Mf0012 taxation management

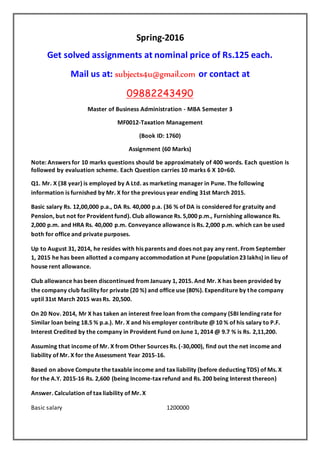

- 1. Spring-2016 Get solved assignments at nominal price of Rs.125 each. Mail us at: subjects4u@gmail.com or contact at 09882243490 Master of Business Administration - MBA Semester 3 MF0012-Taxation Management (Book ID: 1760) Assignment (60 Marks) Note: Answers for 10 marks questions should be approximately of 400 words. Each question is followed by evaluation scheme. Each Question carries 10 marks 6 X 10=60. Q1. Mr. X (38 year) is employed by A Ltd. as marketing manager in Pune. The following information is furnished by Mr. X for the previous year ending 31st March 2015. Basic salary Rs. 12,00,000 p.a., DA Rs. 40,000 p.a. (36 % of DA is considered for gratuity and Pension, but not for Provident fund). Club allowance Rs. 5,000 p.m., Furnishing allowance Rs. 2,000 p.m. and HRA Rs. 40,000 p.m. Conveyance allowance is Rs. 2,000 p.m. which can be used both for office and private purposes. Up to August 31, 2014, he resides with his parents and does not pay any rent. From September 1, 2015 he has been allotted a company accommodation at Pune (population 23 lakhs) in lieu of house rent allowance. Club allowance has been discontinued from January 1, 2015. And Mr. X has been provided by the company club facility for private (20 %) and office use (80%). Expenditure by the company uptil 31st March 2015 was Rs. 20,500. On 20 Nov. 2014, Mr X has taken an interest free loan from the company (SBI lending rate for Similar loan being 18.5 % p.a.). Mr. X and his employer contribute @ 10 % of his salary to P.F. Interest Credited by the company in Provident Fund on June 1, 2014 @ 9.7 % is Rs. 2,11,200. Assuming that income of Mr. X from Other Sources Rs. (-30,000), find out the net income and liability of Mr. X for the Assessment Year 2015-16. Based on above Compute the taxable income and tax liability (before deducting TDS) of Ms. X for the A.Y. 2015-16 Rs. 2,600 (being Income-tax refund and Rs. 200 being Interest thereon) Answer. Calculation of tax liability of Mr. X Basic salary 1200000

- 2. Q2. a) How is advance money received against cost of acquisition adjusted? b) State giving reasons, whether the following assets are Short term or Long term: i) X purchases a house on 10th March 2012 and transfers on 6th June 2014. ii) Y purchases unquoted shares in an Indian company on 10th March 2012 and transfers on 6th June 2012. iii) Z acquires units of mutual fund on 7th July 2013 and transfers those on 10th July 2014. iv) A purchases diamonds on 12 September 2011 and gifts the same to his friend B on 31st December 2014 and B transfers the asset on 20 October 2014. Answer. a) Adjustment of advance money received against cost of acquisition (Section 51) It is possible for an assessee to receive some advance in regard to the transfer of capital asset. Due to breakdown of negotiations the assessee may have retained the advance. In calculating capital gains the above advance retained by the assessee must be used to reduce the cost of acquisition. Q3. Ms. A purchases a house property on 1st January 1976 for Rs. 95,000. She enters into an Agreement for sale of the same property to Mr. X on 1st November 1983 and receives Rs. 10,000 as advance. Following the demise of Mr. X immediately thereafter, the money was forfeited by Ms. A. Later Ms. A gifts her property to her friend Ms. B on 15th May 1985. The following expenses are incurred by Ms. A and Ms. B for improvement of the property: Particulars Cost (Rs.) Additions of two rooms by Ms. A during 1978-79 25,000 Addition of first floor by Ms. A during 1983-84 40,000 Addition of second floor by Ms. B during 1990-91 1,15,000 Ms. B enters into an agreement for sell the property for RS. 8,50,000 to Mr. P on 1st April 1993after receiving an advance of Rs. 50,000. Mr. P could not pay the balance amount within the stipulated time of two months and Ms. B forfeits the amount of advance. Ms. B finally transfers the property toMs. C for Rs. 14,75,000 on 1st December 2014. Given the Fair Market Value of the property on 1st April 1981 being Rs. 1,15,000; Cost Inflation Index for 1981-82 : Rs. 100; for 1983-84 : Rs.116; for 1985-86 : Rs. 133; for 1990-91 : Rs. 182; for 1993-94 : Rs. 244 and 2014-15: Rs.1,024 compute the Capital gains in the hands of Ms. B for the Assessment Year 2015-16. Answer. Calculation of the capital gain of Ms. B for the A.Y 2015-16

