5 August Daily market report

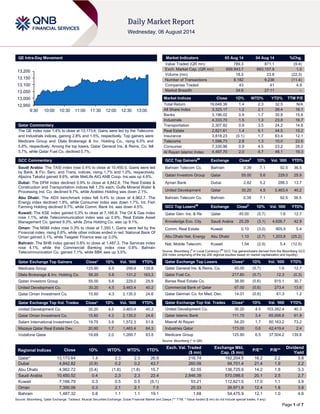

- 1. Page 1 of 7 QE Intra-Day Movement Qatar Commentary The QE index rose 1.4% to close at 13,173.6. Gains were led by the Telecoms and Industrials indices, gaining 2.8% and 1.5%, respectively. Top gainers were Medicare Group and Dlala Brokerage & Inv. Holding Co., rising 6.5% and 5.8%, respectively. Among the top losers, Qatar General Ins. & Reins. Co. fell 5.7%, while Qatar Fuel Co. declined 0.7%. GCC Commentary Saudi Arabia: The TASI index rose 0.4% to close at 10,450.5. Gains were led by Bank. & Fin. Serv. and Trans. indices, rising 1.7% and 1.0%, respectively. Aljazira Takaful gained 9.6%, while MetLife AIG ANB Coop. Ins.was up 4.6%. Dubai: The DFM index declined 0.9% to close at 4,842.8. The Real Estate & Construction and Transportation indices fell 1.3% each. Gulfa Mineral Water & Processing Ind. Co. declined 9.7%, while Arabtec Holding was down 2.1%. Abu Dhabi: The ADX benchmark index fell 0.4% to close at 4,962.7. The Energy index declined 1.8%, while Consumer index was down 1.7%. Int. Fish Farming Holding declined 9.7%, while Comm. Bank Int. was down 4.5%. Kuwait: The KSE index gained 0.3% to close at 7,166.8. The Oil & Gas index rose 1.1%, while Telecommunication index was up 0.9%. Real Estate Asset Management Co. gained 9.3%, while Zima Holding Co. was up 9.1%. Oman: The MSM index rose 0.3% to close at 7,350.1. Gains were led by the Financial index, rising 0.6%, while other indices ended in red. National Bank Of Oman gained 3.1%, while Taageer Finance was up 2.0%. Bahrain: The BHB index gained 0.8% to close at 1,487.3. The Services index rose 4.1%, while the Commercial Banking index rose 0.8%. Bahrain Telecommunication Co. gained 7.1%, while BBK was up 3.5%. Qatar Exchange Top Gainers Close* 1D% Vol. ‘000 YTD% Medicare Group 125.90 6.5 299.4 139.8 Dlala Brokerage & Inv. Holding Co. 58.20 5.8 131.2 163.3 Qatari Investors Group 55.00 5.6 229.0 25.9 United Development Co. 30.20 4.5 3,463.4 40.2 Qatar Oman Investment Co. 15.60 4.3 2,135.0 24.6 Qatar Exchange Top Vol. Trades Close* 1D% Vol. ‘000 YTD% United Development Co. 30.20 4.5 3,463.4 40.3 Qatar Oman Investment Co. 15.60 4.3 2,135.0 24.6 Salam International Investment Co. 19.75 3.9 1,572.3 51.8 Mazaya Qatar Real Estate Dev. 20.60 1.7 1,463.4 84.3 Vodafone Qatar 19.69 2.0 1,269.7 83.8 Market Indicators 05 Aug 14 04 Aug 14 %Chg. Value Traded (QR mn) 789.3 871.1 (9.4) Exch. Market Cap. (QR mn) 699,943.7 693,157.9 1.0 Volume (mn) 18.5 23.8 (22.3) Number of Transactions 8,182 9,236 (11.4) Companies Traded 43 41 4.9 Market Breadth 34:6 27:11 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 19,648.36 1.4 2.3 32.5 N/A All Share Index 3,323.17 1.2 2.1 28.4 16.1 Banks 3,196.02 0.9 1.7 30.8 15.6 Industrials 4,333.70 1.5 1.3 23.8 16.7 Transportation 2,307.82 0.9 3.5 24.2 14.8 Real Estate 2,821.61 1.4 5.1 44.5 15.2 Insurance 3,818.23 (0.1) 1.7 63.4 12.1 Telecoms 1,598.73 2.8 1.3 10.0 22.6 Consumer 7,330.96 0.9 4.5 23.2 28.0 Al Rayan Islamic Index 4,497.70 2.0 4.7 48.1 19.3 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Bahrain Telecom Co. Bahrain 0.39 7.1 92.5 36.5 Qatari Investors Group Qatar 55.00 5.6 229.0 25.9 Ajman Bank Dubai 2.82 5.2 288.3 13.7 United Development Qatar 30.20 4.5 3,463.4 40.2 Bahrain Telecom Co. Bahrain 0.39 7.1 92.5 36.5 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Qatar Gen. Ins. & Re Qatar 45.00 (5.7) 1.6 12.7 Knowledge Eco. City Saudi Arabia 25.29 (3.1) 4,626.7 42.9 Comm. Real Estate Kuwait 0.10 (3.0) 905.9 5.4 Abu Dhabi Nat. Energy Abu Dhabi 1.10 (2.7) 1,203.8 (25.2) Nat. Mobile Telecom. Kuwait 1.54 (2.5) 5.4 (12.5) Source: Bloomberg ( # in Local Currency) ( ## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) Qatar Exchange Top Losers Close* 1D% Vol. ‘000 YTD% Qatar General Ins. & Reins. Co. 45.00 (5.7) 1.6 12.7 Qatar Fuel Co. 217.80 (0.7) 12.3 (0.3) Barwa Real Estate Co. 38.95 (0.6) 915.1 30.7 Commercial Bank of Qatar 67.00 (0.6) 273.4 13.6 Qatar German Co. for Med. Dev. 14.01 (0.6) 61.3 1.2 Qatar Exchange Top Val. Trades Close* 1D% Val. ‘000 YTD% United Development Co. 30.20 4.5 103,382.4 40.3 Qatar Islamic Bank 111.70 3.4 65,006.6 61.9 