if the client has budget data for 2003 to 2008, but we want the analysis to extend to 2010, then the model will project financials for 2009 and 2010, based upon the data from 2008, and the revenue growth prediction entered in cell L41, "Step 1. Input Variables". 3. Not all baseline data cells require input unless the user is performing a "Full Value" analysis. Step 3. Input Benefit Estimate The model was designed to calculate benefits based upon user-inputted percentage increases or decreases from baseline financials. Determing what those percentages should be is specific to every situation or investment being analyzed. The sources for determining benefit ranges vary widely, example sources include: typical benefits seen at other XYZ clients, analyst research reports, benchmark figures, vendor case studies, or results from pilot projects at the client. If a benefit estimate cannot be determined easily, one could enter investment (cost) data, and then work backwards to see what kind of benefit is necessary to justify the investment. For example, if we assume that it will cost $5 million to implement a CRM package, and we believe the main benefit will be revenue uplift, the model can be used to calculate what amount of revenue uplift is required to generate a 10% return. Tasks 1. Enter the percentage increase or decrease from baseline financials in column I of "Step 3. Input Benefit Estimate". These percentages can be changed to see the effect on the resulting financial metrics. "Step 8. What-If Analysis" provides an easy way to review various scenarios based upon changing the benefit percentage. The values input into column I will be input into the worksheet "Step 4. Review Benefit Calc", where the values can be adjusted on a year-to-year basis. 2. Enter the first year in which each benefit is expected to begin in column L of "Step 3. Input Benefit Estimate". This year is the year that the full value of the benefit is expected to be realized, although this can be adjusted in the "Step 4. Review Benefit Calc" worksheet. Year 0 refers to the "start year" of the analysis (entered in cell L15 of the "Step 1. Input Variables" worksheet). For example, if the start year is 2003, then entering a 2 will start the benefit calculation in 2005, and continue to the end of the term. 3. For the cost reduction benefits, the user has the option of segmenting "hard" or out-of-pocket cost savings versus "soft" or This document is a partial preview. Full document download can be found on Flevy: https://flevy.com/browse/document/business-case-template-excel-683

- 3. "cost avoidance" savings. The percentage of the full benefit resulting in "hard" savings should be entered in column N of "Step 3. Input Benefit Estimate". For a full discussion of this topic, please refer to the accompanying reference material. Step 4. Review Benefit Calculation The user can review and adjust the benefit calculation derived from the input in "Step 3. Input Benefit Estimate" in the "Step 4. Review Benefit Calc" worksheet. For sake of simplicity in user input, the benefits were input assuming that the full benefit was realized in every year after and including the start year entered by the user in step 3. For those users who would prefer to ramp the benefits or define the benefit for each year, this can be done in Step 4, however, this will require overwriting the formulas in those cells, with the result that some of the sensitivity analysis functionality will be lost. Additional Notes 1. In order to quantify the impact of improving capital efficiency, a reduction in assets must be translated into cash flows. This enables an income statement item (such as operating profit) and balance sheet item (reduction in inventory) to be added together to quantify the total benefit. It is important to realize however, that an increase in operating profit is viewed as a "hard" benefit, while a reduction in inventory is sometimes viewed as a "soft" benefit. The model will translate a reduction in assets into a reduction in capital charge expense by multiplying the value of the asset reduction by the cost of capital entered in cell L23 of "Step 1. Input Variables". The exception is inventory, which is instead multiplied by the inventory carrying cost rate entered in cell L38 of "Step 1. Input Variables". Step 5. Enter Investment All of the investment (costs) required to generate the benefit in Step 4 must be entered into the "Step 5. Enter Investment" worksheet. The "investment" includes both initial one-time implementation costs and any incremental costs over the term (time horizon) of the analysis period. The costs can be divided into roughly two categories, the costs associated with tool implementation (IT costs) and those associated with business process change. The costs need to be entered starting in column K through the end of the analysis period (up to column U). In addition to entering the cost for each item, the type of cost for each item (capitalized vs. non-capitalized) must be specified in column G. Enter a value ranging from 0 to 100% in order to specify the percentage of the cost that will be treated as a capitalized cost. Capitalizing the cost has the effect of creating a depreciation expense in future years. The percentage entered in column G is used to divide the costs entered in columns K - U into two types of costs: operating expenses (shown in worksheet "Op Ex Calc") and Capital Expenditures (shown in worksheet "Step 6. Review Cap Ex"). Additional Notes 1. Labor costs have been divided into multiple categories in order to differentiate between additional out-of-pocket expense and the opportunity cost associated with utilizing current client employees. For example, if the client reassigns ten current This document is a partial preview. Full document download can be found on Flevy: https://flevy.com/browse/document/business-case-template-excel-683

