QNBFS Daily Market Report May 13, 2018

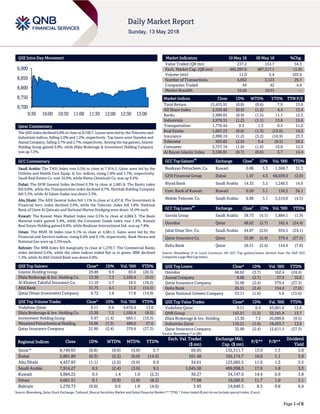

- 1. Page 1 of 8 QSE Intra-Day Movement Qatar Commentary The QSE Index declined 0.8% to close at 8,749.7. Losses were led by the Telecoms and Industrials indices, falling 2.0% and 1.2%, respectively. Top losers were Ooredoo and Aamal Company, falling 3.7% and 2.7%, respectively. Among the top gainers, Islamic Holding Group gained 9.9%, while Dlala Brokerage & Investment Holding Company was up 7.2%. GCC Commentary Saudi Arabia: The TASI Index rose 0.5% to close at 7,914.3. Gains were led by the Utilities and Health Care Equip. & Svc indices, rising 1.8% and 1.7%, respectively. Saudi Real Estate Co. rose 10.0%, while Nama Chemicals Co. was up 9.4%. Dubai: The DFM General Index declined 0.3% to close at 2,881.8. The Banks index fell 0.8%, while the Transportation index declined 0.7%. Ekttitab Holding Company fell 3.5%, while Al Salam Sudan was down 3.3%. Abu Dhabi: The ADX General Index fell 1.1% to close at 4,437.8. The Investment & Financial Serv. index declined 2.6%, while the Telecom. index fell 1.8%. National Bank of Umm Al Qaiwain and National Marine Dredging were down 10.0% each. Kuwait: The Kuwait Main Market Index rose 0.5% to close at 4,884.3. The Basic Material index gained 3.4%, while the Consumer Goods index rose 1.4%. Kuwait Real Estate Holding gained 8.0%, while Boubyan International Ind. was up 7.8%. Oman: The MSM 30 Index rose 0.1% to close at 4,681.5. Gains were led by the Financial and Services indices, rising 0.4% and 0.1%, respectively. Bank Nizwa and National Gas were up 2.3% each. Bahrain: The BHB Index fell marginally to close at 1,270.7. The Commercial Banks index declined 0.4%, while the other indices ended flat or in green. BBK declined 1.4%, while Al Ahli United Bank was down 0.8%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Islamic Holding Group 29.89 9.9 83.0 (20.3) Dlala Brokerage & Inv. Holding Co. 13.30 7.2 1,550.4 (9.5) Al Khaleej Takaful Insurance Co. 11.10 5.7 10.5 (16.2) Ahli Bank 31.75 4.1 11.2 (14.5) Qatar Oman Investment Company 6.72 1.8 17.8 (14.9) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Vodafone Qatar 9.11 0.4 4,676.4 13.6 Dlala Brokerage & Inv. Holding Co. 13.30 7.2 1,550.4 (9.5) Investment Holding Group 5.47 (1.4) 665.1 (10.3) Mesaieed Petrochemical Holding 16.06 (1.5) 400.0 27.6 Qatar Insurance Company 32.90 (2.4) 379.4 (27.3) Market Indicators 10 May 18 09 May 18 %Chg. Value Traded (QR mn) 237.2 153.7 54.3 Exch. Market Cap. (QR mn) 482,387.0 487,317.1 (1.0) Volume (mn) 11.0 5.4 103.6 Number of Transactions 4,052 3,123 29.7 Companies Traded 44 42 4.8 Market Breadth 15:26 10:31 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 15,415.91 (0.8) (0.6) 7.9 13.0 All Share Index 2,559.40 (0.9) (1.2) 4.4 13.4 Banks 2,980.05 (0.9) (1.5) 11.1 12.2 Industrials 2,976.31 (1.2) (1.1) 13.6 15.6 Transportation 1,776.44 0.3 1.5 0.5 11.2 Real Estate 1,667.23 (0.0) (1.3) (13.0) 14.5 Insurance 2,890.19 (1.2) (3.2) (16.9) 23.3 Telecoms 993.82 (2.0) 0.4 (9.5) 29.2 Consumer 5,757.19 (1.0) (1.0) 16.0 12.5 Al Rayan Islamic Index 3,546.91 (0.7) (0.6) 3.7 14.4 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% Boubyan Petrochem. Co. Kuwait 0.88 5.3 1,568.7 31.3 GFH Financial Group Dubai 1.47 4.3 66,039.0 (2.0) Riyad Bank Saudi Arabia 14.32 3.2 1,240.5 14.6 Com. Bank of Kuwait Kuwait 0.50 3.1 134.3 36.1 Mobile Telecom. Co. Saudi Arabia 6.98 3.1 5,519.0 (4.5) GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% Savola Group Saudi Arabia 38.73 (4.1) 1,884.1 (1.9) Ooredoo Qatar 68.62 (3.7) 162.4 (24.4) Jabal Omar Dev. Co. Saudi Arabia 44.87 (2.6) 934.5 (24.1) Qatar Insurance Co. Qatar 32.90 (2.4) 379.4 (27.3) Doha Bank Qatar 26.51 (2.4) 154.4 (7.0) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Ooredoo 68.62 (3.7) 162.4 (24.4) Aamal Company 9.60 (2.7) 37.9 10.6 Qatar Insurance Company 32.90 (2.4) 379.4 (27.3) Doha Bank 26.51 (2.4) 154.4 (7.0) Qatar National Cement Company 53.11 (1.6) 5.6 (15.6) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Vodafone Qatar 9.11 0.4 43,061.6 13.6 QNB Group 143.31 (1.5) 32,181.9 13.7 Dlala Brokerage & Inv. Holding 13.30 7.2 20,089.8 (9.5) Industries Qatar 110.21 (1.6) 18,433.7 13.6 Qatar Insurance Company 32.90 (2.4) 12,611.5 (27.3) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 8,749.65 (0.8) (0.6) (4.0) 2.7 66.05 132,511.7 13.0 1.3 5.0 Dubai 2,881.80 (0.3) (2.2) (6.0) (14.5) 101.48 102,174.7 10.0 1.1 5.9 Abu Dhabi 4,437.83 (1.1) (2.6) (5.0) 0.9 34.61 123,082.5 11.6 1.3 5.5 Saudi Arabia 7,914.27 0.5 (2.4) (3.6) 9.5 1,045.50 499,998.3 17.8 1.8 3.3 Kuwait 4,884.25 0.5 1.4 1.0 (2.3) 30.27 34,147.0 14.4 0.9 3.8 Oman 4,681.51 0.1 (0.9) (1.0) (8.2) 77.08 19,585.5 11.7 1.0 5.1 Bahrain 1,270.73 (0.0) 0.6 1.0 (4.6) 3.95 19,849.3 8.3 0.8 6.4 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades, if any) 8,700 8,750 