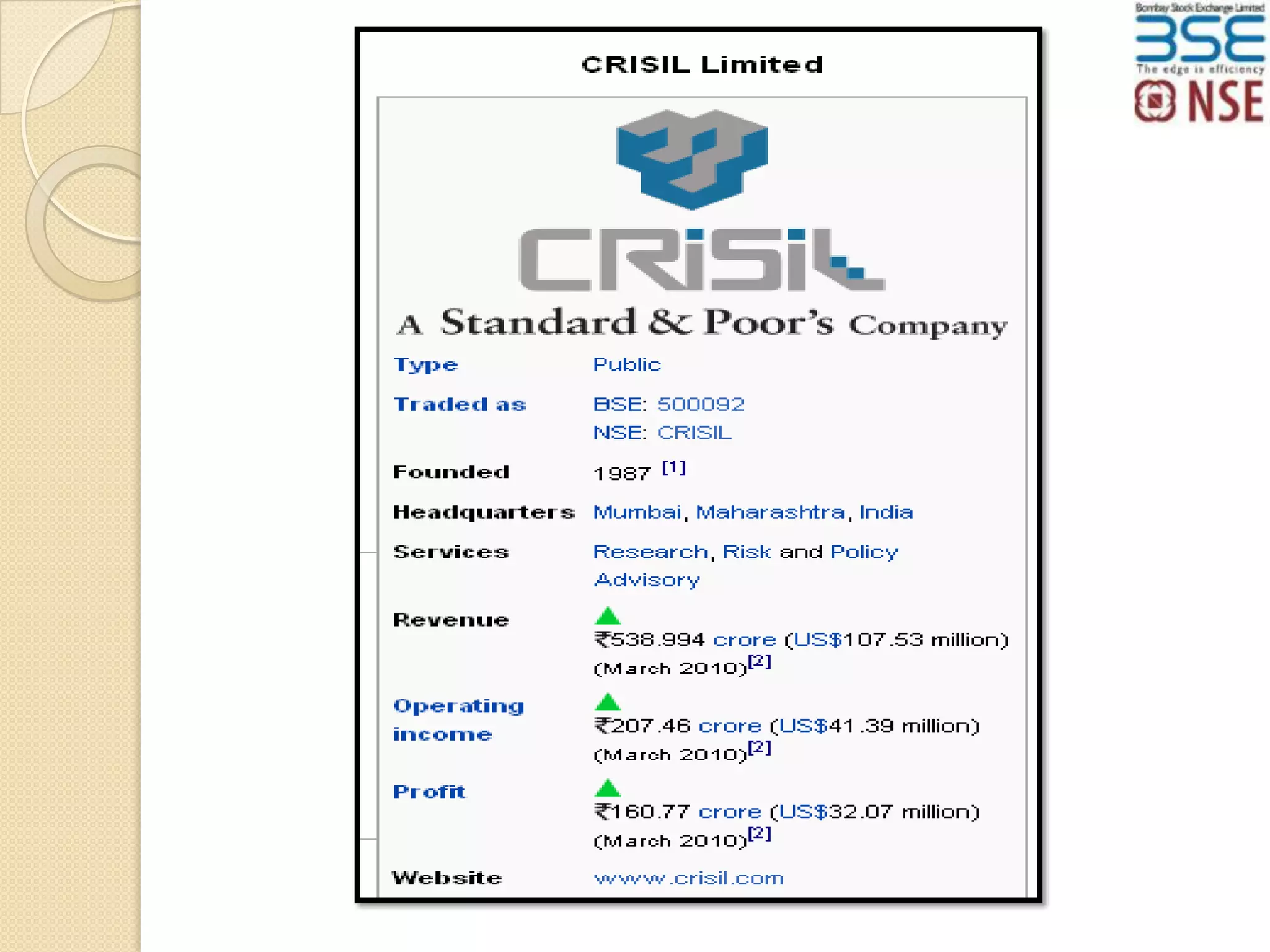

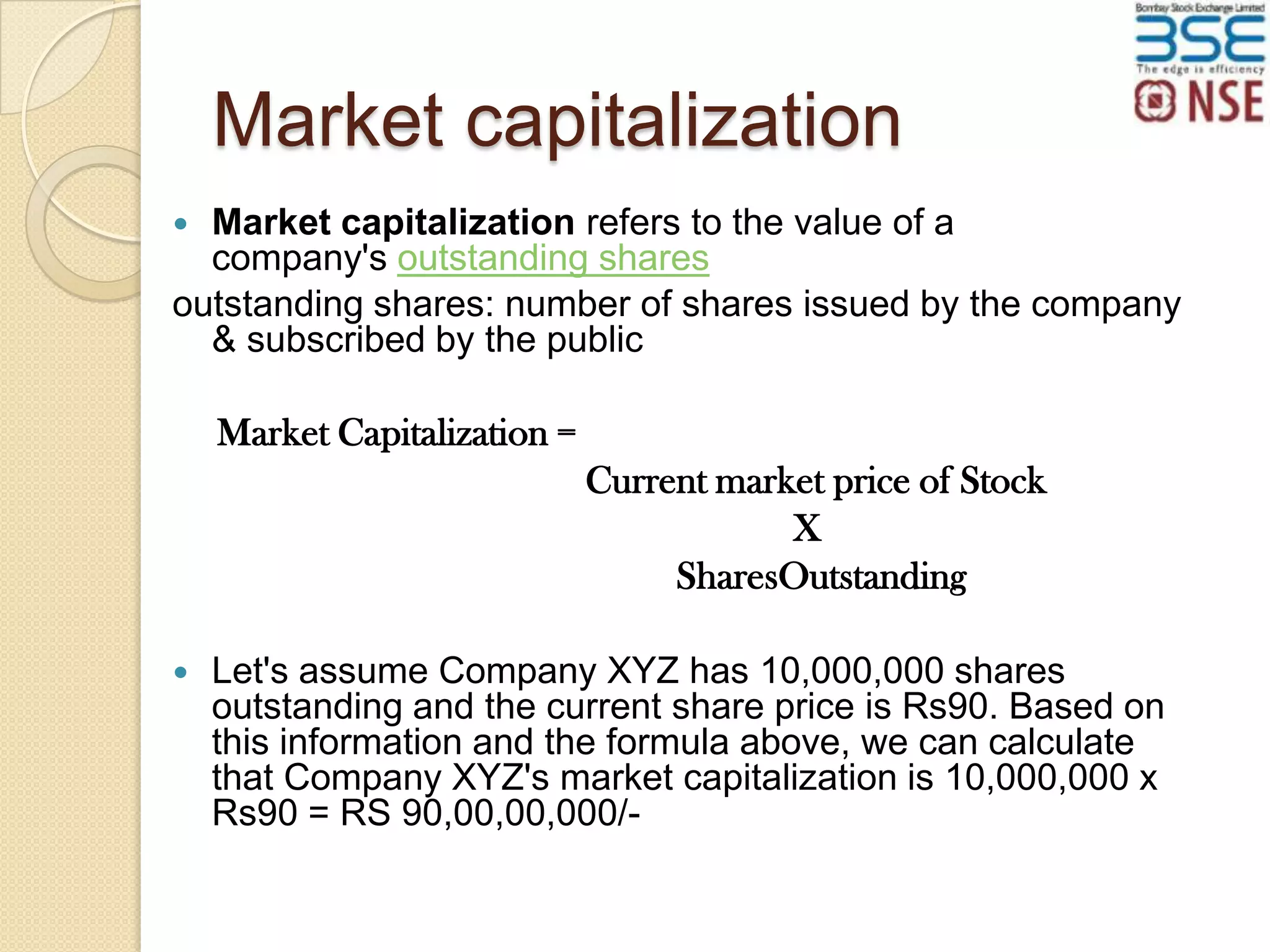

