Aranca Views | China – The Japan of the ‘80s?

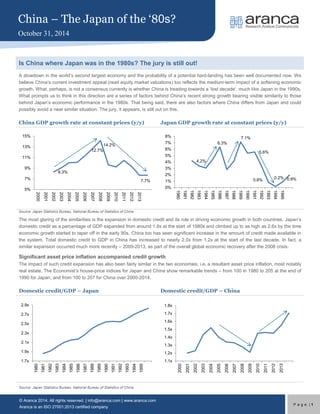

- 1. s China – The Japan of the ‘80s? October 31, 2014 © Aranca 2014. All rights reserved. | info@aranca.com | www.aranca.com Aranca is an ISO 27001:2013 certified company Page | 1 Is China where Japan was in the 1980s? The jury is still out! A slowdown in the world’s second largest economy and the probability of a potential hard-landing has been well documented now. We believe China’s current investment appeal (read equity market valuations) too reflects the medium-term impact of a softening economic growth. What, perhaps, is not a consensus currently is whether China is treading towards a ‘lost decade’, much like Japan in the 1990s. What prompts us to think in this direction are a series of factors behind China’s recent strong growth bearing visible similarity to those behind Japan’s economic performance in the 1980s. That being said, there are also factors where China differs from Japan and could possibly avoid a near similar situation. The jury, it appears, is still out on this. China GDP growth rate at constant prices (y/y) Japan GDP growth rate at constant prices (y/y) Source: Japan Statistics Bureau, National Bureau of Statistics of China The most glaring of the similarities is the expansion in domestic credit and its role in driving economic growth in both countries. Japan’s domestic credit as a percentage of GDP expanded from around 1.8x at the start of 1980s and climbed up to as high as 2.6x by the time economic growth started to taper off in the early 90s. China too has seen significant increase in the amount of credit made available in the system. Total domestic credit to GDP in China has increased to nearly 2.0x from 1.2x at the start of the last decade. In fact, a similar expansion occurred much more recently – 2009-2013, as part of the overall global economic recovery after the 2008 crisis. Significant asset price inflation accompanied credit growth The impact of such credit expansion has also been fairly similar in the two economies, i.e. a resultant asset price inflation, most notably real estate. The Economist’s house-price indices for Japan and China show remarkable trends – from 100 in 1980 to 205 at the end of 1990 for Japan, and from 100 to 207 for China over 2000-2014. Domestic credit/GDP – Japan Domestic credit/GDP – China Source: Japan Statistics Bureau, National Bureau of Statistics of China 8.3% 12.7% 14.2% 7.7% 5% 7% 9% 11% 13% 15% 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 4.2% 6.3% 7.1% 5.6% 0.8% 0.2% 0.9% 0% 1% 2% 3% 4% 5% 6% 7% 8% 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1.7x 1.9x 2.1x 2.3x 2.5x 2.7x 2.9x 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1.1x 1.2x 1.3x 1.4x 1.5x 1.6x 1.7x 1.8x 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

