Case studies for ias 1and 8 and 7.

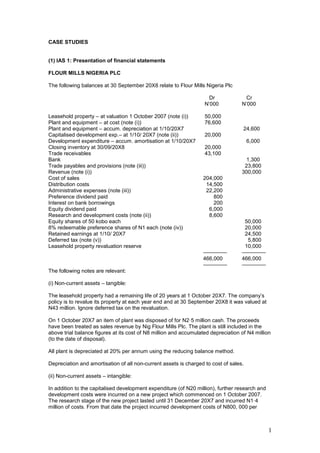

- 1. 1 CASE STUDIES (1) IAS 1: Presentation of financial statements FLOUR MILLS NIGERIA PLC The following balances at 30 September 20X8 relate to Flour Mills Nigeria Plc Dr Cr N’000 N’000 Leasehold property – at valuation 1 October 2007 (note (i)) 50,000 Plant and equipment – at cost (note (i)) 76,600 Plant and equipment – accum. depreciation at 1/10/20X7 24,600 Capitalised development exp.– at 1/10/ 20X7 (note (ii)) 20,000 Development expenditure – accum. amortisation at 1/10/20X7 6,000 Closing inventory at 30/09/20X8 20,000 Trade receivables 43,100 Bank 1,300 Trade payables and provisions (note (iii)) 23,800 Revenue (note (i)) 300,000 Cost of sales 204,000 Distribution costs 14,500 Administrative expenses (note (iii)) 22,200 Preference dividend paid 800 Interest on bank borrowings 200 Equity dividend paid 6,000 Research and development costs (note (ii)) 8,600 Equity shares of 50 kobo each 50,000 8% redeemable preference shares of N1 each (note (iv)) 20,000 Retained earnings at 1/10/ 20X7 24,500 Deferred tax (note (v)) 5,800 Leasehold property revaluation reserve 10,000 –––––––– –––––––– 466,000 466,000 –––––––– –––––––– The following notes are relevant: (i) Non-current assets – tangible: The leasehold property had a remaining life of 20 years at 1 October 20X7. The company’s policy is to revalue its property at each year end and at 30 September 20X8 it was valued at N43 million. Ignore deferred tax on the revaluation. On 1 October 20X7 an item of plant was disposed of for N2·5 million cash. The proceeds have been treated as sales revenue by Nig Flour Mills Plc. The plant is still included in the above trial balance figures at its cost of N8 million and accumulated depreciation of N4 million (to the date of disposal). All plant is depreciated at 20% per annum using the reducing balance method. Depreciation and amortisation of all non-current assets is charged to cost of sales. (ii) Non-current assets – intangible: In addition to the capitalised development expenditure (of N20 million), further research and development costs were incurred on a new project which commenced on 1 October 2007. The research stage of the new project lasted until 31 December 20X7 and incurred N1·4 million of costs. From that date the project incurred development costs of N800, 000 per

- 2. 2 month. On 1 April 2008 the directors became confident that the project would be successful and yield a profit well in excess of its costs. The project is still in development at 30 September 20X8. Capitalised development expenditure is amortised at 20% per annum using the straight-line method. All expensed research and development is charged to cost of sales. (iii) Nigeria Flour Mills Plc is being sued by a customer for N2 million for breach of contract over a cancelled order. Nigeria Flour Mills has obtained legal opinion that there is a 20% chance that it will lose the case. Accordingly Nigeria Flower Mill has provided N400, 000 (N2 million x 20%) included in administrative expenses in respect of the claim. The unrecoverable legal costs of defending the action are estimated at N100, 000. These have not been provided for as the legal action will not go to court until next year. (iv) The preference shares were issued on 1 April 20X8 at par. They are redeemable at a large premium which gives them an effective finance cost of 12% per annum. (v) The directors have estimated the provision for income tax for the year ended 30 September 20X8 at N11·4 million. The required deferred tax provision at 30 September 20X8 is N6 million. Required: In accordance with IAS 1, Presentation of Financial Statement, prepare (a) The statement of comprehensive income for the year ended 30 September 20X8. (b) The statement of changes in equity for the year ended 30 September 20X8. (c) The statement of financial position as at 30 September 20X8. Note: notes to the financial statements are not required. (ACCA F7 Dec 2008 Adapted) (2) IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors (a) IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors contains guidance on the use of accounting policies and accounting estimates. Required: Explain the basis on which the management of an entity must select its accounting policies and distinguish, with an example, between changes in accounting policies and changes in accounting estimates. (b) The directors of Consolidated Breweries are disappointed by the draft profit for the year ended 30 September 2010. The company’s assistant accountant has suggested two areas where she believes the reported profit may be improved: (i) A major item of plant that cost N20 million to purchase and install on 1 October 2007 is being depreciated on a straight-line basis over a five-year period (assuming no residual value). The plant is wearing well and at the beginning of the current year (1 October 2009) the production manager believed that the plant was likely to last eight years in total (i.e. from the date of its purchase). The assistant accountant has calculated that, based on an eight-year life (and no residual value) the accumulated depreciation of the plant at 30 September 2010 would be N7·5 million (N20 million/8 years x 3). In the financial statements for the year ended

