The document describes a dynamic factor model to analyze how financial risks are interconnected within the Eurozone. It uses the model to examine risk dynamics using sovereign CDS and equity returns from 2007-2009 covering the US financial crisis and pre-sovereign crisis in Europe. The model relates asset returns to latent sector factors, macro factors, and covariates. Bayesian inference is applied using MCMC to estimate the time-varying parameters and latent factors.

![Introduction

The Dynamic Factor Model

Bayesian Inference via MCMC

Simulation Study

Application to Sovereign CDS and Equity Data

Conclusions and Current/Future research

Introduction

The Data

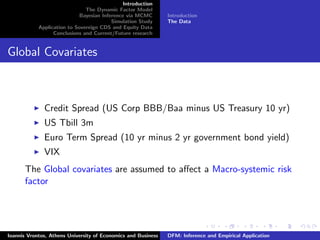

Local and Sector-specific Covariates for Euro Stocks

Country-specific (local) covariates:

Domestic industrial production

Domestic inflation

Sectorial index (Financial vs Non Financial)

Sector-specific covariates:

Momentum (6m minus 1m Eurostoxx 600 computed at time t

by Pt−21/Pt−126 − 1 where Pt is the asset price at time t, in

order to avoid the 1-month reversal period)

Risk Premium Europe (Stoxx Europe 600 earning per share

minus (0.70 × [BofA ML 7-10y Euro Non-Financial] + 0.30 ×

[BofA ML 7-10y Sterling Corporating Non-Financial]) )

Risk Premium US (S&P 500 earning per share minus BofA ML

US Corporate 7-10y Yield)

Ioannis Vrontos, Athens University of Economics and Business DFM: Inference and Empirical Application](https://image.slidesharecdn.com/efmavrontos-150707171649-lva1-app6892/85/A-Dynamic-Factor-Model-Inference-and-Empirical-Application-Ioannis-Vrontos-6-320.jpg)

![Introduction

The Dynamic Factor Model

Bayesian Inference via MCMC

Simulation Study

Application to Sovereign CDS and Equity Data

Conclusions and Current/Future research

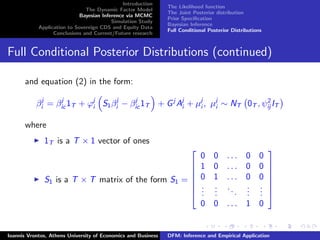

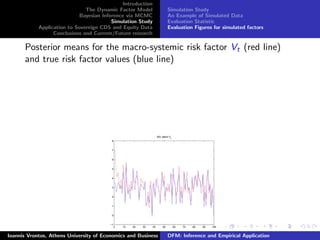

Simulation Study

An Example of Simulated Data

Evaluation Statistic

Evaluation Figures for simulated factors

Evaluation Statistic

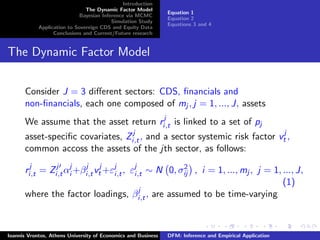

Evaluate the performance of the latent factor estimates by

using the following statistic (Doz, Giannone and Reichlin,

2006, Korobilis and Schumacher, 2014):

SSF0 =

tr v v v v

−1

v v

tr [v v]

where v denotes the latent factor estimates, and v denotes

the true simulated factor

This statistic takes values between zero and one, and

therefore, values of SSF0 close to one indicate good

approximation of the true latent factors

Ioannis Vrontos, Athens University of Economics and Business DFM: Inference and Empirical Application](https://image.slidesharecdn.com/efmavrontos-150707171649-lva1-app6892/85/A-Dynamic-Factor-Model-Inference-and-Empirical-Application-Ioannis-Vrontos-25-320.jpg)