Masraf Al Rayan 54.20 1.7 50,163.2 73.2 Industries Qatar 173.00 0.6 42,419.4 2.4 Medicare Group 125.90 6.5 37,504.2 139.8 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 13,173.64 1.4 2.3 2.3 26.9 216.74 192,204.5 16.2 2.2 3.8 Dubai 4,842.82 (0.9) 0.2 0.2 43.7 260.08 94,701.4 21.4 1.9 2.2 Abu Dhabi 4,962.72 (0.4) (1.8) (1.8) 15.7 62.55 136,725.9 14.2 1.8 3.3 Saudi Arabia 10,450.52 0.4 2.3 2.3 22.4 2,846.39 570,098.5 20.1 2.5 2.7 Kuwait 7,166.79 0.3 0.5 0.5 (5.1) 53.21 112,621.5 17.0 1.1 3.9 Oman 7,350.06 0.3 2.1 2.1 7.5 20.33 26,971.9 12.4 1.8 3.8 Bahrain 1,487.32 0.8 1.1 1.1 19.1 1.68 54,475.9 12.1 1.0 4.6 Source: Bloomberg, Qatar Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 12,950 13,000 13,050 13,100 13,150 13,200 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 7 Qatar Market Commentary The QE index rose 1.4% to close at 13,173.6. The Telecoms and Industrials indices led the gains. The index rose on the back of buying support from non-Qatari shareholders despite selling pressure from Qatari shareholders. Medicare Group and Dlala Brokerage & Inv. Holding Co. were the top gainers, rising 6.5% and 5.8%, respectively. Among the top losers, Qatar General Ins. & Reins. Co. fell 5.7%, while Qatar Fuel Co. declined 0.7%. Volume of shares traded on Tuesday fell by 22.3% to 18.5mn from 23.8mn on Monday. However, as compared to the 30-day moving average of 14.4mn, volume for the day was 28.5% higher. United Development Co. and Qatar Oman Investment Co. were the most active stocks, contributing 18.8% and 13.8% to the total volume respectively. Source: Qatar Exchange (* as a % of traded value) Ratings, Earnings and Global Economic Data Ratings Updates Company Agency Market Type* Old Rating New Rating Rating Change Outlook Outlook Change Bank Dhofar (BD) Fitch Oman VR/LT IDR BB/BBB+ BB+/BBB+ – – Islamic Arab Insurance Co. (Salama) S&P Dubai FSR/CCR BBB+/BBB+ BBB+/BBB+ – Stable Source: News reports (* LT – Long Term, ST – Short Term, FSR- Financial Strength Rating, FCR – Foreign Credit Rating, LCR – Local Currency Rating, IDR – Issuer Default Rating, SR – Support Rating, LC – Local Currency, VR – Viability Rating, CCR – Counterparty Credit Rating) Earnings Releases Company Market Currency Revenue (mn)2Q2014 % Change YoY Operating Profit (mn) 2Q2014 % Change YoY Net Profit (mn) 2Q2014 % Change YoY Abu Dhabi National Hotels (ADNH) Abu Dhabi AED 344.2 17.4% – – 41.4 44.2% Bahrain Family Leisure Co. (BFLC) Bahrain BHD 0.3 -10.4% 0.0 37.7% 0.6 NA Source: Company data, DFM, ADX, MSM Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 08/05 US Markit Markit US Services PMI July 60.8 60.8 60.8 08/05 US Markit Markit US Composite PMI Jul y 60.6 – 60.6 08/05 US ISM ISM Non-Manf. Composite July 58.7 56.5 56 08/05 US Bloomberg IBD/TIPP Economic Optimism August 44.5 47.3 45.6 08/05 EU Markit Markit Eurozone Services PMI July 54.2 54.4 54.2 08/05 EU Markit Markit Eurozone Composite PMI July 53.8 54 53.8 08/05 France Markit Markit France Composite PMI July 49.4 49.4 49.4 08/05 France Markit Markit France Services PMI July 50.4 50.4 50.4 08/05 Germany Markit Markit Germany Services PMI July 56.7 56.6 56.7 08/05 Germany Markit Markit/BME Germany Composite PMI July 55.7 55.9 55.7 08/05 UK HM Treasury Official Reserves Changes July -$616M – $994M 08/05 UK Markit Markit/CIPS UK Composite PMI July 58.8 58 57.9 08/05 UK Markit Markit/CIPS UK Services PMI July 59.1 58 57.7 08/05 Spain Markit Markit Spain Services PMI July 56.2 55.2 54.8 08/05 Spain Markit Markit Spain Composite PMI July 55.7 – 55.2 08/05 Italy Markit Markit/ADACI Italy Composite PMI July 53.1 – 54.2 08/05 Italy Markit Markit/ADACI Italy Services PMI July 52.8 53.8 53.9 08/05 China Markit HSBC China Services PMI July 50.0 – 53.1 08/05 China Markit HSBC China Composite PMI July 51.6 – 52.4 08/05 Japan Markit Markit Japan Services PMI July 50.4 – 49.0 08/05 Japan Markit Markit/JMMA Japan Composite PMI July 50.2 – 50.0 Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Overall Activity Buy %* Sell %* Net (QR) Qatari 64.29% 68.98% (37,043,928.21) Non-Qatari 35.72% 31.02% 37,043,928.21

