Sem.:-I CC 103 Accountancy - I Consignment Accounts

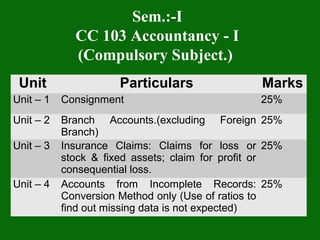

- 1. Sem.:-I CC 103 Accountancy - I (Compulsory Subject.) Unit Particulars Marks Unit – 1 Consignment 25% Unit – 2 Branch Accounts.(excluding Foreign Branch) 25% Unit – 3 Insurance Claims: Claims for loss or stock & fixed assets; claim for profit or consequential loss. 25% Unit – 4 Accounts from Incomplete Records: Conversion Method only (Use of ratios to find out missing data is not expected) 25%

- 3. Introduction: Any manufacturer or whole seller wants to sale his goods in other city or state, there are many methods in modern age. Out of these sale on consignment is one of the methods. But it is too difficult and expensive, therefore he appoints agent in the city and he sends of the goods on his own risk and agent sales goods on behalf of sender of the goods. Who sends the goods is called principals or consignor and whom the goods are sent is called agent or consignee.

- 4. Consignee receives the goods on behalf of the consignor and on risk of the consignor and he sales the same. Consignee dose not purchase the goods and also he become owner of the goods but he tries to dell the goods and receives the commission on the goods sold by him. The goods not sold at end of year, ownership of it remains with consignor. This kind of business is called, business on consignment.

- 5. Features(Characteristics) The features of above explanation is below 1.The relation between two parties is that of a principal and an agent. Is that not that of a buyer and a seller 2.Goods are sold at the risk of the consignor only. Profit or loss on consignment belongs to him. The consignee is concerned with his commission only. 3.If the goods are damaged or destroyed, the consignee is not responsible in any way. 4.The consignee is entitled to recover all expenses that the he incur in connection with the consignment.

- 6. Journal Entries and Accounting in the Consignment (A) In the book of consignor’s Accounts : There are three main accounts are prepared in the ledger of a consignor 1.Consignment A/c 2.Goods Sent on Consignment A/c. 3.Consignee’s A/c

- 7. Journal entries in the books of the consignor 1. When goods are sent on consignment. Consignment A/c Dr. …. To Goods Sent on Consignment A/c) …. (Goods Consigned to agent)

- 8. 2. When the Consignor pays Expenses…. Consignment A/c Dr. ….. To Cash A/c ….. (Insurance, Wages, Freight etc expanses paid for goods sent on Consignment)

- 9. 3. When an advance Cash, Draft or Bill of Exchange is received from consignee Cash or Bank or Bills receivable A/c Dr. …. To Consignee’s A/c. …… (The amount of advance cash, draft and bills is received from consignee is accepted)

- 10. 4. When the Consignor discount the Bills Receivable in the bank….. Cash & Bank A/c Dr. …….. Consignment A/c Dr. (Discount)…. To Bills Receivable A/c. ……. (The amount received on discounting the bill.)

- 11. 5. Entry for Sale Consignees’ A/c. Dr. ……. To Consignment A/c. ……. (Sale proceed of good sent on consignment)

- 12. 6. Expenses paid by Consignee… Consignment A/c. Dr. ……. To Consignees’A/c …… (Insurance, Wages, Freight etc. expenses paid by the Consignee)

- 13. 7. Commission payable to the consignee.. Consignment A/c. Dr. ……. To Consignee A/c. ……. ( Commission payable to the consignee at __% on sales proceed)

- 14. 8. Cash, Draft, or Bills of exchange is received from the consignee..) Cash/ Bank/ bills receivable A/c Dr. ……. To Consignor A/c …… (The Cash/Draft/ Bills receivable from the Consignee)

- 15. 9.Closing Stock of Consignment.. Consignment Stock A/c. Dr. ….. To Consignment A/c. …… (Closing stock of consignment is shown into books)

- 16. 10.Profit / Loss on Consignment A/c…. (A) If consignment a/c show the credit balance i.e. Profit : Consignment A/c Dr. ……. To Profit & Loss A/c. ……. (Profit of consignment is Transfer to P&L A/c.)

- 17. B. If consignment a/c show a debit balance, i.e. Loss : Profit & Loss A/c. Dr. ……. To Consignment A/c. …… (Loss on consignment is transfer to P & L A/c.)

- 18. 11.Closing the goods sent on Consignment A/c… Goods sent on Consignment A/c. Dr. ……. To Trading A/c. …. (Goods sent on consignment is transferred to Trading A/c)

- 19. (B) Accounting entries in the books of consignee…. Consignee prepared only Consignor A/c. in the Account books.