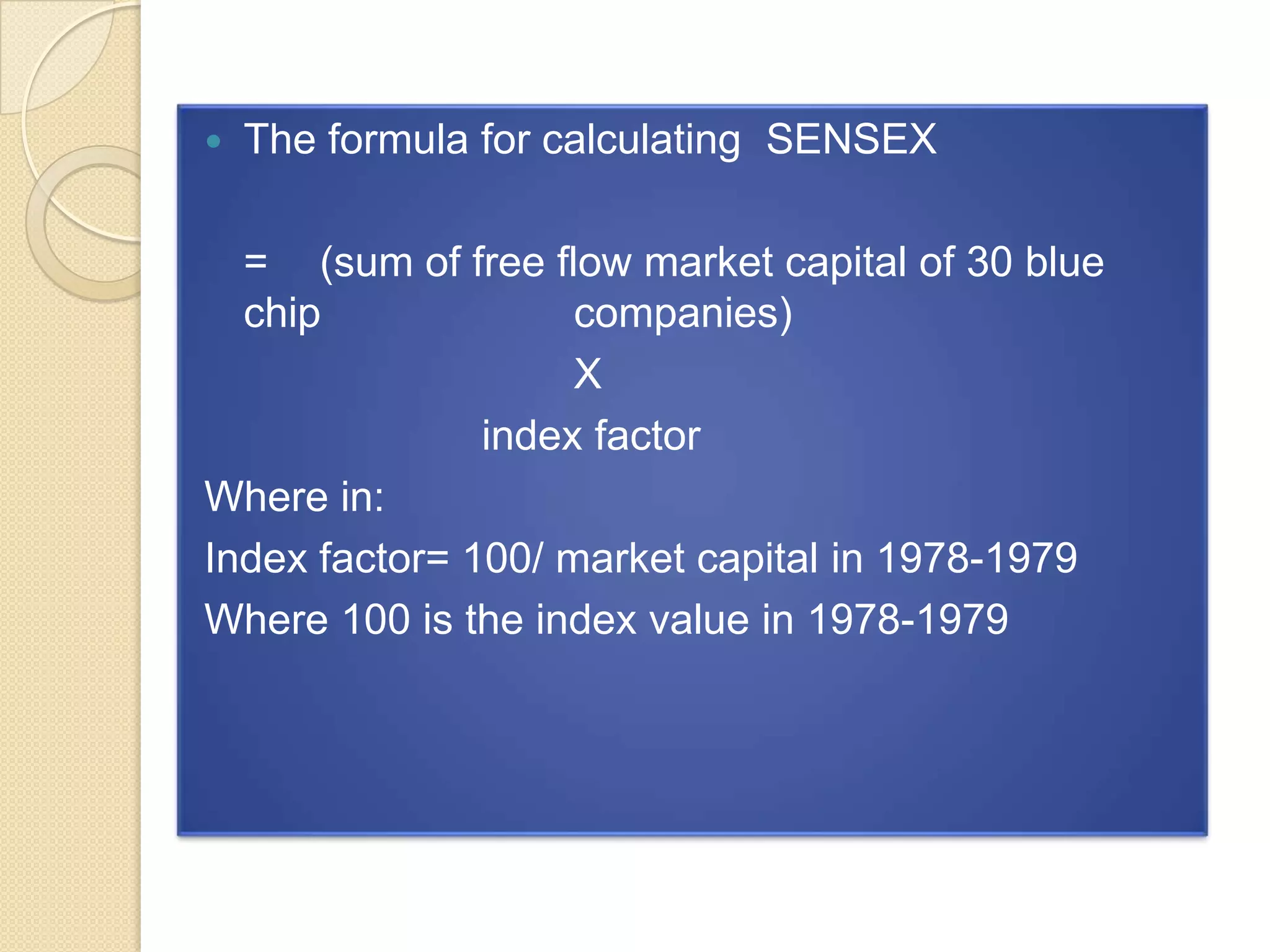

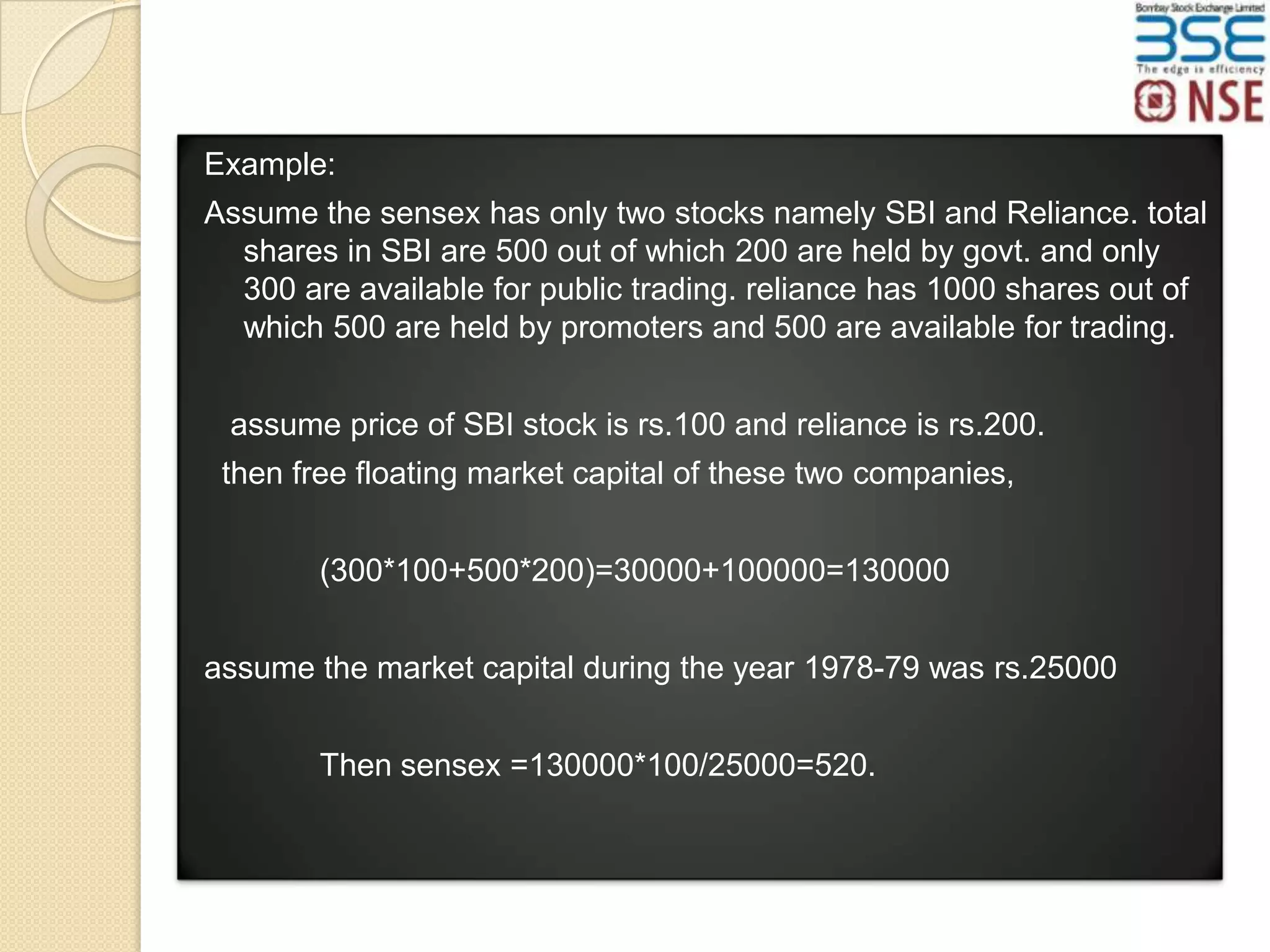

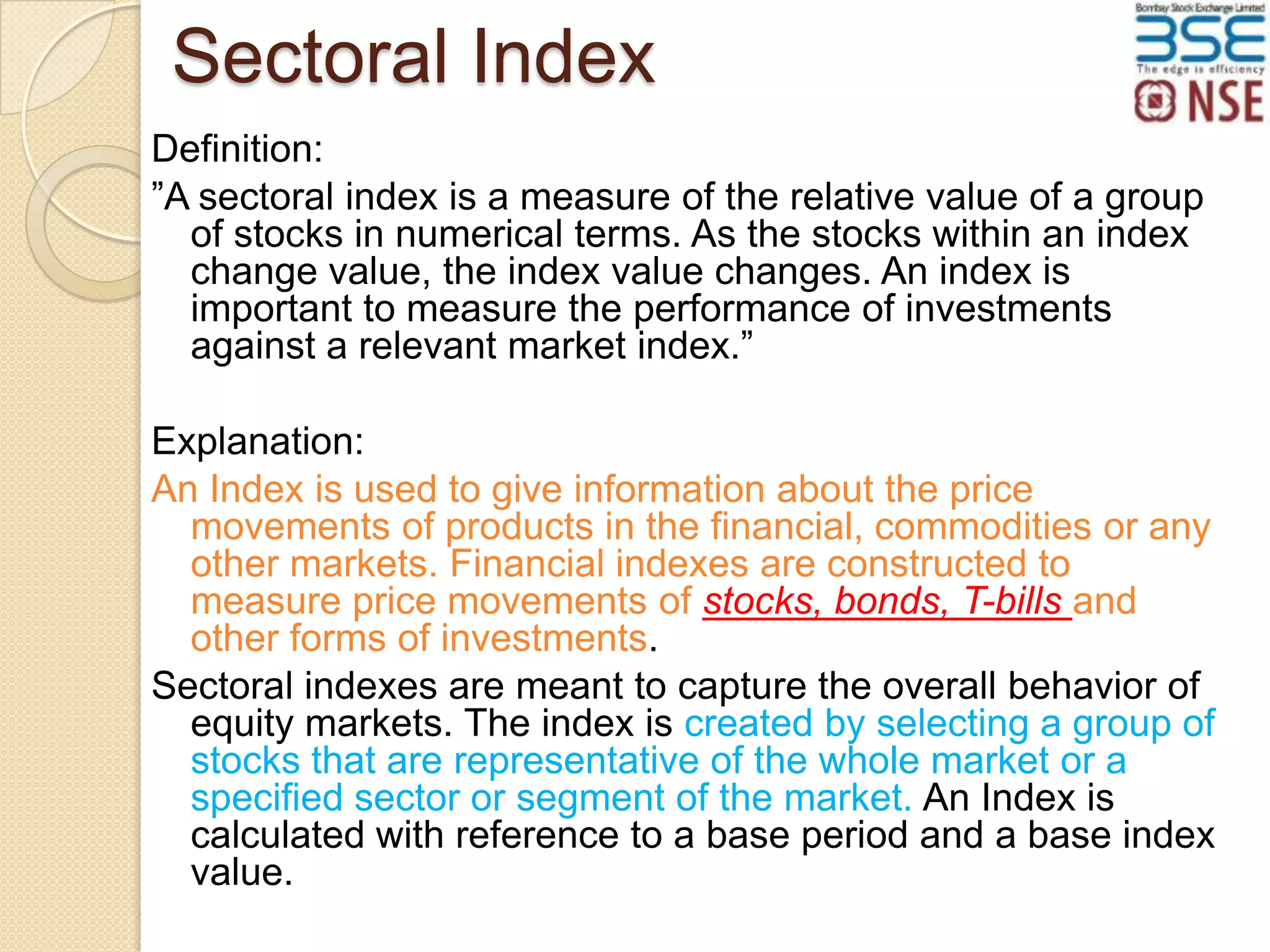

