The 10 most trusted non banking financial companies to watch in 2019 compressed

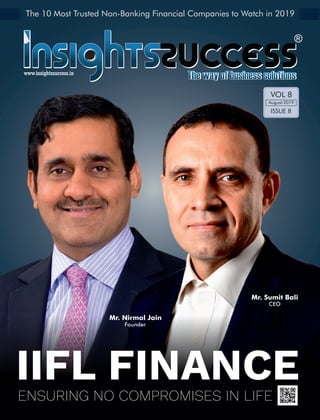

- 1. August-2019 VOL 8 ISSUE 8 IIFL FINANCEENSURING NO COMPROMISES IN LIFE www.insightssuccess.in The 10 Most Trusted Non-Banking Financial Companies to Watch in 2019 Mr. Sumit Bali CEO Mr. Nirmal Jain Founder

- 4. n an economically developing country like India, NBFCs Iare rapidly growing their loan books by providing finance to micro, small and medium-sized enterprises. Non- Banking Financial companies are playing a vital role in the na on, providing a fillip to transporta on, employment genera on, wealth crea on, bank credit in rural segments andfinanciallyweakersec onsofthesociety. In the present economic system of India, Non-banking financial ins tutes can play a vital role in enabling entrepreneurs to realize their strengths. Access to credit is a key factor in empowering economically backsword entrepreneurs. The latent credit demand of an emerging India will allow Non-baking finance companies to fill the gap, especially where tradi onal banks have been the way to serve. Today, the MSME sector is looked upon as the next driver of the new Indian Success story. Non-banking financial ins tutes are ac ng as a catalyst in the growth of this sector. Providing business credit, helping the unbanked and undocumented strata, disrup ng status quo are some the way in which NBFCs are serving the entrepreneurs of India. The Indian MSME sector is growing at an amazing pace and government ini a ves such as Make in India, Skill India, and digitalIndiahavehelpedthissectortoreachheights. Today, NFBCs have punched above their weight and expanded overall credit market in India. Now, the key expecta on from the government of India is to create a stable policy environment which can facilitate the long term growthoftheNBFCsector. NBFCs: Fuelling Growth of Indian Micro Businesses From the Editor Abhijeet kakade Abhijeet kakade

- 5. SME-SMO Executives Manoj, Ketki Circulation Manager Tanaji Digital Marketing Manager Prashant Chevale Technical Specialist Amar, Pratiksha Co-designer Sapana Shinde Art & Picture Editor Rahul Kavnekar Art & Design Head Amol Kamble Associate Designer Poonam Mahajan Copyright © 2019 Insights Success Media and Technology Pvt. Ltd., All rights reserved. The content and images used in this magazine should not be reproduced or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without prior permission from Insights Success Media and Technology Pvt. Ltd. Reprint rights remain solely with Insights Success. Printed and Published by Insights Success Media and Technology Pvt. Ltd. Corporate Ofces: Insights Success Media Tech LLC 555 Metro Place North, Suite 100, Dublin, OH 43017, United States Phone - (614)-602-1754 Email: info@insightssuccess.com For Subscription: www.insightssuccess.com Insights Success Media and Technology Pvt. Ltd. Ofce No. 22 & 510, Rainbow Plaza, Shivar Chowk, Pimple Saudagar, Pune, Maharashtra 411017 Phone - India: +91 7410079881/ 82/ 83/ 84/ 85 Email: info@insightssuccess.in For Subscription: www.insightssuccess.in sales@insightssuccess.com August, 2019 Follow us on : www.facebook.com/insightssuccess/ https://twitter.com/insightssuccess Cover Price : RS. 150/- Editor-in-Chief Pooja M. Bansal Managing Editor Devasish Kanojiya Executive Editor Abhijeet Kakade RNI NUMBER: MAHENG/2018/75953 Business Development Executive Asif Patel Business Development Lead Ashwini Pahurkar

- 6. IIFL FINANCEEnsuring No Compromises in Life Moneycontrol A Pioneer in Digital Financial Services 16 CoverStory Security Insights How Secure are Instant Loan Portals Interview with Insights Success CXO 24 Through the Professional’s Eye NRIs Seeking Home Loans in India - A Checklist 32 08

- 7. C O N T E N T S Adhikar Micronance Uplifting the life of Underprivileged People Fusion Micronance A Decade-Old Voyage in Women Empowerment Kudos Finance Funding Ideas, Empowering Ideators Nightingale Transforming the Lives of Underprivileged Piramal Capital & Housing Finance Financing Your Dreams of Growth 22 28 30 38 36

- 8. NBFCs Streamlining Finance for Everyone on-banking finance companies are playing crucial role in development of Economy. With each passing day, Nthe nation is realizing the importance of NBFC institutes and what can be a better way than recognizing the industry leaders who are contributing distinctively in transforming the lives of its beneficiaries? In this edition, we introduce “The 10 Most Trusted Non Banking Financial Companies To Watch In 2019”, in order to assist businesses to choose the right companies. Assessing the scenario in versatile perceptions, our magazine has brought light onto the companies, who are providing excellent products and solutions to its clients. This list showcases the best Non-banking finance companies that are bench-marking their presence in this sector. In this issue, we have featured India Infoline Finance Limited as the cover story. It is a subsidiary of IIFL Holdings Limited, India Infoline Finance Ltd.(IIFL Finance) is one of the leading non-banking finance in the nation. Adhikar Microfinance is one of the leading Microfinance Institutes in India serving the needs of underprivileged segment of the society. Fusion Microfinance Pvt. Ltd is India’s one of the leading microfinance company. Kudos Finance and Investments Pvt. Ltd. is a NBFC formed with a goal to help finance small-scale urban businesses through the medium of unsecured loans. Nightingale Finvest Private Limited (NFPL) provides micro credit services to its clients. Piramal Capital & Housing Finance Limited (PCHFL) provides housing finance and other financing solutions across the entire capital stack. We also have Moneycontrol as interview with insights success. It is pioneer in a digital finance services. We have included articles like Entrepreneurship – How Secure are Instant Loan Portals written by Akshay Mehrotra is the Co-founder and CEO of EarlySalary, India's largest consumer lending application and NRIs Seeking Home Loans in India Written by Shajai Jacob is CEO of Anarock property consultants. It's time to flip the pages and get to know about industry movers with a reading pleasure!

- 11. At IIFL we love disruptive innovations IIFLFINANCE Ensuring No Compromises in Life