8,800 8,850 8,900 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 8 Qatar Market Commentary The QSE Index declined 0.8% to close at 8,749.7. The Telecoms and Industrials indices led the losses. The index fell on the back of selling pressure from GCC and non-Qatari shareholders despite buying support from Qatari shareholders. Ooredoo and Aamal Company were the top losers, falling 3.7% and 2.7%, respectively. Among the top gainers, Islamic Holding Group gained 9.9%, while Dlala Brokerage & Investment Holding Company was up 7.2%. Volume of shares traded on Thursday rose by 103.6% to 11.0mn from 5.4mn on Wednesday. Further, as compared to the 30-day moving average of 10.6mn, volume for the day was 3.7% higher. Vodafone Qatar and Dlala Brokerage & Investment Holding Company were the most active stocks, contributing 42.5% and 14.1% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings Releases and Global Economic Data Earnings Releases Company Market Currency Revenue (mn) 1Q2018 % Change YoY Operating Profit (mn) 1Q2018 % Change YoY Net Profit (mn) 1Q2018 % Change YoY Allianz Saudi Fransi Cooperative Insurance Co. Saudi Arabia SR 298.5 -0.4% – – 1.4 2.3% Al-Babtain Power and Telecommunication Co. Saudi Arabia SR – – 28.9 -26.8% 19.4 -50.4% Fitaihi Holding Group Saudi Arabia SR – – -3.0 N/A 1.5 -87.5% Walaa Cooperative Insurance Co. Saudi Arabia SR 310.5 3.6% – – 2.7 122.0% National Agricultural Marketing Co. Saudi Arabia SR – – 2.0 35.8% 1.5 0.1% Al-Ahlia Insurance Co. Saudi Arabia SR 34.3 -25.1% – – 6.4 314.2% Al-Baha Investment and Development Co. Saudi Arabia SR – – – – 747.9 12377.6% Saudi Arabian Cooperative Insurance Co. Saudi Arabia SR 370.6 -1.1% – – 1.5 -29.3% Bupa Arabia for Cooperative Insurance Co. Saudi Arabia SR – – 2489.2 10.5% 20.8 75.2% Arabian Pipes Co. Saudi Arabia SR – – -5.1 N/A -8.8 N/A Arabian Shield Cooperative Insurance Co. Saudi Arabia SR 240.9 0.4% – – 1.8 32.6% Al Alamiya for Cooperative Insurance Co. Saudi Arabia SR – – 100.7 16.7% 1.6 -2.7% United Cooperative Assurance Co. Saudi Arabia SR 104.0 -4.5% – – 0.5 -60.5% Taiba Holding Co. Saudi Arabia SR – – 47.7 -17.8% 27.2 -48.2% Aseer Trading, Tourism and Manufacturing Co. Saudi Arabia SR – – 39.7 -25.7% 11.7 -43.5% CHUBB Arabia Cooperative Insurance Co. Saudi Arabia SR 98.9 17.0% – – 1.2 62.5% Salama Cooperative Insurance Co. Saudi Arabia SR 246.2 8.1% – – 4.1 453.5% Source: Company data, DFM, ADX, MSM, TASI, BHB. Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 05/10 US Department of Labor Initial Jobless Claims 5-May 211k 219k 211k 05/100 US Department of Labor Continuing Claims 28-April 1,790k 1,800k 1,760k 05/10 US Bureau of Labor Statistics CPI MoM April 0.2% 0.3% -0.1% 05/10 US Bureau of Labor Statistics CPI YoY April 2.5% 2.5% 2.4% 05/10 UK UK Office for National Statistics Trade Balance March -£3,091 -£2,000 -£1,176 05/10 UK UK Office for National Statistics Industrial Production MoM March 0.1% 0.2% 0.1% 05/10 UK UK Office for National Statistics Industrial Production YoY March 2.9% 3.1% 2.1% 05/10 UK UK Office for National Statistics Manufacturing Production MoM March -0.1% -0.2% -0.2% 05/10 UK UK Office for National Statistics Manufacturing Production YoY March 2.9% 2.9% 2.5% Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 45.93% 37.48% 20,040,311.75 Qatari Institutions 13.14% 18.21% (12,016,599.45) Qatari 59.07% 55.69% 8,023,712.30 GCC Individuals 1.47% 1.16% 725,938.00 GCC Institutions 0.74% 2.25% (3,594,110.57) GCC 2.21% 3.41% (2,868,172.57) Non-Qatari Individuals 13.33% 10.30% 7,188,117.51 Non-Qatari Institutions 25.39% 30.59% (12,343,657.24) Non-Qatari 38.72% 40.89% (5,155,539.73)

- 3. Page 3 of 8 05/10 UK UK Office for National Statistics Construction Output SA MoM March -2.3% -2.3% -1.0% 05/10 UK UK Office for National Statistics Construction Output SA YoY March -4.9% -5.7% -1.8% 05/10 CH National Bureau of Statistics PPI YoY April 3.4% 3.4% 3.1% 05/10 CH National Bureau of Statistics CPI YoY April 1.8% 1.9% 2.1% 05/11 IN India Central Statistical Org. Industrial Production YoY March 4.4% 6.2% 7.0% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) News Qatar QNB Group named ‘Best Bank in Qatar’ by Euromoney magazine – QNB Group has been named ‘Best Bank in Qatar’ by global banking sector publication, Euromoney magazine, marking a new recognition of the bank’s leadership in the local banking market. The award was received during the distinguished ‘Euromoney Middle East Awards for Excellence’ ceremony recently held in the presence of senior executives in banking and financial sectors. QNB Group was selected for the award based on a wide range of criteria, from both the group’s strong performance and financial results, and its innovative banking products solutions tailored to meet the individual needs of its customers. (Gulf-Times.com) Qatar tops world with 10.5% average