- 2. s China – The Japan of the ‘80s? October 31, 2014 © Aranca 2014. All rights reserved. | info@aranca.com | www.aranca.com Aranca is an ISO 27001:2013 certified company Page | 2 Economist – house price index comparison Urban Commercial land prices, y/y change – Japan Source: Japan Statistics Bureau, National Bureau of Statistics of China The chart on the right above shows the dramatic collapse in commercial real estate prices in Japan after nearly a decade of high credit and strong economic growth. The sharp fall in the real estate prices in Japan also had a significant impact on the country’s financial sector. A large portion of the credit in the market was collateralized against commercial and residential real estate and a drop in the sector spiraled into the banking space. In China too, corporate debt, a big chunk of which is collateralized against real estate properties (mostly commercial), has soared in the recent past. The current level points to corporate debt nearly 130% of the country’s GDP. Will the real-estate sector be China’s Achilles heel too? Should the real estate sector in China suffer a major downturn, its impact on the overall economy could potentially be material. Given the trends seen in the recent past, it would be unwise to not be wary of such a possibility. In a recent note published by Aranca, “China Property Market: Prepare for the End Game? – September, 2014”, analyst Nikhil Salvi points to a visible correction in the market and possible steps being considered by the government to stem it. Sale of commercial real-estate was down by an average 9% in 1H2014 v/s a growth of 35% in 2013. Prices of residential properties fell on a m/m basis in 64 of the top 70 cities in July 2014 v/s just four in 2013 alone. Investment in RE development, y/y change - China Fund sources for RE developers, y/y change – China Source: National Bureau of Statistics of China The impact from a softening real-estate market in China could not only impact the corporate sector and its economic growth, it is also likely to inflate a certain degree of social unrest, given the existing affordability issues and lower disposable income levels in China compared to Japan in the 1980s. 75 110 145 180 215 4Q80 4Q82 4Q84 4Q86 4Q88 4Q90 4Q92 4Q94 4Q96 4Q98 4Q00 4Q02 4Q04 4Q06 4Q08 4Q10 4Q12 2Q14 Japan China -10% -5% 0% 5% 10% 15% 20% 1988 1989 1990 1991 1992 1993 1994 1995 20.5 19.3 19.7 19.2 19.5 19.8 19.3 16.8 16.4 14.7 14.1 13.7 12 13 14 15 16 17 18 19 20 21 Jan-Jul Jan-Aug Jan-Sep Jan-Oct Jan-Nov Jan-Dec Jan-Feb Jan-Mar Jan-Apr Jan-May Jan-Jun Jan-Jul 31.5 28.9 28.7 27.2 27.6 26.5 12.4 6.6 4.5 3.6 3.0 3.2 - 5.0 10.0 15.0 20.0 25.0 30.0 35.0 Jan-Jul Jan-Aug Jan-Sep Jan-Oct Jan-Nov Jan-Dec Jan-Feb Jan-Mar Jan-Apr Jan-May Jan-Jun Jan-Jul 2013 2014 2013 2014 2013

- 3. s China – The Japan of the ‘80s? October 31, 2014 © Aranca 2014. All rights reserved. | info@aranca.com | www.aranca.com Aranca is an ISO 27001:2013 certified company Page | 3 China too suffering from an ageing population and a softening exports sector For economies such as Japan and China and several other Asian nations, working population growth is a reasonable measure of how steady and sustainable economic growth can be. China’s current working age population (15-64) is witnessing a steady decline in growth, similar to what the early 90s in Japan. We believe China’s one-child per family policy, which has been in place for a number of years now, has been the reason behind the plateauing working population. Working population growth – Japan Working population growth – China Source: Japan Statistics Bureau, National Bureau of Statistics of China Another common ground between Japan and China has been their reliance on exports to drive the economy. While Japan’s export industry softened largely as a result of the Plaza Accord which led to a stronger Yen, the resulting stimulus and expansionary policies eventually caused the bubble to bust and further constrained the export industry. China on the other hand, appears to be consciously controlling its exports and focus more on increasing domestic consumption. Given the difference in the demographics between the two nations and given the recent drop in exports growth, domestic consumption patterns need to change meaningfully for them to support overall economic growth. Growth in exports, y/y change – Japan Growth in exports, y/y change – China Source: Japan Statistics Bureau, National Bureau of Statistics of China Further, we believe that China’s competitive advantage in its exports industry has a long-term declining trend given the rising labor costs, production costs and increased focus on climate control and environmental issues globally. While Japan suffered from a structural appreciation in Yen especially after the 1985 Plaza Accord, Yuan’s appreciation has been much more gradual. That being said, rising labor costs in China have acted as a double whammy making exports a lot more uncompetitive now than a few years ago. 0.7% 2.2% 2.0% 1.8% 0.3% 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 0.7% 2.0% 1.9% 1.8% -0.8% 0.5% -1.0% -0.5% 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 -10.0% -5.0% 0.0% 5.0% 10.0% 15.0% 20.0% 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 -15.0% -10.0% -5.0% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

