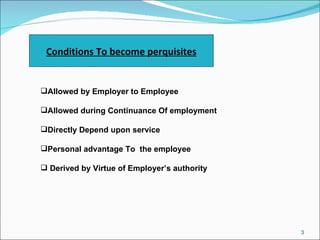

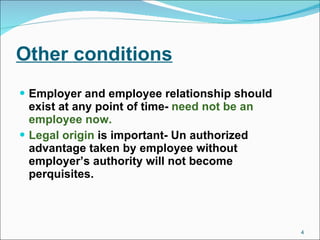

The document discusses various types of perquisites that are taxable in the hands of an employee. It defines perquisites as casual emoluments or benefits provided to an employee in addition to their salary. Some key points include:

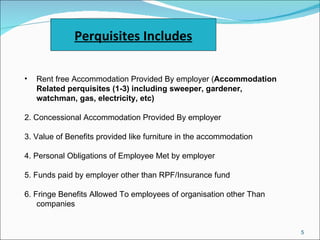

- Rent-free accommodation provided by the employer is taxable as a perquisite. The taxable amount depends on factors like location and whether the property is owned or rented by the employer.

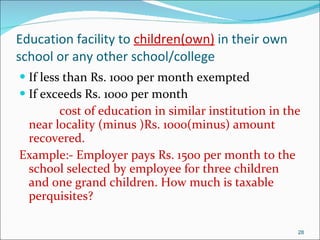

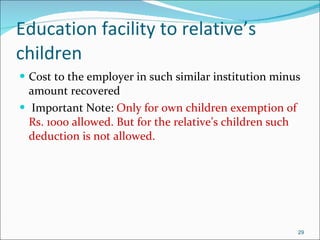

- Other common taxable perquisites include utilities like gas, electricity and water paid by the employer, as well as facilities like transport and education for employees' families.

- There are certain exemptions, like a fixed allowance of up to Rs. 100 per child for education or Rs. 300

![solution Computation of taxable salary of Sri Mohan for assessment Year 2008-09 Basic Salary 120000 Bonus 16000 Dearness allowance(50% forming part of salary) 60000 Project allowance 15000 Commission on purchase 16000 City compensatory allowance 25000 Medical allowance 12000 Employer contribution to RPF in excess of 12% of salary 2000 [20000- 12% of (120000+ 50% of 60000)] Salary from B ltd 80000 Advance of salary 20000 Value of housing facility[10% of (120000+16000+30000+ 31400 15000+16000+25000+12000+80000)] Taxable Salary 397400](https://image.slidesharecdn.com/perquisites-120118000918-phpapp01/85/Perquisites-21-320.jpg)