- 12. Asubsidiary of IIFL Holdings Limited, India Infoline Finance Ltd. (IIFL Finance) is a systemically important non-deposit accepting non-banking finance company. It is one of the largest and most diversified non-banking finance companies in India. The IIFL Group was founded over two decades ago. The NBFC arm was initially incorporated in the year 2004 as India Infoline Investment Services Private Limited and converted into a Public Limited Company in the year 2007. Now, it is known as India Infoline Finance or IIFL Finance. In terms of share of business and profitability, IIFL Finance is the largest entity in the IIFL Group. It will be soon listed as a separate entity on the exchanges as part of the Scheme of Reorganization of the IIFL Group. The Absolute IIFL Finance IIFL Finance is engaged in the business of home loans, loans against property, gold loans, SME finance, capital market finance and microfinance loans. It offers small- ticket loan products to retail borrowers, delivered through a pan India branch network. IIFL Finance has over 1,900 branches and digital channels. The company had loan Assets Under Management (AUM) in excess of Rs. 34,904 crores at the end of March 2019. The capital adequacy ratio near twenty per cent is well above the minimum requirement. About eighty-five per cent of its loans are retail in nature and close to fifty per cent is priority sector lending compliant. IIFL Finance has a long-term credit rating of AA (Stable) by Crisil, AA (Stable) by ICRA and AA (Positive) by CARE. The parent, IIFL Group has a customer base of over four million across eight countries. The NBFC operation has branches mostly in smaller towns and rural locations. The wealth business manages and advises about Rs. 170,000 crores of assets. IIFL Institutional Equities caters to over 400 global funds. Over the years, IIFL forayed into life insurance & mutual fund distribution, institutional equities business, consumer finance business and wealth management businesses. IIFL also expanded globally and has regulated subsidiaries in eight major global financial centers. Leader in digital finance We are living in an era where digitalization is revolutionizing finance space in an amazing way. Digitalization is core to IIFL Finance’s way of working. The company offers end-to-end customer journey on digital platform. The loan origination happens through its in-house app on a tablet followed by underwriting processes, which also heavily use digital tools, thereby automating the decision making and reducing human interaction. Being an innovator and early adopter of digital transformation, IIFL Finance is able to offer a 22 minute end-to-end loan processing turn-around time for gold loans. This is one of the fastest and most advanced loan experiences offered by any NBFC in India. All of its customer touch points are digitally enabled bringing huge efficiencies to company’s businesses and help them provide frictionless services to customers. A large part of company’s new customer acquisition is through digital mode. It is also introducing chatbots to help its customer service team to provide better experience to customers. Also, IIFL is investing into robotic process automation to digitize legacy systems and processes. The company’s digital analytics team uses machine learning models to design credit policy decisions accurately. It also helps to reduce risk by providing early warning on possible delinquencies. In addition, the company has partnered with some of India’s most innovative fin-tech companies and leverage their expertise to provide best-in-class customer experience and meet expectations of the millennial customers, who prefer do-it-yourself mode of loan processing. About the CEO Sumit Bali, the CEO and Executive Director of IIFL Finance, is a seasoned banker carrying vast experience in the Indian corporate sector. He holds a PGDM from IIM Ahmedabad and B.A (Hon) from St. Stephen’s College, New Delhi. Prior to his current role, Sumit has spent over two decades with the Kotak Group. His last position at Kotak Mahindra Bank was of Senior Executive Vice President, overseeing consumer banking retail asset products including home loans, loan against property, credit cards, salaried personnel loans, and SME loans. Previously, he also held the position of CEO of Kotak

- 13. Mahindra Prime Ltd. (KMPL) and also was a Director on KMPL’s Board. He began his career with Glaxo India Limited in the year 1990 and has also worked with Asian Paints (I) Ltd. The Legendary Founder Nirmal Jain is the Founder and Chairman of IIFL Group. He is a first generation entrepreneur, who is credited with building one of the largest financial services groups in India in just about two decades. He is a PGDM (Post Graduate Diploma in Management) from IIM, Ahmedabad, a rank holder Chartered Accountant, and a Cost Accountant. Nirmal Jain began his career in the year 1989 with Hindustan Lever Limited (HUL), the Indian arm of Unilever. After a few years, in the year 1995, he founded his own equity research company, which is today known as India Infoline or IIFL Group. The company's pioneering work in equity research had set new standards. Further, in the year 1999, he launched the website www.indiainfoline.com where he made available his research free on the Internet. Finally, in the year 2000, the company forayed into the transaction space, with the launch of the online trading portal. Under his leadership, the company started diversifying the business model by adding multiple business streams while remaining focused on the core domain of financial services. Under Nirmal Jain’s visionary direction, today IIFL is one of the largest financial services firms in India backed by marquee global investors like Fairfax Group, private equity major General Atlantic, and the UK government’s private equity fund - CDC Group. Nirmal Jain has successfully steered IIFL to reach the epitome of success and stands amongst India's leading financial services groups. NBFC is Important! The profound team at IIFL has shared their views on NBFC as follows. In FY18, NBFCs accounted for more than a third of incremental credit. Broadly, PSU banks, private, banks and NBFCs have an equal share in incremental credit. More importantly, most NBFCs do not fund large projects or industrial houses, so their relative share in consumer and small business finance is even greater. As per estimates of a rating agency, NBFCs

- 14. accounted for 44 per cent of the total credit to retail and small business segments. They have played a very important role in making credit available to those who do not have access to formal credit. One can cite examples of excesses in any sector, but by and large flow of credit is essential to keep the momentum of growth. Even consumer credit helps in driving demand and thereby production and growth. In other words, the flow of credit to the bottom of the pyramid, millions of people in the informal sector, helps them produce more and consume more. IIFL Finance’s focus on Financial Literacy and Environmental, Social and Governance (ESG) programs IIFL Finance’s major clientele is from smaller locations and have been underserved in the financial system. Therefore, IIFL Finance along with IIFL Foundation has set up financial literacy centres across West Bengal, Jharkhand, Odisha, Assam, Meghalaya and Karnataka to impart financial literacy and is expanding to more states. The financial literacy centres not only educate them, but also handhold and initiate them into the financial system like opening a bank account, understanding government schemes beneficial for them, understanding crucial financial products like insurance, mutual funds etc and make financially prudent. IIFL Finance has so far reached more than 100,000 people and aims to reach over 200,000 people by end of 2020. Dr Sarika Kulkarni, CEO, IIFL Foundation said, “Being a financial services company it is our moral obligation to create a financial literate community and help them break the vicious circle of poverty through financial prudence.” In addition to financial literacy, IIFL Finance runs ‘IIFL Milan’, one of India’s largest Environmental, Social and Governance programs by a corporate. This is in line with IIFL's effort to be a part of the community and ensure that the community’s well being is taken care of in addition to business relationships. Our effort is to provide nance to the underserved One of India's most diversied NBFCs

- 15. Under IIFL Milan, 10,109 activities have so far been conducted, touching 315,000 lives through varied themes. IIFL Finance has also under taken one of India's largest girl child education initiatives in Rajasthan, where it aims to help the every girl child study at least until class 10 within the next ten years. IIFL Foundation has set up ‘Sakhiyon Ki Baadi’, unique community schools across Rajasthan, which facilitates education in inaccessible locations as per the time convenience of the students in dialogue with the local community. Notable Awards, Achievements, and Recognitions The Economic Times has listed IIFL among the top five companies in India, on which investors trust. It has been ranked as one of the Forbes ‘India’s Super 50 Companies’, a benchmark to identify Indian companies that exhibit high growth in profitability, sales and shareholder returns. IIFL is also among the ‘Outlook Business Outperformers’ - a prestigious list of eight companies which have beaten the Sensex over a five-year period. The Mint newspaper has recognized it among the seven financial conglomerates in India. Also, IIFL has been recognized as ‘India’s Most Trusted Financial Service Brand (Non-Bank)’ by the Brand Trust Report India Study. It has also received ‘India’s Most Promising Brand' award at WCRC Global India Excellence Summit in London. Growing with the Ultimate Strategies In the last quarter of 2018, the company halved its commercial paper exposure, down from 24% to 12%. The funding mix remains well diversified including term loans, securitization and direct assignments, refinance and non-convertible debentures. The company recently raised over Rs. 1100 Cr via NCDs. The company is further in discussions with other institutions for long-term funding agreements along with sanctioned undrawn credit lines from banks. On the asset side, the loan book has a relatively short maturity pattern, with 25% of loans having a maturity of less than six months and 39% of loans having a maturity of less than 12 months. The company has a positive asset-liability mismatch across all buckets and continues to maintain a comfortable liquidity position. IIFL Finance has a long-term credit rating of AA (Stable) by Crisil, AA (Stable) by ICRA and AA (Positive) by CARE. The Future Vision As India is the world's fastest growing economy, the NBFC sector has huge scope for its growth. IIFL Finance has a diversified product portfolio, caters to needs of a broad spectrum of customers – salaried, self-employed, informal sector, HNIs, and corporates. IIFL Finance aiming to address growing financial needs in under-served markets. About 85% of the book is retail in nature, therefore, the focus of the company will remain on retail lending especially in the middle-class borrower segment. Home loans, Gold loans, SME financing, and Microfinance will be key areas for growth for IIFL Finance.

