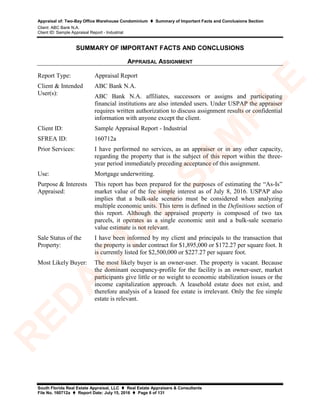

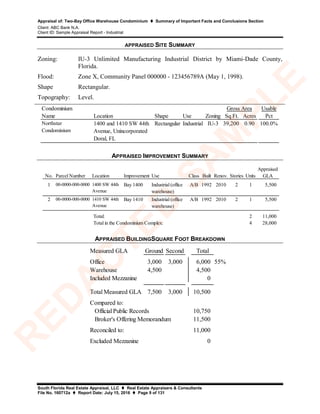

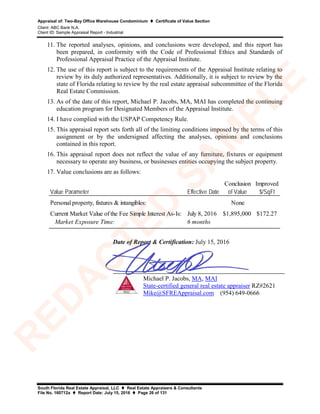

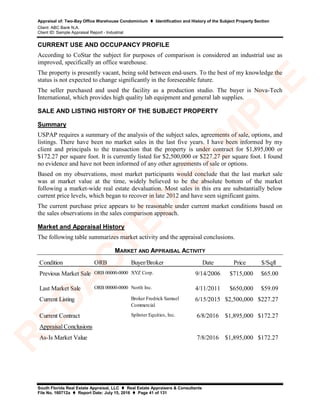

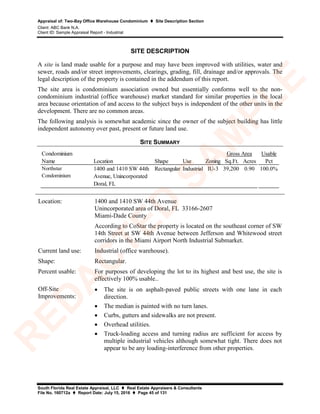

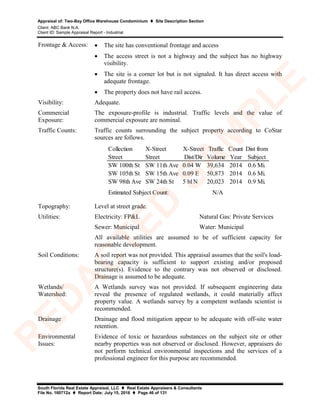

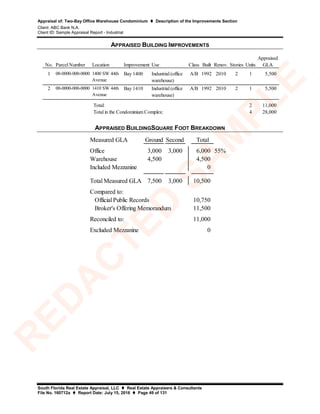

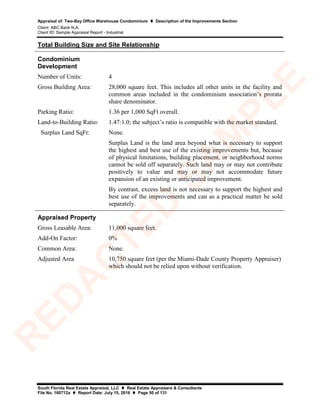

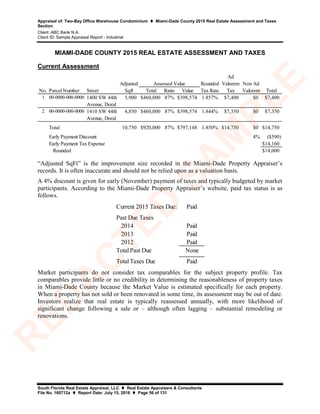

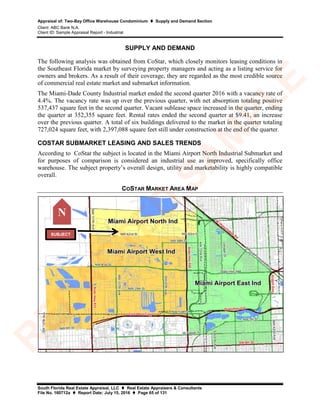

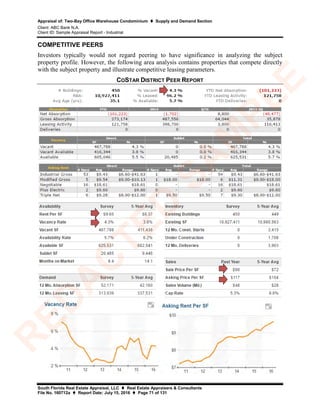

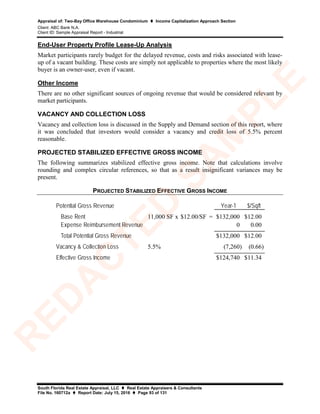

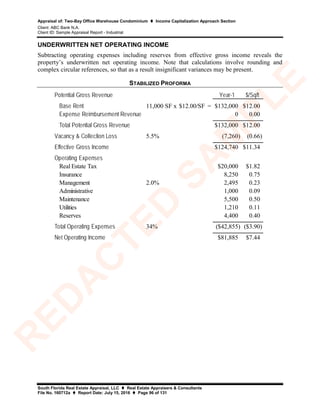

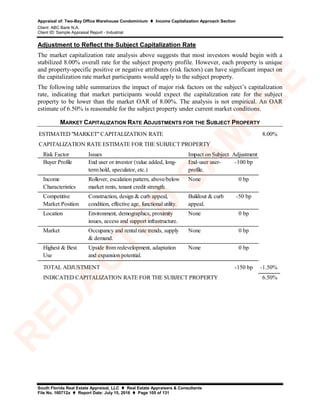

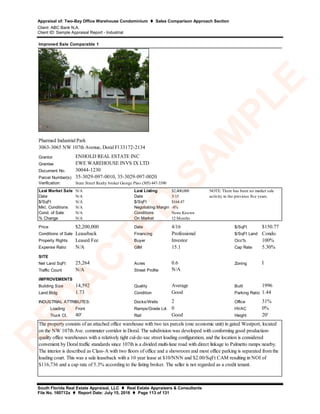

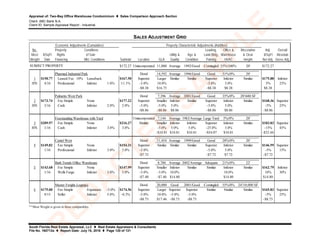

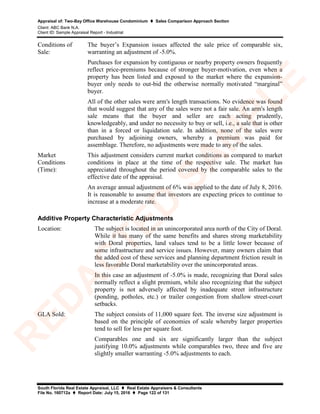