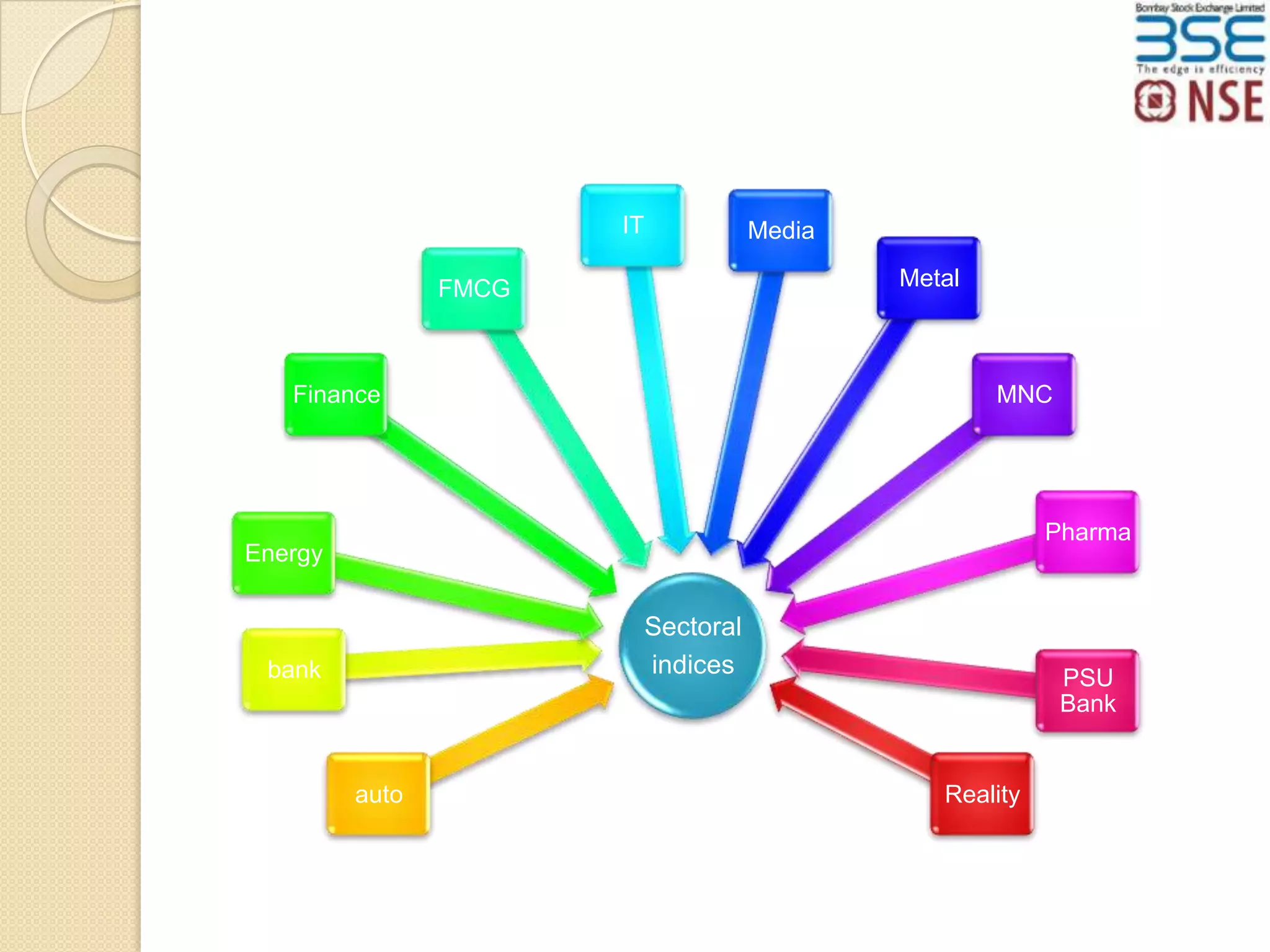

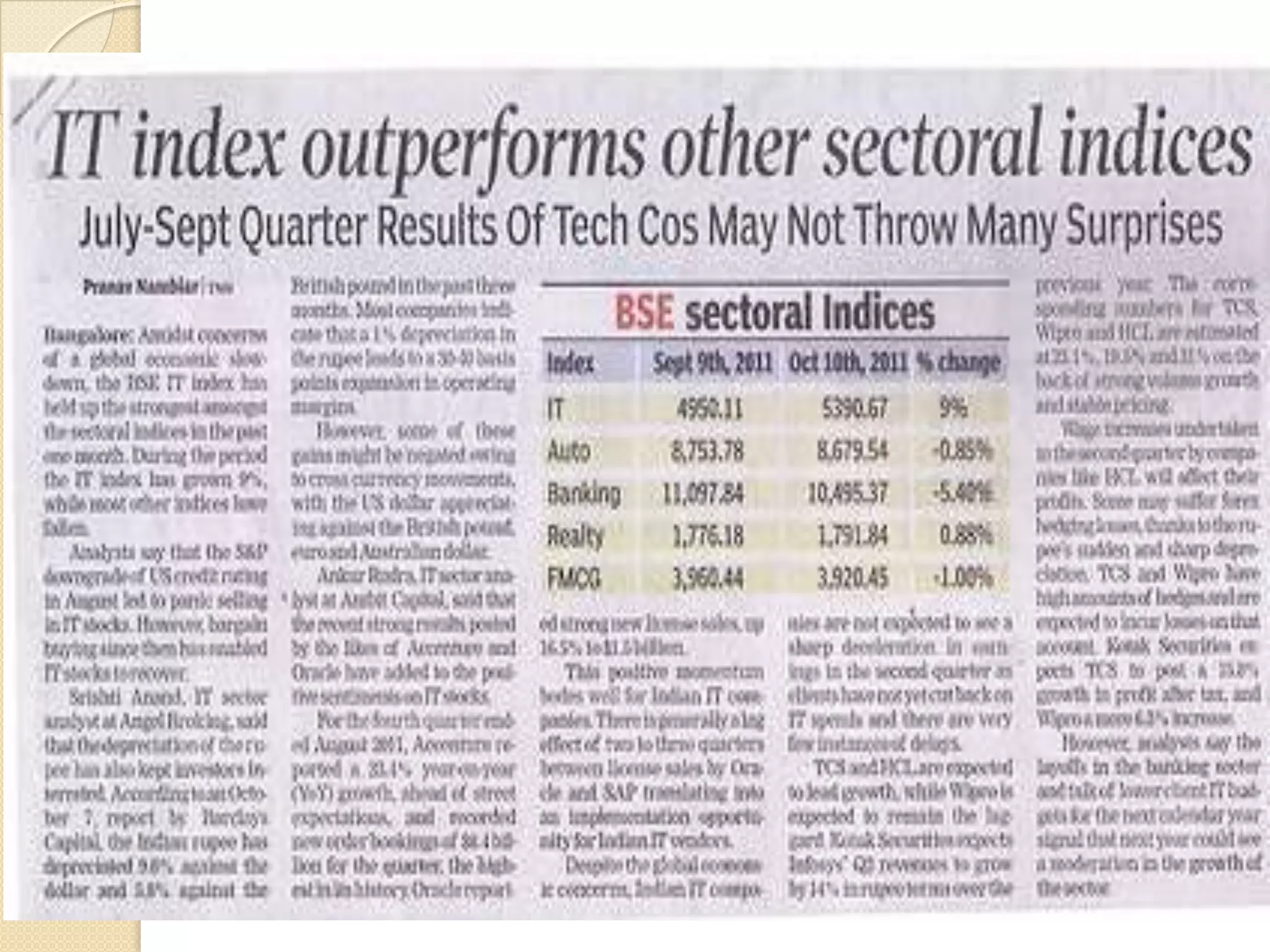