- 4. s China – The Japan of the ‘80s? October 31, 2014 © Aranca 2014. All rights reserved. | info@aranca.com | www.aranca.com Aranca is an ISO 27001:2013 certified company Page | 4 China labor cost and currency movement Significant appreciation in Yen post Plaza Accord Source: Japan Statistics Bureau, National Bureau of Statistics of China Where there are similarities, there are differences too While there are some striking similarities in the growth recipe for China versus what Japan experienced in the 1980s, we list down some differences too. While some may apply the much clichéd ‘too big to fail’ argument in China’s case as well, we do note some structural differences in the two economies as well. China remains relatively below-par when it comes to urbanization levels. A good percentage of the population still lives in semi-urban and rural areas and presents an opportunity to push for higher domestic consumption through increased economic standards. Also, China’s current urbanization levels are similar to what Japan had in the early 1970s. A rapid increase in Japan’s urban population played a crucial role in driving the country’s economic growth in the 1970s and mid-1980s. Urbanization percentage – Japan v China GDP per capita – Japan v China (USD) Source: World Bank The other major difference and partially a result of the lower urban population, is China’s significantly lower per capita GDP compared to where Japan was in the 1980s, nearly 1/6th currently. Both these factors for China were present in case of Japan at a time when the latter was at the cusp of a continued high growth phase. Another important point to note is China’s current population employed in the agriculture sector. With as much as half the population living in semi-urban and rural areas, the agriculture sector currently supports nearly 30% of the country’s population. The percentage has steadily declined over the past three decades, but still remains sizeable. Japan on the other hand had nearly 90% of its population employed by non-agriculture sectors in the 1980s. We believe that a higher agriculture employment presents a few opportunities – 1) 65.0 70.0 75.0 80.0 85.0 90.0 95.0 100.0 105.0 90.0 110.0 130.0 150.0 170.0 190.0 210.0 Mar-00 Feb-01 Jan-02 Dec-02 Nov-03 Oct-04 Sep-05 Aug-06 Jul-07 Jun-08 May-09 Apr-10 Mar-11 Feb-12 Jan-13 Dec-13 Labor cost index USDCNY 20 30 40 50 60 70 80 90 100 110 Mar-80 Jan-81 Nov-81 Sep-82 Jul-83 May-84 Mar-85 Jan-86 Nov-86 Sep-87 Jul-88 May-89 Mar-90 Jan-91 Nov-91 Sep-92 Jul-93 May-94 Mar-95 USDJPY 78 53 0 10 20 30 40 50 60 75 76 76 77 77 78 78 79 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 Japan China 35,451 6,807 0 1000 2000 3000 4000 5000 6000 7000 8000 - 5,000 10,000 15,000 20,000 25,000 30,000 35,000 40,000 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 Japan China

- 5. s China – The Japan of the ‘80s? October 31, 2014 © Aranca 2014. All rights reserved. | info@aranca.com | www.aranca.com Aranca is an ISO 27001:2013 certified company Page | 5 China agriculture employment trend Despite a steady decline, China’s current agriculture employment still remains high at around 30% We believe this offers opportunities for China: 1) A shift to urban and non-agriculture employment could increasing domestic consumption and mitigate the impact of softening exports 2) a shift from agriculture to non-agriculture employment would also offset the ageing working population Source: World Bank it gives China the opportunity to increase the economic standards of its average populace, thereby increasing domestic consumption and mitigating the impact of softening exports, and 2) a shift from agriculture to non-agriculture employment could take care of the ageing working population in the urban areas, an advantage which Japan did not have in the 1990s when its economy began tapering off. We also believe that, given the above factors, China does have room to grow out of the middle-income group into a well-diversified higher earning, spending and consuming upper-middle class. We note that, although there are striking similarities between the current Chinese growth scenario and the Japan of the 1980s, there are opportunities that can help China avoid a prolonged limp in growth. That being said, a lot of these structural opportunities need to be exploited with prudent government policies and controlled and measured investments. Although a ‘lost decade’ for China may still remain far-fetched, it remains to be seen how the rest of the decade unfolds and whether the current hawkish investor stance changes. Policy measures that can avoid a Japan-like scenario and capitalize on the favorable differences: Despite the setup in China being a lot similar to Japan prior to its ‘Lost Decade’, what differs in China’s case is the government’s intentions, although partial, towards taking a tough stand and implement non-populist measures. We believe that, being a non- democratic government is a key differentiator that could make China well equipped to provide a ‘soft-landing’, should the need arise. To this effect, the government has already implemented some preemptive measures like liberalizing the economic sectors in a timely manner, reducing state’s dominance and reforming the financial system. The extent of growth in unproductive capital formation in China is much greater than what Japan had at a similar phase of development. The overinvestment in China has largely been driven by the lower rate of borrowing that the state-owned entities have enjoyed, coupled with the benefits of monopolistic pricing and government subsidies. Withdrawal of these state-sponsored economic moats would make these entities financially unviable, leading to pile up of nonperforming loans and bond defaults. However, we believe the following factors are favorably stacked up in China that would help it avoid a fate similar to that of Japan’s: Growing international pressure to reduce its massive trade surplus would mean appreciating its artificially undervalued currency. With the export story hinging on the currency competitiveness, the country has been gradually scaling back on its protectionist measures, thereby placing a cap on the over investments in sectors with over capacity Unlike Japan, where developed domestic markets were already saturated to absorb the output that lost its export sheen, China has a relatively developing domestic market. This would likely absorb the surplus output from the already installed capacities thereby providing a cushion and reducing the prevalence of bad loans. Chinese authorities also seem to be actively involved in instilling confidence by taking proactive and non-populist measures, something that lacked in Japan’s case. Measures like Chinese Central Bank injecting 500 billion yuan into the country's 25 30 35 40 45 50 55 60 65 70 75 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012