- 16. Read it FirstRead it First Subscribe today Global Subscription Yes I would like to subscribe to Insights Success Magazine. Address : Country :City : State : Zip : Date : CORPORATE OFFICE Name : Telephone : Email : Insights Success Media and Technology Pvt. Ltd. Ofce No. 22 & 510, Rainbow Plaza, Shivar Chowk, Pimple Saudagar, Pune, Maharashtra 411017 Phone - India: +91 7410079881/ 82/ 83/ 84/ 85 USA: 302-319-9947 Email: info@insightssuccess.in For Subcription: www.insightssuccess.in Cheque should be drawn in favour of : INSIGHTS SUCCESS MEDIA AND TECH PVT. LTD.

- 17. Our predictive analytics and benchmarking solutions help organizations understand where they are today, and empower them to take control of their future based on meaningful information. Equifax combines powerful, AI-enabled analytic capabilities with powerful data resources, delivering the vital answers you need for advancing organizational performance while minimizing risk. Leverage our unrivaled consumer, commercial and employment data assets alongside your own data sources with a portfolio of innovative analytics solutions to seamlessly deliver relevant, actionable insights that drive bottom line results. Trust our expertise and innovative technology to analyze, predict and understand the impact of evolving trends related to employment, fraud, strategic markets and credit. Use the knowledge gained to create new opportunities that enrich customer lifetime value, employee engagement and profitability.

- 19. MONEYCONTROL A PIONEER IN DIGITAL FINANCIAL SERVICES In an exclusive interview with Insights Success, Gautam Shelar, Business Head of Moneycontrol gave some insightful answers highlighting the influences made by the company to take the finance industry to the next level. IS: From setting up a business from scratch to scaling up to large businesses like Times Group in the past and now as the Business Head for Moneycontrol – looking back, how do you define this journey? Gautam: It feels marvelous to have been at the cusp of the digital revolution, the journey has been transformational and disruptive. I have had the advantage of witnessing and contributing to India’s growth chart of digitalization. Having spent close to more than a decade in the media industry has been highly rewarding albeit challenging experience. During my stint with Times, my main focus was on leading innovations and building a robust team and support system that propels the growth of the brand in the perennially changing digital environment. With moneycontrol, my role has expanded and accumulates the gamut of my experience in the digital media industry. At present, as India is going through a digital renaissance within a highly competitive market. It becomes imperative to be at the top of the game and constantly innovate our offerings basis the evolving dynamics of the industry. At the same time ensuring moneycontrol remains the leader of its segment by formulating strategies that blend creativity with innovative advancements. We have always strived to lead the game with an experimental approach, creating multiple touch points for our readers that constantly redefines the formats in delivering information and news. For instance, moneycontrol is one of the only Indian financial and business multi-platform publication that extends to creative albeit reader friendly web-comics, podcasts, and premium applications. IS: What was your source of motivation? Or, who is your role model or the person that inspires you? Have your family played a significant role in scripting your success voyage? Gautam: All we need to do is persistently improve on ourselves by looking around us to find something that inspires us. I meet a lot of people every day, all from different industries and backgrounds, each one of them inspiring me in their own way. This whole experience has been nothing short of heartwarming and has truly brought a host of things into perspective. Having said that, the biggest inspiration in my life is my mother. All my life, since the beginning she has being my icon. She is the driver in my life as she herself is an entrepreneur and I have seen her revel in the good times and not lose heart in the struggles. As they say, if family is your first school, then mother is your first teacher. She taught me that hard times can be overcome with sheer determination and will and enable you to emerge as victorious. I know how strong-minded she is and that has always inspired me to push myself to do more and more Interview with Insights Success |August 2019 17

- 20. things in my life. She has thought me to get out of my comfort zone and do go for that extra mile. IS: A decade of experience in digital media, how do you determine the key areas of a business that needs to be strategized? Gautam: Determining the key focus pillars of any organization is of utmost importance. It is the foundation of the cores and beliefs on which a brand functions and operates. Designing a growth strategy involves envisioning deliberate long-term plans that is beneficial and leverages all the available resources to its optimum. In my experience, these are the pillars that have aided me in developing a robust growth strategy for businesses – Brand Ethos and Value – Molding an expansive chart of your brand’s ethos and the values that it will hold is the foremost thing in the growth chapter of any company. It is the North Star of any business that directions the rest of the operations and services of the business Key Indicators – Identifying key indicators that affect the growth of the businesses, and constantly are innovating the services and offerings as per the changing requirements of the consumer Talented workforce – A talented and skilled workforce is the key to lead a business towards growth. They are the propellers who take forward the brand ethos and values. IS: Kindly introduce ouTr readers with the exquisite products and services offered along with talking about your role as a Business Head at MoneyControl. Gautam: Internet has become the universal source of information for millions of people, at home, at school, and at work. Internet has changed the dissemination and consumption of information. People have access to real-time updates just by a click on their palms. Smartphone penetration aided by Jio’s acceleration in providing cheap data has revolutionized the bridge between people and digital. Leveraging the shift and transformation moneycontrol has constantly extended into multiple platforms and has further augmented its multimedia positioning through various innovative and value-added offerings to advocate financial literacy amongst its audience. Ensuring that the consumer, be it a seasoned trader, investor or a newbie, receives everything at their fingertips, the moneycontrol website, app and podcast work in tandem towards the common goal of informing and educating the audience in matters of all-things-finance. With moneycontrol’s audience comprising of digital-first and conscious users, the platform aimed to deliver information through varied mediums (website, app, podcast) featuring information in distinct formats. Moneycontrol’s multi-platform presence serves it to be the one-stop- destination bringing all business news and trends for audience that is constantly on-the-move. With moneycontrol realizing the demand for premium and personalised services, the platform rolled out Moneycontrol Pro and the Moneycontrol Podcasts. As the perfect product for loyal users who heavily consume market-related information and news, Moneycontrol Pro brings daily investment recommendations, curated markets data, exclusive trading recommendations, independent equity analysis, actionable investment ideas and practical insights from market gurus. On the other hand, the podcast property provided a means to an end by engaging with an audience that had been so far left untapped. The audio podcasts sheds light on the various aspects pertaining to investments, personal finance, market trends, etc. The digital offerings by moneycontrol are the perfect amalgamation of in-house expertise and capabilities for breakthrough journalism and storytelling that provide high- quality content in captivating formats. Along with this, I am also responsible for introducing new products and services, In addition to strategizing and processing plans for moneycontrol, that help generate advertising revenue. With the race to be the first in the information age being of paramount importance, the consumer can be rest assured that via moneycontrol they receive the latest news and reports that is backed with research, analysis and industry perspective. IS: Digital platforms have far more outreach as compared to traditional business models. How has the financial sector embraced technology to create multiple channels to serve their audience better? Gautam: Since 2014, a slew of policy measures like Digital India, Skill India, Make in India, Startup India, has thrust the nation towards an unprecedented digital August 2019|18