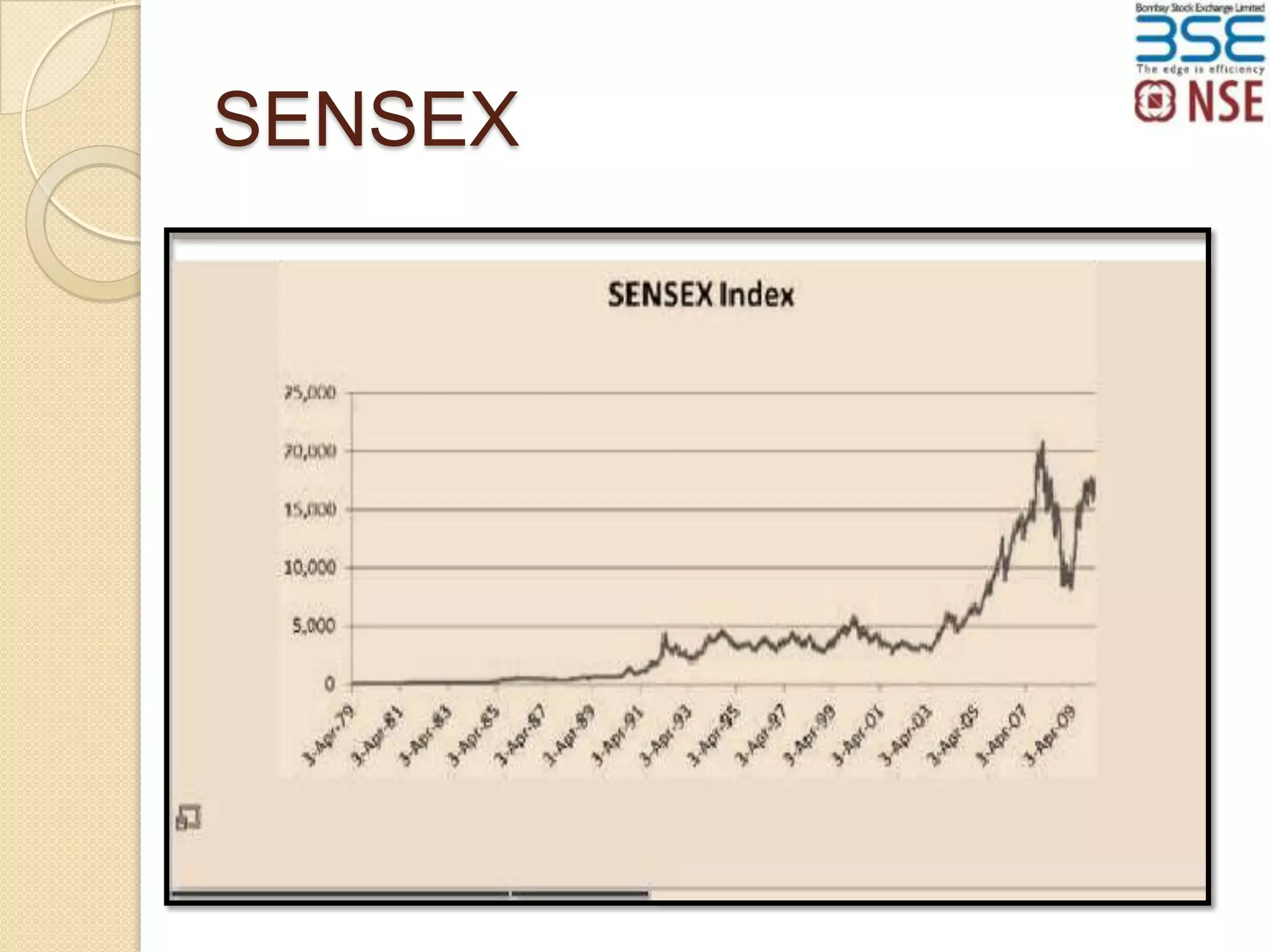

The document provides an overview of the Sensex and Nifty stock market indices in India. It discusses that the Sensex tracks the performance of the 30 largest companies listed on the Bombay Stock Exchange, while Nifty tracks the 50 largest companies listed on the National Stock Exchange. It provides details on how the indices are calculated and composed. It also discusses sectoral indices and provides examples of different sectoral indices that track specific industries.