The document discusses the National Stock Exchange of India and how its indices are calculated. It provides details on:

- What a stock exchange is and major exchanges in India like NSE and BSE

- Background on NSE, including that it is India's largest financial market and third largest in the world in terms of trading volume.

- Indices launched by NSE, including the S&P CNX Nifty 50 index which tracks the performance of 50 large, liquid companies.

- How stocks are selected for the Nifty 50 based on criteria like market capitalization, liquidity, and sector representation.

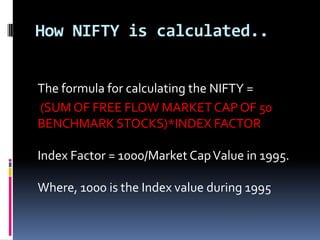

- The Nifty is calculated based on the free-float market capitalization of