- 21. revolution. In addition, with Reliance Jio’s enabled smartphone penetration and affordable data prices have aided digitization to grow from strength to strength and has gradually overtaken the traditional outreach of various business operations. Rapid advancements in technology has made digital an integral part of our everyday lives. It has altered the content consumption pattern of the consumers. The gradual shift from traditional to digital has not been restricted to one segment but all the industries. The growth of tech-driven initiatives has enhanced customer experience, thereby improving efficiency and reduced costs. Subsequently, the finance sector has undergone meteoric advancements in the digital domain. People track stocks and all the latest trends on their screens instantly. Leading the way, moneycontrol is one of the only finance and business news destinations that also provide a mutual fund investment platform – Money Control Transact. It provides ease in handling end-to-end digital transactions with personalized recommendations for mutual funds based on multiple parameters. Extending itself to a multi digital platform; moneycontrol leverages it to reach out to a wider audience with readily available and informed knowledge on any company along with quick and real time access to the trends of the industry. IS: Moneycontrol Pro –This exclusive application was launched on March 2019. Kindly take us through initial idea or concept that led to the development of this app along with the distinctive features that makes it your USP over others. Gautam: Moneycontrol works towards a vital goal of providing insights along with informing and educating their audience with the latest trends in the finance and business industry. It has brought together the user and the experts all under one roof to ensure that the consumer, be it a seasoned trader, investor or a newbie, receives everything at their fingertips on one destination. By identifying the rising demand for premium and personalized content, we released an ad-free moneycontrol Pro app to give our audience more personalized and customized presentation of the financial news and allowing them to keep track of the latest events around the globe. The exclusive content is backed with credible and authentic insight backed with extensive research and expert analysis. With content that goes beyond the mainstream our readers get to make an informed investment. Our services allows them to monitor and update their watchlists and portfolio's related to Stocks, Mutual Funds, ULIPs, Bullion, commodities, futures and currencies to monitor. With our readers having a real-time watch over the price and volume of stocks, the app has also stolen a march over its competitors by providing an enhanced charting tool to assist the investor. This strategic idea leads to immense knowledge sharing in the trading and investing sector, resulting in the consumer making a much-more informed investing decision. IS: How do you depict the growth trajectory of Moneycontrol for the coming years? Gautam: The long-term aim for moneycontrol was to build a platform that caters to all the demands and requirements of the reader related to the finance and business industry. The backbone of the growth has been to provide accurate information and research-based analysis to our audience and become the go-to platform for all their financial decisions. For instance, one of our offerings based on Mutual Funds is the ‘Moneycontrol Transact’ that enables the users to understand and undertake all the Mutual Fund activities comprising of making investments, viewing recommendations and analyzing markets/investments on- the-go. The app is highly personalized and enjoys a value- added feature that recommends suitable mutual funds to users based on the multiple parameters. The Network18’s association with Reliance Jio lends aid in thrusting the platform on an incremental and radical innovation path. The future lies in deeper penetration of smartphones across the length and breadth of the country. We have forever striven to innovate and improve, while staying true to the quality and authenticity of the content. With a staunch objective of retaining our leadership position we have kept the consumer at the core and ensure that they make well informed investing decisions. By constantly innovating to cater to the evolving needs of the reader, we aspire to build trust in the minds of our audience. Moneycontrol, as the leader in the market sector, always looks out to give the consumer a fresh perspective, format and platform to access information, and we shall continue to churn out a host of services in the near future that they can be proud to use. |August 2019 19

- 24. ADHIKAR MICROFINANCE Income Generation Loan- Income Generation Loan is one of the primary loan products offered to underprivileged women in rural and semi-rural areas. Under this product segment, the company provides loans to women who are not being able to access formal financial services to improve their standard of living. Over the years Adhikar has touched the lives of 1.93 lakhs of clients. Water and Sanitation Loan -As large numbers of households in Odisha are exposed to unhygienic living conditions and water-borne diseases in the absence of clean drinking water, Adhikar is envisioned towards this cause and hence working on ‘creation of low cost infrastructure for accessibility of water and toilets’ to ensure safe drinking water and hygienic sanitation for the people. Adhikar provides WATSAN loan termed as ‘Jeevan Dhara’ and reached out to 3348 clients. Energy Loan-The company offers safe, sustainable solar solution in the lives of the rural and tribal communities of Odisha for their social and economic empowerment. Around 3648 clients are benefited through this product. MSME Loan -MSME loan is offered to small entrepreneurs (small business owner). MSME loan is one of the Based out of Odisha, Adhikar Microfinance Private Limited is the organization which is dedicated to uplift life of underprivileged people. The company is committed to creating a stable and inclusive financial system for betterment of socially and economically backward people. The company has touched the lives of million people through its 84 branches in five states across the country. It has a strong presence in some of the most backward districts of Odisha including Nabarangpur, Malkangiri, Koraput, Kalahandi, Bolangir, Nuapada and Bastar district in Chhattisgarh. Also some of the backward areas of Assam and West Bengal. Over the years, Adhikar has undertaken various financial inclusion programs through remittance, credit linkage to Self Help Groups (SHGs) and credit for income generation activities, water and sanitation, house renovation, and insurance services for its clients. The company also conducts financial literacy programs, safety, and hygiene practices with skill training activities for its client’s growth. It is associated with more than 15000 SHGs and has served more than 2 lakh clients. Lading Light of Adhikar Microfinance With over a decade of experience in the field of microfinance, Mr. Amin is the Founder and Managing Director of the company. In addition he also is a veteran social development professional with twenty-six years of extensive experience in the sector. He is one of the early votaries of the microfinance movement in Odisha. He has a master's degree in Law from the Utkal University, Bhubaneswar, Odisha. He completed the certificate course/diploma in Human Rights from the Chulalongkorn University, Bangkok and has a certificate in credit delivery and recovery mechanism from the Garmin Bank, Bangladesh and Harvard Business School, Boston, USA. In addition he is an Ashoka Fellow for the innovative approach to financial and social intermediation through SHGs. Under his dynamic leadership and financial acumen, Adhikar has reached out to extremely difficult geographical locations including left wing extremist affected districts of Odisha and Chhattisgarh. Exceptional Services Driving Change Adhikar Microfinance offers financial and non-financial products to meet specific social needs of the disadvantaged section of the community. The company offers below financial services to its clients. Uplifting the life of Underprivileged People “Microcredit is all about giving hope” - Natalie Portman August 2019|22

- 25. basic requirements of the poor and underprivileged communities for the expansion of their respective business and generates more income. The company provides MSME Loan to small entrepreneurs or small business owners for their various financial needs. Over the year 199 clients are benefited through this loan. Low-Cost Housing Loan- Adhikar addresses the housing finance need of the poor and underprivileged and offers low-cost housing loan/house improvement loan with an easy repayment provision. Micro-insurance- Though poor are vulnerable to workplace injuries, only a few of them are covered under formal insurance. The company’s all of the customer are covered under credit line insurance with joint life cover Making a World a Better place Adhikar strives for the betterment of society through its exceptional non-financial services. Financial Literacy- Access to formal credit along with financial education is the key to financial inclusion of the poor and unprivileged. Adhikar is striving towards rendering financial literacy to educate its customers on various financial services and risk management. Cloth for Work (CFW) -Clothing is one of the most important aspects of human life and Adhikar makes it available for the needy while keeping their dignity intact. Skill Training for Entrepreneurship- Adhikar strongly believes in the idea of “Entrepreneurship” as the driving force behind sustainable and large scale development of the marginalized and deprived communities. It envisioned to scale-up the capacity of the youths for employment and entrepreneurship by imparting skill. Prioritizing Client Needs Adhikar Microfinance is always ready to walk an extra mile for its customers. The company is creating best-in-class income generation activities for low- income individuals to improve their quality of living. With better access to financial services, health, hygiene and sustainable green energy, the company is ensuring utmost customer satisfaction. With the use of innovative information communication technology, Adhikar is serving a large number of customers in a faster, transparent, secure ways. The company supports a robust and resilient service to the beneficiaries. Moreover, business processes are most efficient with the use of technology. Future Roadmap Adhikar has become the preferred lender and a partner of the customers in transforming their social and economic life. Focus on robust digital technology to reach out to more underprivileged customers in remote locations with digital financial services and meeting the current needs like MSME loans, housing loans, automobile loans etc. The company is looking forward to spread out to 6 states in India. Adhikar is the only MFI in Eastern India to reach the most disadvantaged people in remote locations. We cherish this idea and further strengthen it to achieve the financial inclusion into a reality. It wants to be the leading MFI in Eastern India working in most difficult locations including the conflict zones. We are transforming the lives of socially and economically backward people ‘’ |August 2019 23