growth rate for 20 years – Qatar has been ranked first in the world index of countries that have achieved record economic growth in 20 years from 1997, according to a report carried by CNBC Arabia. Qatar achieved an average rate of 10.5% compound annual growth to come on top of the world. China ranked second with an economic growth rate of 9.1%, Ethiopia third with a growth rate of 8%, India fourth with 7% and Nigeria fifth in the world with 5.8% growth. Economic prospects for Qatar remain positive, with growth expected to reach 2.8% in 2018, while LNG production will rise to 100mn tons per year by 2023. The World Bank expects the Qatari economy to grow this year and expects an average growth of 3% in the next two years. The World Bank, in a recent report said that the increase in Qatar's energy export revenues will contribute to easing financial constraints, as well as spending on the multi-year program for infrastructure development in preparation for the 2022 FIFA World Cup and the launch of the $10bn Barzan Natural Gas Project in 2020. Qatar's gross domestic product (GDP) rose last year to $220bn, from $218bn in 2016, making a real GDP growth rate of 2%, which was better than expected. (Gulf-Times.com) Qatar-US trade volume witnesses double-digit growth – The bilateral trade volume in goods between Qatar and the US witnessed a double-digit growth (year-on-year) in first quarter of this year (1Q2018) compared to the corresponding period last year. The combined value of goods exchanged between the two countries reached at QR4.30bn ($1.18bn) in 1Q2018, registering a sharp jump of nearly 23% compared to QR3.49bn ($961mn) in the first three months of the previous year (2017), latest official data released by the US Department of Commerce showed. The balance of trade in goods between Qatar and the US in 1Q2018 stood at QR1.21bn ($333mn), which also saw double-digit growth of 16.64% compared to QR1.04bn ($285.5mn) for the same period in 2017. The trade balance between the two countries continued to be in favor of the US-the world’s largest economy, according to statistics available on US Census Bureau’s official website. (Peninsula Qatar) Qatar-Oman trade triples last year – Bilateral trade between Qatar and Oman tripled in one year to more than QR1.8bn in the fourth quarter of 2017, said HE the Minister of Finance Ali Sherif Al-Emadi. In the fourth quarter of 2016, bilateral trade between the two countries stood at QR600mn, Al-Emadi said at the 19th session of the Qatari-Omani Joint Committee. However, he stressed the need for more efforts to increase trade between the two countries by “making maximum use of shipping lines” between Qatar and Oman. Al-Emadi also reviewed the achievements made to strengthen economic cooperation in sectors such as agriculture, livestock, transportation, telecommunications, energy, tourism, education, construction and banking services with investments exceeding QR10bn. (Gulf-Times.com) Ministry to open Milaha offices in Iraq's Umm Qasr port – The Ministry of Transport and Communications (MoTC) announced it will soon be opening offices affiliated to Qatar Navigation (Milaha) in Umm Qasr Port in Iraq. The offices aim to facilitate the maritime flow between Qatar and Iraq, a step coming in harmony with the great development of relations between Qatar and Iraq, especially that the Qatari-Iraqi relations are approaching an important stage of bilateral cooperation at all levels in order to benefit the people of both countries. A statement issued by the ministry highlighted the results of the meeting between HE the Minister of Transport and Communications, Jassim Seif Ahmed al-Sulaiti and Iraq's Transport Minister Kazem Finjan during his visit to Doha in April. (Gulf-Times.com) Qatar stresses support for WTO multilateral agreements – Qatar, as an adherent to a 40-member group led by Switzerland, has stressed its full support for the WTO and the multilateral agreements. Recently, Qatar participated in the General Council meeting of the World Trade Organization at the WTO’s headquarters in Geneva, Switzerland. The 40-member group voiced concerns over growing trade tensions and the risks associated with the multilateral trading system and global trade amid recently increasing trade protection measures and countermeasures between a numbers of countries. The group called on all parties to resolve their differences through dialogue and co-operation within the framework of various WTO bodies. Qatar is the only Arab country to join the 40- member group of the WTO, and was one of the founding countries of the organization, which it joined in 1996. Qatar hosted the WTO Fourth Ministerial Conference in 2001, when the Doha Development Agenda (DDA), which is the centerpiece of the ongoing WTO negotiations, was launched. (Gulf- Times.com)