![Introduction

The Dynamic Factor Model

Bayesian Inference via MCMC

Simulation Study

Application to Sovereign CDS and Equity Data

Conclusions and Current/Future research

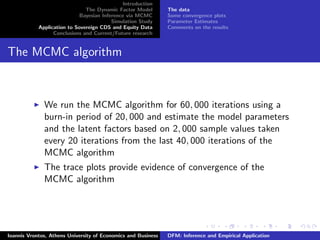

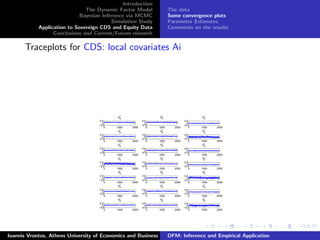

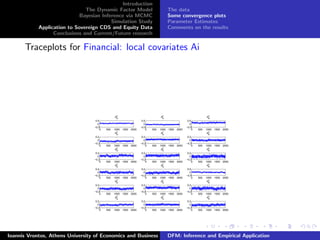

The data

Some convergence plots

Parameter Estimates

Comments on the results

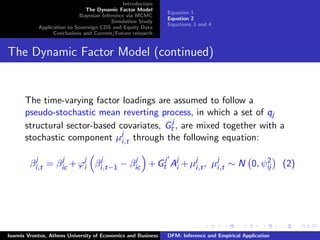

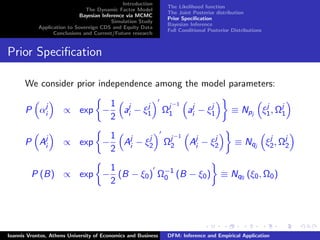

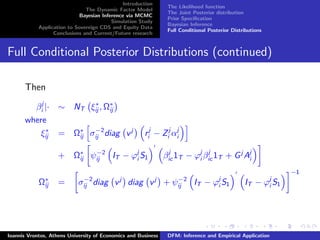

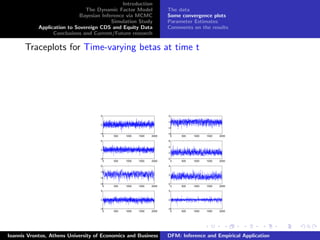

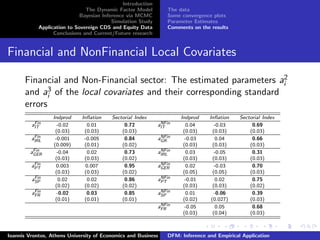

Autoregressive Parameters

The estimated autoregressiver parameters ϕj

i and their

corresponding standard errors [in the time-varying betas equation]

CDS ϕcds

GER ϕcds

GR ϕcds

SP ϕcds

FR ϕcds

IRE ϕcds

IT ϕcds

PO

Estimates -0.15 -0.04 0.02 -0.12 0.11 -0.03 -0.01

Std.Error (0.05) (0.06) (0.07) (0.05) (0.05) (0.06) (0.05)

Financials ϕFin

IT ϕFin

IRL ϕFin

GER ϕFin

PT ϕFin

SP ϕFin

FR

Estimates 0.29 0.14 -0.04 0.09 -0.01 0.09

Std.Error (0.08) (0.05) (0.06) (0.09) (0.08) (0.06)

Non − Financial ϕNFin

IT ϕNFin

GR,t ϕNFin

IRL ϕNFin

GER ϕNFin

PT ϕNFin

SP ϕNFin

FR

Estimates -0.18 0.14 -0.28 -0.32 -0.27 -0.16 0.14

Std.Error (0.08) (0.18) (0.09) (0.08) (0.09) (0.07) (0.10)

Ioannis Vrontos, Athens University of Economics and Business DFM: Inference and Empirical Application](https://image.slidesharecdn.com/efmavrontos-150707171649-lva1-app6892/85/A-Dynamic-Factor-Model-Inference-and-Empirical-Application-Ioannis-Vrontos-51-320.jpg)