- 26. How SECURE are INSTANT LOAN PORTALS ABOUT THE AUTHOR Akshay Mehrotra is the Co-founder and CEO of EarlySalary, India’s largest consumer lending application. He has over 16 years of experience at some of the biggest brands in the country. Armed with a Master’s Degree in Business Administration from Symbiosis Institute of Management Studies, Pune, Akshay Mehrotra is now spearheading his own Start-up venture EarlySalary. Prior to this, Akshay was associated with brands like Future Retail Ltd, PolicyBazaar.com, Big Bazaar and Bajaj Allianz Life Insurance Co. Ltd. His business acumen and attention to detail led to him being conferred with the “Most Talented CMO of the Year” award in 2013 – 2014 in the retail space, by CMO Asia. In his leisure time, he likes to explore new places and spend time with his family. August 2019|24

- 27. Akshay Mehrotra Co-founder |August 2019 25 Security Insights

- 28. Instant loans are available on various portals online. Their application and approval process is fast and hassle-free, and the loan is transferred almost immediately to your account. Everything from the application process to document verification is done online, from the comfort of your home. However, while this is very convenient, you need to be careful while sharing personal information online, especially when it relates to financial matters. Many websites and loan portals are secure and you can trust them to keep your information safe, but there are also many websites and apps which may turn out to be fake and breach your privacy. Instant loan portals are just like all other websites some are secure while others are not. Hence, to ensure that your personal information is protected and not misused, you need to be careful which portals to trust with your information. Here are some tips to help you find out if the lender is legit and trustworthy. Check their physical address and contact information Every company has a physical office, and online lenders are no exception. Reputable lenders would have their address and contact number listed on their website. If no address or contact information is listed, it is a major red flag. Without a chance of contacting your lender, there is no way to hold them accountable for any mistakes. There is also the much greater danger that the company doesn’t exist at all. Even if contact information is listed, it is always better to call them and speak to the people in charge to get an idea of the legitimacy of the lender before sharing your financial information with them. Check if the website is secured and encrypted This is the easiest and most basic thing to do before deciding whether to trust any website with your information. Hackers and scammers tend to steal and misuse your information through unprotected websites. If your browser is showing security errors in the website, you need to be wary of it unless you trust the lender implicitly. All you need to do to verify the encryption on the website is look at the address bar. A secure website has a “lock” icon and its URL starts with “https” instead of “http”. If these are present, the portal is more likely to be safe. Watch out for Scammers A major indication of scammers is if they ask you to pay a fee upfront while you’re applying for a loan. This is the most common red flag you’ll come across when it comes to online instant loan portals. No reputable lender would ask you to pay upfront fees. The fee may be masked as something fancy or benign, like “processing fee”, but you’re not responsible to cover any initial payment. Such a demand is a clear sign that the website is dishonest, and you should never take loans from such portals. Another sign that the lender is a scammer is if they are offering loans to anyone without a credit check. It may seem a good deal, but reputable lenders don’t take the risk of giving you a loan without ensuring that you can repay them. A loan you get without credit checks may seem too good to be true because it usually is. Scammers tend to charge ridiculously high penalties and late fees if you fall behind on your payments, which they count on. Create a strong password All online portals, apps and websites are susceptible to hacking and security breaches, no matter how secure they claim to be. The best way to prevent misuse of your information is to set a strong password. It may seem an insignificant detail, too tedious to pay much attention to, but its importance cannot be ignored. A strong password may be difficult to remember, especially if you haven’t used it elsewhere, but the best way to keep your financial information safe is to use a password that is difficult to crack and also not used in any social media account. Try to use uppercase and lowercase letters as well as numbers, and even symbols if it is permitted. This will significantly minimize identity threats and help in keeping your information safe. Be wary of unprofessional customer service Unprofessional or unresponsive customer service is always an off-putter, but in case of online loan portals, it is a red flag which may indicate that the website is not trustworthy. A primitive website which is full of errors is a sign that you may be dealing with scammers. Another thing to look out for is how their customer service staff speaks to you. While financial institutions are not known for their warm service, they are usually professional, if not polite. If, on speaking with the staff, you get the impression that there is something fishy, trust your instincts. After all, it is better to be safe than sorry. Care must be taken to ensure that your information is safe with the instant loan portal you choose, and many portals provide security features like encrypted transactions to ensure the security of your financial information. EarlySalary is one such portal, which is leading in security features and gives immense importance to information protection and privacy. August 2019|26

- 30. F USION MICROFINANCE experiences, his expertise lies in building businesses, managing large teams in a cost-efficient manner, strategy, key relationship management and handling all dimensions of the business. Under his leadership, Fusion has grown into one of the leading microfinance institutions and continues to expand its operations. He was on the Board of MFIN, a Self-Regulatory Organization for NBFC-MFIs. MFIN works closely with regulators and other key stakeholders. It plays an active part in the larger financial inclusions dialogue through the medium of microfinance. In 2015, he attended and successfully completed a Strategic leadership program at Harvard Business School. Reaching for the Skies There are some ethics and principles that Fusion cares and implements throughout its organization and operations which are stated below - • Integrity: “We adhere to ethical standards to ensure integrity, transparency, independence & accountability in dealing with all stakeholders,” says Team Fusion. • Responsibility: “Growing with responsibility, we are very high on governance mechanism, strategic risk management framework and well-diversified portfolios,” tells Devesh. • Passionate People and Working Rural India along with tier three, four and five towns have been considered as significant contributors to the growth of Indian economic story over the last fifteen to twenty years. The goods and services with respect to the agricultural activities carried throughout these areas have consistently enhanced, ensuring an all-around resurgence in activities across the economic plain in the last two decades. NBFC’s have played a pioneering role in catering to the credit requirements of millions of customers in these areas both in the secured and unsecured lending landscape. Today, these NBFCs have a place of pride in having a large pie of the Indian credit market. It has also evolved by offering ‘one window’ and para banking services to customers at their doorstep, enabling larger parts of the country to be brought under the umbrella of financial services and as a result, the gains have been more evident. NBFC credit as a percentage of India’s GDP is approximately 13%. Various estimates put NBFCs catering to 30-45% of the total credit in India. Recently, a special category of NBFCs, the MFIs(Micro Finance Institutions) are proving to be a frontrunner in Inclusive Growth. Along with a customer base of around 3.8 crores to an asset book size of approx. Rs. 1,87,000 crores, it is growing at an impressive rate of more than 35%. One such company enlisting its growth in the said MFIs is Fusion Microfinance Pvt. Ltd. Established in January 2010, Fusion operates on the time-tested Joint Liability Group (JLG) model with 100% women clients from rural and semi-rural areas. Headquartered in Delhi, Fusion is providing financial services through 524 branches that spread across 18 Indian states. It believes in robust business practices, transparent policies expressed towards the Customer- focused Approach with regard to the clientele. Fusion primarily works in rural and semi-urban areas providing financial services to women belonging to the economically and socially deprived section of the society. Over 85% of the active loan clients of Fusion belong to the marginalized communities such as ST/SC and OBC. It is providing financial services in 205 backward districts out of 254 operational districts. Handling The Reigns Founder and CEO - Devesh Sachdev is an XLRI post graduate with sixteen years of experience in the service industry. He started his career with Citi group in 1996 prior to Fusion’s origin. In the past, he has worked in capacity of a Director in BSA Group of Companies where he successfully led the growth of BSA to a pan India foothold with diversified service offerings. Across all the diverse A Decade-Old Voyage in Women Empowerment August 2019|28