- 4. Page 4 of 8 QTA: Cruise tourism to help Qatar excel as a destination – Cruise tourism, which has become one of the most important sectors of Qatar’s tourism, will further help the country excel and grow as a destination, Qatar Tourism Authority’s Acting Chairman, Hassan al-Ibrahim said. Speaking on the sidelines of the cruise season closing ceremony 2017-18 in Doha recently, he noted that the cruise sector grew 39% (compared to last cruise season), receiving more than 65,000 visitors on board 22 luxury and mega ships. (Gulf-Times.com) MEC organizes joint training program on patent with WIPO – The Ministry of Economy and Commerce (MEC), in cooperation with World Intellectual Property Organization (WIPO), organized a training program on international requests on the electronic system of Patent Cooperation Treaty (ePCT). The ePCT is a new online service that makes the process of international patent application filing easier and more efficient, and offers users and national patent office’s a number of advantages. The training program comes within the framework of the Ministry’s efforts to increase the number of trained personnel on the use of ePCT, improve the efficiency and readiness of employees, enhance their capabilities and competence in dealing with ePCT, and identify all procedures that would optimize the system and ensure a smooth and efficient workflow and provide an ideal service for applicants. (Peninsula Qatar) Qatar officially joins World ATA Carnet Council – Qatar has officially joined the World ATA Carnet Council (Watac) and is slated to implement the ATA Carnet system in the country from August 1, it was announced by Sheikha Tamadar al-Thani, Director of International Relations and Chambers’ Affairs at Qatar Chamber and the International Chamber of Commerce (ICC) Qatar. Sheikha Tamadar, who addressed the council meeting hosted recently by the International Chamber of Commerce’s World Chambers Federation in Xi’an, China, said Qatar’s formal accession to the council as a full member was the result of lengthy negotiations during previous sessions with Watac officials. (Gulf-Times.com) Qatar plans new waterfront project in West Bay – Qatar's Public Works Authority Ashghal has announced plans to develop the West Bay North Beach area in Doha, creating a “major viable, connected, sustainable and attractive waterfront destination of choice.” The project is expected to complement the existing recreational, leisure and hospitality offering within the city and the wider Doha Municipality area, said a statement from Ashghal. (Zawya) International New York Fed sees US GDP growing at 2.97% in second quarter – The US economy is likely growing at a 2.97% annualized pace in the second quarter, little changed from the 2.96% rate calculated a week earlier, the New York Federal Reserve’s Nowcast model showed. This week’s data on import, producer and consumer prices led to virtual no change on the regional central bank’s model to estimate the gross domestic product in the current quarter, the New York Fed said. (Reuters) US consumer prices rise slightly; labor market tightening – US consumer prices rose less than expected in April, suggesting that inflation was increasing at a moderate pace, which could allow the Federal Reserve to continue gradually raising interest rates. But with the labor market tightening and oil prices rising after President Donald Trump pulled the US out of an international nuclear deal, promising to restore stiff sanctions on Iran, price pressures are expected to accelerate in the coming months. Inflation is flirting with the US central bank’s 2% target. Policymakers have in recent days signaled they would not be too concerned if inflation overshot the target, reiterating what the Fed said in its statement last week. The Labor Department said its Consumer Price Index rose 0.2% in April as increases in the cost of gasoline and rents were tempered by a drop in motor vehicle prices. A three-month slide in India’s inflation rate likely ended in April due to higher energy prices, a Reuters poll found, which could intensify pressure on the central bank to hike interest rates. (Reuters) Subdued UK industrial output data caps glum first quarter for economy – British industrial output barely rose in March, confirming a glum first quarter for the economy that looks likely to scupper a Bank of England interest rate hike later. The data, released along with figures for the construction industry and overseas trade, did nothing to alter the picture of an economy that has struggled for momentum in recent months. While heavy snow storms swept through Britain in early March, the Office for National Statistics (ONS) stuck with its earlier judgment that this had little overall impact on the economy’s performance in the first three months of 2018. The ONS said industrial output inched up by 0.1% MoM