- 3. 3 30 September 2009, the accumulated depreciation was N8 million (N20 million/5 years x 2). Therefore, by adopting an eight-year life, Consolidated Breweries can avoid a depreciation charge in the current year and instead credit N0·5 million (N8 million – N7·5 million) to the income statement in the current year to improve the reported profit. (ii) Most of Consolidated Breweries’ competitors value their inventory using the average cost (AVCO) basis, whereas Consolidated Breweries uses the first in first out (FIFO) basis. The value of Consolidated Breweries’ inventory at 30 September 2010 (on the FIFO basis) is N20 million; however on the AVCO basis it would be valued at N18 million. By adopting the same method (AVCO) as its competitors, the assistant accountant says the company would improve its profit for the year ended 30 September 2010 by N2 million. Consolidated Breweries’ inventory at 30 September 2009 was reported as N15 million, however on the AVCO basis it would have been reported as N13·4 million. Required: Comment on the acceptability of the assistant accountant’s suggestions and quantify how they would affect the financial statements if they were implemented under IFRS. Ignore taxation. (ACCA F7 Dec 2010) (3) IAS 7 Statement of Cash Flow Pinto is a publicly listed company. The following financial statements of Pinto are available: Statement of comprehensive income for the year ended 31 March 2008 N’000 Revenue 5,740 Cost of sales (4,840) –––––– Gross profit 900 Income from and gains on investment property 60 Distribution costs (120) Administrative expenses (note (ii)) (350) Finance costs (50) –––––– Profit before tax 440 Income tax expense (160) –––––– Profit for the year 280 –––––– Other comprehensive income Gains on property revaluation 100 –––––– Total comprehensive income 380 –––––– Statements of financial position as at 31 March 2008 31 March 2007 N’000 N’000 N’000 N’000 Assets Non-current assets (note (i)) Property, plant and equipment 2,880 1,860

- 4. 4 Investment property 420 400 –––––– –––––– 3,300 2,260 Current assets Inventory 1,210 810 Trade receivables 480 540 Income tax asset nil 50 Bank 10 1,700 nil 1,400 ––––– –––––– –––––– –––––– Total assets 5,000 3,660 –––––– –––––– Equity and liabilities Equity shares of 20 kobo each (note (iii)) 1,000 600 Share premium 600 nil Revaluation reserve 150 50 Retained earnings 1,440 2,190 1,310 1,360 ––––– –––––– –––––– –––––– 3,190 1,960 Non-current liabilities 6% loan notes (note (ii)) nil 400 Deferred tax 50 50 30 430 ––––– –––––– Current liabilities Trade payables 1,410 1,050 Bank overdraft nil 120 Warranty provision (note (iv)) 200 100 Current tax payable 150 1,760 nil 1,270 ––––– –––––– –––––– –––––– Total equity and liabilities 5,000 3,660 –––––– –––––– The following supporting information is available: (i) An item of plant with a carrying amount of N240, 000 was sold at a loss of N90, 000 during the year. Depreciation of N280, 000 was charged (to cost of sales) for property, plant and equipment in the year ended 31 March 2008. Pinto uses the fair value model in IAS 40 Investment Property. There were no purchases or sales of investment property during the year. (ii) The 6% loan notes were redeemed early incurring a penalty payment of N20, 000 which has been charged as an administrative expense in the income statement. (iii) There was an issue of shares for cash on 1 October 2007. There were no bonus issues of shares during the year. (iv) Pinto gives a 12 month warranty on some of the products it sells. The amounts shown in current liabilities as warranty provision are an accurate assessment, based on past experience, of the amount of claims likely to be made in respect of warranties outstanding at each year end. Warranty costs are included in cost of sales. (v) A dividend of 3 kobo per share was paid on 1 January 2008. Required: Prepare a statement of cash flows for Pinto for the year to 31 March 2008 in accordance with IAS 7 Statement of cash flows. (ACCA F7 Jun 2008)