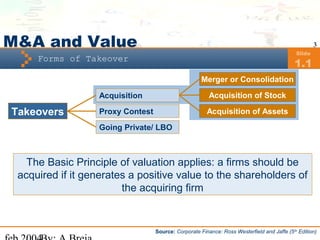

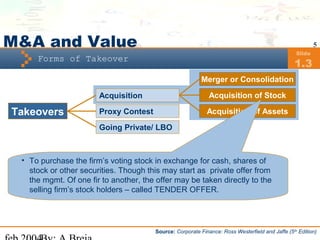

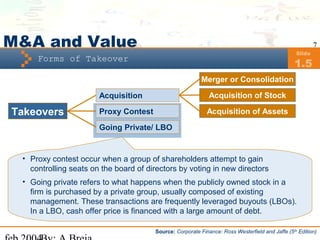

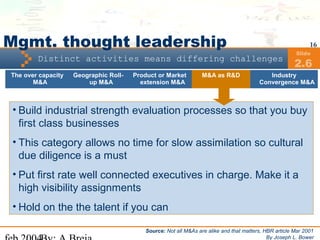

The document discusses the different types of mergers and acquisitions (M&A) and the unique challenges that each presents for management. It outlines seven types of M&As - overcapacity M&A, geographic roll-up M&A, product/market extension M&A, M&A as R&D, industry convergence M&A - and notes that distinct activities lead to differing management challenges for each type. Key challenges addressed include rationalizing merged companies, dealing with cultural differences, conducting thorough due diligence, and allowing acquired companies autonomy versus forcing integration. The document is intended to help management tailor their approach to the specific type of M&A.

![60

Cisco’s acquisition strategy

Slide

5.10

Vignette – Cisco Systems

Both firms must share similar visions “about where the industry is

going [and] what role each company wants to play in the industry. So you

have to look at the visions of both companies and if they are dramatically

different, you should back away.”

The acquisition must “produce quick wins for [the] shareholders.”

There must be “long-term wins for all four constituencies --

shareholders, employees, customers, and business partners.”

“The chemistry (between the companies) has to be right.” He

thought that this was difficult to define, but involved both parties being

comfortable with their counterparts.

Geographic proximity is important. If the newly acquired firm is

located close to Cisco, then interaction will be easier.

Source: Understanding Cisco’s Acquisition and Development Strategy (Working paper , 2004)

By: Prof. Martin F. Kenney, Department of Human and Community Development, Univ. of California](https://image.slidesharecdn.com/ma-12411972307-phpapp01/85/Mergers-amp-Acquisitions-in-High-Tech-Industry-60-320.jpg)