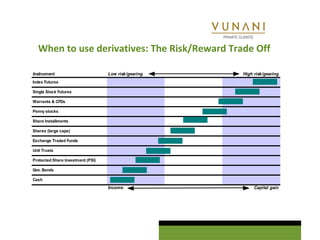

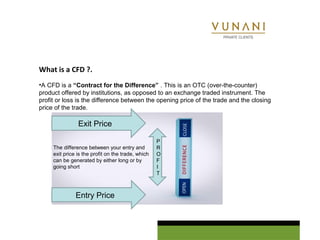

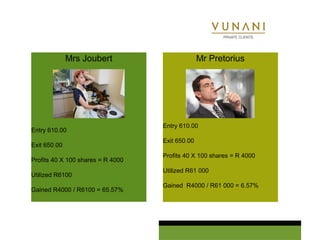

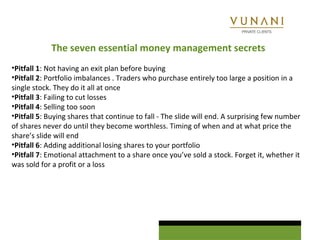

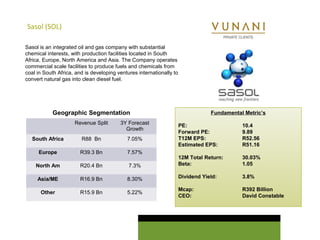

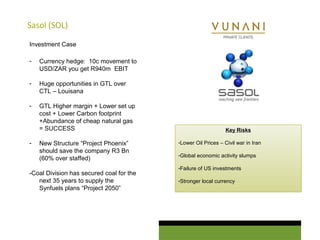

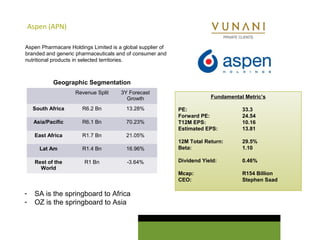

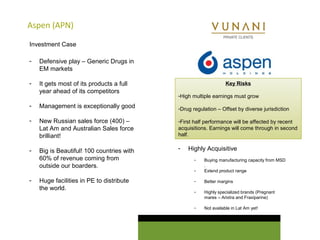

The document outlines a trading blueprint, detailing the differences between investors and traders, and provides essential trading tools and money management secrets. It highlights the use of derivatives for trading strategies and introduces two stock recommendations, Sasol and Aspen Pharmacare, including their key metrics and investment risks. The document emphasizes the significance of having a clear trading approach and awareness of market dynamics to achieve successful outcomes.