- 6. s China – The Japan of the ‘80s? October 31, 2014 © Aranca 2014. All rights reserved. | info@aranca.com | www.aranca.com Aranca is an ISO 27001:2013 certified company Page | 6 undercapitalized top banks (providing buffer against the increasing bad loans) and expanding the municipal-bond market allowing localities to refinance with direct bond sales will boost sentiment in the financial system. Property markets have also seen measures like improving mortgage loan criteria and increasing tax rates to reduce speculative purchases to address asset bubble concerns. Meanwhile, Pension scheme reforms of uniting the urban and rural systems, would see increased public funds lending support to the local markets. Curtailing Shadow Banking: Shadow banking has been one of the primary concerns, which is estimated to have artificially kept the interest rates lower. Smaller banks in China, faced with stringent competition, have been more aggressive to adopt shadow banking, fueling growth for interbank activities. With a view to instill confidence in the financial system and stem the growth of shadow banking, policymakers recently tightened market liquidity to address alarming levels of interbank funding transactions. Beijing has also been tightening its policy on wealth management products, cross-border arbitrage flows and the bond market aimed at curbing the money flow into the riskier shadow banking activities. Initiatives like these are an indication of the government’s intent to tackle the growing public debt menace and avoid a fate as that of Japan’s. We believe such measures would see China continue on a path of growth, which although might be lower than the standards it achieved in the past three decades, but would be safer than the path Japan found itself on. Shadow banking– China Some of the policy actions taken by the government to curb the growth in shadow banking in China include: 1. Regulations on wealth management products by issuing accounting rules for banks for such products 2. Less aggressive stance on injecting liquidity in the system in a scenario of sudden spike in interest rates 3. Stronger auditing of local government and municipality debt 4. Setting up a financial regulation coordination entity under the purview of the PBoC and other financial institutions Source: National Bureau of Statistics of China Research Note by: Avinash Ganesh Singh with contribution from Lekha Badlani, Nitisha Pagaria and Tushar Patil - 5,000 10,000 15,000 20,000 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Regulated lending Unregulated lending (CNY bn)

- 7. s China – The Japan of the ‘80s? October 31, 2014 © Aranca 2014. All rights reserved. | info@aranca.com | www.aranca.com Aranca is an ISO 27001:2013 certified company Page | 7 ARANCA DISCLAIMER This report is published by Aranca, Inc. Aranca is a customized research and analytics services provider to global clients. The information contained in this document is confidential and is solely for use of those persons to whom it is addressed and may not be reproduced, further distributed to any other person or published, in whole or in part, for any purpose. This document is based on data sources that are publicly available and are thought to be reliable. Aranca may not have verified all of this information with third parties. Neither Aranca nor its advisors, directors or employees can guarantee the accuracy, reasonableness or completeness of the information received from any sources consulted for this publication, and neither Aranca nor its advisors, directors or employees accepts any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of this document or its contents or otherwise arising in connection with this document. Further, this document is not an offer to buy or sell any security, commodity or currency. This document does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. The appropriateness of a particular investment or currency will depend on an investor’s individual circumstances and objectives. The investments referred to in this document may not be suitable for all investors. This document is not to be relied upon and should not be used in substitution for the exercise of independent judgment. This document may contain certain statements, estimates, and projections with respect to the anticipated future performance of securities, commodities or currencies suggested. Such statements, estimates, and projections are based on information that we consider reliable and may reflect various assumptions made concerning anticipated economic developments, which have not been independently verified and may or may not prove correct. No representation or warranty is made as to the accuracy of such statements, estimates, and projections or as to its fitness for the purpose intended and it should not be relied upon as such. Opinions expressed are our current opinions as of the date appearing on this material only and may change without notice. © 2014, Aranca. All rights reserved.