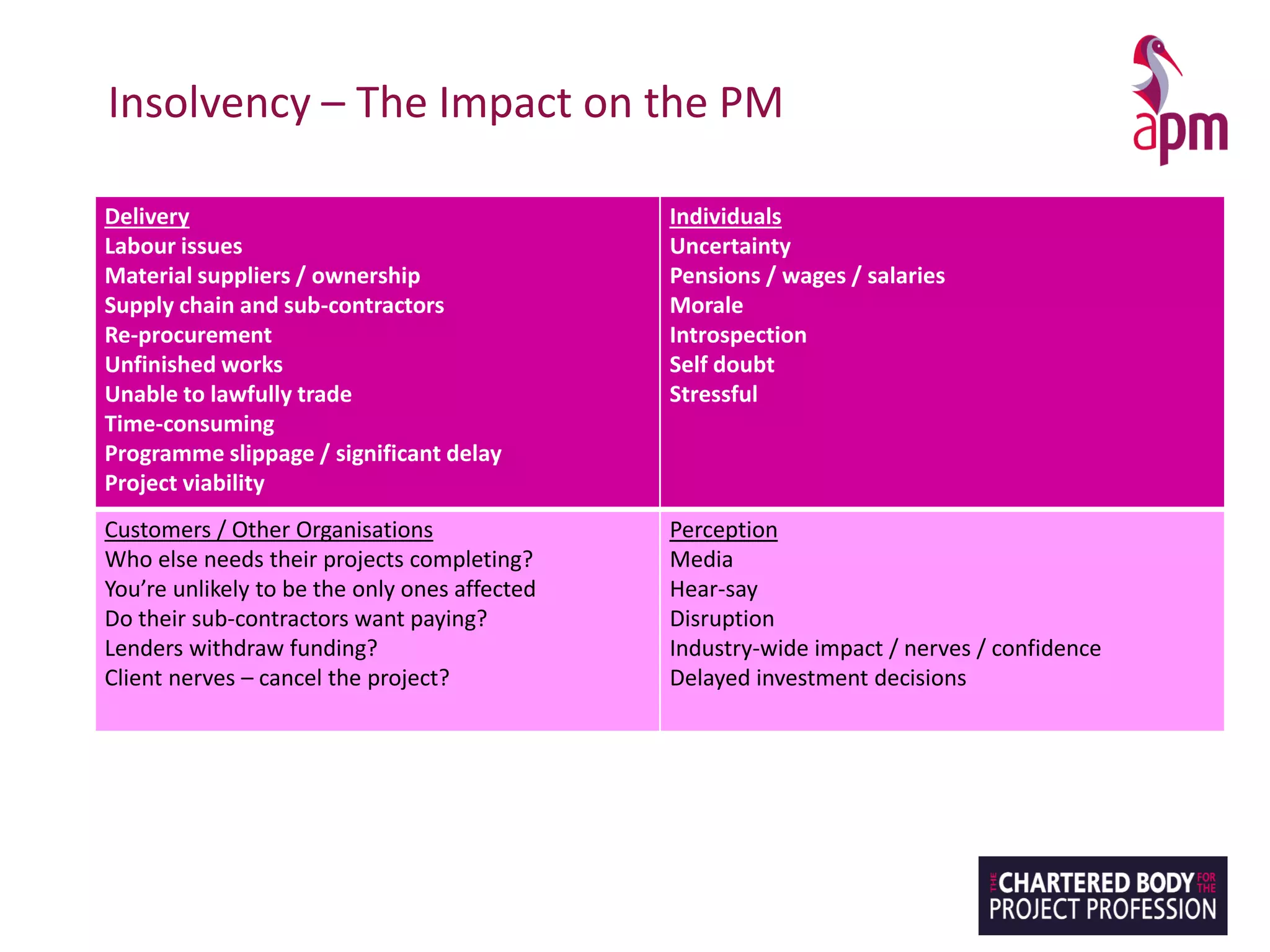

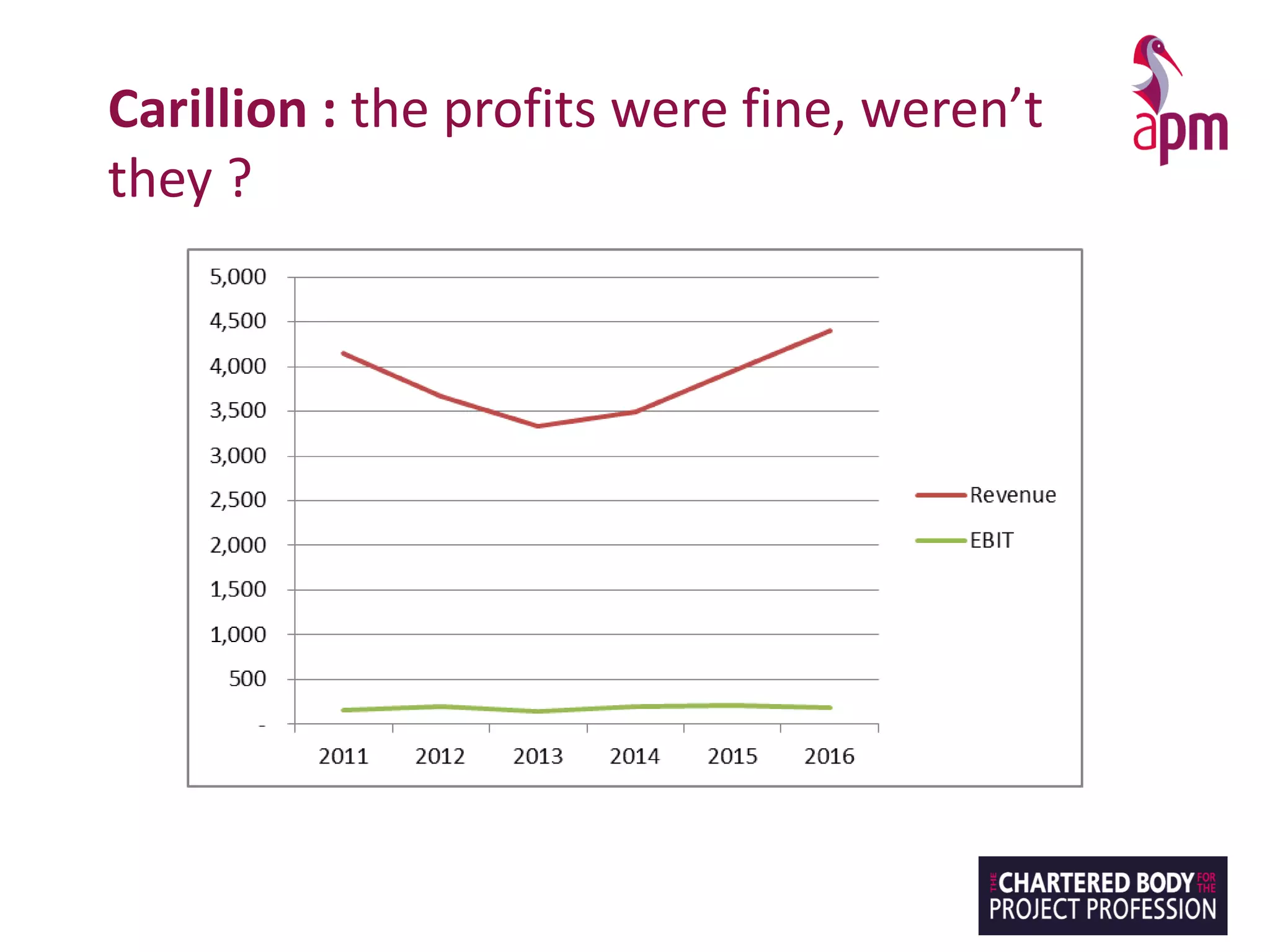

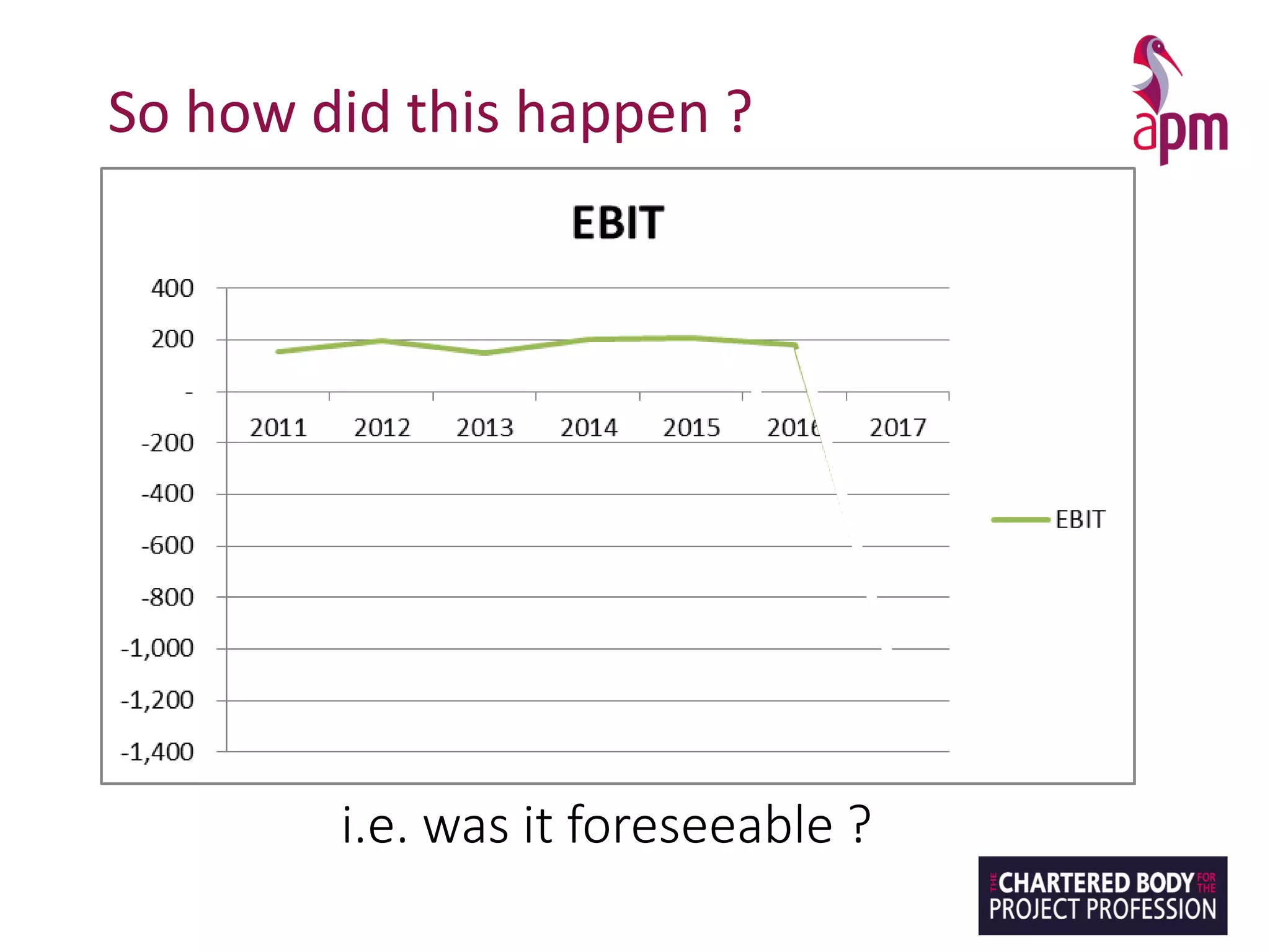