in March, the same pace as in February and slightly below the consensus for growth of 0.2% in a Reuters poll of economists. British data have mostly soured over the past month, forcing investors to ax widespread bets that the BoE will raise interest rates this month. (Reuters) German construction workers seal inflation-busting wage deal – German unions and employers on Saturday reached an inflation-busting pay hike of roughly 6% for more than 800,000 construction workers, the strongest wage deal sealed so far this year in Europe’s biggest economy. The IG Bau union said construction workers in West Germany would get a pay hike of 5.7% while wages in East Germany would jump by 6.6%. Both steps are backdated to May 1. The deal, reached after 19 hours of mediation by former Economy Minister Wolfgang Clement, has duration of 26 months. “That’s the highest wage deal sealed nationwide this year,” IG BAU head Robert Feiger said, adding that the result ensured workers finally got their fair share of the economic boom. The German economy is enjoying an unusually prolonged upswing, now in its ninth year, expanding by 2.2% in 2017. With employment at record highs, construction companies in particular are struggling with massive labor shortages. (Reuters) Japan economy seen shrinking for first time in two years in first quarter – Japan economy seen shrinking for first time in two years in first quarter, negative reading, while slight, would snap Japan’s longest period of economic expansion, eight straight quarters of growth - since its 1980s bubble economy. But analysts said the expected January-March weakness may be only a temporary soft patch, arguing that higher prices for fresh vegetables and bad winter weather likely weighed on consumer spending in the quarter. The global economy also has remained firm, suggesting Japan will regain traction in the second

- 5. Page 5 of 8 quarter, they added. Gross domestic product (GDP) probably shrank at an annualized rate of 0.2% in the first quarter after a 1.6 of expansion in the final quarter of 2017, the poll of 18 analysts showed. That would mark the first contraction in the world’s third-largest economy since late 2015. (Reuters) China April new loans rise but shadow lending shrinks – Chinese banks extended 1.18tn Yuan ($186.37bn) in net new Yuan loans in April, up slightly from March and higher than expectations, as policymakers look to support the economy as it faces fresh risks from US trade threats. Credit data also showed Chinese regulators are continuing to make progress in their campaign to clamp down on riskier lending practices and shadow banking in the world’s second-largest economy. Analysts polled by Reuters had seen new Yuan loans of 1.1tn Yuan, down slightly from March’s 1.12tn Yuan. (Reuters) Reuters poll: India April retail inflation seen climbing on higher oil prices – A three-month slide in India’s inflation rate likely ended in April due to higher energy prices, a Reuters poll found, which could intensify pressure on the central bank to hike interest rates. A jump in the global price of oil, India’s costliest import, plus overestimated government expenditure and a sharp weakening in the rupee could cause the Reserve Bank of India to review its long-standing neutral stance. The median forecast in the poll of nearly 30 economists was for April’s annual rate of consumer inflation to rise to 4.42% from March’s 4.28%. If that is the case, April will be the sixth straight month of inflation above the RBI’s 4% medium-term target. The highest forecast was 5.50%. One economist saw the pace as below the RBI’s target, at 3.88%, due to eased food prices. (Reuters) Regional Saudi Arabian banks plan US Dollar bonds despite ample liquidity – At least three commercial banks in Saudi Arabia are preparing US Dollar debt issues, sources said, in what would be the first hard-currency debt sales by Saudi Arabian banks in several years. The banks want to diversify their sources of finance and boost capital levels, but are in no rush for the cash as they are still flush with liquidity due to sluggish credit growth and looser public spending. The Kingdom’s increasing reliance on international bond issues has also freed up liquidity for local banks. (Reuters) Samba Financial Group posts 6% gain in first quarter’s profit – Samba Financial Group posted 6% increase in first quarter net profit, boosted by a gain in special commissions and investments in addition to a decrease in credit costs and salary expenses. The Saudi Arabian banking group's net profit rose to SR1.31bn in the first three months of the year from the same period in 2017. Special commission income and investments increased 5.5% to SR1.43bn in the quarter from the corresponding period last year. The earnings came in above the average analyst estimate of SR1.28bn, according to Bloomberg. The