- 4. employees to the project, we need to take into account the opportunity cost of those employees time, even though it does not represent an additional out-of-pocket expense. Step 6. Review Capital Expenditures This worksheet ("Step 6. Review Cap Ex") calculates the depreciation schedule for capitalized assets in order to determine the tax shield benefits of depreciation. The model assumes that the assets have a five-year depreciation schedule using the straight-line method. For example, hardware purchased in year 0 for $1M, would have the following depreciation schedule: $200K in year 0, $200K in year 1, $200K in year 2, $200K in year 3, and $200K in year 4. The straight-line method is used in the model as a simplifying assumption, generally speaking, the client would most likely utilize more complex depreciation methods. Thus, the depreciation schedules can be overwritten by the user in the ("Step 6. Review Cap Ex") worksheet. Step 7. Review Cash Flow Result This worksheet ("Step 7. Review Cash Flow Result") presents all of the positive and negative cash flows, and calculates the return on investment metrics such as NPV, IRR, and payback period. This sheet summarizes the financial result of the business case. Both a before-tax and after-tax analysis is presented. The user has the option of removing "soft" benefits and costs in this sheet by overwriting rows 15, 17, 38, and 49, although this is not recommended (since the user should attempt to quantify all costs and benefits). Additional Notes 1. For the purposes of discounting cash flows, all positive cash flows (benefits) are assumed to occur at the end of the period (year). The year 0 negative cash flows (costs) are assumed to occur at the start of year 0, while negative cash flows after year 0 are assumed to occur at the end of the period. 2. The marginal corporate tax rate (entered in cell L34 of "Step 1. Input Variables") is applied to calculate the after-tax cash flow analysis. The marginal tax rate may not be appropriate in some cases; the actual cash tax rate is preferred. 3. The payback period calculation entered into the model is not the traditional way that payback is calculated, and hence may want to be adjusted by the user. The model determines the number of years required to recoup the investment made in year 0 based upon net cash flows from year 1 onwards. Step 8. What-if Analysis This sheet allows the user to perform a sensitivity analysis ("what-if" analysis) on a single variable (benefits, assumptions, or investment). The benefit variables are those specified in the "Step 3. Input Benefit Estimate" worksheet, the assumptions are selected variables This document is a partial preview. Full document download can be found on Flevy: https://flevy.com/browse/document/business-case-template-excel-683

- 5. from the "Step 1. Input Variables" sheet, and the investments are those entered in the "Step 5. Enter Investment" sheet. The user selects the variable to be analyzed from the drop-down box in cell C6. The user can then review the result of changing the value of this variable by entering up to ten different values for the variable in cells C8:C17. The results for each of these 10 scenarios are shown in a side-by-side comparison in cells F8:M17. The user can also view the effect of changes to the selected variable on after-tax NPV in graphical format by clicking on the "View Graph" button. The scenario number entered in cell B6 will determine the value of the variable that is visible in the rest of the model, for example, when selecting a benefit variable, the value of the variable that is entered into the "Step 4. Review Benefit Calc" worksheet. For example, if 4 is entered in cell B6, and "Increase Revenues" is chosen as the variable to be analyzed, then scenario 4 (value in cell C11) will be input into the sheet "Step 4. Review Benefit Calc". Additional Notes 1. When selecting a benefit variable, the percentage change entered in the ten scenario cells (C8:C17) should always be positive since the benefit variables are already stated in terms of benefit capture. For example, if the benefit variable "Reduce COGS" is selected, the values entered in cells C8:C17 should be positive, representing percentage reductions in COGS. 2. When selecting one of the three assumption variables ("Discount Rate", "WACC", "Inventory Carrying Cost Rate"), the values entered in the ten scenario cells (C8:C17) should be the value of the selected variable, not a percentage change from the value entered in the "Step 1. Input Variables" sheet. For example, if the discount rate entered in the "Step 1. Input Variables" sheet is 15%, and the user desires to see the effect of changing the discount rate to 16 - 26%, then enter 16 - 26% (in one percent increments) in cells C8:C17. 3. When selecting one of the investment variables, the user has the option of entering either percentage increases or decreases in the ten scenario cells (C8:C17) to reflect increases or decreases in the investment (entered in "Step 5. Enter Investment" worksheet). The percentages entered should reflect increases / decreases not a percentage of the overall cost. For example to see the effect of a 10% reduction in hardware costs, select "Tools Implementation - Hardware" from the drop-down list, and enter -10% in one of the scenario cells (C8:C17). The user can affect the investment sum at multiple levels, either the overall investment, the tool implementation cost, the process change cost, or more granular levels of the tool implementation or process change cost. The model will not alter the original cost data entered in the "Step 5. Enter Investment". Special Note: Multiple Benefit Streams, Divisional/Business Unit Benefits versus Corporate Benefits This Benefits Case Template was designed to accommodate a single primary workstream or a single business entity (e.g., division, business unit, or overall company, etc). However, if the user wishes to determine the cumulative benefits of multiple workstreams or the aggregate contribution of separate business entities, the user will need to create multiple files, each representing the individual workstreams or the individual entities. This document is a partial preview. Full document download can be found on Flevy: https://flevy.com/browse/document/business-case-template-excel-683