- 20. 1.Consignee give advance to the Consignor…. Consignor’s A/c. Dr. …… To Cash/ Bank/ Bills payable A/c. …… (Amount of advance sent by cash or draft or by bills)

- 21. 2. Consignee pays expenses on behalf of consignor…. Consignor’s A/c. Dr. ….. To Cash A/c. …… (Expenses paid on the consignment onward)

- 22. 3.consignee sold the goods….. (A) For cash sales…. Cash/ Bank A/c. Dr. …….. To Consignor’s A/c. ……. (Goods sold at cost)

- 23. B. For Credit Sale… Debtors A/c. Dr. …… To Consignor’s A/c. …… (Goods sold on credit.)

- 24. C. Goods return from Credit Sales… Consignor’s A/c. Dr. ……. To Debtors A/c. …… (Goods return from credit sales)

- 25. D. Consignee retained (purchased) the goods for own use…. Purchase A/c. Dr. …….. To Consignor’s A/c. ……. (Consignee retained the goods for own use)

- 26. 4. Commission due on sales…. Consignor’s A/c. Dr. ……. To Commission A/c. …… (Commission due on sales at __%)

- 27. 5. For Account is Settled…. Consignor’s A/c. Dr. ……. To Cash / bank / Bills payable A/c. ……. (Amount of cash or bank draft of bills sent for settlement)

- 28. Ex:-1 A of Ahmadabad consigned goods worth Rs.50,000 to C of Kolkata and paid Rs. 4,000 for railway freight and carriage. C accepted as an advance a bill of Rs. 20,000 drawn by A, which the latter discount of Rs. 600 C paid Rs. 2,000 for clearing and other charges, He sold all the goods for Rs. 70,000. He is entitled to a commission as 5% on sales. He settled his account with a bank draft for the balance. Make journal entries and prepare necessary accounts in the books of both parties.

- 29. Journal entries in the books of consignor Ahmadabad's ‘A’ accounts : 1. When goods are Sent on consignment…. Consignment A/c Dr. `50,000 To Goods Sent on Consignment A/c `50,000 ( `50,000 of Goods Consigned to agent)

- 30. 2.When Consignor pays Expenses… Consignment A/c Dr. ` 4,000 To Cash A/c ` 4,000 ( `4000 Freight expanses paid for goods sent on Consignment)

- 31. 3. When an advance is received from consignee …. Bills Receivable A/c Dr. ` 20,000 To Consignee’s A/c. ` 20,000 (The amount of `20,000 advance bills is received from consignee is accepted)

- 32. 4. When Consignor discount the Bills Receivable in the bank Cash A/c Dr. `19,400 Consignment A/c Dr. ` 600 (Discount) To Bills Receivable A/c. `20,000 (The amount received on discounting the bill.)

- 33. 5. Sale by the Consignee….. Consignee A/c. Dr. `70,000 To Consignment A/c. `70,000 (Sale proceed of good sent on consignment)

- 34. 6. Expenses paid by Consignee… Consignment A/c. Dr. 2,000 To Consignee’s A/c 2,000 ( Clearing and other expenses paid by the Consignee)

- 35. 7. Commission payable to the consignee.. Consignment A/c. Dr. ` 3,500 To Consignee A/c. `3,500 ( Commission payable to the consignee at 5% on sales proceed)

- 36. 8. Amount received from the consignee.. Bank A/c Dr. ` ….. To Consignee's A/c `……. ( The Draft or Bill Receivable from the Consignee)

- 37. 9. Profit / Loss on Consignment A/c…. Consignment A/c Dr. `…… To Profit & Loss A/c. `….. (Profit of consignment is Transfer to P&L A/c.)

- 38. 10. Closing the goods sent on Consignment A/c… Goods sent on Consignment A/c. Dr.` ...... To Trading A/c. ` ...... (Goods sent on consignment is transferred to Trading A/c)

- 39. B. Necessary Accounts Dr. Consignment A/c. Cr. Particulars ` Particulars ` To,Good sent on consi. A/c 50,000 To, Cash A/c. 4,000 By, Consignee's A/c (Sale ) 70,000 To,Consignee's A/c 2,000 To,Consignee's A/c (Commis.) 3,500 70,00070,000 Profit: To, P & L A/c. 9,900 Slide-40 To, Bills Reciveable A/c 600

- 40. Dr. Consignee 'C' A/c. Cr. Particulars ` Particulars ` Dr. Good sent on consignment A/c. Cr. Particulars ` Particulars ` By Consignment A/c 50,000 By Bills Reciveble A/c 20,000 To, Consignment A/c. 70,000 By Consignment A/c (Exp.) 2000 By Consignment A/c (Comm) 3,500 To Treding 50,000 44,500 50,00050,000 70,000 70,000 By Bank A/c (Draft) Slide-39

- 41. (B) Accounting Entries in the Books of Consignee : Consignee prepared only Consignor’s A/c. in the Account books.