- 31. • Culture: “Passionate & strong team and positive workplace culture fosters an environment where employees feel connected and contribute to achieving,” he adds further. • Humility: “Fusion leads with humility. Continuously evolving to achieve excellence, believes in a collaborative effort, collectively takes its employees forward, values stakeholders, appreciate the success and accept the challenges,” opines Devesh. • Exceptional Client Focus: “Putting the ‘client first’has been a quintessential Fusion credo across years and the focus has always been to provide seamless services to our clients across the length and breadth of the country,” adds Fusion team. By keeping the above principles in mind, the Fusion team provides its clients with optimum services. By connecting with Fusion, the 1.5 million women customers across the country, came under the larger ‘organized financial umbrella’ and mainstream credit line. They are assured of a long term partner in growth and not a fair- weather friend. Also, they received a chance to upgrade themselves, be it on Financial Literacy Level or learning vocational subjects under the organization’s well-entrenched CSR program. The clients are encouraged to become entrepreneurs in their own right leading to a better standard of living for them and the family. This helps them in providing better education, health and better stature in society. Through this process, Fusion is being able to create more jobs in its catchment area leading to better overall development in the rural ecosystem. Challenge Accepted! Industry Disrupted... From all these years, the company has turned opportunities into achievements. 1.5 million women clients from rural areas depict the vast customer loyalty Fusion has. Achieving an exceptional feat in employee satisfaction, Fusion has entered the top quadrant among BFSI organizations with a score of 78% in the Employee Satisfaction Survey, conducted by Aon Hewitt. “We successfully launched our mobile app, mShakti,” states Devesh emphasizing on the company’s digital journey. This unique solution has significantly improved customer on-boarding process, TAT for the loan processing has reduced, improved inventory management of loan documents and secured data management in terms of keeping digital copies of all the documents safe. The company has taken steps to strengthen a strong risk management framework which seeks to proactively identify, address and mitigate existing and emerging risks. The firm is supported by diversified lenders which includes private banks, mutual funds and other financial institutions. The future aspirations of the company includes: • Effective client life-cycle engagement. Providing need-based flexible financial solutions. • Aspiring to serve 5 million customers in the next 3 to 4 years through PAN India coverage. • Continuous investment in innovative technologies in order to provide a seamless experience to the clients. • Build a ‘Best Place to Work’ platform. The Plan is to recruit 5000 plus members, to make a strong ‘Fusion Team’. • Scale-up responsibly and explore new products. Use of data analytics for insightful business decisions and risk mitigation while maintaining a continuous focus on human capital. We are motivated to provide sustainable socio-economic growth to our clients ‘’ |August 2019 29

- 32. K UDOS FINANCE of the populations are part of the India story. NBFC’S have broken the link of large parts of the population relying on loan sharks to meet their financial needs, thereby empowering the nation. Using technology, NBFCs are enabling achievement of higher scale and predictability of service. It has allowed on-boarding of customers, evaluation and delivery of the loan to be changed dramatically. While they continue to provide funding for various personal and business needs, NBFCs themselves have gone through a stinging funds crunch in the last 6 months. Since the IL&FS crisis, the funds from two main providers - MFs and banks - have been drying up. While a few of the NBFCs had the mismatch on maturity tenors for asset and liability, but the majority of others including the short team lenders who did not have these issues had also to bear the brunt. There are a lot of discussions on opening up lines through public sector banks or RBI providing a special window with a line of credit for NBFCs. However, this needs to be resolved on an urgent basis so that both the NBFCs A n entrepreneur needs a few basic things to start a venture – a unique idea, a target customer, and finance. Of these, money and idea are perhaps the most crucial. Many a time, they have to let go of an idea just because there wasn’t enough money to back it. For such ambitious, purpose- driven, and self-employed people in the country, the need is – access to money. While banking institutes and Venture Capitalists are doing their part, the role of Non-Banking Financial Companies has been gaining attention. Kudos Finance and Investments is one such technology led data-driven NBFC catering to those in need of financial help to realize their potential. Since inception, it has disbursed over 130 crores, completed over 1 lac loans having over 50,000 unique customers present over eight hundred cities in the country. Living the Dreams It all started when Pavitra Walvekar, then working in San Francisco, returned to India and noticed a massive gap in fulfilling debt requirements for the under- served market. It was a challenging market to serve since its an unsecured product with most customers not having Strong financial paperwork. The foundation for Kudos was laid and through a focused data led approach and perseverance the team proved the model and kept executing, even evolving their offering with time. Pavitra feels, “Our lives are fulfilling when we have meaning and purpose. Living a life that benefits other people’s lives is the best way possible to live. In a small way, I have meaning and purpose with families we support through employment and the loans we give in the market.” He was later joined by Naresh Vigh as Co-founder a ex-Bajaj and industry veteran NBFC – The Evolving Support NBFC’s are catering to customers usually overlooked and left out of the formal system by private and public sector banks. NBFC’s have integrated them by being risk takers and built specific niche understanding of these markets. The country can only grow if large parts Funding Ideas, Empowering Ideators August 2019|30

- 33. and the large economic base being served by them, start galloping forward fast again. The Way to Achieve Kudos! Kudos Finance is a profitable venture that is backed by multiple banking institutions. The understanding of a specific customer niche allows it to tailor an experience that is appropriate for the customer. The company’s understanding of customer’s margins, business cycles, experience allows it to cater to them with speed and accuracy thereby solving the problem of going to multiple places to get a loan and giving a great customer experience. Believing that no-one size fits all, it has curated specific solutions by dividing the self-employed into 3 categories MSME- Mom and pop shops all under 1Cr in turnover eg. retailers, traders, general stores ticket size 3-5 lacs Professional Loans- Doctors, CA'S, Architects ticket size 7-10lacs Partnerships- Using various platforms plugging into distribution networks for a specific niche market eg. Education fees, Doctor hardware purchase,Uber drivers etc Ticket size 5k-80k An in-house tech team has built capabilities to enable contactless disbursement, authentication and collection. Its differentiated approach uses data mining to K-STAMP customers, which is a pre-approved methodology to acquire customers. Through K-STAMP strategy Kudos achieves: • Super experience for the customer as the loan is disbursed within 48 hours • Higher conversion for the sales team • Avoiding highly leveraged customers that come through DSA channels • Lower processing cost a team is working only on files with a very high probability of approval, leading to higher profitability. Getting Future Ready Being a part of customers’ growth and supporting them through each life cycle of their business gives team Kudos immense joy and pride in positively impacting peoples lives. Pavitra says, “I envision a company of scale that caters and reaches a million lives. The aim is to execute with speed and accuracy with operations across India and creating a 1000cr book company.” Our country is growing and we are playing a small part in its growth by empowering peoples lives ‘’ |August 2019 31