- 6. Additionally, the user will need to perform a summation manually in order to calculate the total costs and benefits from all the workstreams or business entities. Depending upon the granularity of the summation view required, any of the worksheets could be copied and pasted onto a new worksheets to generate a consolidated view. For example, if an overall view of each workstream's contribution to Net Present Value is desired, the "Financial Summary" tabs from each workstream could be consolidated onto one worksheet. Or, if an overall view of each division's contribution to total benefits is desired, the Incremental Benefits Summary table in the "Step 4. Review Benefit Calc" tab could be consolidated onto one worksheet. This document is a partial preview. Full document download can be found on Flevy: https://flevy.com/browse/document/business-case-template-excel-683

- 7. General Inputs Data Source Term (years) The length, in years, of the analysis. If the client has a standard term that is used for cost/benefit analysis, then we should use it, otherwise it should be determined based on a reasonable time to recover benefits. Term is critical to determining Discounted Cash Flow (DCF). Usually a 5-year term is typical. The model will accept up to a 10-year term. Start Year The year in which the initial investment is made. The time horizon for the DCF analysis will equal start year + term. Model assumes that first year investment will be made at start of this year. Discount Rate for Cash Flows (Default: Weighted Average Cost of Capital) The rate used to calculate the project's net present value and payback period. This rate is normally provided by the client's finance organization. It should be the client's weighted average cost of capital for projects with similar risk profiles as the one being evaluated in the business case. The client's Discount Rate is critical to determining DCF. Client's Weighted Average Cost of Capital This rate is utilized to calculate the benefits associated with reductions in balance sheet items other than inventory. Using the cost of capital rate we can calculate the "opportunity cost" of having capital tied up in assets. For example, a $100M reduction in receivables, at a cost of capital of 15%, would net a benefit of $15M, since theoretically the company should be able able to earn that return if the cash tied up in assets were used elsewhere. Client's Hurdle Rate The client's hurdle rate is the minimum rate of return that they expect to achieve for an investment. It is used as a comparison to the NPV calculated using the discount rate, and can be compared against the internal rate of return. Some clients have a predefined hurdle rate while others use the same hurdle rate as their discount rate. The client's Hurdle Rate is helpful, but not needed, in determining DCF. Client's Marginal Tax Rate The marginal corporate tax rate is utilized to generate an after-tax cash flow for incremental net positive cash flows generated by the investment, and to estimate the positive cash flow from tax benefits associated with capitalization of assets. The standard marginal corporate tax rate in the US is 40%. Client's Inventory Carrying Cost Rate Utilized to calculate benefit of reduced inventory. It is based upon the cost of capital rate, plus a rate that factors 2 storage & handling, risk (damage, shrinkage, obsolescence, re-positioning), and service (insurance and taxes) costs. Client's Expected Revenue Growth (CAGR) This is utilized to generate data for the baseline, "as is" case. It is not necessary if we have actual projections for the time horizon being utilized. 10% 40% 40% 5 2003 14% 14% 20% This document is a partial preview. Full document download can be found on Flevy: https://flevy.com/browse/document/business-case-template-excel-683