![Introduction

The Dynamic Factor Model

Bayesian Inference via MCMC

Simulation Study

Application to Sovereign CDS and Equity Data

Conclusions and Current/Future research

The data

Some convergence plots

Parameter Estimates

Comments on the results

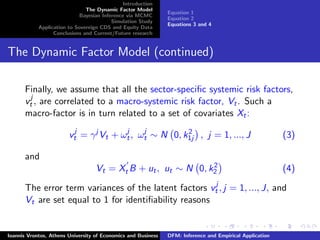

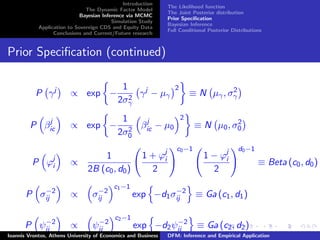

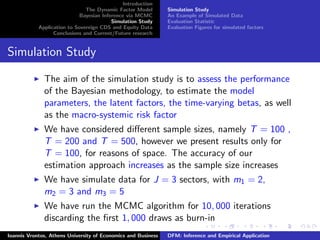

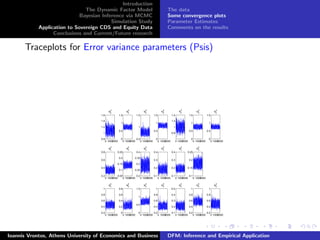

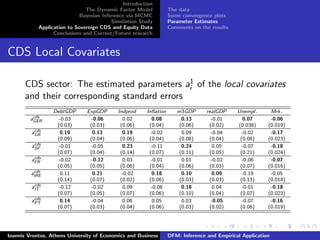

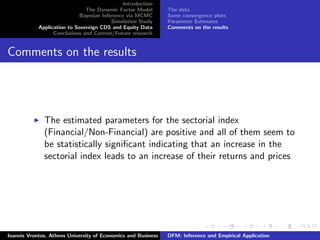

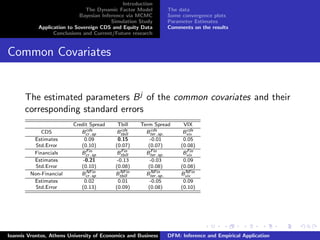

Constant Parameters

The estimated parameters βj

ic and their corresponding standard

errors [constants in the time-varying betas equation]

CDS βcds

GER βcds

GR βcds

SP βcds

FR βcds

IRE βcds

IT βcds

PO

Estimates -0.05 0.11 0.11 0.07 0.04 0.11 0.09

Std.Error (0.04) (0.04) (0.05) (0.04) (0.05) (0.04) (0.04)

Financials βFin

IT βFin

IRL βFin

GER βFin

PT βFin

SP βFin

FR

Estimates -0.19 0.05 0.03 0.06 -0.04 0.004

Std.Error (0.06) (0.02) (0.03) (0.05) (0.03) (0.03)

Non − Financial βNFin

IT βNFin

GR,t βNFin

IRL βNFin

GER βNFin

PT βNFin

SP βNFin

FR

Estimates -0.11 -0.04 0.004 0.02 -0.04 0.04 -0.02

Std.Error (0.04) (0.05) (0.05) (0.05) (0.04) (0.04) (0.06)

Ioannis Vrontos, Athens University of Economics and Business DFM: Inference and Empirical Application](https://image.slidesharecdn.com/efmavrontos-150707171649-lva1-app6892/85/A-Dynamic-Factor-Model-Inference-and-Empirical-Application-Ioannis-Vrontos-52-320.jpg)

![Introduction

The Dynamic Factor Model

Bayesian Inference via MCMC

Simulation Study

Application to Sovereign CDS and Equity Data

Conclusions and Current/Future research

The data

Some convergence plots

Parameter Estimates

Comments on the results

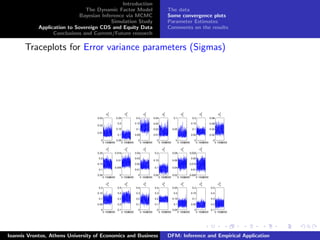

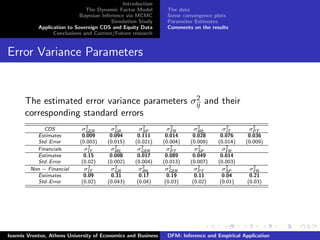

Error Variance Parameters

The estimated error variance parameters ψ2

ij and their

corresponding standard errors [in the time-varying betas equation]

CDS ψ2

GER ψ2

GR ψ2

SP ψ2

FR ψ2

IRL ψ2

IT ψ2

PT

Estimates 1.06 0.73 0.78 0.83 0.99 0.74 0.75

Std.Error (0.09) (0.07) (0.08) (0.07) (0.10) (0.07) (0.07)

Financials ψ2

IT ψ2

IRL ψ2

GER ψ2

PT ψ2

SP ψ2

FR

Estimates 0.34 0.14 0.28 0.18 0.19 0.17

Std.Error (0.05) (0.01) (0.03) (0.03) (0.02) (0.02)

Non − Financial ψ2

IT ψ2

GR ψ2

IRL ψ2

GER ψ2

PT ψ2

SP ψ2

FR

Estimates 0.45 0.23 0.69 0.42 0.21 0.57 0.48

Std.Error (0.06) (0.06) (0.10) (0.06) (0.03) (0.06) (0.07)

Ioannis Vrontos, Athens University of Economics and Business DFM: Inference and Empirical Application](https://image.slidesharecdn.com/efmavrontos-150707171649-lva1-app6892/85/A-Dynamic-Factor-Model-Inference-and-Empirical-Application-Ioannis-Vrontos-54-320.jpg)