- 3. Sale Proceeds 14,75,000 Less: Indexed cost of acquisition 70,356 Q4. i) Ms. Brinda, a U.S. citizen visits India on 1st January 2014 to study and conduct research on Indian folk culture. She has been regularly visiting India for 100 days in the past five consecutive years to carry the research. Advise the residential status of Ms. Brinda under extant rules referring to section 6 of the Income-tax Act 1961. ii) What are the provisions of Advance tax under section 2(1)? Answer. i) Residential status: On the parameter of residence in India, there are three categories: resident, non-resident, and not ordinarily resident. The definition depends upon physical presence of the person in case of individuals, and upon control and management in case of companies and HUFs. Q5. Explain the need of Service tax in India. What are the different approaches to Service tax in India? Answer. Service tax is a tax levied by Central Government of India on services provided or to be provided excluding services covered under negative list and considering the Place of Provision of Services Rules, 2012 and collected as per Point of Taxation Rules, 2011 from the person liable to pay service tax. Person liable to pay service tax is governed by Service Tax Rules, 1994 he may be service provider or service receiver or any other person made so liable. It is an indirect tax wherein the service provider collects the tax on services from service receiver and pays the same Q6. Mr. X (aged 59 years) furnishes the following Profit and Loss account for the year ended 31st March, 2015. Compute the Gross Total Income of Mr. X under respective heads, his Net Taxable Income and Tax liability in the assessment year 2015-16. Particulars Rs. Particulars Rs. General Expenses 13,400 Gross profit 3,15,500 Bad debts 22,000 Commission 8,600 Advance tax 2,000 Brokerage 37,000 Insurance 600 Miscellaneous Income 2,500 Salary to Staff 26,000 Bad Debt Recovery 11,000 Salary to Mr. X 51,000 Interest on Debenture (Net interest Rs.22,500 + TDS Rs. 2,500) 25,000 Interest on Cash Credit 4,000 Interest on Fixed Deposits (Net interest Rs. 11,700 + TDS Rs. 1,300) 13,000 Interest on loan to Mrs. X 42,000

- 4. Interest on Capital of Mr. X 23,000 Depreciation 48,000 Advertisement 7,000 Contribution to Employees’ Provident Fund 13,000 Net Profit 1,60,600 Total 4,12,600 Total 4,12,600 Supplementary information: Permissible depreciation as per CBDT circular is Rs. 37,300 which includes depreciation of permanent glow sign board. i. Advertisement expenditure includes Rs. 3,000, being cost of permanent glow sign board affixed outside the office premises. ii. Commission accrued but not received Rs. 4,500 is not credited to P & L Account. iii. Mr. X pays premium of Rs. 6,000 on his own life. iv. General expenses include: a) Rs. 500 spent for arranging a party for Mr. X’s son who arrives from Canada. b) Rs. 1,000 for contribution toa political party. v. Loan availed from Mrs. X was for payment of arrear tax. A Mr. X (aged 59 years) furnishes the above Profit and Loss account for the year ended 31st March, 2015. Compute the Gross Total Income of Mr. X under respective heads, his Net Taxable Income and Tax liability in the assessment year 2015-16. Answer. Computation of Gross Total Income of Mr. X under respective heads, his Net Taxable Income and Tax liability in the assessment year 2015-16: Spring-2016 Get solved assignments at nominal price of Rs.125 each. Mail us at: subjects4u@gmail.com or contact at 09882243490