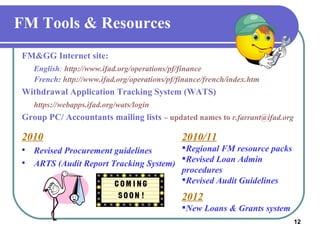

The document summarizes a workshop on fiduciary capacities for project implementers from 14 countries in Eastern and Southern Africa. The workshop aimed to upgrade capacities and facilitate experience sharing in financial management, procurement, audit, and accounting. Over 128 staff participated and discussed best practices from projects in the region. Key topics included financial reporting, procurement, audit functions and guidelines, and challenges faced in implementation. Sharing experiences and using IFAD resources and tools were emphasized to strengthen fiduciary systems and increase project implementation results.