Women in Fintech: Evolving the Financial Landscape

This document provides perspectives on using FinTech in strategic financial planning from three speakers: Krystyna Kolesar of the Department of the Army, Donnie Harper of the Federal Reserve Bank of Richmond, and Davyd Jones of Edward Jones Investments. Kolesar discusses how the Army is using technology like cloud computing and automation to improve strategic financial planning. Harper outlines the growth of FinTech in corporate and retail sectors and career prospects in data analytics. Jones emphasizes how technology is changing financial planning landscapes and the importance of understanding economics. The overall message is that FinTech is transforming financial systems and there are opportunities to get involved and help shape its responsible development.

Recommended

Recommended

More Related Content

What's hot

What's hot (13)

Similar to Women in Fintech: Evolving the Financial Landscape

Similar to Women in Fintech: Evolving the Financial Landscape (20)

More from Career Communications Group

More from Career Communications Group (20)

Recently uploaded

Recently uploaded (20)

Women in Fintech: Evolving the Financial Landscape

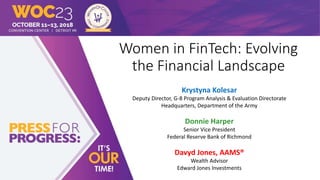

- 1. Women in FinTech: Evolving the Financial Landscape Krystyna Kolesar Deputy Director, G-8 Program Analysis & Evaluation Directorate Headquarters, Department of the Army Donnie Harper Senior Vice President Federal Reserve Bank of Richmond Davyd Jones, AAMS® Wealth Advisor Edward Jones Investments

- 2. Perspectives on using FinTech in Strategic Financial Planning a. How technology is transforming our financial landscapes b. Potential risks to financial stability and integrity that FINTECH may cause, and how we mitigate them c. Practical steps women can take to move forward in the industry d. How a diverse leadership culture is critical to our organization successes with technology Public Sector – Defense Private Sector – Wealth Management Public Sector – Corporate Financial 2 3 Perspectives: Where You Stand Determines How You See FinTech…

- 3. KrystynaKolesar–ArmySeniorExecutive 3 Strategic Financial Planning for the Army: $182B for 5-year Future Years Defense Program: Complex cycles, Using Technology to Buy Technology

- 4. Changing How We Do Strategic Financial Planning Using Technology Use Technology to Solve Problems and Create Opportunities • Use Cloud Computing to Reduce Costs, Create Capacity + Security • Define Decision Space: Show Leaders Multiple Scenarios at Once • Integrate Data + Business Intelligence to answer New Questions • Pilot New Capabilities: AI, Machine Learning, New Analytics… Change How We See Ourselves Change How Leaders See Organizations RPAs mimic actions humans do for computer-based tasks RPAs can Automate: • System Access • Funds Distribution KrystynaKolesar–ArmySeniorExecutive 4

- 5. • Be Empowered as part of our Workforce: Build Skills and Collaborate across Boundaries • Embrace New Technologies that Fit Mission + Security Needs: Understand Tech Benefits and Risks • Contribute to and Leverage our Community • Be Ready to Integrate New Capabilities Find Your Fit: Guide Your Journey Ahead 2018 Technology Rising Star Juley Bates manages a portfolio including Cyber 2018 Technology All Star Annette Henry leads our IT Systems cloud migration Talk with Our Technology Leaders as we celebrate the accomplishments of the Army’s workforce in Science, Technology, Engineering, and Mathematics… KrystynaKolesar–ArmySeniorExecutive 5

- 6. 6 FinTech – Corporate and Retail Sectors: • First U.S. mainstream FinTech – PayPal, many other commercially methods Chase/Samsung/Apple Pay. • Spot solutions are now enterprise class – disrupting the financial services industry. More C2B. • Worldwide adoption of FinTech is estimated at 33% - Investment is estimated at $175 billion/year by 2020. • Quarter of the FinTech market is crypto-currencies (e.g., BitCoin) and blockchain/ distributed ledger technologies. • FinTech is moving beyond just payments – data analytics, trading, mortgages, loans, insurance, etc. • Regulatory and governance activities are lagging behind – but it’s not all the “Wild Wild West.” DonnieHarper–FederalReserveBankofRichmond

- 7. 7 FinTech – Career Prospects: • Most solutions come about as a result of solving a problem, rather than trying to create something new. • Beyond technical competencies – talent to correlate consumer level needs directly with providers, value add. • Business intelligence and data analytics will always be key – every electronic device produces data! • Consider needs others don’t prioritize: e.g., cyber considerations, integration services, project management. • Maintain an entrepreneurial mindset: sky is the limit, anticipate failures, and challenge and status quo. DonnieHarper–FederalReserveBankofRichmond

- 8. 8 •Career Prospects: • Value of women in finance • Technology driving innovation • Value STEM provides • Areas of Growth DavydJones–PrivateSectorWealthManager

- 9. 9 • How Tech is Changing Financial Planning • Wealth controlled by women • Innovation changing landscapes • Behaviors behind it all • Education • Value of understanding the economics behind it all • Impact this has on your future and legacy DavydJones–PrivateSectorWealthManager

- 10. Takeaways on using FinTech in Strategic Financial Planning • Technology is transforming public and private sector financial landscapes • Learn risks and mitigations to benefit from FinTech, and learn how to learn • Shape diverse leadership cultures by bringing your expertise and collaboration 10 Public Sector – Defense Private Sector – Wealth Management Public Sector – Corporate Financial 3 Perspectives: Where You Stand Determines How You See FinTech… Many Opportunities For You to Contribute!