- 8. Client Financial Data ($000s) YEAR (-1) YEAR (0) YEAR (+1) YEAR (+2) YEAR (+3) YEAR (+4) YEAR (+5) 2002 2003 2004 2005 2006 2007 2008 Abbreviated Income Statement Net Sales 10,000$ 11,000$ 12,100$ 13,310$ 14,641$ 16,105$ 17,716$ Cost of Goods Sold (COGS) 50$ 55$ 61$ 67$ 73$ 81$ 89$ Selling, General, & Administrative (SG&A) Sales 30$ 33$ 36$ 40$ 44$ 48$ 53$ Marketing -$ -$ -$ -$ -$ -$ Customer Service -$ -$ -$ -$ -$ -$ Finance -$ -$ -$ -$ -$ -$ HR -$ -$ -$ -$ -$ -$ IT -$ -$ -$ -$ -$ -$ Logistics -$ -$ -$ -$ -$ -$ Other -$ -$ -$ -$ -$ -$ Research & Development (R&D) 5,000$ 5,500$ 6,050$ 6,655$ 7,321$ 8,053$ 8,858$ Operating Income 4,920$ 5,412$ 5,953$ 6,549$ 7,203$ 7,924$ 8,716$ Abbreviated Balance Sheet Operating Working Capital Assets Average AR Balance -$ -$ -$ -$ -$ -$ Average Inventory Balance -$ -$ -$ -$ -$ -$ Other Current Assets -$ -$ -$ -$ -$ -$ Net Plant, Property, and Equipment (PP&E) -$ -$ -$ -$ -$ -$ Other Long-Term Assets -$ -$ -$ -$ -$ -$ This document is a partial preview. Full document download can be found on Flevy: https://flevy.com/browse/document/business-case-template-excel-683

- 9. Input Values Benefit Drivers Percentage Increase / Decrease from Baseline "As-Is" Case Year Benefit Expected to Begin (>=0) Percentage of Benefit Derived from "Hard" Savings (Out-of-Pocket) Percentage of Benefit Derived from "Soft" Savings (Cost Avoidance) Increase Revenues 0% 0 Reduce Costs Reduce COGS 0% 0 100% 0% Reduce Selling Costs 0% 0 100% 0% Reduce Marketing Costs 0% 0 100% 0% Reduce Customer Service Costs 0% 0 100% 0% Reduce Logistics Costs 0% 0 100% 0% Reduce R&D Costs 0% 0 100% 0% Reduce Finance Admin Costs 0% 0 100% 0% Reduce HR Costs 0% 0 100% 0% Reduce IT Costs 0% 0 100% 0% Reduce All Other Admin Costs 0% 0 100% 0% Increase Capital Efficiency Reduce Operating Working Capital Assets Reduce AR 0% 1 Reduce Inventory 0% 1 Reduce Other Current Assets 0% 1 Reduce Net Plant, Property, and Equipment (PP&E) 0% 1 Reduce Other Long-Term Assets 0% 1 User Input Required This document is a partial preview. Full document download can be found on Flevy: https://flevy.com/browse/document/business-case-template-excel-683

- 10. INCREMENTAL BENEFITS SUMMARY YEAR (0) YEAR (+1) YEAR (+2) YEAR (+3) YEAR (+4) YEAR (+5) 2003 2004 2005 2006 2007 2008 Net Sales Uplift -$ -$ -$ -$ -$ -$ Associated EBITA Uplift -$ -$ -$ -$ -$ -$ Incremental Cost Savings Hard - "Out of Pocket" -$ -$ -$ -$ -$ -$ Soft - "Cost Aviodance" -$ -$ -$ -$ -$ -$ Total Cost Savings -$ -$ -$ -$ -$ -$ Capital Charge Reduction Short-Term Assets -$ -$ -$ -$ -$ -$ Long-Term Assets -$ -$ -$ -$ -$ -$ Total Capital Charge Reduction -$ -$ -$ -$ -$ -$ Total Incremental Positive Cash Flow -$ -$ -$ -$ -$ -$ This document is a partial preview. Full document download can be found on Flevy: https://flevy.com/browse/document/business-case-template-excel-683