- 42. 1. Consignee give advance to the Consignor…. Consignor’s A/c. Dr. `20,000 To Bills payable A/c `20,000 (`20,000 advance sent by bills)

- 43. 2. Consignee pays expenses on behalf of Consignor…. Consignor’s A/c. Dr. `2,000 To Cash A/c. `2,000 (Expenses paid on the consignment onward)

- 44. 3. Sold the goods….. A. For Cash sales…. Cash/ Bank A/c. Dr. `70,000 To Consignor’s A/c. `70,000 (Goods sold at cost)

- 45. 4. Commission due on sales…. Consignor’s A/c. Dr. `3,500 To Commission A/c. `3,500 (Commission due on sales at 5%)

- 46. 5. For Account is Settled…. Consignor’s A/c. Dr. `44,500 To Bank A/c. `44,500 (Amount of cash or bank draft of bills sent for settlement)

- 47. Dr. Consignor 'A' A/c. Cr. Particular ` Particular ` To Bills payble A/v (Adv.) 20,000 By Cash A/c. (Sale) 70,000 To Cash A/c. (Exp.) 2,000 To Commission A/c (Commi.) 3,500 44,500 70,000 70,000 To Bank A/c.

- 48. VALUATION OF CLOSING STOCK When the whole of goods sent on consignment is not sold, the value of the closing stock of consignment should be ascertained and brought into the books to ascertain the profit. The following points should be remembered in this connection: 1.Proportionate expenses of the consignor are added to the cost of the goods lying unsold with the consignee. The expenses incurred on goods sent increase the cost of the goods.

- 49. 2. Proportionate expenses incurred by the consignee may also be added to the value of the closing stock. Only non-recurring expenses should be considered for the purpose. Naturally selling expenses incurred by the consignee can not be included as are recurring expenses * e.g. advertisement, salary of the salesmen etc. are such expenses and they do not increase the value of the goods lying in stock.

- 50. Consignee’s Expenses Non-recurring Recurring (1) Clearing Charges (2) Customs (3) Octroi (4) Carriage inwards the proportionate share of above expenses are added to the cost of closing stock. (1) Godown Rent (2) Insurance (3) Office and Administrative charges Proportionate share of such expenses should not be added to the cost of closing stock.

- 51. 3. The closing stock should be at the cost price or market price whichever is lower. Proportionate expenses must be added, if the closing stock is valued at cost. In case the market price is lower then the cost price, the proportionate expenses should not be added and must be valued at the market price only. 4. When the closing stock of consignment contains damaged goods that require repairs, the value of the stock is reduced to the extent. Alternatively, a reserve may be created to the extent of the estimated expenses on repairs.

- 52. The valuation of closing stock would be done as follows: Units Rs. (1)Cost of goods sent (2)Add: Expenses paid by consignor Total cost of goods sent (3)Less: Goods destroyed in transit or goods that did not reach (i)Destroyed in Transit (ii)Goods that did not reach the consignee (Goods –in- transit) (4)Less: Shortage or Normal loss (Only Units) (5)Add: Consignee’s non-recurring exp. Cost of Saleable goods received by Consignee …… …… …… ……. ……. …… …… …… …… …… …… …… …… …… Cost of Saleable Goods Cost of Closing Stock = Units of Stock X Saleable Units

- 53. LOSS OF THE GOODS SENT ON CONSIGNMENT: When goods sent on consignment, some of the goods may be destroyed by some accident or there may be some inevitable loose due to causes like evaporation, breaking of bulk etc. such losses are classified into two categories: (1) Normal loss and (2) Abnormal loss Normal Loss: The loss which is unavoidable and cannot be prevented is normal loss. It occurs due to natural causes like evaporation or due to the nature of goods. No entry for loss will be made in the book of accounts.

- 54. (2) Abnormal Loss: Loss due to carelessness or natural calamity etc. which dose not occur regularly is abnormal loss, e.g. goods destroyed by fire. This loss is an abnormal loss because it dose occur regularly in consignment business. Hence it must be transferred to the Profit and Loss A/c. directly. The entry will be follows: Profit and Loss A/c Dr. ……… To consignment A/c ………. If the Insurance Co. accepts only part of the claim then the entry will be….. Insurance co’s A/c Dr. ……. Profit & Loss A/c Dr. ……. To Consignment A/c (Total amt. of loss)……..