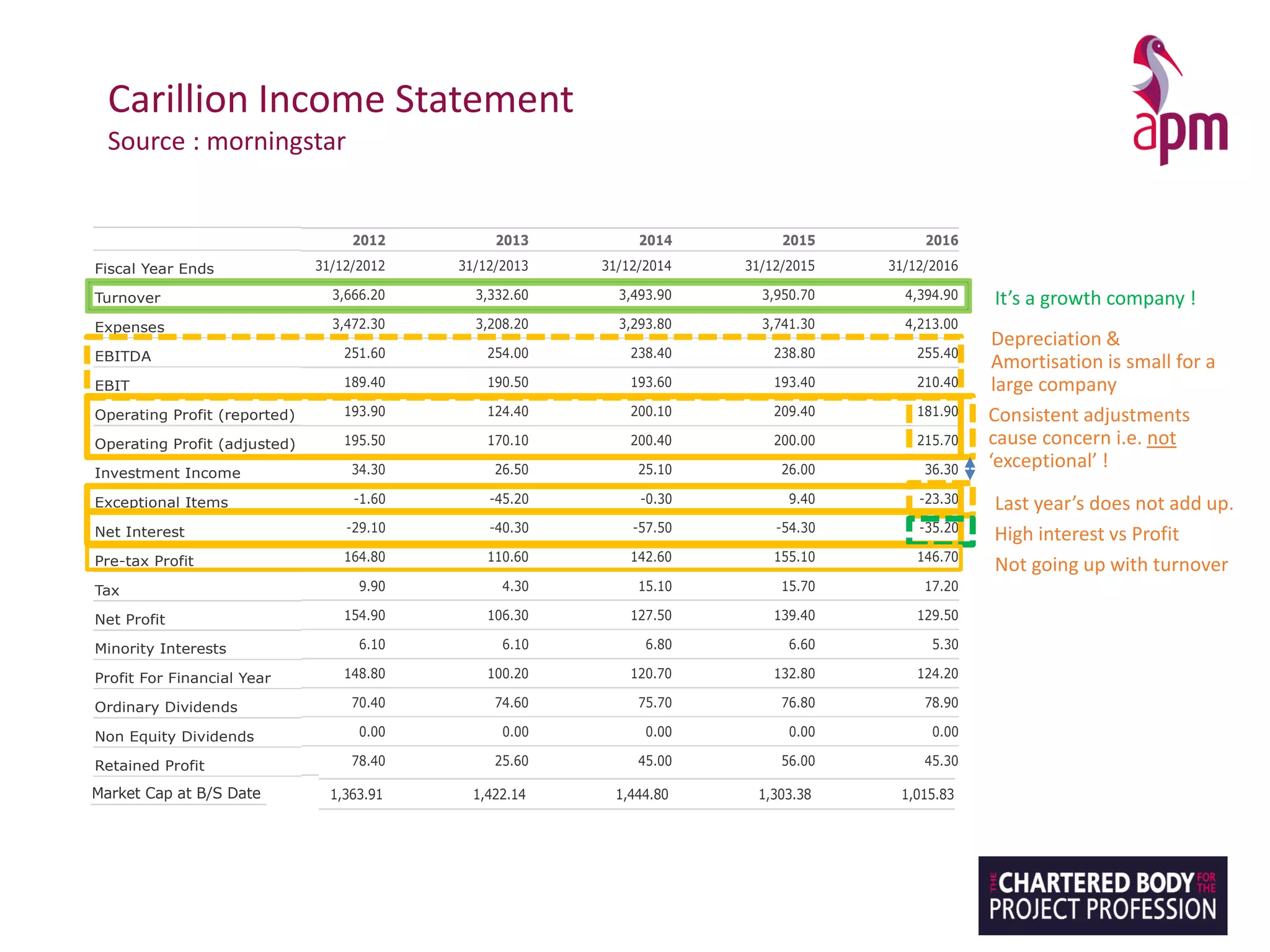

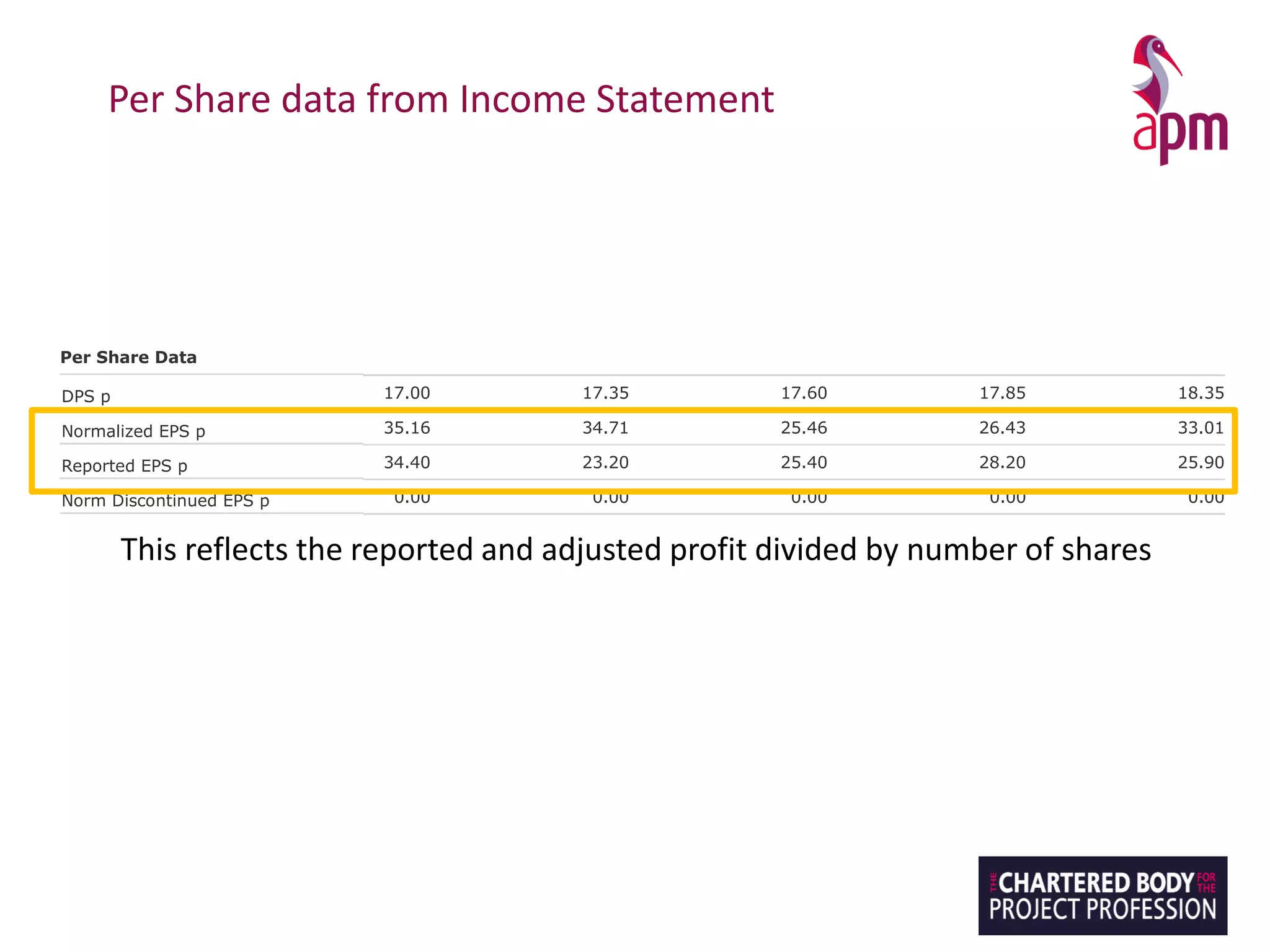

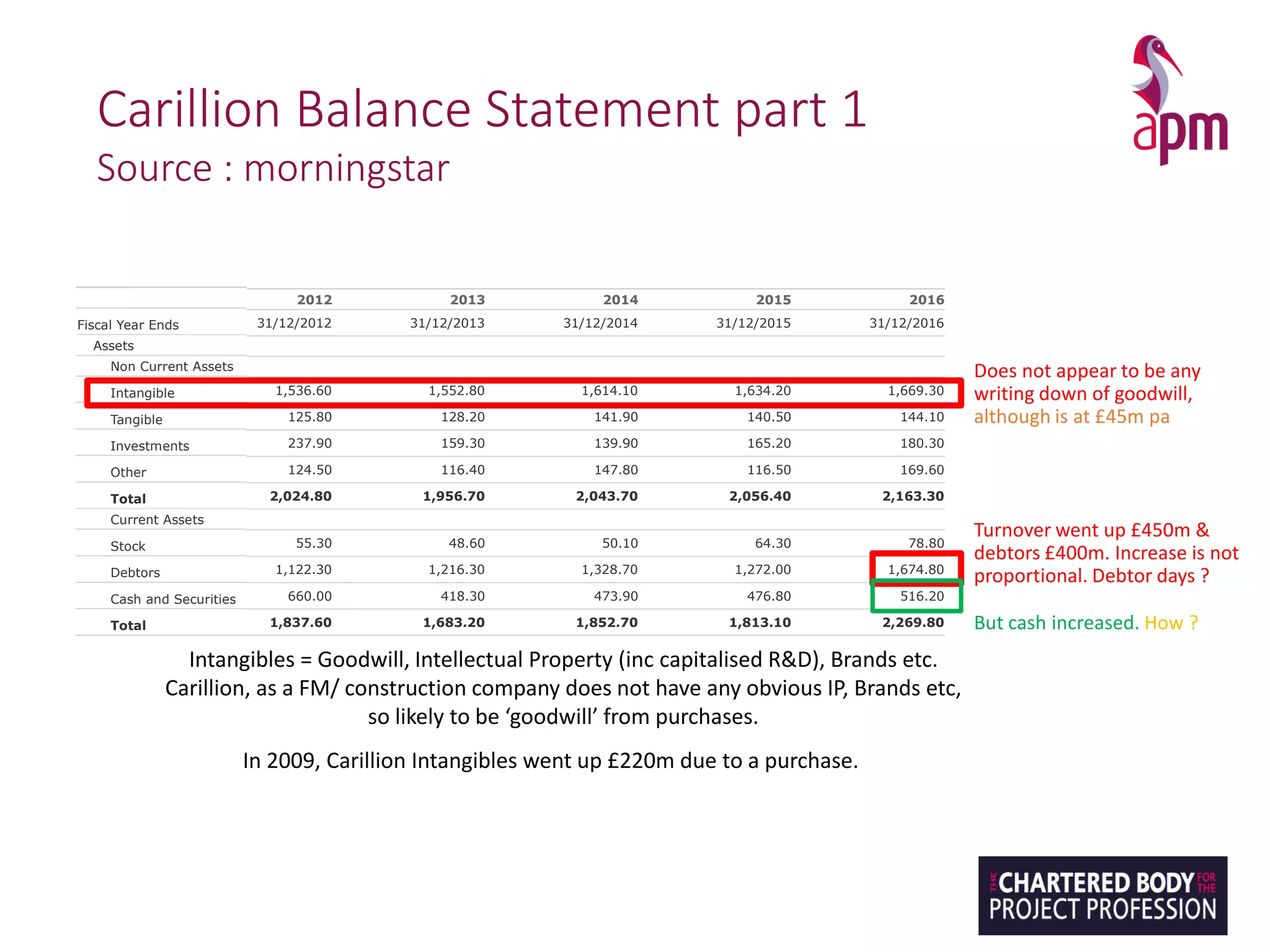