- 3. Page 3 of 7 News Qatar Qatar stock market set to be flooded with more liquidity – Qatar issued a law formally raising the limit of foreign ownership in the listed companies to 49%. The move paves the way for more liquidity flow into the country’s stock market that has a capitalization of $192.21bn. The foreign ownership limit in most listed companies was 25% earlier. Non-Qatari GCC nationals, who were previously treated as foreigners for the purpose of trading in Qatari stocks, are to be now treated as Qatari citizens. This means their ownership of Qatari stocks will not be counted in as being part of foreign ownership. Meanwhile, QNA said the Emir HH Sheikh Tamim bin Hamad Al Thani had issued Law No. 9 of 2014, which amends some provisions of Law No. 13 of 2000 regulating investment of non-Qatari capital in economic activity. The law says that listed companies should seek approval from the Ministry of Economy and Commerce to amend their Articles of Association to raise the foreign ownership limit to 49%. QNA said the legislation also provides for raising this percentage (49) for foreigners further with approval from the State Cabinet. The law is to be effective from the date of issue and is to be published in the official gazette. (Peninsula Qatar) QCB auctions T-bills worth QR4bn – The Qatar Central Bank (QCB) has auctioned treasury bills worth QR4bn on August 5, 2014, for which it received bids totaling QR5.305bn. T-bills worth QR2bn with a three-month maturity period were auctioned at a yield of 0.73%. T-bills with a six-month maturity period worth QR1bn were sold at a yield of 0.96%, while T-bills with nine- month maturity period worth QR1bn were auctioned at a yield of 1.10%. (QCB) MERS reports QR112.8mn net profit in 1H2014 – Al-Meera Consumer Goods Company (MERS) reported a net profit of QR112.8mn in 1H2014 as compared to QR57.6mn in 1H2013. The Company’s EPS amounted to QR5.64 in 1H2014 versus QR3.16 in 1H2013. (QE) QNB Group: Qatar’s international reserves hit record $42.2bn in June – The QNB Group (QNBK) in its latest ”Qatar Monthly Monitor” said, Qatar’s international reserves surged to $42.2bn in June, driven by a large current account surplus. QNBK said the country’s international reserves have been “steadily rising” over the years on large current account surpluses. The latest available information suggests that import cover stood at 7.9 months at the end of June, well above the IMF recommended level of three months for pegged exchange rates. QNBK said Qatar’s current account balance stood at $17.2bn in the first quarter of 2014. The report showed Qatar’s foreign merchandise trade balance registered a surplus of QR32.3bn in June 2014. The surplus fell 1.3% YoY due to a large increase in imports (23.3%), reflecting strong domestic demand. Meanwhile, merchandise exports grew by 3.3% on high gas & oil prices. Total exports in June stood at QR41.5bn, while imports stood at QR9.2bn. Japan topped the export destinations in June accounting for 26% of Qatar’s exports, followed by South Korea (18%) and India (11%). The UAE was the largest exporter to Qatar in June (13%), closely followed by China (11%) and the US (10%). According to QNBK, domestic demand in Qatar is growing strongly on the back of “investments and private consumption”. Strong domestic demand from investments and private consumption drove double-digit non- hydrocarbon growth (11.5%) in 1Q2014. QNBK said quoting the Ministry of Development Planning and Statistics (MDPS), the share of investment in GDP rose to 28.2%, as compared to 26.8% a year earlier. (Gulf-Times.com) QNB Group: Non-hydrocarbon sector grows double-digit in Qatar – Strong domestic demand from investments and private consumption drove double-digit non-hydrocarbon growth (11.5%) in 1Q2014. The QNB Group’s (QNBK) ‘Qatar monthly monitor’ noted that the share of investment in GDP rose to 28.2% as compared to 26.8% a year earlier. Citing the Ministry of Development Planning and Statistics (MDPS) report, QNB analysts said the growth is driven by the implementation of major projects in preparation for the 2022 FIFA World Cup. The share of private consumption to GDP rose to 13.8% in 1Q2014 as compared to 13.2% a year earlier. The share of private consumption