- 55. DEL CREDERE COMMISSION: Generally, commission is allowed the consignee on the gross sale proceeds. The consignee dose not undertakes any responsibility for bad debts in case of credit sales. But the consignor dose not know anything about the financial position of the customer who purchases on credit from the consignee. Hence, the consignor would like to shift this responsibility to the consignee, who is in touch with the customers. An extra commission is allowed for undertaking the termed Del Credere Commission. When Del credere commission is allowed to the consignee, he pays the full amount of credit sale and bears the bad debts, if any. In such a case, no entry is passed for bad debts in the books of the consignor.

- 56. 1. Del credere commission is calculated only on credit sales if it is given in the example. 2. If the total sale is given but the amount of the credit sale is not specified, then the total sale should be considered as credit sale and del credere commission should be calculated accordingly. 3. Not del credere commission should be allowed on goods purchased by the consignee himself

- 57. Account Entries: In the book of consignor: 1.When delcredere commission allowed to the consignee, no entry is made in the consignor’s book for bad debts. 2.when no delcredere commission is allowed to the consignee the amount of bad debts is debited to consignment account and is credited to consignee’s account. 3.when goods are sold on recommendation of the consignor then the loss of bad debt is to be borne by the consignor and not by the consignee. Hence, the consignor will debit consignment account and credit consignee’s account with amount of bad debts.

- 58. In the book of consignee’s: 1.When del credere commission is allowed to the consignee, he will credit the commission Account, as the amount is recoverable from the consignor. In such case is any bad debt, the same has to be borne by the consignee. It will reduce his commission income. The entry will be made as follows: Bank A/c Dr. ……. Bad Debts A/c Dr. ……. To Consignment Debtors A/c …….. Commission A/c Dr. ……. To Bad Debts A/c …….

- 59. 2. If del credere commission is not allowed to the consignee and there is any bad debt the same would be debited by the consignee to consignor’s account and credited to the consignment debtors account. 3. When goods are sold on the recommendation of the consignor, the consignee will debit consignor’s Account credit customer’s account.

- 60. Example of normal and abnormal loss: Ex:5 On 1st September 2010, Vijay & Co. Bombay sent on consignment to Sanjay Bros. of Surat 1000 Table fans costing Rs. 300 each. The freight and other charges on the consignment amounted to Es.25000. 100 Table fans were destroyed in transit due to accident and the Insurance Co. accepted the claim of Rs. 12,000. Sanjay Bros. paid Rs. 18,000 for expenses of remaining goods. The consignee accepted a bill of Rs.1,00,000 drawn by the consignor, which latter discounted for Rs.95,000. From the Account Sale received from Sanjay Bros. it was seen that 800 fans were sold at Rs.450 each. Sanjay Bros. had paid Rs. 6,000 for storage and advertisement. Consignee were entitled to a commission of 5% on sales. Prepare Consignment Account in the Books of Vijay & Co.

- 61. In book of Vijay & Co, Dr. Consignment Account Cr. Particular Particular` ` To Good sent on cnsi. A/c (1000fans x Rs.300 each) 3,00,000 To Cash A/c. (Freight & Oth. Charges) 25,000 To Sanjay Bros. A/c. 18,000 To Bill receivable A/c (Disc) 5,000 By Insurance A/c. 12,000 By P & L A/c. 20,500 To. Sanjay Bros. A/c Exp. 6,000 By Sanjay Bros. A/c.(Sale) 3,60,000 To. Sanjay Bros. A/c Comm. 18,000 By Consignment stock A/c 34,500 4,27,000 To P & L A/c Profit 55,000 4,27,000 Slide62

- 62. Abnormal loss: 100 fans x Rs.300 = 30,000 +Proportionate Expenses of Consignor 2,500 (1000 ; 25,000 :100 ; ? ) 32,500 (25,000 x 100 / 1000 ) Insurance Co. A/c. 12,000 Profit & Loss A/c 20,500 To Consignment A/c 32,500 Sale: 800 Fans x Rs.450 = 3,60,000 and Commission 5% is 18,000 Closing Stock; Total Fans 1000 Less : Destroyed 100 + Sale 800 900 Stock =100 Value of Stock:- Cost price 100 x 300 = 30,000 + Proportionate Expenses of Consignor 2,500 32,500 + Consignee’s non-recurring exp.(900 ;18,000 : 100 ; ?) 2,000 (18000x100/900) 34,500Slide61

