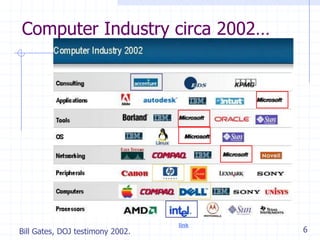

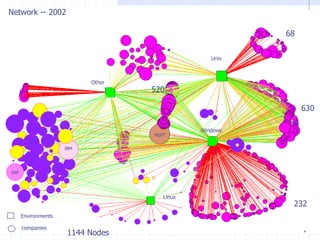

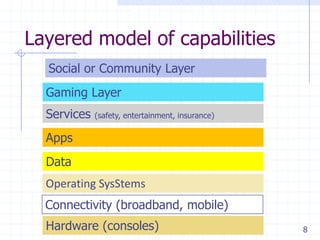

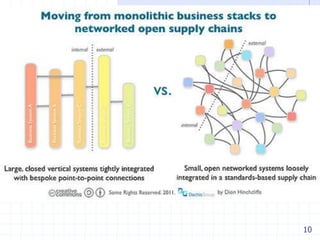

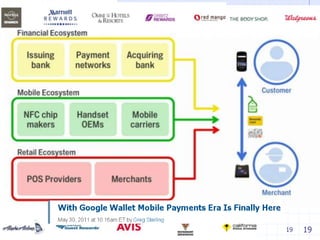

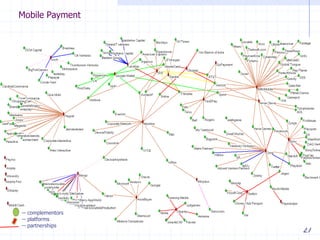

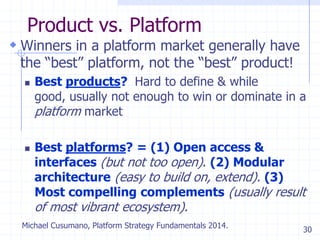

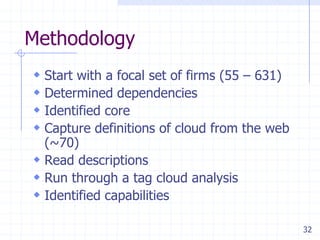

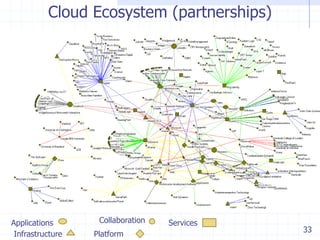

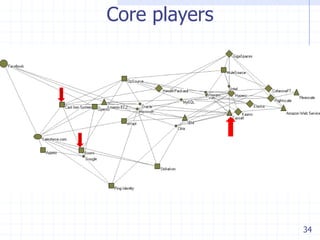

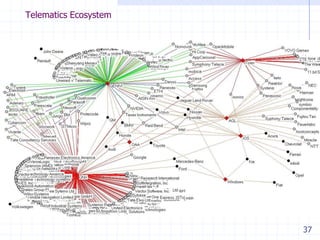

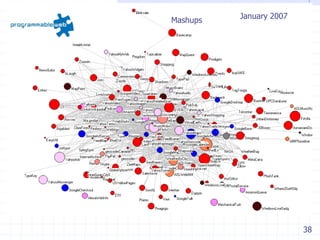

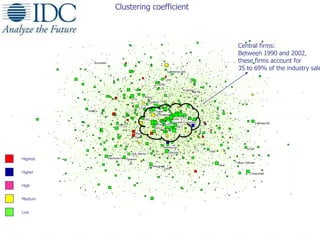

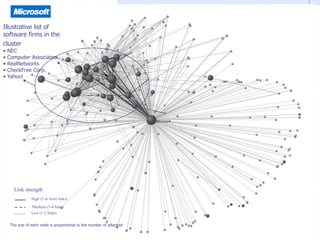

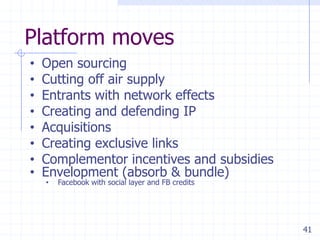

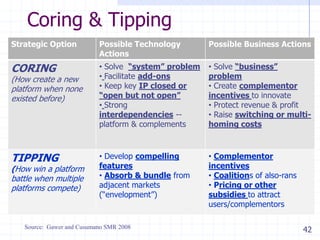

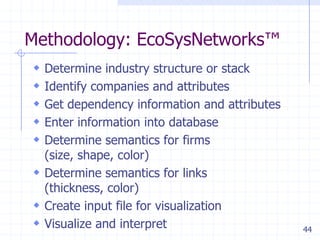

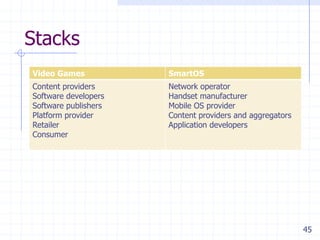

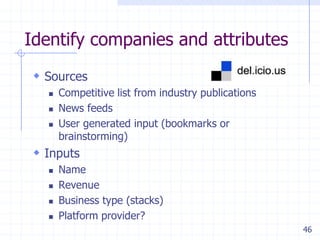

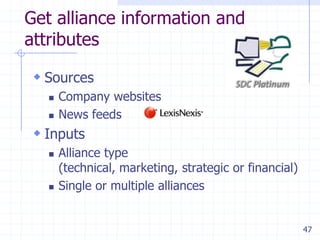

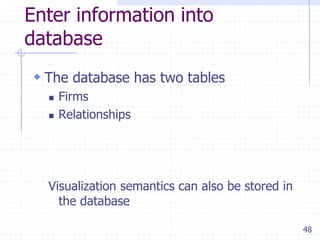

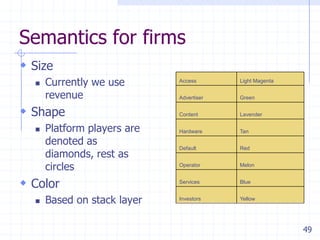

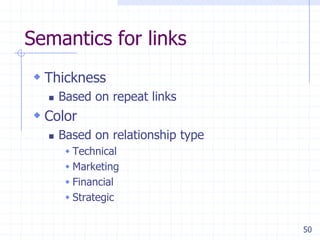

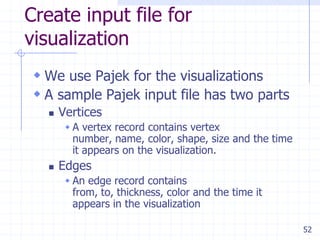

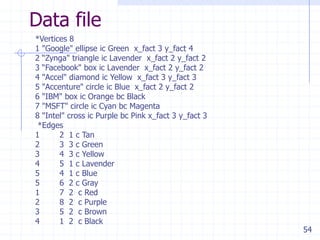

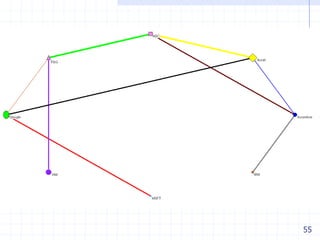

This document provides an overview of visualizing software ecosystems. It begins with an agenda and definitions of ecosystems and industry platforms. Examples of mobile payment, cloud computing, and telematics ecosystems are described. The methodology used to generate ecosystem visualizations is explained, including identifying companies, relationships, and attributes. Semantics are assigned to visualize firms by size, shape and color and relationships by thickness and color. The document concludes with findings on charting your own ecosystem and considering strategic moves.