remains low by international standards, but is expected to rise over the medium-term. Qatar’s overall CPI inflation fell to 2.8%, partially due to falling international food prices. Foreign inflation contributed 0.4% to overall inflation in June 2014. The contribution of domestic inflation fell to 2.4% notwithstanding rising rent, fuel and energy inflation (7.4%). QNBK analysts expect further growth in population to drive domestic inflation, leading to a modest rise in overall inflation to 3.4% for 2014 as a whole. However, there is a small risk that the fast-growing economy could lead to supply bottlenecks owing to limited domestic logistics capacity, pushing up inflation more than expected. (Peninsula Qatar) International Sturdy US services, factory data boost growth picture – US services sector activity hit an 8-1/2 year high in July and factory orders surged in June, bolstering expectations of solid economic growth in the third quarter. The recent reports added to employment and consumer spending data in suggesting sustained momentum in the economy that could bring the Federal Reserve closer to raising interest rates. The Institute for Supply Management's services index rose to 58.7 in July from 56.0 in June. While the index only dates to 2008, an examination of subcomponents with a longer track record indicate that was the highest level of activity since December 2005. A reading above 50 indicates expansion. Activity in the sector, which accounts for more than 80% of the US economy, was boosted by a jump in orders, which touched their highest point in nearly nine years. A sub-index gauging services industry employment also rose as did order backlogs, but export order growth moderated. (Reuters) Markit: US services sector growth dips in July – According to a survey by Markit, the pace of growth in the US services sector dipped in July as compared to June, but still posted its second- highest reading in 4-1/2 year. Markit said its final services Purchasing Managers Index hit 60.8 in July, down from the preliminary reading of 61.0, which was also the reading for June. The 61.0 print for June was the highest final reading for any month since the survey began in October 2009. A reading above 50 signals expansion in economic activity. Markit’s Chief Economist Chris Williamson said that the services sector grew at a rapid pace, just slightly weaker than June’s post-recession high, accompanied by a surge in factory production. However, there are signs that the growth could cool in the coming months. The survey indicated that the rate of job creation has waned, as have inflows of new business. (Reuters) Argentina says to formally demand US banks make bond payouts – Argentina will formally demand that intermediary banks charged with delivering the country's debt payments make hundreds of millions of dollars in payouts that were due in June but that have been blocked by a US court. Argentina defaulted last week after losing a long legal battle with hedge funds that rejected the terms of debt restructurings in 2005 and 2010. The government deposited payments owed to holders of

- 4. Page 4 of 7 its restructured bonds with intermediaries Citibank Argentina and Bank of New York Mellon. US District Judge Thomas Griesa said the deposits were illegal because he had ordered Argentina not to pay restructured bondholders without paying the holdouts at the same time. The economy ministry will formally demand that Bank of New York Mellon and Citibank Argentina make the payouts despite Griesa's order. (Reuters) BRC: UK shop prices fall in July at fastest rate since 2006 – The British Retail Consortium (BRC) said that prices in British shops fell in July at the fastest rate since records began seven- and-a-half years ago, marking 15 months of sinking prices. The BRC said retail prices in July were 1.9% lower than a year earlier, marking the largest decline in shop prices since the series started in December 2006. Prices had fallen by 1.8% in June. Food prices rose just 0.3%, also the smallest rise on record as compared to 0.6% in the previous month. The BRC said there was deep and widespread discounting across grocery stores. Prices