- 63. GOODS INVOICED AT SELLING PRICE : Ordinarily the pro-forma invoice is prepared at the cost price. But sometimes, it is also prepared at a selling price. (1) The purpose is not to let the consignee know the cost of goods. Otherwise, the consignee will come to know the profit earned on consignment which may induce him to deal in those goods himself. (2) By showing higher price, the consignor want to indirectly ask the consignee to sell goods at high price. (3) By showing higher cost, the Consignor shows a lower profit margin, so that the consignee dose not demand a higher commission. The consignor will add a margin of profit while preparing the pro-forma invoice. In this case the account can be prepared in Consignor ‘s books on the basis of the invoice price , so following adjustments entry must be pass have to be made while ascertaining profit or loss on consignment. Good sent on Consignment A/c. Dr. ………. To Consignment A/c ……… ( Being the adjustment for difference between invoice price and cost price)

- 64. Under this method, even the closing stock is valued at invoice price, which is credited to the Consignment A/c. This will necessitate passing an adjustment entry for the difference. The consignment account will be debited and the consignment stock reserve A/c. will be credited with the difference. the entry will be pass as follows : Consignment A/c Dr. ………. To Consignment Stock Reserve A/c ………. (the adjustment for bringing the closing stock to the cost price.) A table covering the percentage on cost from given percentage on invoice price: % on invoice price % on cost price 10% 11 1/9% (1/9 th of cost) 16 2/3 % 20% (1/5 th of cost) 20% 25% (1/4 th of cost) 25% 33 1/3% (1/3 rd of cost) 33 1/3% 50% (1/2 of cost) 50% 100% (Profit equal to cost)

- 65. Ex.11: Royal Radio consigned 500 radios to Prabhat Radio Service on 1-3-2006. The cost price was Rs. 600 Per radio, but the pro-forma invoice was made out at a figure so as to show a profit of 25% on invoice price. On the same day, Royal Radio incurred the following expenses : Carriage Rs. 1,000 Freight Rs. 15,000 Insurance Rs. 12,500 On the same day, Prabhat Radio Service sent a bank draft for Rs. 1,22,000. On 30th June,2006 Prabhat Radio Service sent an account Sale and a Bank draft for the amount payable. According to the Account sale 300 Radios were sold at Rs.820 each for cash. 50 Radios were sold at Rs. 850 each to Nitin on credit and 20 Radios were sold at Rs. 840 each to Sanatan on the recommendation and responsibility of Royal Radio. Selling expanses incurred Rs.5,225; Octroi incurred Rs. 3,500. Nitin and Sanatan became bankrupt and Prabhat Radio could recover only 80% from their estate. Prabhat Radio Service is entitled to receive a commission of 5% on sale and 2% Del Credited Commission on credit sales, and 1/7 share of the net profit on consignment after deducting both his commission and share of profit Prepare necessary Account in the books of the consignor (Guj. Uni.F.Y. April-2004)

- 66. Calculation:- (1)The invoice is prepared, so as to make a profit of 25% on invoice price Suppose invoice price = Rs. 100 Less: Profit = Rs. 25 Cost Price = Rs. 75 For Rs. 75 cost ; Rs. 100 invoice price “ 600 “ ; (?) 600x100 = Rs.800 75 Profit is Rs. 800 – 600 = 200 Rs. So amount of total price is 500 radio X Rs. 800 = Rs.4,00,000 and Profit is 500 radio X Rs 200 = Rs.1,00,000. Sale :- Cash 300 Radios X Rs. 820 each = 2,46,000 On credit 50 “ X Rs. 850 “ = 42.500 to Nitin “ 20 “ X Rs. 840 “ = 16,800 to Sanatan on Recomm. 370 3,05,300 Commission:- Rs. 3,05,300 X 5% = 15,265 Del Credited Rs. 42,500 X 2% = 850 16,115 Slide-68

- 67. Closing Stock : (At Invoice Price) Total Goods Sent = 500 Radios Less : Sold = 370 “ closing Stock = 130 “ Value Of Stock:- Invoice Price 130 Radios X Rs. 800 = 1,04,000 + Consignor Proportion Expenses (28,500 X 130/500) = 7,410 + Consignee's “ “ (3,500 X 130/500) = 910 Total = 1,12,320 Profit in Closing stock is 130 Ra. X Rs. 200 = Rs. 26,000. Bad Debts :- Only on Recommended Sale Total Sale 16,800 X 20% = 3,360 Rs. Share of Profit with consignee:- Suppose Profit is Rs.1 + Consignee share 1/7 = 1 1/7 = 8/7 is total Profit Total Profit 34,920 x 1/7 x 7/8 = 4,365 Rs. Net Profit is 30,555. Slide-68

