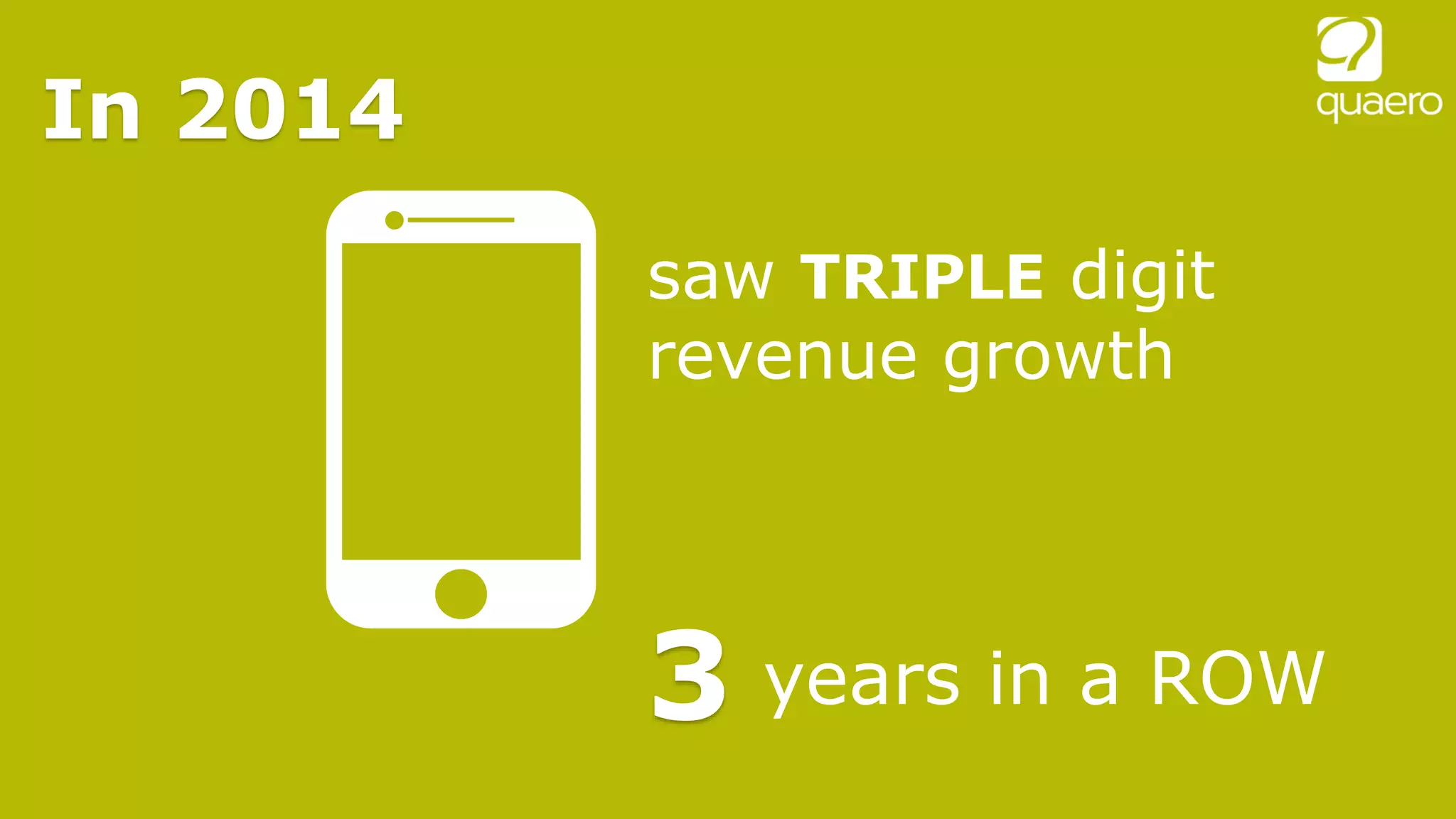

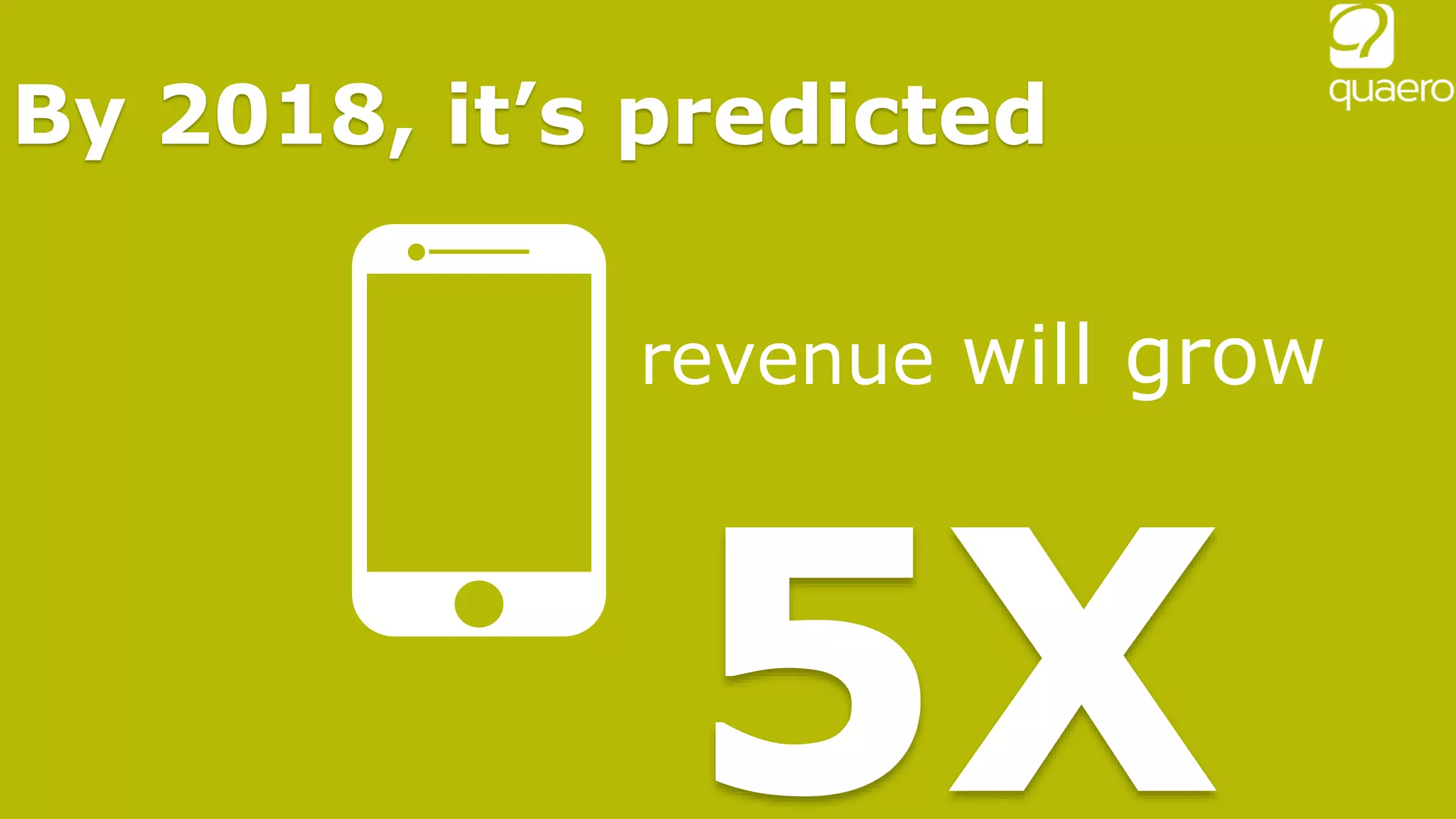

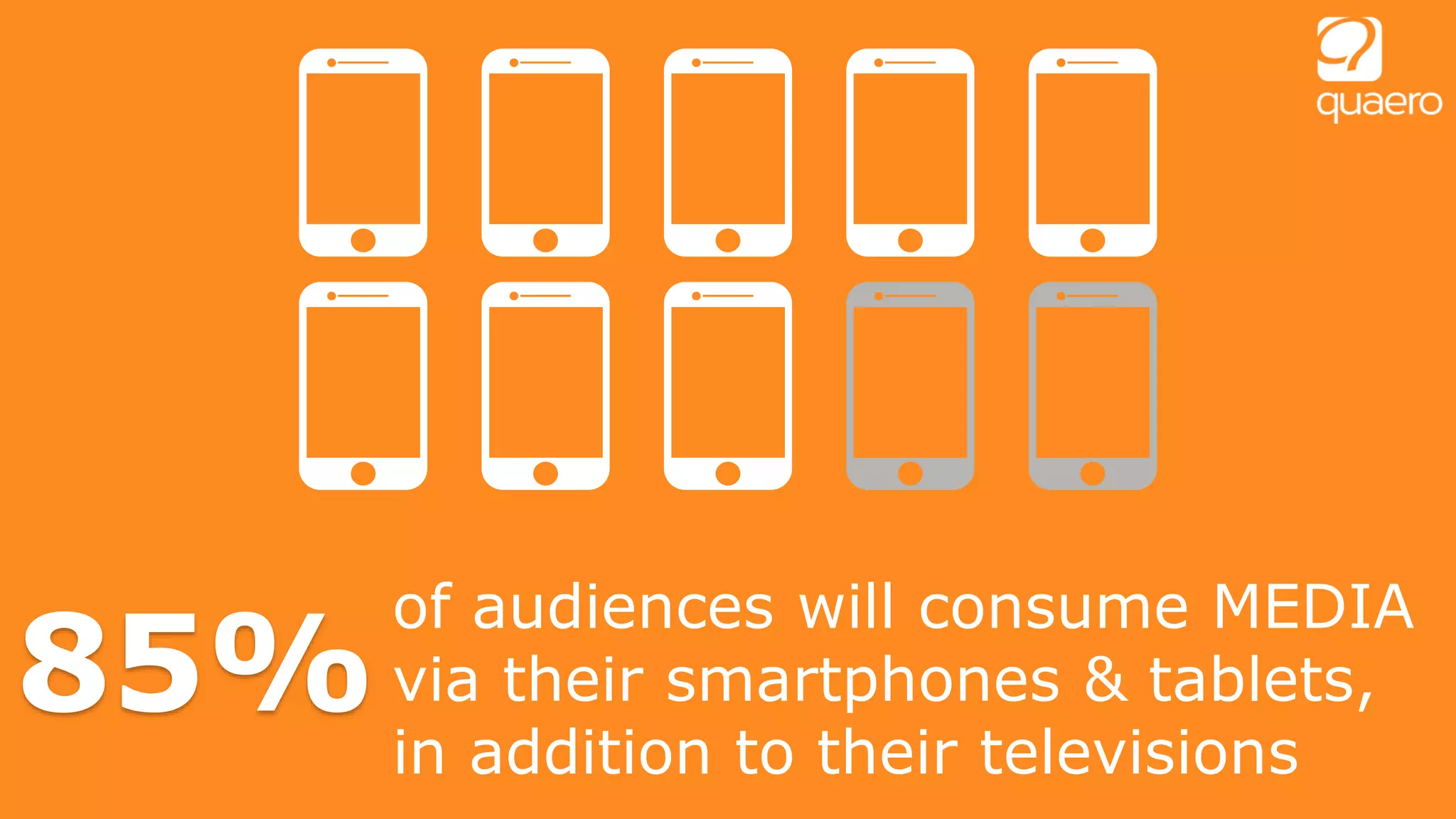

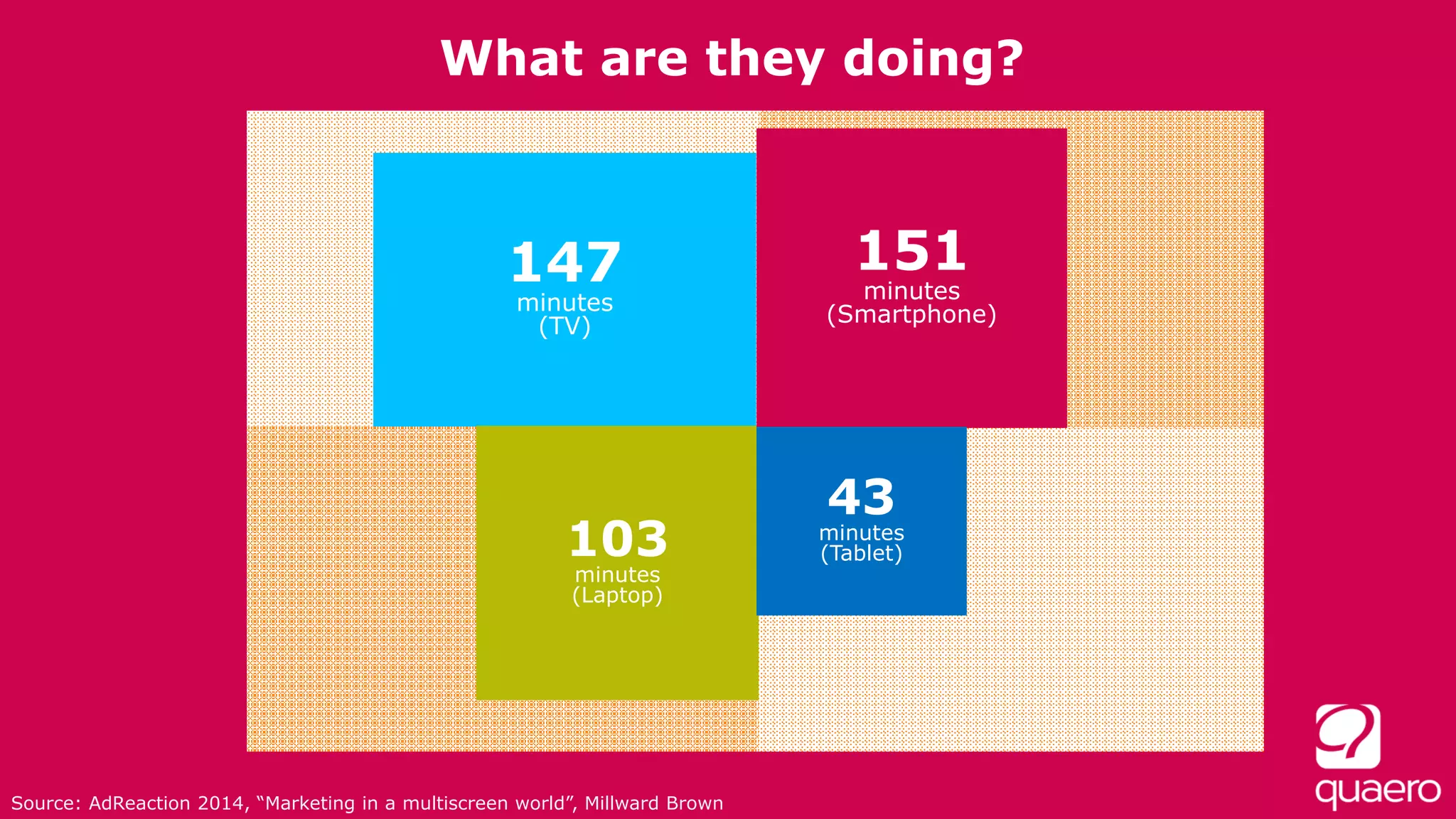

The document discusses the increasing trend of digital ad spending surpassing TV by 2016, reaching an estimated $103 billion by 2019, driven by mobile consumption. It highlights that while 85% of audiences consume media on mobile devices, less than 20% of total ad delivery is allocated to mobile advertising. To capitalize on mobile moments, the document suggests strategies like encouraging logged-in experiences, experimenting with cross-device solutions, and catering to mobile contexts.

![44% of online shoppers begin by using a Search Engine

Go!

Source: Social Times, Social Mobile, Search – Amazing E-Commerce Stats, Facts &

Figures [Infographic]](https://image.slidesharecdn.com/mobile-consumption-ad-spend-v8-150210141249-conversion-gate01/75/Closing-the-Gap-Between-Mobile-Consumption-Ad-Spend-19-2048.jpg)

![Half of social media-

driven purchasing

happens within one

week of sharing,

tweeting, liking, or

favoriting a product

Source: Social Times, Social Mobile, Search – Amazing E-

Commerce Stats, Facts & Figures [Infographic]](https://image.slidesharecdn.com/mobile-consumption-ad-spend-v8-150210141249-conversion-gate01/75/Closing-the-Gap-Between-Mobile-Consumption-Ad-Spend-20-2048.jpg)