- 34. Shajai Jacob is CEO - GCC (Middle East) of ANAROCK Property Consultants, launched by real estate industry veteran Anuj Puri in 2017. A well-rounded sales & marketing expert, Mr. Jacob was previously Executive Director & Head - Marketing (West Asia) at one of India's leading international property consultancies. He is based out of ANAROCK's Dubai office, has complete oversight of the Firm's brokerage operations across the Middle East & North A f r i c a n c o u n t r i e s , a n d spearheads ANAROCK's rapidly growing Middle Eastern business. He has 18+ years of rich experience in building brands and widening the visibility and scope for leading b u s i n e s s e s a n d h a s d e e p expertise across national and international markets. In the past, he worked with major firms such as Hindustan Unilever, YES BANK, United Spirits, Kingfisher Airlines and Barista. He holds a Master degree in Business Administration. ABOUT THE AUTHOR Shajai Jacob CEO August 2019|32

- 35. NRIS SEEKING HOME LOANS IN INDIA - A CHECKLIST Just like resident Indians, NRIs can invest in any number of properties in India and are also eligible to avail of home loans for as many properties as they like. Of course, while there is no cap on the number of properties for which an NRI can take home loans for, repayment capacity must always be factored in. Over- leveraging is never a good idea and regardless of what viewpoint a bank takes, NRIs must do their own repayment capacity calculations. In India, most banks and non-banking financial institutions offer home loans to NRIs. However, the tenure of the home loan may vary, and the rate of interest is usually higher for NRIs. Loan Tenure and Rate of Interest An NRI usually has to pay a higher rate of interest than resident Indians. The tenure for a home loan to an NRI usually ranges between 5 to 20 years - only in select cases can it go up to 30 years for salaried professionals. Most banks determine the loan amount eligibility of NRI borrowers based on their income and credit history. Apart from fulfilling basics like minimum age, qualification and years of employment, one must earn a minimum amount to qualify for a home loan. The mandatory income limit again varies from bank to bank and also differs for the country of residence. For instance, $24,000 a year is considered the minimum income level for US-based NRIs. The loan amount can start from a few lakhs and go up to crores, depending on how much is the bank convinced of one’s eligibility. Some banks may allowNRIs to club their spouse’s or sibling’s income with theirs to improve their eligibility, while other banks will only consider the principal borrower’s income. Obviously, it is important to have a good credit history and high credit score, as banks will invariably check the intending borrower’s credit report - both in the country of residence and India. Eligibility Requirements Any NRI can apply for a home loan in India as long as he/she is capable of repaying the loan and meets the eligibility requirements. These can again vary from bank to bank - however, most banks follow basic guidelines: Age:The home loan applicant should be minimum 18 years and maximum 60 years of age. This age limit may differ depending on the bank in question - for instance, Axis Bank lists 24 years as the minimum age for NRI applicants. Job tenure:The applicant should have been employed abroad for at least two years, or should be serving a valid job contract abroad for a minimum period of two years. Type of account:The applicant needs to open an NRE/NRO (non-resident rupee/non-resident ordinary) account from which to service the home loan. Documents Required for Availing Home Loan • Valid passport and visa documents for the mandatory know your customer (KYC) exercise. • Permanent address proof in India. • Appointment letter, work experience certificate, work permit and contract of employment from the current employer in the concerned country. • Salary pay-slips and supporting statements of Non- Resident External (NRE) and Non-Resident Ordinary |August 2019 33 Through the Professional’s Eye

- 36. (NRO) bank accounts. • Address proof from the current country of residence, verified by the current employer (this can be supplied by mail as well), along with the income tax return statements from the concerned country. • A valid qualification certificate to pass eligibility criteria. • A General Power of Authority (GPA), duly notarized. Repayment of Home Loan An NRI can opt for various routes to make the repayment of their home loan EMIs, which must mandatorily be paid in Indian rupees via an NRE or NRO account: • Transfer money from an overseas bank account through regular banking channels. • Issue post-dated cheques or an Electronic Clearance Service (ECS) mandate from an NRE, NRO or Foreign Currency Non-Repatriable (FCNR) bank account. • Pay from the rental income accrued from the property. • Issue cheques for the EMI from a local relative’s bank account. The designated GPA holder must be present in person at the time of disbursement of the home loan, as his/her signature is required by the bank in the absence of the main applicant. Importance of Power of Attorney Most lenders require a Power of Attorney (PoA) while extending home loans to NRIs. A PoA is a document stating that the NRI has given someone else the authority to make certain decisions and act on their behalf. The logic behind this requirement is since the NRI lives in a foreign country, the lender needs someone in India to deal with. The PoA enables the bank to have a point of contact in India in case of any property or loan-related issue. Usually, lenders insist that the NRI borrowers appoint their parents, friends or children as the PoA holder. While these are the broad guidelines for NRIs availing home loans in India, it is also important that NRIs do their own due diligence and compare the best bank options available. Since certain rules vary from bank to bank, NRIs should check the information available online and also speak to the concerned representative in each of the banks under consideration. This not only allows them to identify the best option suiting their requirements but also opens a window for possible customizations. Bank Annual Interest Rate Annual Rate for Loan amount up to INR 30 Lakhs Annual Rate for Loan amount up to INR 75 Lakhs Rate for Loan amount above INR 75 Lakhs SBI 8.70%onwards 8.65 - 8.75% 8.90 - 9.00% 9.00 - 9.10% HDFC Bank 8.80% onwards 8.75 - 9.25% 8.95 - 9.45% 9.00 - 9.50% ICICI Bank 8.95% onwards 8.95% 9.10% 9.15% Axis Bank 8.80% onwards 8.90% 9.05% 9.10% Canara Bank 8.85% onwards 8.75% 8.85% 8.90% Prevailing Rate of Interest for NRIs in leading banks in India August 2019|34

- 38. NIGHTINGALE microfinance institution. We have taken our strategy to go more and more unbanked areas to serve the under preveleiged section of the society as commited to our mission.An Ingenious Leader of Nightingale Mantu Nath Sarma is the Managing Director and CEO of the company. Under his leadership, the company continues to provide micro-credit activities to the underprivileged section of the society. He is a post graduate in Commerce possessing over 17 years of experience in the field of promotion and financing of MSMEs, Microfinance, and Financial Structuring. “Without upgrading the economic condition of poor and low-income group of the society, there will not be any change of lives and living standard of poor and low-income group of the society and also generate employment to unemployed”, Says Mantu. He is instrumental in spreading the outreach of microcredit wing of Nightingale Charitable Society with the consistent growth in business. To change the economic conditions of the poor, Mantu has raised fund from various financial institutions and banks for Non-banking financial companies are an integral part of the Indian Financial system. The NBFC sector in India has undergone significant over the past few years. This sector plays a strategic important role in poverty alleviation. Microfinance institutes are the robust pillars of progress, economic growth, and development of the economy. In developing countries like India, Women-centric microfinance institutions are playing a critical role in empowering Women. Over the years, Microfinance institutions have helped nation to achieve the objective of financial inclusion. With a social vision to reach out an underprivileged segment of society, especially women between the age group eighteen to fifty- five, Nightingale Finvest Private Limited (NFPL) offers microcredit services to transform the lives their lives. The company is dedicatedly providing its services to the sixteen districts of the Assam, Meghalaya, Mizoram, and Arunachal Pradesh. Nightingale has 37 branches in 13 districts of Assam and 1 branch in Meghalaya, Mizoram, and Arunachal Pradesh as on date. Successful Journey over the Years The journey of the nightingale started seventeen years back when Nightingale Charitable Society was formed on Gandhi Jayanti Day, 2nd October 1997 at Guwahati. With a vision to conduct various social activities in a rural area, Nightingale is registered under the Societies Act in the year 1998.To change the economic conditions of the poor, the society started its micro-finance activities by availing fund from financial institutes and banks to generate income activities for the underprivileged. We believe that we have earned full faith of the poorest class of the society to whom we are associating like a catalyst for their upliftment and for that we can console ourselves that our organization has contributed something to the society which directly reflects our success. Today, the Company is working with experienced and knowledgeable professionals with vast experience and complementary skill set in the financing of MSMEs, and other similar product since we believe with the eternal philosophy that the success of any institution requires competency standards on the part of its staff . The history & track record of management is critical for the growth and sustainability of Transforming the Lives of Underprivileged August 2019|36