- 68. In the book of Royal Radio (consignor) Dr. Consignment A/c Cr. ` ` To Good sent on consignment Ac. (500 ra. x `800 ) 4,00,000 To Cash Ac. (Expenses) Carriage 1,000 Freight 15,000 Insurance 12,500 28,500 By Prsabhat ra.ser. A/c. (Sale) Cash - 300 ra x `820= 2,46,000 Credit - 50 “ x `850= 42,500 Recom.- 20 “ x `840= 16,800 3,05,300 By Good sent on consi. A/c (Profit 500ra.x `200) 1,00,000 To Prabhat Radio Service A/c. (Exp.) Selling 5,225 Octroi 3,500 8,725 To Prabhat Radio Service A/c. (Bad Debts) 3,360 To Prabhat Radio Service A/c. (Commi.) General 15,265 Del Credited 850 16,115 By Consignment Stock A/c. 1,12,320 To Consi. Stock Res. A/c.(Pft.) 26,000 5,17,6205,17,620 To Prabh.Radio ser. A/c 4,365 To Profit & Loss A/c 30,555 34,920 Slide-67 Slide-66 Slide-69

- 69. Dr. Prabhat Radio Service A/c. Cr. Dr. Good sent on Consignment A/c. Cr. ` ` ` ` By Bank A/c (Advance) 1,22,000 To Consignment A/c. (Sale) Cash - 300 ra x `820= 2,46,000 Credit - 50 “ x `850= 42,500 Recom.- 20 “ x `840= 16,800 3,05,300 By consignment A/c Ac. (500 ra. x ` 800 ) 4,00,000 To Good sent on consi. A/c (Profit 500ra.x ` 200) 1,00,000 By Consignment A/c. (Exp.) Selling 5,225 Octroi 3,500 8,725 By Consignment A/c. (Bad Debts) 3,360 By Consignment A/c. (Commi.) General 15,265 Del Credited 850 16,115 By Consignment A/c. 4,365 3,05,300 3,05,300 1,50,735By Bank A/c (Draft) 4,00,0004,00,000 3,00,000To Trading A/c. Slide-68

- 70. Ex.No.46 (Guj.Uni.March,2010) Calculation: Sales price and Profit: cost price ` 1000 + 25% profit is `250 it means sales price is ` 1250, so total sales price is ` 1250 x 500 fans = ` 6,25,000 and profit is ` 250 x 500 fans = ` 1,25,000. Bill Receivable Discount: ` 2,40,000 x 12% x 4/12 = ` 9,600 Slide-72 Sale and Commission Cash - 120 fans x `1500= 1,80,000 Credit -320 “ x `1700= 5,44,000 Recom.- 20 “ x `1600= 32,000 7,56,000 Commission:- General ` 7,56,000 x 5% = 37,800 Del Credere ` 5,44,000 x 2% = 10,880 Total:- 48,680

- 71. Abnormal Loss: 10 fans are destroy by fire and its Cost price 10 fans x `1000 = 10,000 +propor.ex. of Consignor `30,000 x 10/500 = 600 + “ of Consignee `45,000 x 10/500 = 900 Total loss :- 11,500 Insurance com. Pass amount ` 8,700, so actual loss is `2,800 Closing Stock: Total sent fans 500 Less : Sale 460 loss 10 470 stock :- 30 Value of stock: 30 f x `1,250=37,500 + propor.ex. Of Consignor 30,000 x 30/500 = 1,800 +Propor. Non rec. ex of Consignee 45,000x30/500 = 2,700 Total :- 42,000 Profit in stock :-30x250= 7,500 Bed debts:- Bad debts count on recommended sale 32,000 x .50 = 16,000 Slide-72

- 72. In book of The Gautam (consignor) Dr. Consignment A/c Cr. ` `To Good sent on consignment Ac. (500 Fan x `1250 ) 6,25,000 To Cash Ac. (Expenses) Carriage 5,600 Freight 10,000 Insurance 14,400 30,000 By Govind A/c. (Selling) Cash - 120 fan x `1500= 1,80,000 Credit - 320 “ x `1700= 5,44,000 Recom.- 20 “ x `1600= 32,000 7,56,000 By Good sent on consi. A/c (Profit 500ra.x ` 250) 1,25,000 To Govind A/c. (Exp.) Adv. 25,000 Octroi 7,800 Ins. 22,200 God.Ex. 15000 70,000 To Govind A/c. (Bad Debts) 16,000 To Govind A/c. (Commi.) General 37,800 Del Credited 10,880 48,680 By Consignment Stock A/c. 42,000 To Consi. Stock Res. A/c.(Pft.) 7,500 9,34,5009,34,500 To Profit & Loss A/c 1,27,720 Slide-70 Slide-73 Slide-71 By Insurance Co.A/c. 8,700 “ P.& L. A/c 2,800 To Bill Receivable a/c.(Disc.) 9,600