of furniture, electrical goods and gardening tools fell at a faster rate in July. Official data last month showed consumer price inflation (CPI) increased to 1.9% in June, just below the Bank of England's 2% target, although economists said the rise was driven by one-off factors. (Reuters) Surprise jump in UK services PMI heralds continued strong growth – Britain's services industry grew last month at the fastest pace since November, raising the chance that the rapid economic recovery will continue for the rest of the year and potentially bring forward a rise in interest rates. The monthly Markit/CIPS purchasing managers index for the services sector beat economists' expectations and contrasted with a mostly downbeat recent string of economic data. A similar survey of manufacturing hit a one-year low last week, but the rebound in services took the composite PMI for the private sector as a whole to a three-month high. This may encourage the Bank of England to rethink a prediction made in May that the economy would slow slightly in the second half of 2014. (Reuters) Regional GCC FDI falls by 14.6% to reach $24bn in 2013 – According to a report released by the United Nations Conference on Trade and Development (UNCTAD), foreign direct investment (FDI) in the GCC region fell for the fifth consecutive year in 2013. GCC FDI declined 14.6% from $28bn in 2012 to $24bn in 2013. This comes despite an improvement in world FDI, which increased by 9.1% to reach $1.5tn in 2013. As a result, the GCC’s share of world FDI has fallen to 1.6% from 4.2% in 2009. The UAE led the GCC in FDI for the first time in 2013, with $10.5bn, pushing Saudi Arabia into second place. Along with Bahrain, the UAE is the only country to record four consecutive years of increasing FDI inflows, as investors return to the property, manufacturing and services sectors and as the country gears up for the Dubai World Expo in 2020. Saudi Arabia has experienced five consecutive years of declining FDI flows. FDI decreased by 24% from $12.2bn in 2012 to $9.3bn in 2013. FDI flows to Kuwait are estimated to have decreased to $2.3bn in 2013. (GulfBase.com) Saudi labor ministry asks for SR14.9bn annually on reforms – According to a Saudi Ministry of Labor report, the ministry is asking the government to spend SR14.9bn annually on labor market reforms and take steps to move Saudi citizens into private sector jobs. The reforms include quotas for companies to hire Saudi nationals, levies on firms which employ large numbers of foreigners, and training and unemployment benefits schemes. The ministry’s report said that the reforms had achieved initial success in 2013, with the number of Saudis working in the private sector rising to about 1.5mn at the end of 2013 from 681,481 people before the reforms began. The proportion of Saudi nationals employed in the private sector climbed to 15.15% in 2013 from 9.9% in 2009. Meanwhile, the unemployment rate fell to 11.7% at the end of 2013 from 12.1% in 2012. (GulfBase.com) SWCC’s Yanbu plant to install another desalination unit – Saline Water Conversion Corporation (SWCC) said that the second unit of the new desalination plant, which is under construction in Yanbu, will be installed by this weekend. The unit was delivered by Doosan Global for the desalination and power generation facility of the Yanbu Third Phase project. The project is believed to be the largest desalination plant in the world. The new unit is the second of six units to be supplied by Doosan Global for the Yanbu project that will supply 550,000 cubic meter of water to the Madinah province when completed. The first unit of the project was installed in May 2014. While Doosan supplies four units, two units will be manufactured in the Kingdom as part of a technology transfer agreement. The third and fourth units will be installed in November 2014, while the fifth and sixth units will be installed by 1H2016. (GulfBase.com) SABB HSBC Saudi PMI rises to 60.1 in July 2014 – The seasonally adjusted SABB HSBC Saudi Arabia Purchasing Managers Index (PMI) rose to 60.1 points in July 2014 from 59.2 points in June, on a scale where the 50-point level separates expansion