gains came despite 2% drop in total operating profit due to a decrease in banking fees and other operating income. Loans and advances fell 6.6% to SR116bn in the first quarter while customer deposits increased 1.2% to SR172.3bn. (GulfBase.com) SABIC eyes 50% stake in ONGC’s west India petchem plant – Saudi Basic Industries Corp. (SABIC) wants to buy about half of the $4.6bn Indian petchem project backed by Oil and Natural Gas Corp. (ONGC), according to sources. ONGC is a majority shareholder in ONGC Petro Additions Ltd. (OPaL), which operates India’s biggest petrochemical plant in western Gujarat state. SABIC want to have a significant stake in OPaL, around 50%, sources said. Previously, ONGC had held talks about selling a stake in the project with Saudi Aramco and Petrochemical Industries Co., a unit of Kuwait Petroleum Corp., sources added. (GulfBase.com) Bahri adds new VLCC to boost oil fleet strength – National Shipping Company of Saudi Arabia (Bahri) has taken the delivery of ‘Amad’, a very large crude-oil carrier (VLCC), further enhancing its market-leading capabilities in crude oil transportation. The new vessel marks the last of the 10 VLCCs added to Bahri’s fleet as part of its agreement with South Korea- based Hyundai Samho Heavy Industries, a leading global shipbuilding company. (GulfBase.com) Subsidiary of TASNEE enters into an Option Agreement with Tronox for selling 90% of the Slagger in Jazan – TASNEE announced that Advanced Metal Industries Cluster Company Limited (AMIC), a subsidiary of TASNEE (owned equally by Tasnee and Cristal) enters into an Option Agreement with Tronox Limited (Tronox) , a global mining and inorganic chemicals company, In accordance with the Option Agreement, Tronox shall acquire 90% of AMIC ownership in a world-class titanium slag smelter facility (the Slagger) which has the capacity to supply up to 500kt of TiO2 slag and 220kt of pig iron, located in the Jazan City for Primary and Downstream Industries in the Kingdom of Saudi Arabia. (GulfBase.com) IMF: UAE's VAT move has gone well, inflation to moderate – The UAE’s introduction of value-added tax has gone smoothly and inflation, having jumped in response, will moderate, according to Natalia Tamirisa, Head of the International Monetary Fund’s (IMF) mission to the country. Tamirisa said the 5% VAT rate imposed at the start of this year was a big cultural and administrative shift in a country that has traditionally had minimal taxation. Given the challenges, VAT introduction has been well managed and relatively smooth. Annual consumer price inflation jumped to 4.8% in January, the highest since 2015, but dropped back to 3.4% in March. Tamirisa said the latest data suggested the impact of the tax would be short-lived, partly because inflation had dropped in areas of the economy not covered by VAT. (Reuters) UAE, Moldova agrees to strengthen economic cooperation – UAE-Moldova Business Forum hosted by the Dubai Chamber of Commerce and Industry highlighted trade and investment opportunities in Moldova. The two countries planed on establishing a joint economic committee as part of the agreement, which will serve as a platform to discuss mutual areas of cooperation. The forum focused on several key sectors such as telecommunications, agriculture, infrastructure and tourism. A total of 80 bilateral business meetings were held following the events which were joined by a wide variety of Moldovan companies and their UAE counterparts. (GulfBase.com) Sharjah Airport Authority signs AED100mn contracts – Sharjah Airport Authority (SAA) announced that it has signed three agreements related to its ongoing comprehensive expansion

- 6. Page 6 of 8 project. The value of the contracts are approximately AED100mn and include the delegation of consultancy services to ADP Ingénierie, a French company that specialises in airport architecture and engineering, with extensive airport design experience in the UAE and abroad. (GulfBase.com) Swiss group MSC inks $1bn UAE port development deal – MSC Mediterranean Shipping Company, a Swiss-based leader in global transportation and logistics, is set to invest close to $1.08bn on the development of a new container terminal at Khalifa Port. The funding, which will be done through the Geneva-based group's Terminal Investments Limited (TiL), comes as part of a 30-year concession agreement it has signed with Abu Dhabi Ports. The new container terminal represents one of MSC's strategic investments as one of the world’s leading container shipping lines. (GulfBase.com) The US and UAE sign pact to resolve airline competition claims – The US and UAE signed a deal to resolve US claims that Gulf carriers have received unfair government subsidies, the US State Department stated. The voluntary agreement, which applies to Etihad and Emirates airline, is similar to a deal announced