![3

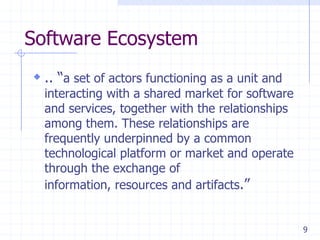

Ecosystem

Loose networks – of suppliers, distributors,

outsourcing firms, makers of related products or

services, technology providers, and a host of other

organizations – that affect, and are affected by the

creation and delivery of a company’s own

offerings. [Marco Iansiti]

An economic community supported by a

foundation of interacting organizations and

individuals—the organisms of the business world.

The economic community produces goods and

services of value to customers, who are themselves

members of the ecosystem [James Moore]](https://image.slidesharecdn.com/ecosystemvisualizationmethodology-140404074050-phpapp01/85/Understanding-Software-Ecosystems-3-320.jpg)

![4

Creating Awesome Users

Don't make a better [X], make a better

[user of X].

Kathy Sierra

Think about how customers experience

the product or service](https://image.slidesharecdn.com/ecosystemvisualizationmethodology-140404074050-phpapp01/85/Understanding-Software-Ecosystems-4-320.jpg)

![5

Computer Industry [circa 1980s…]

Source: Bill Gates Testimony - link

Bill Gates, DOJ testimony 2002.](https://image.slidesharecdn.com/ecosystemvisualizationmethodology-140404074050-phpapp01/85/Understanding-Software-Ecosystems-5-320.jpg)