of activity from contraction. The sub-index for output, at 65.3 points, was the highest since February 2012, while the sub-index for new orders was the highest since September 2013. The companies that participated in the survey cited rising numbers of new projects and good market conditions for July's rapid growth in activity. The growth in Saudi Arabia's non-oil business activity accelerated to its fastest level in July since September 2012, while the growth in the UAE's non-oil private sector edged down in the month but remained high by historical standards, the survey showed. The Saudi growth was boosted by strong output and new orders. However, the capacity constraints were evident in a rise in the sub-index for backlogs of work, which at 55.6 points was the highest since the survey began in August 2009. The rates of inflation of purchase costs, staff costs and overall input prices accelerated in July from June, as was the growth in output prices. The UAE index, which measures the performance of the manufacturing and services sectors, was at 58.0 points in July 2014, down from 58.2 points in June 2014. The output growth dropped to 61.6 points in July from 63.3 points in June 2014, while the growth of new orders fell more moderately. The employment growth slowed slightly but stayed comfortably in the positive territory. Input price inflation edged down to 55.0 points, while output price growth increased slightly but was still negative at 49.5 points. (GulfBase.com) SAMA appoints Vice-Governor – Saudi Arabian Monetary Agency (SAMA) has appointed Mr. Abdulaziz bin Saleh bin Othman Al Furaih as the Vice-Governor. Al Furaih served as Deputy CEO in Riyadh Bank before joining SAMA as Vice- Governor. (Bloomberg) Saudi Aramco awards $54mn EPC contract to Essar Projects – Saudi Arabian Oil Company (Saudi Aramco) has awarded a $54mn engineering, procurement and construction (EPC) contract to India-based Essar Projects. The project involves the upgradation of a Crude Stabilization Unit at Aramco’s Abqaiq Plant in Shaybah. The scope of work entails engineering, procurement and construction of a crude tank, replacement of crude pumps and associated civil, piping, electrical and instrumentation facilities. The work is expected to take 29 months to complete. (Bloomberg)

- 5. Page 5 of 7 JETRO: UAE-Japan trade hits AED94.91bn in 1H2014 – According to Japan External Trade Organization (JETRO), the total trade between the UAE and Japan grew by around 3.2% to AED94.91bn in 1H2014 as compared to around AED90.22bn in 1H2013. The UAE exports to Japan rose by 1.5% to AED78.1bn in 1H2014 as compared to AED76.96bn in 1H2013. The UAE exports to Japan accounted for around 27% of Japan’s total imports from the Middle East during 1H2014 which stood at $79.3bn. The UAE is Japan’s second trade partner in the Middle East after Saudi Arabia. The UAE imports from Japan also rose by around 12% to AED16.81bn in 1H2014 as compared to AED15.01bn in 1H2013. The surplus of the UAE balance of trade slightly dropped in the first 6 months of 2014 owing to the robust growth of imports. It stood at AED61.33bn as compared to AED61.95bn in 1H2013. The UAE imports accounted for around 34% of Japan’s total exports to the Middle East, which stood at $13.64bn in 1H2014. (GulfBase.com) Du launches VoLTE technology for first time in Mideast – Emirates Integrated Telecommunications Company (Du) has launched a Voice over LTE (VoLTE) technology for the first time in the Middle East. The customers of Du in the UAE will be able to simultaneously access the internet at 4G LTE speeds while making a crystal-clear voice call, made possible by the VoLTE technology. Du has announced the successful completion of its network’s first VoLTE call. (GulfBase.com) DFM enrolls 5 brokerage firms to margin trading members – Dubai Financial Market (DFM) announced that Al Safwa Islamic Financial Services, Global for Shares & Bonds, Al Fardan Financial Services, Al Brooge Securities and Al-Sharhan Stock Center have been accredited to provide margin trading. With this, the total number of DFM brokerage firms providing this service has reached to 24. (DFM) AE wins $7.8mn University of