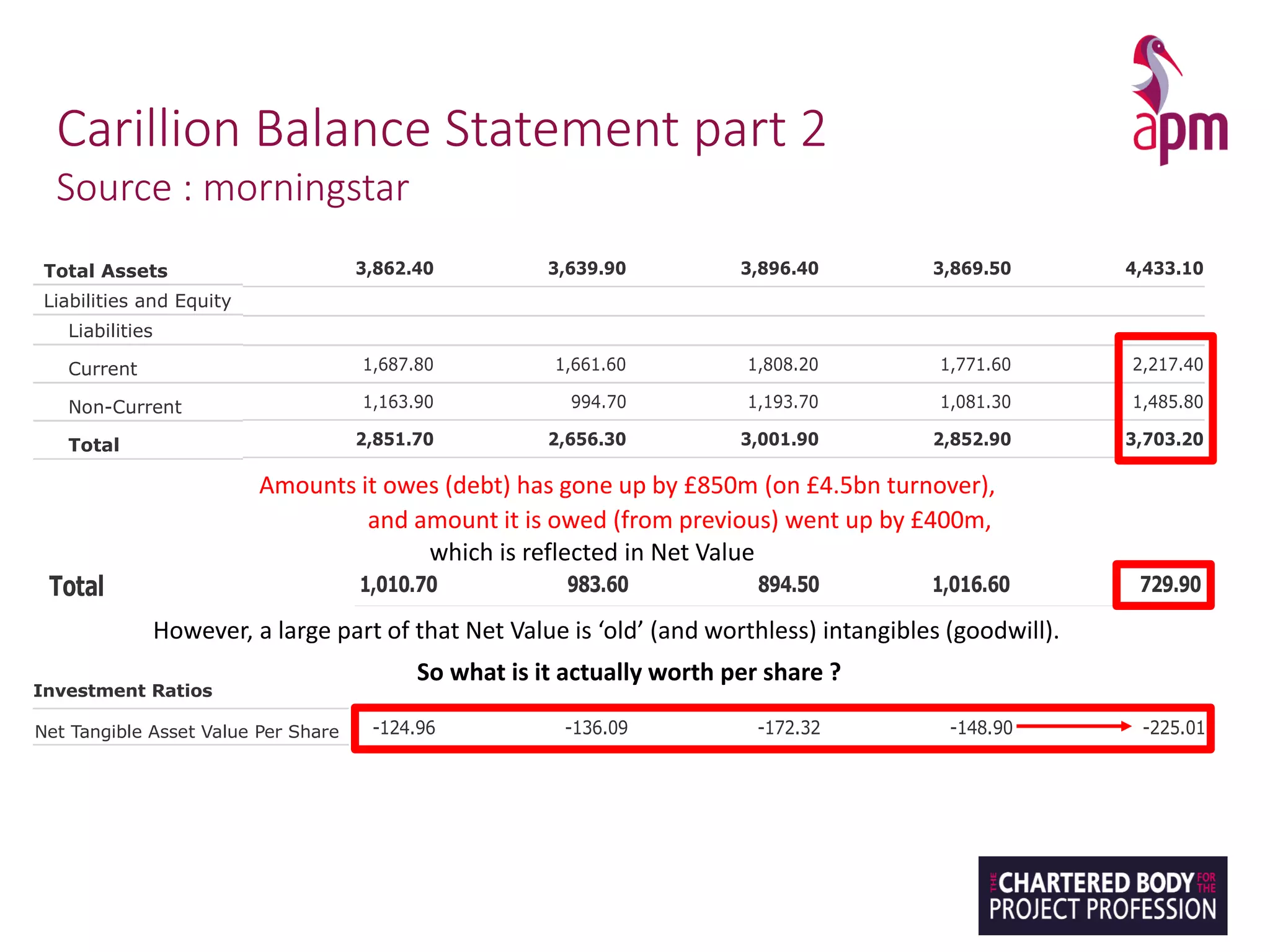

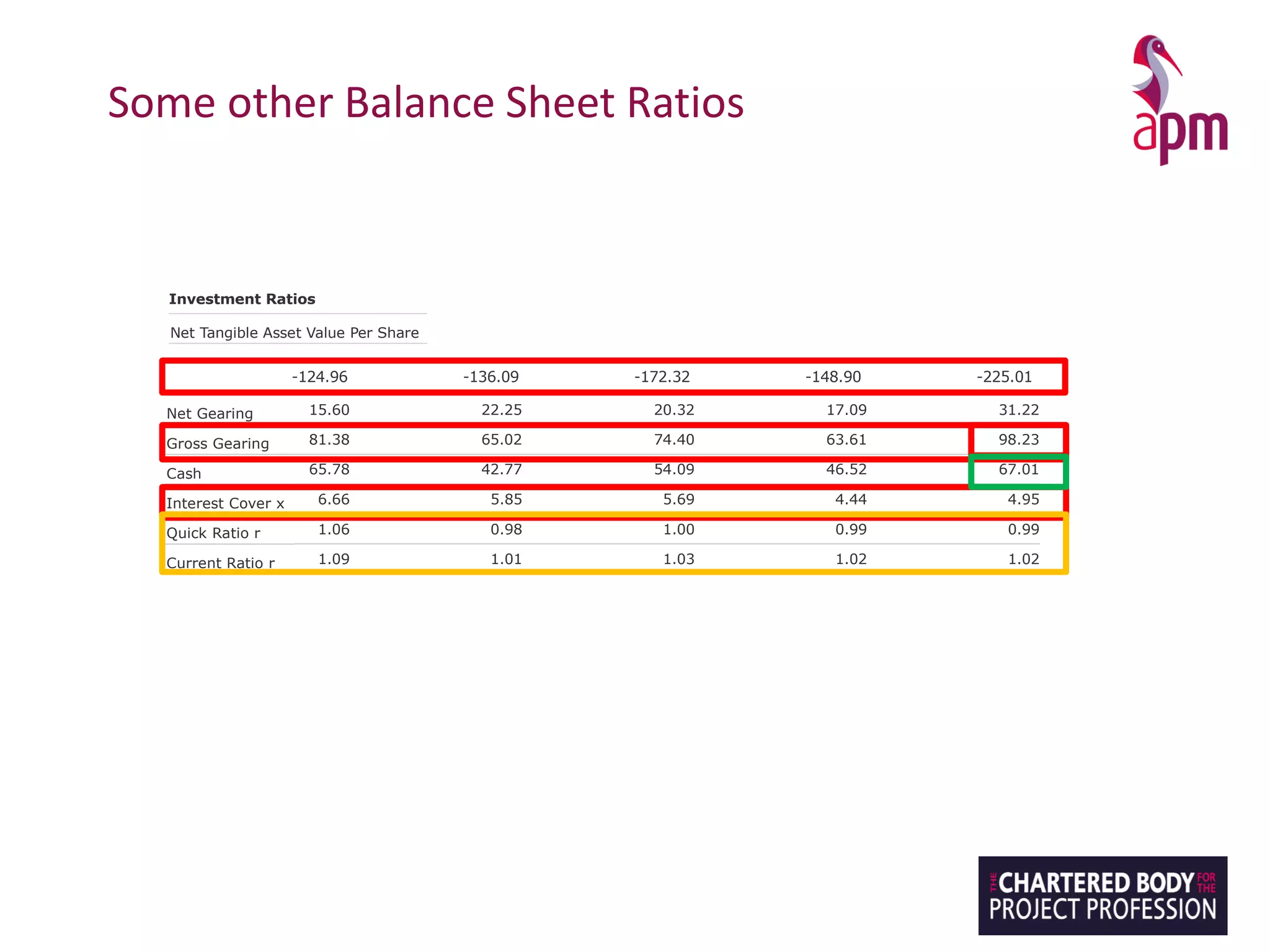

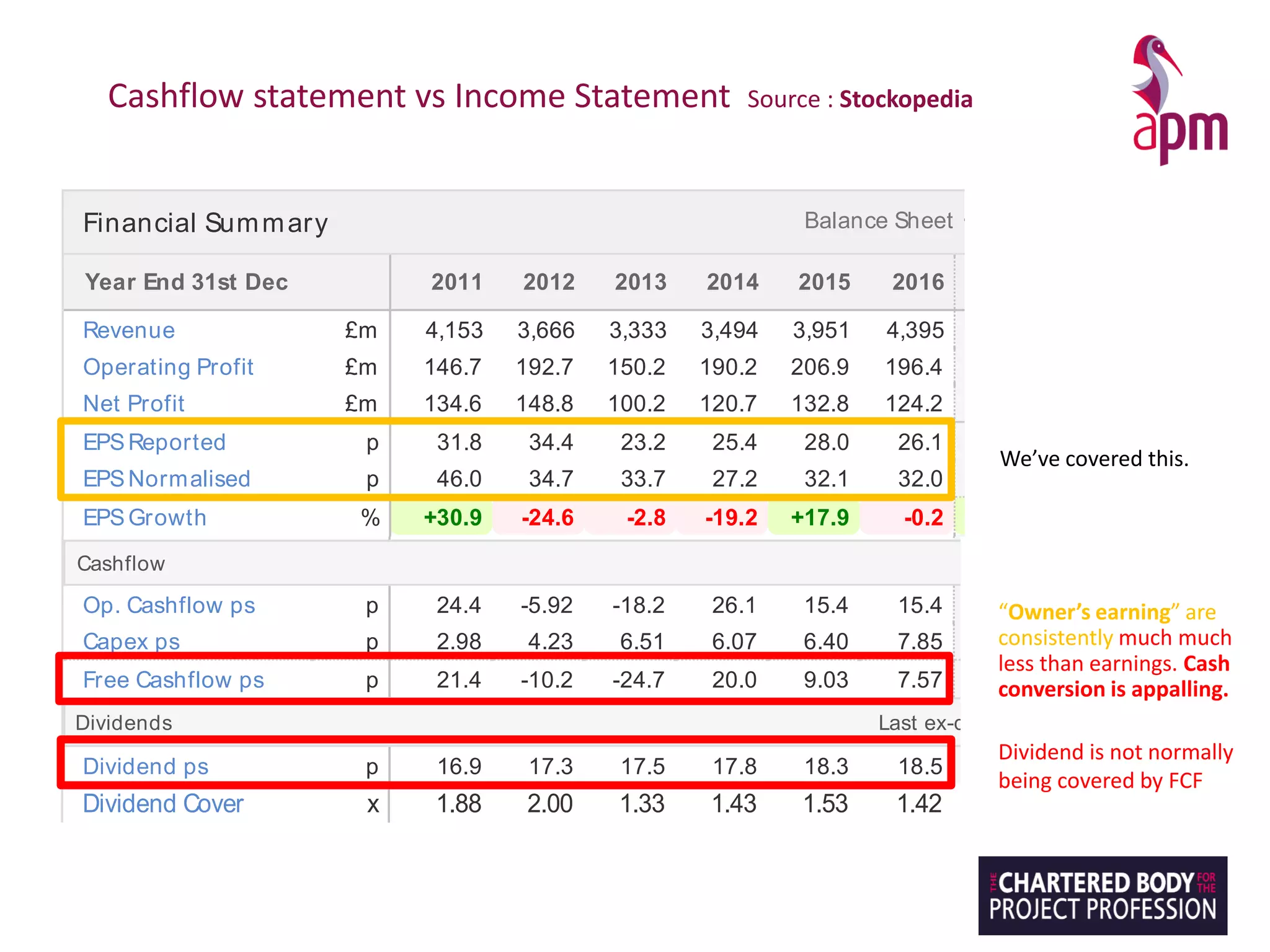

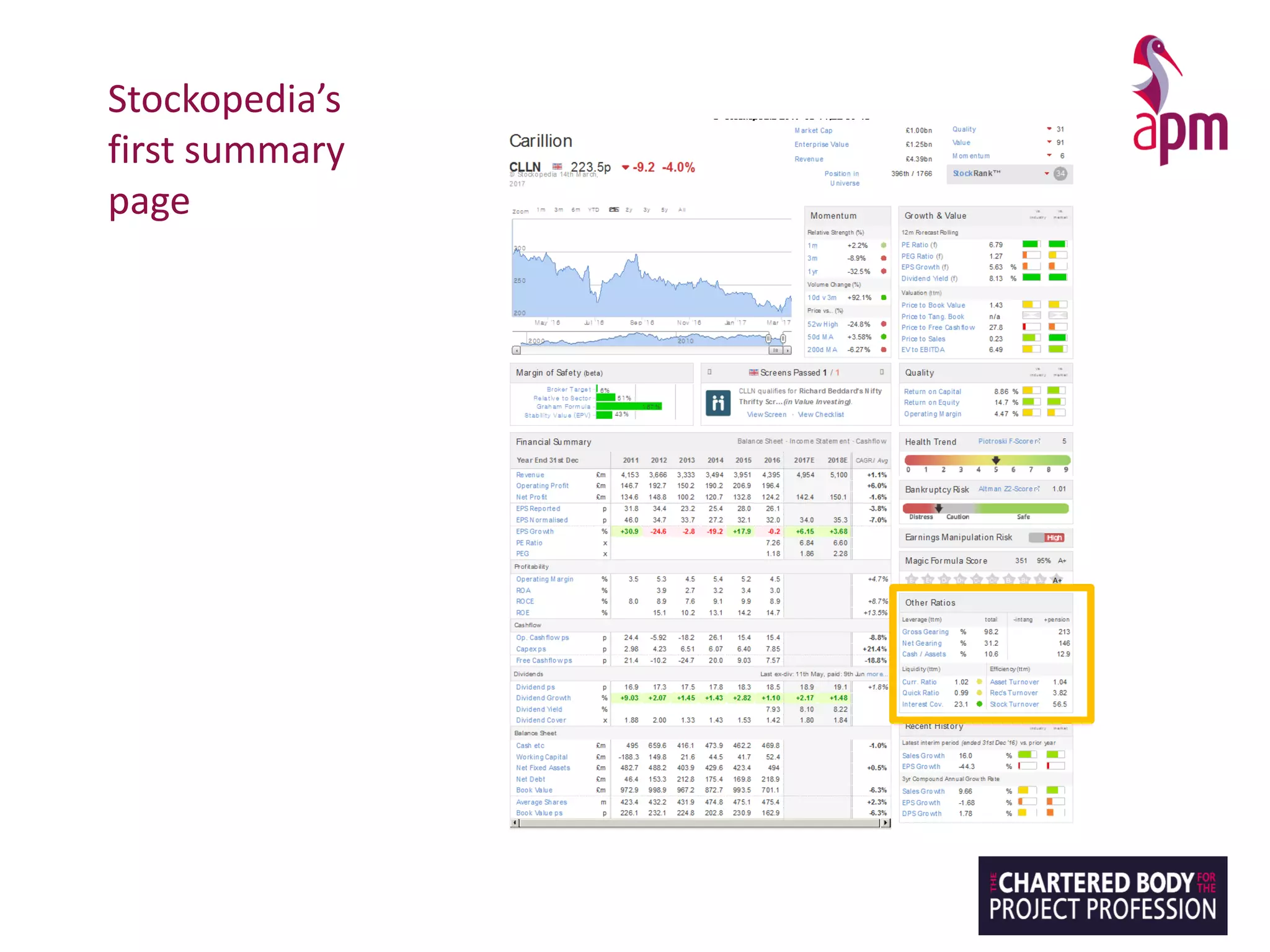