- 39. generating income activities for low-income households. His ethics helps him to make a good relationship with officials of the banks and financial institutes. This help in raising fund from numerous financial institutes and banks. He has been monitoring the activities and complied with guidelines of regulatory authorities. Making a Mark On account of his ability and knowledge, the Managing Director of the company was nominated by SIDBI for undergoing training on Strategic Response to Risk in Microfinance Markets at Boulder Institute of Microfinance at Washington DC . The activities of Nightingale Charitable Society were acknowledged by the North Eastern Development Finance Corporation Ltd. The society is awarded with a certificate of excellence in 2010 excellence in Enterprise creation and contribution to the growth of the economy in the N.E Region. The company has bagged award as the best microcredit finance company in Assam. The company also awarded as Best NBFC in North Eastern Region by MSME Banking Excellence Award. In this connection the Government of India, Department of Home Affairs telecasted a documentary in Doordarshan Titled # Purbottar ke Sitare # (Star of the Northeast) for half an hour highlighting all our activities for the society in the northeast as a mark of their recognition. Making the world a better place to live-in Nightingale is also engaged in Social activities like health check-up camps, cleanliness programs, AIDs awareness, benefits of forestry, etc. The microcredit activities of the Company have extended to un-served areas where other MFIs are not assessed to the areas. The company is providing services to areas where banks or other MFIs are not adequate to provide financialsupport. Nightingale is successful in transforming the lives of many unprivileged people. The company is dedicated to raise the income of poor people and uplift their financial condition. The company has inspired many poor people to become an entrepreneur by providing financial assistance, necessary training and continuous counseling by our dedicated staff members. The Road Ahead Progressing forward with a positive approach, the company’s aim is to provide microcredit to 1 million families by the end of 2025. The company is also expanding its activities to entire states of N.E Region. The company is implementing the technology of m-pose company spice money for cashless transaction. Nightingale will continue to deliver best in class microcredit services to underprivileged in the future since it is a tool for economic growth and poverty alleviation. We are changing the lives of underprivileged through microcredit services ‘’ |August 2019 37

- 40. PIRAMAL CAPITAL & HOUSING FINANCE operational efficiency by eliminating data duplication, reducing paperwork, facilitating a seamless data flow for effective monitoring and control. A recent scheme relies on a technology-led solution in both customer acquisition and stakeholder (distributors and developer) management. It has the ability to send out well-targeted propositions, provide more personal access to customers, lower turnaround time and provide more efficient service. It is expected to significantly impact the company's ability to scale the size of its book, whilst also creating a USP, through its reliance on technology. Innovation – The Key to Growth The Piramal Group has successfully created industry benchmarks time and again by launching unique strategies and relying on both product and process innovations to gain a competitive edge. In order to detect early warning signals, it created a unique asset monitoring model across its investments with the team monitoring each project on a regular basis. This includes conducting regular site visits for real estate projects, maintaining monthly MIS updates on the progress of each investment, ensuring Khushru Jijina is the Managing Director of Piramal Capital & Housing Finance. A Chartered Accountant with an illustrious career spanning well over three decades in the field of real estate, corporate finance and treasury management, he has been with the Piramal Group for around 18 years. His role encompasses overseeing the entire spectrum of activities ranging from origination, investments, asset management, exits and new fundraisings. The Financial Group Piramal Capital & Housing Finance Limited (PCHFL) is registered as a housing finance company with National Housing Bank (NHB). It is engaged in various financial services businesses and provides both wholesale and retail funding opportunities across industry sectors. In real estate, it provides housing finance and other financing solutions across the entire capital stack such as structured debt, construction finance, flexible lease rental discounting etc. PCHFL also offers customised financing solutions to the hospitality sector. The wholesale business in the non-real estate sector includes separate verticals: Corporate Finance (CFG) - It provides customized funding solutions to companies across sectors such as infrastructure, renewable energy, industrials, etc. Emerging Corporate Lending (ECL) – It focuses on providing funds to Small and Medium Enterprises (SMEs). Tech-transformation The country's NBFC sector is experiencing rapid growth, due to macroeconomic conditions and high credit penetration. It is also witnessing major disruptions through the adoption of tech-driven innovations. In its early days, PCHFL focused on building a standardized set of systems, business processes and underwriting standards to achieve scale and redefining the market with innovative products. Today it is touted as having some of the best processes and governance standards as evidenced and validated at multiple instances by the regulators, various external service providers as well as the rating agencies themselves. Leveraging technology, PCHFL adopted a customized and built to suit technology platform that spans the entire wholesale finance business. It helped the company to enhance its Financing Your Dreams Of Growth August 2019|38

- 41. collection of receivables, conducting regular project monitoring meetings with the clients and more. The fund management business also brought certain unique and innovative strategies such as slum redevelopment (Mumbai Redevelopment Fund) or bulk buying of apartments (Apartment Fund). It has also translated this entrepreneurial mind-set into the introduction of multiple new products within its wholesale lending business over the years – from a ‘Flexi-LRD’ to the ‘Piramal Preferred Partner’ program. Recently, it set up the Emerging Corporate Lending team to target small and medium enterprise lending in order to access smaller corporates. In its retail Housing Finance business, it introduced a unique business model – B2B2C – (business to developer to customer) which is a key differentiator. In this model, it has leveraged existing robust relationships with its developer partners combined with innovative product offerings such as: SUPER Loans – A popular product that factors the future income potential after assessing the credit parameters for the retail loan to enable customers to purchase their ideal home. AdvantAGE -- Specially designed for parent-child wherein both can pay a higher EMI in the initial years when their income is higher. In the later years, when total family income is reduced, the customer can avail an option to pay lower EMIs factoring the revised family income. Bridge -- It caters to those customers who aspire to buy a new house by helping them with the down payment before selling their existing property. Triumphant Moments From winning awards and accolades for its wide scale of abilities, to firmly maintaining a bottom line that speaks for itself, PCHFL’s performance has been widely recognised by the industry. It has received several accolades, including Asia One: Global India 2017, Business Leader of the Year: Global Real Estate Congress 2017, Visionary in Real Estate Financing: NDTV Property Awards 2017, CXO of the year: Realty Plus 2018 and CEO of the year: 8th EPC World Awards. Inspiring Generations to Come The Piramal Group values of Knowledge, Action, Care and Impact guide PCHFL's culture and are also personified by its purpose – ‘Doing Well and Doing Good’. In the same mould, Khushru would like to encourage the youth today to take a very long term view when starting out in their professional lives and careers. He says, “I have always believed that the most important advice that can be given to the younger generation is to be true to themselves; to not to act in haste and take the wrong path, to be ambitious but humble and to have the courage to say and do what they truly believe in, even if others try to discourage you. Stay true to your values, beliefs and remember the path is never easy. Believe in yourself, build a long term vision and work towards it consistently, passionately and with an overarching sense of purpose.” PCHFL through its group companies provides customized strategies for institutional and retail investors ‘’ |August 2019 39