- 73. Dr. Govind’s A/c.(Consignee) Cr. ` ` By bill Recie. a/c (Advance) 2,40,000 By Consignment A/c. (Bad Debts) 16,000 By Consignment A/c. (Commi.) General 37,800 Del Credited 10,880 48,680 7,56,000 7,56,000 By Bank A/c (Draft) 3,81,320 Slide-72 To Consignment A/c. (Selling) Cash - 120 fan x `1500= 1,80,000 Credit - 320 “ x `1700= 5,44,000 Recom.- 20 “ x `1600= 32,000 7,56,000 To Consgnment A/c. (Exp.) Adv. 25,000 Octroi 7,800 Ins. 22,200 God.Ex. 15000 70,000

- 74. Ex. Guj.Uni.Nov.2011 Sale and Profit : Suppose cost price is ` 100. Then profit is 25% ` 25 So selling price is ` 125 If ` 125 selling price that profit is ` 25 ` 50,000 “ “ ? 25 =50,000 X----- = ` 10,000 profit 125 So cost if ` 40,000 Total Selling ` 50,000 x 10 = ` 5,00,000 So total profit ` 10,000 x 10 = ` 1,00,000 Solide-78

- 75. 2,50,000 X 12 X 2 = vvvvvvvvvvvvvv = ` 5,000 Discount 100 X 12 So cash is ` 2,45,000. Selling and Commission: 1.Selling 5Laptop x ` 54,000 = ` 2,70,000 2.for credit sale 2 “ x ` 60,000 = ` 1,20,000 Total= ` 3,90,000 Commission: 1.General ` 3,90,000 of 5% ` 19,500 2. Del cradiar`1,20,000 of 2% ` 2,400B Total:- ` 21,900 Bill receivable Discount ov ` 2,50,000 for 4 month and interest 12% Annual. Discounted after 2 months. Slide-78

- 76. Abnormal loss: 2 Laptop are heavly damage Cost is ` 40,000 X 2 laptop = 80,000 +Popr.Exp of Consignor s` 19,000 X 2/10) = 3,800 Total loss= ` 83,800 Pass for Insurance ` 72,500 So Abnormal loss if ` 11,300 Closing Stock: Total 10 Laptop Less:- Sale 7 Loss 2 9 cc Closing stock 1 cc Value of Stock ov 1 Laptop ` 50,000 + Popr.Exp of Consignor “ (19,000 X 1/10) ` 1,900 + Popr. Non-recu. Exp of Consignor (12,000 X 1/8) ` 1,500 ` 53,400 So Profit in closing stock is = `10,000 Slide-78

- 77. A book of Alpesh (Consignor) AccountA book of Alpesh (Consignor) Account Dr. Consignment A/c. Cr. ` ` To Good sent on co a/c 5,00,000 “ Cash a/c. Freight 5,000 Carriage 6,000 Insu. 8,000 19,000 “ bill Receivable (Dis.) 5,000 “ Gaurang’s a/c. Exp. Octroi 5,700 Insu. 6,300 Adv.exp. 4,000 16,000 By Gaurang’s a/c (salling) Cash: 5 Laptop X 54,000= 2,70,000 Credit:- 2 Laptop X 60,000= 1,20,000 3,90,000 “ Gaurang’s a/c. Comm. General 19,500 Del Cre. 2,400 21,900 By Insu. Co. a/c 72,500 “ P.&L. a/c. (loss) 11,300 83,800 By Good sent on co a/c (pro.) 1,00,000 (10 Laptop X ` 10,000) By Consi.stock a/c. 53,400 “ Consig.stock Res.a/c. 10,000 6,24,2006,24,200 P.&L. a/c. 55,300 Slide-75 Slide-76 Slide-77 Slide-79

- 78. Dr. Gaurang’s (Consignee) A/c. Cr. ` ` By bill receivable 2,50,000 3,90,000 3,90,000 1,02,100By Bank a/c. (Draft) To Consignment a/c. (sale) Cash 5 Laptop X 54,000= 2,70,000 Credit 2 Laptop X 60,000= 1,20,000 3,90,000 “ Consignment a/c. Exp. Octroi 5,700 Insurance 6,300 Adv. 4,000 16,000 “ Consignment a/c. (Com.) General 19,500 Del Cradi.co. 2,400 21,900 Slide-78

- 79. Ex.No.Ex.No.88 Discount of Bill Receivable:Discount of Bill Receivable: = 50,000 x 18 x 2 100 x 12 = `1500 Discount Abnormal loss: 100 Lt. Oil X ` 10 = 1000 + Prop.Ex.of Consignor 10,000 Lt.Oil : ` 2000 100 “ : ? 100 X 2000 = 10,000 20 1020 Less: Pass by Insurance Co. 800 Abnormal loss: 220