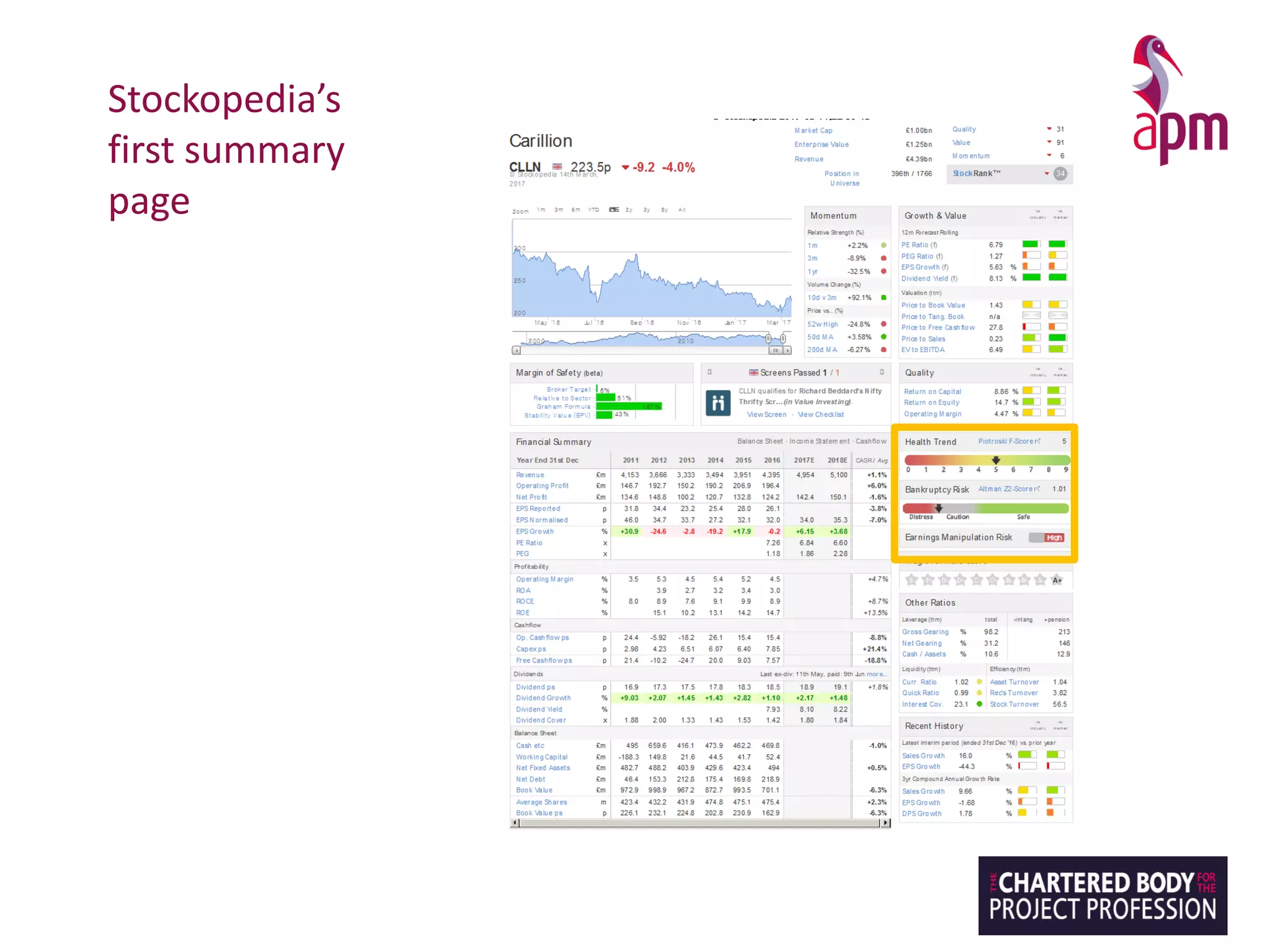

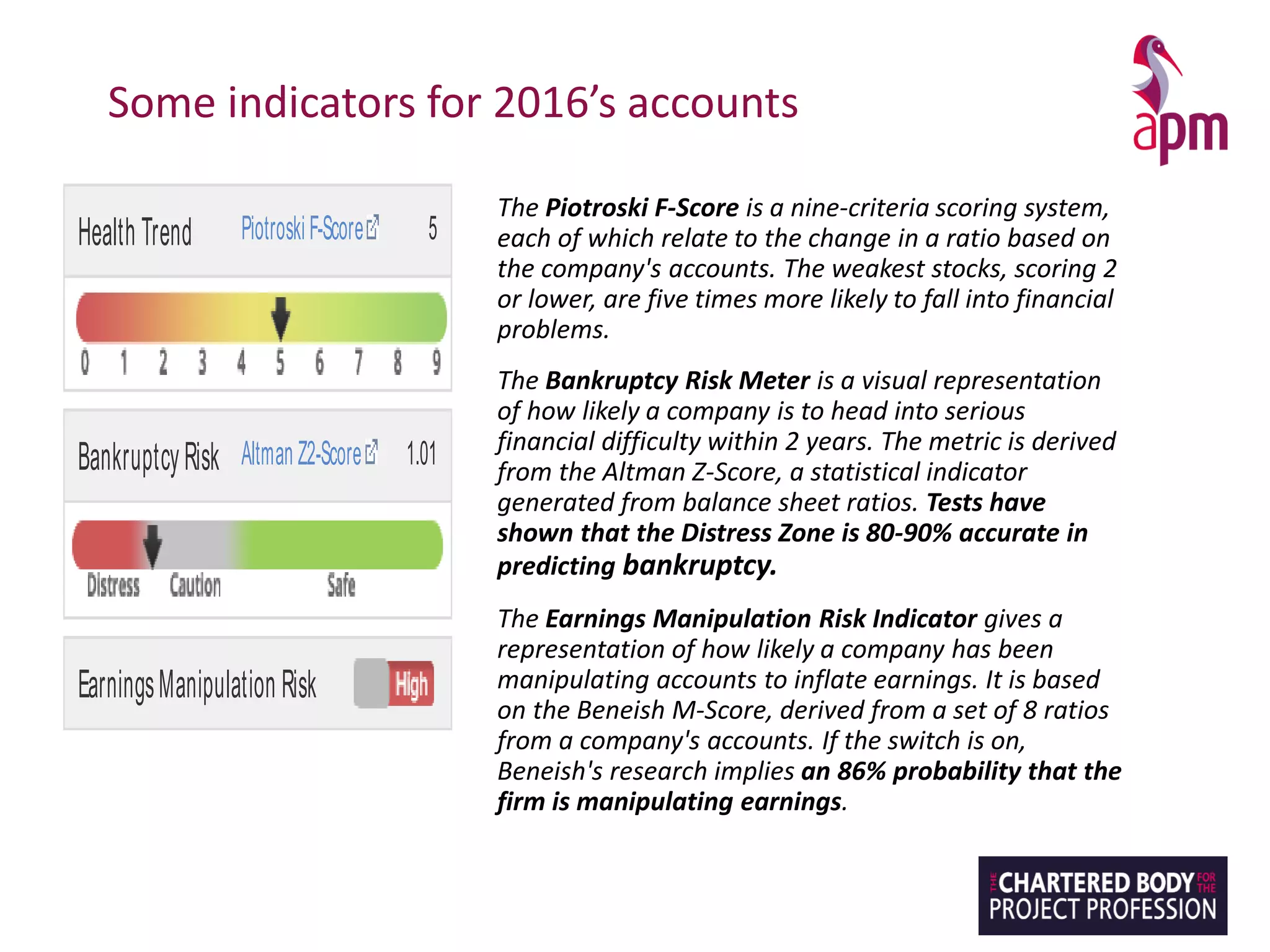

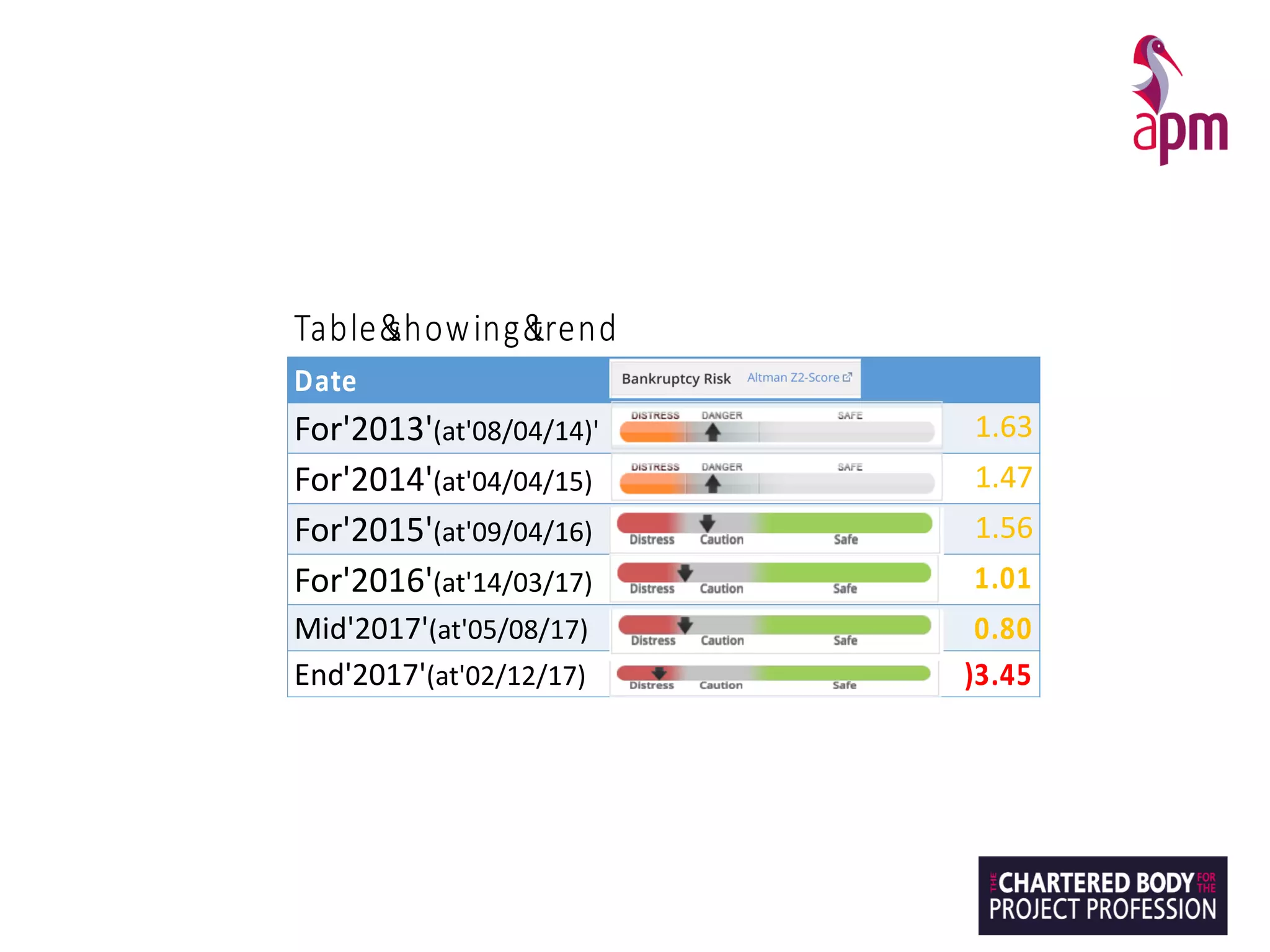

The webinar discusses lessons learned from the Carillion collapse, focusing on the importance of selecting financially sound providers and understanding bankruptcy and insolvency concepts. Key insights include the warning signs of insolvency, the impact of such failures on projects, and the necessity of conducting comprehensive financial due diligence. The presenters emphasize raising awareness among project managers to enable informed discussions with financial professionals, rather than providing specific supplier recommendations.