in January between the US and Qatar in which Qatar agreed to release detailed financial information about state-owned Qatar Airways. (Reuters) Dubai Exports leads local firms eyeing Croatia opportunities – Dubai Exports led a trade mission to Croatia aimed at connecting local firms with counterparts in the European Union’s (EU) newest member state, which could act as a gateway to the rest of the EU. Mohammad Al Kamali, Deputy CEO of Dubai Exports, an agency of the Department for Economic Development, said, “Croatia is a market full of potential for UAE companies and this was evident in the B2B meetings during our trade mission. Croatian companies were extremely eager to meet with our delegation and we see promising signs for the future.” Bilateral trade between Dubai and south-east Europe has been rising in recent years and 2017 saw an increase of 4% over 2016. (GulfBase.com) DP World, Azerbaijan explore opportunities – DP World’s Chairman and CEO, Sultan Ahmed Bin Sulayem met with the President of Azerbaijan Ilham Aliyev to explore future opportunities for economic cooperation and existing arrangements to develop logistics infrastructure in the country. Sulayem highlighted the advisory role DP World is playing in the development the Alyat Free Trade Zone following an agreement in September 2016. The future business hub is part of a network of planned economic zones in the country forming part of the Eurasian trade corridor with the country sitting astride major transport arteries that feature in the One Belt One Road initiative. (GulfBase.com) Dubai Land Department discusses real estate investment opportunities in Egypt – Dubai Land Department (DLD), through its investment arm the Real Estate Investment Management and Promotion Centre, has hosted several meetings with government officials and leading Egyptian investors as part of the Centre’s recent visit to Egypt. The visit was part of DLD’s ongoing efforts to discuss possible cooperation opportunities between the two countries in the field of investment through the real estate roadshow and workshops held by the Centre in Cairo. (GulfBase.com) Dana Gas close to Sukuk restructuring agreement with creditors – UAE’s energy producer Dana Gas is close to reaching agreement on restructuring $700mn in Islamic bonds, potentially ending a complex and protracted legal battle with its creditors, according to sources. Dana Gas last year halted payments on its Sukuk, saying the bonds had become unlawful because of changes in Islamic finance. Holders of the Sukuk contest its position and are demanding to be paid back. (Reuters) CEO: ADNOC plans further downstream expansion – Abu Dhabi National Oil Co. (ADNOC) plans to double its refining capacity and triple petrochemicals output potential by 2025, as the state energy firm focuses more on downstream expansion to be on par with Big Oil and capture new growth markets, according to ADNOC’s CEO, Sultan Al Jaber. To reach that goal ADNOC will need to create new joint ventures and partnerships and not just rely on its existing assets. The company is also looking at different options for its ADNOC Refining subsidiary, including bringing on strategic partners but an initial public offering (IPO) for the unit is not on the radar screen at this point in time, Al Jaber said. (Reuters) Sharjah Islamic Bank lists $500mn Sukuk on Nasdaq Dubai – Nasdaq Dubai welcomed the listing of $500mn Sukuk by the Sharjah Islamic Bank, the third listing by the Emirati lender on the region’s international exchange. The new Sukuk is Sharjah Islamic Bank’s third listing on Nasdaq Dubai following two Sukuk listings of $500mn each by the bank in 2015 and 2016. The listing supports the continuing expansion of Sharjah Islamic Bank’s Shari’ah-compliant financial activities through its networks across the country including personal and corporate banking as well as investment banking and international services, on behalf of individual and institutional clients. (GulfBase.com) Housing market in Kuwait poised to boom in 2Q2018 – Despite mixed performance in the first quarter of 2018, the various sectors of the property market in Kuwait, particularly the housing one, are projected to recover in the current quarter, experts agreed. The new housing areas such as Al Metla, East Sulaibikhat, Sabah Al Ahmad and Saad Al Abdullah have showed signs of recovery since the beginning of the year backed by government funded infrastructure projects, according to Arab Real Estate Company’s CEO, Haidar Hasan Al Juma. The commercial sector, one of the most active sectors on the market, has seen increased demand and active contract bidding. (GulfBase.com) S&P affirms Sultanate of Oman’s ‘BB/B’ ratings – S&P stated Sultanate of Oman ‘BB/B’ ratings affirmed; outlook ‘Stable’. Oman's fiscal and external deficits are still sizable but have been sensitive to recent improvements in oil prices. S&P expect that economic performance will improve due to stable oil production and solidifying growth in the non-oil economy. The ‘Stable’ outlook balances S&P’s expectation that Oman's fiscal and external deficits will narrow over the next 6-12 months, against the risk that its still-significant external buffers will deteriorate further. (Reuters) Raysut Cement Company seeks to ramp up domestic, international footprint – Raysut Cement Company, the Sultanate’s biggest cement manufacturer, says it is exploring