- 80. Closing stock: Total send 10,000 Lt. Less: Sold 8,855 Lt. 1,145 Lt. Less: Loss 50 Ab n.loss100 150 ” Closing stock: 995 ” Value: Units ` Good send by consignor (`10) 10,000 1,00,000 + Exp.of “ -- 2,000 Toal cost of good send 10,000 1,02,000 Less: Loss 50 -- Ab n.loss 100 1,020 9,850 1,00,980 Add: Non rec.exp.by consignee -- 1,970 Cost of selling goods 9,850 1,02,950 Value of closing stock: =Cl.Stock X Value of Stock Goods of sellable = 995 X 1,02,950/9,850 = 10,400

- 81. Account in book of The Shyamal(consignor) Dr. Consignment A/c Cr. ` `To Good sent on consignment Ac. (800 G x `1600 ) 12,80,000 To Cash Ac. (Expenses) Carriage 2,400 Freight 9,600 Insurance 12,000 24,000 By Govind A/c. (Selling) Cash - 160 g x `1800= 1,88,000 Credit - 480 “ x `2000= 9,60,000 Recom.- 80 “ x `1900= 1,52,000 14,00,000 By Good sent on consi. A/c (Profit 800Gx ` 400) 3,20,000 To Amal A/c. (Exp.) Adv. 22,360 Octroi 6,000 Ins. 18,000 46,360 To AmalA/c. (Bad Debts) 60,800 To Amal A/c. (Commi.) General 56,000 Del Credited 19,200 75,200 By Consignment Stock A/c. 1,04,440 To Consi. Stock Res. A/c.(Pft.) 25,600 18,44,60018,44,600 To Amal a/c. (profit share) 52,240 To Profit & Loss A/c 2,71,200 Slide-42 Slide-43 Slide-44 By Insurance Co.A/c. 15,160 “ P.& L. A/c 5,000 To Bill Receivable a/c.(Disc.) 7,200 Slide-45

- 82. Dr. Amal’s A/c.(Consignee) Cr. ` ` By bill Recie. a/c (Advance) 2,40,000 By Consignment A/c. (Bad Debts) 60,800 By Consignment A/c. (Commi.) General 56,000 Del Credited 19,200 75,200 14,00,000 14,00,000 By Bank A/c (Draft) 9,23,400 Slide-41 To Consignment A/c. (Selling) Cash - 160 g x `1800 = 1,88,000 Credit - 480 “ x `2000 = 9,60,000 Recom.- 80 “ x `1600= 1,52,000 14,00,000 To Consgnment A/c. (Exp.) Adv. 22,360 Octroi 6,000 Ins. 18,000 46,360 By Consignment A/c. (P.Share) 54,240

- 83. Ex.No.39 (Guj.Uni.March,2007) Calculation: Sale price and Profit: Suppose Invoice price is `100 – 25% profit means `25 = `75 is cost price : if `75 cost price : sale pr.`100 so what is sale price when cost is `1200 = 1200 x 100/75 = ` 1600 total sale price So Total sale is 800 Geyser x ` 1600 = ` 12,80,000 and Profit is = 800 Geyser x `400 = `3,20,000 Bill Receivable Discount: ` 2,40,000 X 18% X2/12 = ` 7,200 Slide-41 Sale and Commission Cash - 160 G x `1800= 1,88,000 Credit -480 “ x `2000= 9,60,000 Recom.- 80 “ x `1900= 1,52,000 14,00,000 Commission:- General ` 14,00,000 x 4% = 56,000 Del Credited ` 9,60,000 x 2% = 19,200 Total:- 75,200

- 84. Abnormal Loss: 16 geyzer are destroy by fire and its Cost price 16 G x `1200 = 19,200 +propor.Ex. Of Consignor `24,000 x 16/800 = 480 + “ Non Re of Consignee ` 24,000 x 16/800 = 480 Total loss :- 20,160 Insurance com. Pass amount ` 15,160 so actual loss is ` 5,000 Closing Stock: Total sent gezer 800 Less : Sale 720 loss 16 736 stock :- 64 Value of stock: 64 g x ` 1,600=1,02,400 + propor.ex. Of Consignor 24,000 x 64/800 = 1,920 +Propor. Non rec. ex of Consignee 24,000x64/800 = 1,920 1,06,240 - repair charge 1,800 = 1,04,4401,04,440 Bed debts:- Bad debts count on recommended sale 1,52,000 x .40 = 60,800 Slide-41

- 85. Share of Profit: Suppose profit is ` 100 + Con. Share ` 20 So total profit is `120 If `120 Profit : Consi.Share `20 So `3,25,440 “ : m 20 x 3,25,440 = ------------- ----- 120 = ` 54,240 So profit of consignment A/c. is = `3,25,444 – 54,240 = `2,71,200. Slide-41