- 11. SUMMARY Tools Implementation Total Hardware Costs $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Software Costs $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Labor Costs Opportunity Cost $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Out-of-Pocket Internal Resource $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Third Party - Accenture $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Third Party - Vendor $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Third Party - Other $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Other $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Other Costs $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Tools Implementation Total $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Process Change Total Labor Costs Opportunity Cost $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Out-of-Pocket Internal Resource $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Third Party - Accenture $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Third Party - Vendor $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Third Party - Other $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Other $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Other Costs $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Process Change Total $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 TOTAL $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 This document is a partial preview. Full document download can be found on Flevy: https://flevy.com/browse/document/business-case-template-excel-683

- 12. SUMMARY Tools Implementation Total Hardware Costs $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Software Costs $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Labor Costs Opportunity Cost $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Out-of-Pocket Internal Resource $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Third Party - Accenture $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Third Party - Vendor $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Third Party - Other $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Other $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Other Costs $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Tools Implementation Total $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Process Change Total Labor Costs Opportunity Cost $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Out-of-Pocket Internal Resource $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Third Party - Accenture $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Third Party - Vendor $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Third Party - Other $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Other $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Other Costs $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Process Change Total $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 TOTAL $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 This document is a partial preview. Full document download can be found on Flevy: https://flevy.com/browse/document/business-case-template-excel-683

- 13. SUMMARY ASSETS (CAPITAL EXPENDITURES) Tools Implementation Total Hardware Costs $0 $0 $0 $0 $0 $0 Software Costs $0 $0 $0 $0 $0 $0 Labor Costs Opportunity Cost $0 $0 $0 $0 $0 $0 Out-of-Pocket Internal Resource $0 $0 $0 $0 $0 $0 Third Party - Accenture $0 $0 $0 $0 $0 $0 Third Party - Vendor $0 $0 $0 $0 $0 $0 Third Party - Other $0 $0 $0 $0 $0 $0 Other $0 $0 $0 $0 $0 $0 Other Costs $0 $0 $0 $0 $0 $0 Tools Implementation Total $0 $0 $0 $0 $0 $0 Process Change Total Labor Costs Opportunity Cost $0 $0 $0 $0 $0 $0 Out-of-Pocket Internal Resource $0 $0 $0 $0 $0 $0 Third Party - Accenture $0 $0 $0 $0 $0 $0 Third Party - Vendor $0 $0 $0 $0 $0 $0 Third Party - Other $0 $0 $0 $0 $0 $0 Other $0 $0 $0 $0 $0 $0 Other Costs $0 $0 $0 $0 $0 $0 Process Change Total $0 $0 $0 $0 $0 $0 TOTAL $0 $0 $0 $0 $0 $0 This document is a partial preview. Full document download can be found on Flevy: https://flevy.com/browse/document/business-case-template-excel-683

- 14. Before Tax Cash Flow Analysis Net Cash Flow Before Tax $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Present Value (Discount Rate) $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 NPV (Discount Rate) $0 Present Value (Hurdle Rate) $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 NPV (Hurdle Rate) $0 IRR #NUM! Cumulative Cash Flow $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Payback Period 1 years After Tax Cash Flow Analysis Net Cash Flow After Tax $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Present Value (Discount Rate) $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 NPV (Discount Rate) $0 Present Value (Hurdle Rate) $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 NPV Hurdle Rate $0 IRR #NUM! Cumulative Cash Flow $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Payback Period 1 years This document is a partial preview. Full document download can be found on Flevy: https://flevy.com/browse/document/business-case-template-excel-683