Dubai MEP deal – AE Arma- Elektropanç (AE) has won a $7.8mn contract to carry out MEP works on the first phase of the University of Dubai project in Dubai Academic City. Main contractor Kier Dubai awarded AE the deal which will see the firm work on the university’s main building, management faculty buildings, and the information technology departments. Covering a confined space of 21,200 square meters, the University of Dubai project comprises a number of phases and is affiliated with the Dubai Chamber of Commerce and Industry (DCCI). (Bloomberg) NBAD OneShare underperforms benchmark in 1H2014 – National Bank of Abu Dhabi (NBAD) reported a rise of 8.5% for its NBDA OneShare MSCI UAE UCITS ETF for 1H2014, as against a benchmark performance of 11.1%. Top five relative holdings in the ETF are Air Arabia, Shuaa Capital, Ral Properties, Dana Gas and Eshraq Properties. The realized tracking error for the period was 2.4%. This was slightly above what was initially anticipated, according to the fund manager’s report. The report stated that dividends are usually paid out after a period of six weeks in the UAE. During the dividend season (February-April 2014), at a time when the market was strong, the fund held receivables on dividends which created a drag on performance. The lag between receiving and reinvesting cash led to a variance, which led to a tracking error which was higher than anticipated. (GulfBase.com) Reem Mall work to start early in 2015 – Construction work on The Reem Mall in Abu Dhabi is set to begin at the start of 2015. The project is to go through a single-phase construction period and will take around three years to complete, officially opening in 2018. An investment of around $1bn will be put into The Reem Mall project and will include around 450 stores, 85 restaurants, and a range of entertainment features across three floors. National Real Estate Company (NREC), which is developing the mall, has appointed Stuart Ingram as Director of development for project. Ingram will be responsible for all aspects of development and delivery of the project. (GulfBase.com) Adnoc Distribution closes 3 service stations for maintenance – Abu Dhabi National Oil Company for Distribution (ADNOC Distribution) has announced the closure of Al Samha 1, Zafaranah and Al Mushrif service stations in the emirate of Abu Dhabi beginning from August 3, 2014 for a period of four months. Part of the company’s ongoing efforts to modernize its service station network, the closure will facilitate the deployment of general maintenance works as well as upgrade of equipment and machinery. Adnoc Oasis convenient stores at Al Samha 1 and in Al Mushrif service stations will continue to remain operational during the maintenance period, while the Adnoc Oasis store in Zafaranah will be closed. Adnoc Distribution has also announced the use of alternative service stations to ensure customers are not inconvenienced by the closure. The closure of these three stations is part of company’s regular maintenance plan which covers the entire service station network. (GulfBase.com) TCA Abu Dhabi: Abu Dhabi hotel guests up 28% in 1H2014 – According to the figures released by Abu Dhabi Tourism & Culture Authority (TCA Abu Dhabi), more than 1.7mn guests checked into Abu Dhabi’s hotels and hotel apartments in 1H2014, marking a 28% uplift on 1H2013. The arrivals delivered 5,147,392 guest nights, which was up 22% on the comparative period in 2013 with occupancy climbing 8% YoY. Hotel and room revenues both jumped 15% to AED3.089bn and AED1, 578bn respectively. Guest nights and revenues with occupancy also rebounded to reach 77%. The half year performance was aided by a jump in YoY uplift for the month of June 2014 when guest arrivals rose 14% to 264,203, guest nights climbed 18% to 771,997, the average length-of-stay nudged up 4% to 2.92 nights and occupancy moved up 8% to 70%. Hotel revenues rose 16% to AED413mn. The number of hotels in the emirate stood at 154 in June 2014 with a total of 27,405 rooms as against 145 hotels in June 2013, accounting for 25,270 rooms. (GulfBase.com) Mubadala to get 10.5% stake in Batista’s mining unit – Brazilian tycoon Eike