- 7. Page 7 of 8 prospects for the expansion of its facilities in Suhar and Duqm ports, as well as green-field investment opportunities in East Africa. This comes on top of the majority government-owned company’s newly unveiled plans to establish a major cement plant in the East European state of Georgia, a final investment decision for which is anticipated next month. (GulfBase.com) Oman's retail sector to generate 54,000 jobs – Oman’s rapidly expanding retail sector could generate up to 54,000 jobs for the next generations of professionals, says a top retail advisor in the Sultanate. Maimunah Shebani, the founder and Managing Director of the Retail Agency, which looks to raise awareness of the advantages of the retail sector in Oman, in collaboration with government agencies, says the upcoming major retail projects in Oman could absorb large number of jobseekers and fresh graduates. (GulfBase.com) Bahrain Development Bank launches $100mn venture capital fund – Bahrain Development Bank (BDB) launched $100mn Venture Capital Fund of Funds aimed at boosting the start-up ecosystem in Bahrain and the Middle East. The fund was set up following instructions from HRH Prince Salman Bin Hamad Al Khalifa, Crown Prince, Deputy Supreme Commander and Chairman of the Bahrain Economic Development Board (EDB). The Al Waha Fund of Funds will invest in venture capital funds that have a presence in Bahrain – providing additional capital to funds supporting start-ups in Bahrain and across the Middle East. (GulfBase.com) Bahrain launches $1bn energy fund – Bahrain’s government launched an energy fund that aims to raise $1bn from local, regional and international investors to develop the Kingdom’s energy assets, Oil Minister, Sheikh Mohammed Bin Khalifa Al Khalifa said. The Bahrain Energy Fund will receive its initial capital from local entities including Nogaholding, the investment arm of Bahrain’s National Oil and Gas Authority, as well as from investment banks Osool and SICO, according to the Minister’s statement. (Reuters) KHCB's net profit narrows to BHD0.8mn in 1Q2018 – Khaleeji Commercial Bank (KHCB) recorded net profit of BHD0.8mn in 1Q2018 as compared to BHD1.5mn in 1Q2017. Total income came in at BHD4.3mn as compared to BHD5.5mn in 1Q2017. Total assets stood at BHD735.16mn at the end of March 31, 2018 as compared to BHD785.22mn at the end of December 31, 2017. Financing assets stood at BHD331.45mn, while placements from financing institutions stood at BHD99.58mn at the end of March 31, 2018. EPS came in at BHD0.00086 in 1Q2018 as compared to BHD0.00155 in 1Q2017. (Bahrain Bourse)

- 8. Contacts Saugata Sarkar, CFA, CAIA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa Mohamed Abo Daff QNB Financial Services Co. W.L.L. Senior Research Analyst Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6589 PO Box 24025 mohd.abodaff@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 8 of 8 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg ( # Market was closed on May 11, 2018) Source: Bloomberg (*$ adjusted returns) 60.0 80.0 100.0 120.0 140.0 Apr-14 Apr-15 Apr-16 Apr-17 Apr-18 QSEIndex S&P Pan Arab S&P GCC 0.5% (0.8%) 0.5% (0.0%) 0.1% (1.1%) (0.3%) (1.2%) (0.8%) (0.4%) 0.0% 0.4% 0.8% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,318.30 (0.2) 0.2 1.2 MSCI World Index 2,131.96 0.4 2.0 1.4 Silver/Ounce 16.67 (0.3) 0.8 (1.6) DJ Industrial 24,831.17 0.4 2.3 0.5 Crude Oil (Brent)/Barrel (FM Future) 77.12 (0.5) 3.0 15.3 S&P 500 2,727.72 0.2 2.4 2.0 Crude Oil (WTI)/Barrel (FM Future) 70.70 (0.9) 1.4 17.0 NASDAQ 100 7,402.88 (0.0) 2.7 7.2 Natural Gas (Henry Hub)/MMBtu# 2.73 0.0 (0.6) (22.8) STOXX 600 392.40 0.5 1.3 0.3 LPG Propane (Arab Gulf)/Ton 89.00 1.0 1.1 (9.0) DAX 13,001.24 0.2 1.4 0.1 LPG Butane (Arab Gulf)/Ton 90.13 0.7 4.2 (14.7) FTSE 100 7,724.55 0.7 2.1 0.7 Euro 1.19 0.2 (0.1) (0.5) CAC 40 5,541.94 0.3 0.4 3.8 Yen 109.39 (0.0) 0.2 (2.9) Nikkei 22,758.48 1.4 1.9 3.0 GBP 1.35 0.2 0.1 0.2 MSCI EM 1,164.48 0.7 2.5 0.5 CHF 1.00 0.3 (0.0) (2.6) SHANGHAI SE Composite 3,163.26 (0.1) 2.8 (1.7) AUD 0.75 0.1 0.1 (3.4) HANG SENG 31,122.06 1.0 4.0 3.5 USD Index 92.54 (0.1) (0.0) 0.4 BSE SENSEX 35,535.79 0.3 1.0 (1.1) RUB 61.95 0.4 (0.9) 7.5 Bovespa 85,220.23 (2.0) 0.4 2.6 BRL 0.28 (1.4) (2.0) (8.0) RTS 1,193.98 1.2 4.1 3.4 81.8 81.3 73.5