- 15. Single Variable Sensistivity Analysis ($000s) SCENARIO REFERENCE SCENARIO Pre-Tax NPV (Discount Rate) After-Tax NPV (Discount Rate) Pre-Tax NPV (Hurdle Rate) After-Tax NPV (Hurdle Rate) Pre-Tax IRR After-Tax IRR Non-Discounted Cumulative Benefit After Tax ($) Non-Discounted Cumulative Investment (Cost) ($) 1 0.0% $0 $0 $0 $0 #NUM! #NUM! $0 $0 1 0.0% 1 $0 $0 $0 $0 #NUM! #NUM! $0 $0 2 2.0% 2 $0 $0 $0 $0 #NUM! #NUM! $0 $0 3 4.0% 3 $0 $0 $0 $0 #NUM! #NUM! $0 $0 4 6.0% 4 $0 $0 $0 $0 #NUM! #NUM! $0 $0 5 8.0% 5 $0 $0 $0 $0 #NUM! #NUM! $0 $0 6 10.0% 6 $0 $0 $0 $0 #NUM! #NUM! $0 $0 7 -2.0% 7 $0 $0 $0 $0 #NUM! #NUM! $0 $0 8 -4.0% 8 $0 $0 $0 $0 #NUM! #NUM! $0 $0 9 -6.0% 9 $0 $0 $0 $0 #NUM! #NUM! $0 $0 10 18.0% 10 $0 $0 $0 $0 #NUM! #NUM! $0 $0 SCENARIO VARIABLE SCENARIO OUTPUT VALUES Select variable from drop-down list DIRECTIONS: Use cells C8:C17 to compare the impact of changing the value of the variable selected from the drop-down list. For example, choose "Increase Revenues" from the drop-down list, and see the results of the 10 scenarios specified in cells C8:C17 to the right. For the investment variables, the user can specify both positive and negative percentage increases/decreases. For the assumption variables, input the actual value of the variables. Results of changes to variable selected from drop-down list on financial metrics shown here The scenario number entered here from the list below (B8:B17) will input the corresponding variable value (from C8:C17) into the benefit calculation sheets in the model Optional User Input This document is a partial preview. Full document download can be found on Flevy: https://flevy.com/browse/document/business-case-template-excel-683

- 16. Financial Summary FINANCIAL INDICATORS (Incremental/Forward-Looking) Term of Analysis: 5 Years Start Year: 2003 Discount Rate: 14% Before-Tax After-Tax Analysis Analysis Non-Discounted Cumulative Benefits ($000s) $0 $0 Non-Discounted Cumulative Investment ($000s) $0 $0 Net Non-Discounted Cash Flow ($000s) $0 $0 Net Present Value ($000s) $0 $0 Internal Rate of Return (IRR) #NUM! #NUM! Payback Period (Years) 1 1 This document is a partial preview. Full document download can be found on Flevy: https://flevy.com/browse/document/business-case-template-excel-683

- 17. Example Charts Net After-Tax Cash Flows vs. Time Positive / Negative Cash Flows vs. Time $0 $0 $0 $0 $0 $1 $1 $1 $1 $1 $1 2003 2004 2005 2006 2007 2008 $0 $1 $1 $1 $1 $1 $1 Optional User Input This document is a partial preview. Full document download can be found on Flevy: https://flevy.com/browse/document/business-case-template-excel-683

- 18. NPV (Discount Rate) vs. Single Variable Change Positive Cash Flow by Benefit Categories vs. Time $0 $0 $0 $0 $0 2003 2004 2005 2006 2007 2008 $0 $0 $0 $0 $0 $1 $1 $1 $1 $1 $1 -10.0% -5.0% 0.0% 5.0% 10.0% 15.0% 20.0% $1 $1 $1 $1 $1 $1 This document is a partial preview. Full document download can be found on Flevy: https://flevy.com/browse/document/business-case-template-excel-683

- 19. Negative Cash Flow by Cost Categories vs. Time $0 $0 $0 $0 $0 $1 2003 2004 2005 2006 2007 2008 Total Capital Charge Reduction Incremental Cost Savings Operating Profit Uplift from Revenue Uplift $0 $0 $0 $0 $0 $1 $1 $1 $1 $1 $1 2003 2004 2005 2006 2007 2008 Tools Implementation Process Change This document is a partial preview. Full document download can be found on Flevy: https://flevy.com/browse/document/business-case-template-excel-683

- 20. 1 Flevy (www.flevy.com) is the marketplace for premium documents. These documents can range from Business Frameworks to Financial Models to PowerPoint Templates. Flevy was founded under the principle that companies waste a lot of time and money recreating the same foundational business documents. Our vision is for Flevy to become a comprehensive knowledge base of business documents. All organizations, from startups to large enterprises, can use Flevy— whether it's to jumpstart projects, to find reference or comparison materials, or just to learn. Contact Us Please contact us with any questions you may have about our company. • General Inquiries support@flevy.com • Media/PR press@flevy.com • Billing billing@flevy.com