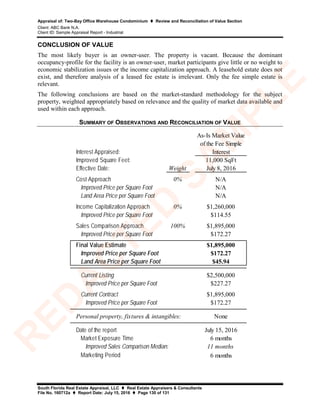

- The appraisal estimates the as-is market value of a two-bay office warehouse condominium located in Doral, Florida as of July 8, 2016 for the purpose of mortgage underwriting for ABC Bank N.A.

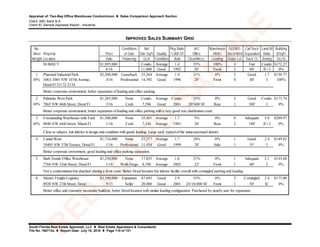

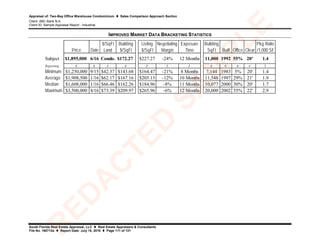

- The property is currently under contract for $1,895,000 or $172.27 per square foot and is listed for $2,500,000 or $227.27 per square foot.

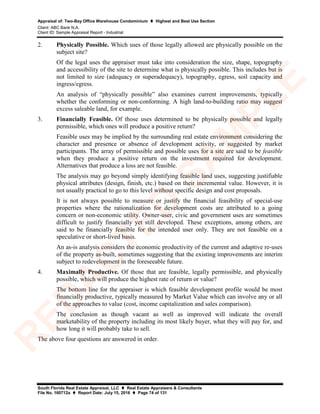

- The most likely buyer is an owner-user as the property is currently vacant. The appraisal estimates the fee simple interest in the property using the sales comparison approach.