UAE VAT Capital Assets Scheme

•Download as DOCX, PDF•

0 likes•21 views

Capital Assets Scheme is a scheme whereby the initially recovered Input Tax is adjusted based on the actual use during a specific period.

Report

Share

Report

Share

Recommended

Fixed Assets Accounting is very essential for matching costs with revenues. A fixed asset is an asset held with the intention of being used for producing goods. Check the above presentation for in-depth details.

For more such innovative content on management studies, join WeSchool PGDM-DLP Program: http://bit.ly/SlideshareFaccounting

Join us on Facebook: http://www.facebook.com/welearnindia

Follow us on Twitter: https://twitter.com/WeLearnIndia

Read our latest blog at: http://welearnindia.wordpress.com

Subscribe to our Slideshare Channel: http://www.slideshare.net/welingkarDLPFixed Assets Accounting

Fixed Assets AccountingWe Learn - A Continuous Learning Forum from Welingkar's Distance Learning Program.

Summary of the_new_amendments_to_the_executive_regulations_for_law_no_19_of_2...

Summary of the_new_amendments_to_the_executive_regulations_for_law_no_19_of_2...Warba Insurance Co Kuwait

Impact of VAT on Construction and Real Estate in UAEImpact of VAT on Construction and Real Estate in UAE

Impact of VAT on Construction and Real Estate in UAESyed Asif Zaman ACA, FPFA, AAIA, CISA, MBA, B.Sc.

More Related Content

What's hot

Fixed Assets Accounting is very essential for matching costs with revenues. A fixed asset is an asset held with the intention of being used for producing goods. Check the above presentation for in-depth details.

For more such innovative content on management studies, join WeSchool PGDM-DLP Program: http://bit.ly/SlideshareFaccounting

Join us on Facebook: http://www.facebook.com/welearnindia

Follow us on Twitter: https://twitter.com/WeLearnIndia

Read our latest blog at: http://welearnindia.wordpress.com

Subscribe to our Slideshare Channel: http://www.slideshare.net/welingkarDLPFixed Assets Accounting

Fixed Assets AccountingWe Learn - A Continuous Learning Forum from Welingkar's Distance Learning Program.

Summary of the_new_amendments_to_the_executive_regulations_for_law_no_19_of_2...

Summary of the_new_amendments_to_the_executive_regulations_for_law_no_19_of_2...Warba Insurance Co Kuwait

What's hot (13)

Circular No. 123/42/2019– GST dated 11th November 2019

Circular No. 123/42/2019– GST dated 11th November 2019

Summary of the_new_amendments_to_the_executive_regulations_for_law_no_19_of_2...

Summary of the_new_amendments_to_the_executive_regulations_for_law_no_19_of_2...

Similar to UAE VAT Capital Assets Scheme

Impact of VAT on Construction and Real Estate in UAEImpact of VAT on Construction and Real Estate in UAE

Impact of VAT on Construction and Real Estate in UAESyed Asif Zaman ACA, FPFA, AAIA, CISA, MBA, B.Sc.

Similar to UAE VAT Capital Assets Scheme (20)

Impact of VAT on Construction and Real Estate in UAE

Impact of VAT on Construction and Real Estate in UAE

Direct Tax Planning and financial management decisions

Direct Tax Planning and financial management decisions

Chapter 10 - VAT Recovery | Taxation & VAT - UAE | Skillmount Online Diploma ...

Chapter 10 - VAT Recovery | Taxation & VAT - UAE | Skillmount Online Diploma ...

Income Tax Amendments Applicable to AY 2020-21 (FY 2019-20)

Income Tax Amendments Applicable to AY 2020-21 (FY 2019-20)

Vietnam Accounting Standards - VAS 16 Borrowing Costs

Vietnam Accounting Standards - VAS 16 Borrowing Costs

Summerized_CH_5_Ethiopian_Income_Tax_Schedulesstructure (1).pptx

Summerized_CH_5_Ethiopian_Income_Tax_Schedulesstructure (1).pptx

Recently uploaded

Recently uploaded (20)

Satoshi DEX Leverages Layer 2 To Transform DeFi Ecosystem.pdf

Satoshi DEX Leverages Layer 2 To Transform DeFi Ecosystem.pdf

NO1 Best Black Magic Removal in Uk kala jadu Specialist kala jadu for Love Ba...

NO1 Best Black Magic Removal in Uk kala jadu Specialist kala jadu for Love Ba...

How can I withdraw my pi coins to real money in India.

How can I withdraw my pi coins to real money in India.

ASSESSING HRM EFFECTIVENESS AND PERFORMANCE ENHANCEMENT MEASURES IN THE BANKI...

ASSESSING HRM EFFECTIVENESS AND PERFORMANCE ENHANCEMENT MEASURES IN THE BANKI...

20240514-Calibre-Q1-2024-Conference-Call-Presentation.pdf

20240514-Calibre-Q1-2024-Conference-Call-Presentation.pdf

Managing personal finances wisely for financial stability and

Managing personal finances wisely for financial stability and

Retail sector trends for 2024 | European Business Review

Retail sector trends for 2024 | European Business Review

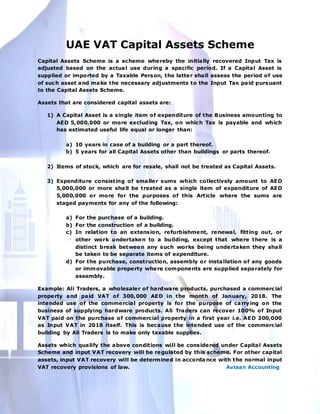

UAE VAT Capital Assets Scheme

- 1. UAE VAT Capital Assets Scheme Capital Assets Scheme is a scheme whereby the initially recovered Input Tax is adjusted based on the actual use during a specific period. If a Capital Asset is supplied or imported by a Taxable Person, the latter shall assess the period of use of such asset and make the necessary adjustments to the Input Tax paid pursuant to the Capital Assets Scheme. Assets that are considered capital assets are: 1) A Capital Asset is a single item of expenditure of the Business amounting to AED 5,000,000 or more excluding Tax, on which Tax is payable and which has estimated useful life equal or longer than: a) 10 years in case of a building or a part thereof. b) 5 years for all Capital Assets other than buildings or parts thereof. 2) Items of stock, which are for resale, shall not be treated as Capital Assets. 3) Expenditure consisting of smaller sums which collectively amount to AED 5,000,000 or more shall be treated as a single item of expenditure of AED 5,000,000 or more for the purposes of this Article where the sums are staged payments for any of the following: a) For the purchase of a building. b) For the construction of a building. c) In relation to an extension, refurbishment, renewal, fitting out, or other work undertaken to a building, except that where there is a distinct break between any such works being undertaken they shall be taken to be separate items of expenditure. d) For the purchase, construction, assembly or installation of any goods or immovable property where components are supplied separately for assembly. Example: Ali Traders, a wholesaler of hardware products, purchased a commercial property and paid VAT of 300,000 AED in the month of January, 2018. The intended use of the commercial property is for the purpose of carrying on the business of supplying hardware products. Ali Traders can recover 100% of Input VAT paid on the purchase of commercial property in a first year i.e. AED 300,000 as Input VAT in 2018 itself. This is because the intended use of the commercial building by Ali Traders is to make only taxable supplies. Assets which qualify the above conditions will be considered under Capital Assets Scheme and input VAT recovery will be regulated by this scheme. For other capital assets, input VAT recovery will be determined in accorda nce with the normal input VAT recovery provisions of law. Aviaan Accounting