INCOME TAX RETURNS AY 2019 -20

•

0 likes•24 views

The Income Tax department has notified I-T return forms for individuals and companies for the assessment year 2019-20. For more info, please visit our site: http://caanshoo.com/gst/

Report

Share

Report

Share

Download to read offline

Recommended

More Related Content

What's hot

What's hot (20)

Optitax's presentation on annual return & reco. statement

Optitax's presentation on annual return & reco. statement

Summary of Amendments in CGST Act, 2017 till Finance Act, 2020

Summary of Amendments in CGST Act, 2017 till Finance Act, 2020

# Annual Returns – GSTR 9 & 9A + Audit GSTR 9C # By SN Panigrahi

# Annual Returns – GSTR 9 & 9A + Audit GSTR 9C # By SN Panigrahi

Similar to INCOME TAX RETURNS AY 2019 -20

Similar to INCOME TAX RETURNS AY 2019 -20 (20)

GSTR-9 Annual Return -Updated with Case Studies (GST)

GSTR-9 Annual Return -Updated with Case Studies (GST)

GSTR-9: Applicability, Due Date, Turnover Limit, and Compliance Details

GSTR-9: Applicability, Due Date, Turnover Limit, and Compliance Details

#GST Invoice Under Reverse Charge & Other Compliance's# By SN Panigrahi

#GST Invoice Under Reverse Charge & Other Compliance's# By SN Panigrahi

Different types of GST returns to be filed under GST Act.pdf

Different types of GST returns to be filed under GST Act.pdf

Presentation of Taxmann's Webinar on New GST Return System for Small Taxpaye...

Presentation of Taxmann's Webinar on New GST Return System for Small Taxpaye...

Recently uploaded

VIP Call Girls Pune Kirti 8617697112 Independent Escort Service Pune

VIP Call Girls Pune Kirti 8617697112 Independent Escort Service PuneCall girls in Ahmedabad High profile

Recently uploaded (20)

(8264348440) 🔝 Call Girls In Keshav Puram 🔝 Delhi NCR

(8264348440) 🔝 Call Girls In Keshav Puram 🔝 Delhi NCR

BEST Call Girls In Old Faridabad ✨ 9773824855 ✨ Escorts Service In Delhi Ncr,

BEST Call Girls In Old Faridabad ✨ 9773824855 ✨ Escorts Service In Delhi Ncr,

Tech Startup Growth Hacking 101 - Basics on Growth Marketing

Tech Startup Growth Hacking 101 - Basics on Growth Marketing

VIP Kolkata Call Girl Howrah 👉 8250192130 Available With Room

VIP Kolkata Call Girl Howrah 👉 8250192130 Available With Room

Sales & Marketing Alignment: How to Synergize for Success

Sales & Marketing Alignment: How to Synergize for Success

VIP Call Girls Pune Kirti 8617697112 Independent Escort Service Pune

VIP Call Girls Pune Kirti 8617697112 Independent Escort Service Pune

0183760ssssssssssssssssssssssssssss00101011 (27).pdf

0183760ssssssssssssssssssssssssssss00101011 (27).pdf

BEST Call Girls In Greater Noida ✨ 9773824855 ✨ Escorts Service In Delhi Ncr,

BEST Call Girls In Greater Noida ✨ 9773824855 ✨ Escorts Service In Delhi Ncr,

Grateful 7 speech thanking everyone that has helped.pdf

Grateful 7 speech thanking everyone that has helped.pdf

Cash Payment 9602870969 Escort Service in Udaipur Call Girls

Cash Payment 9602870969 Escort Service in Udaipur Call Girls

Call Girls In Radisson Blu Hotel New Delhi Paschim Vihar ❤️8860477959 Escorts...

Call Girls In Radisson Blu Hotel New Delhi Paschim Vihar ❤️8860477959 Escorts...

Call Girls In Sikandarpur Gurgaon ❤️8860477959_Russian 100% Genuine Escorts I...

Call Girls In Sikandarpur Gurgaon ❤️8860477959_Russian 100% Genuine Escorts I...

/:Call Girls In Jaypee Siddharth - 5 Star Hotel New Delhi ➥9990211544 Top Esc...

/:Call Girls In Jaypee Siddharth - 5 Star Hotel New Delhi ➥9990211544 Top Esc...

Vip Dewas Call Girls #9907093804 Contact Number Escorts Service Dewas

Vip Dewas Call Girls #9907093804 Contact Number Escorts Service Dewas

Call Girls Navi Mumbai Just Call 9907093804 Top Class Call Girl Service Avail...

Call Girls Navi Mumbai Just Call 9907093804 Top Class Call Girl Service Avail...

Call Girls In Sikandarpur Gurgaon ❤️8860477959_Russian 100% Genuine Escorts I...

Call Girls In Sikandarpur Gurgaon ❤️8860477959_Russian 100% Genuine Escorts I...

INCOME TAX RETURNS AY 2019 -20

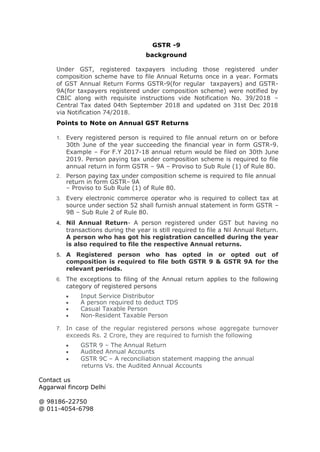

- 1. GSTR -9 background Under GST, registered taxpayers including those registered under composition scheme have to file Annual Returns once in a year. Formats of GST Annual Return Forms GSTR-9(for regular taxpayers) and GSTR- 9A(for taxpayers registered under composition scheme) were notified by CBIC along with requisite instructions vide Notification No. 39/2018 – Central Tax dated 04th September 2018 and updated on 31st Dec 2018 via Notification 74/2018. Points to Note on Annual GST Returns 1. Every registered person is required to file annual return on or before 30th June of the year succeeding the financial year in form GSTR-9. Example – For F.Y 2017-18 annual return would be filed on 30th June 2019. Person paying tax under composition scheme is required to file annual return in form GSTR – 9A – Proviso to Sub Rule (1) of Rule 80. 2. Person paying tax under composition scheme is required to file annual return in form GSTR– 9A – Proviso to Sub Rule (1) of Rule 80. 3. Every electronic commerce operator who is required to collect tax at source under section 52 shall furnish annual statement in form GSTR – 9B – Sub Rule 2 of Rule 80. 4. Nil Annual Return- A person registered under GST but having no transactions during the year is still required to file a Nil Annual Return. A person who has got his registration cancelled during the year is also required to file the respective Annual returns. 5. A Registered person who has opted in or opted out of composition is required to file both GSTR 9 & GSTR 9A for the relevant periods. 6. The exceptions to filing of the Annual return applies to the following category of registered persons Input Service Distributor A person required to deduct TDS Casual Taxable Person Non-Resident Taxable Person 7. In case of the regular registered persons whose aggregate turnover exceeds Rs. 2 Crore, they are required to furnish the following GSTR 9 – The Annual Return Audited Annual Accounts GSTR 9C – A reconciliation statement mapping the annual returns Vs. the Audited Annual Accounts Contact us Aggarwal fincorp Delhi @ 98186-22750 @ 011-4054-6798