Batista will transfer 17.1mn shares (10.5%) of his iron ore mining company MMX Mineraçao e Metalicos SA to Abu Dhabi government investment fund Mubadala Development Corporation. The transaction will cut Batista’s stake to 46% of the Rio de Janeiro-based company. The move will end his full control of the company, but he will remain the largest shareholder. The transaction should be completed by the end of September 2014. Batista has debts with Mubadala related to deals he made before the collapse and break-up of his giant EBX industrial group that includes MMX. Batista will also transfer 185.6mn shares of Prumo Logistica SA (10.44%) to Mubadala in 3Q2014. (GulfBase.com, Bloomberg) Kuwait real estate sector sales reach KD522mn in June – Kuwait’s real estate market has achieved a record breaking performance in 1H2014 with sales reaching KD522mn in June 2014. The sector broke the KD500mn-mark for the first time and saw its third monthly record performance in under a year. Exceptional performances across all three sectors helped push sales up, with the commercial sector recording its best figures yet. Sales in the residential sector reached KD172mn in June, reflecting a 3.4% YoY increase. The number of transactions in June reached 590, up 25% YoY. The sector recorded a little over KD1bn in sales in 1H2014, growing by 17% as compared to 1H2013. However, the number of transactions in 1H2014

- 6. Page 6 of 7 dropped by 9% YoY. Sales in the investment sector stood at KD235mn in June 2014, up 90% YoY. However, the sector also experienced a slight decline of 1% YoY in the number of transactions. With larger values but fewer transactions, the average transaction size increased in June to KD1.3mn. Sales in the investment sector during 1H2014 totaled KD964mn, up 52% YoY; the number of transactions was up by 12%. Sales in the commercial sector more than doubled YoY as sales totaled KD114mn in June. The sector recorded 9 transactions; down by 25% YoY. Sales for 1H2014 reached KD273mn, up 60% YoY. The Kuwait Credit Bank (KCB) approved 530 loans worth approximately KD32mn in June. The value of loans approved declined by 2% on a YoY basis. Meanwhile, the value of loans disbursed by KCB reached KD20mn, reflecting a YoY increase of 80%. (GulfBase.com) CBO: Service sector follows oil in Oman’s GDP growth – According to a report by the Central Bank of Oman (CBO), Oman’s service sector is occupying the second position of dominance after the hydrocarbon sector as far as the composition of the country’s GDP is concerned. With a share of 39.7% in total real GDP, the sector witnessed a growth of 7.4% during 2012 as compared to 7.7% during 2011. According to the report, increased expenditure on public administration and defense, social expenditure on education and health and infrastructure building had a positive impact on the services growth in the recent period. The share of services sector increased from 34.9% during 2012 to 37.3% during 2013. In terms of growth, the sector posted a growth of 10% during 2013 as against 15.1% in 2012. Wholesale and retail trade with a share of 8.4% in the overall real GDP and 21.2% of the services sector performed very well with a growth rate of 13.0% during 2012 as compared to 7.5% in 2011. (GulfBase.com) Sumail Estate to get OMR50mn infrastructure facilities – Sumail Industrial Estate in Oman is in the final stages of evaluating bids for the infrastructure facilities construction worth OMR50mn. The infrastructure facilities will include roads and sewerage networks for the estate. There are only three companies which are in the fray for final allotment, with Larsen & Toubro (Oman) with the lowest bid. The other two companies are Galfar Engineering & Contracting and Egyptian Contracting Co. & Partners. The Sumail Industrial Estate attracted investments worth OMR125mn in 2013. (GulfBase.com) Al Suwadi Power appoints new CFO – Al Suwadi Power Company has appointed Mr. Muhammad Fawad Akhtar as the new Chief Financial Officer (CFO) effective August 1, 2014, replacing Mr. Cliff Dickinson, who has resigned as CFO effective July 31, 2014. (MSM) Al Anwar announces agreed price for stake sale in Taageer Finance – Al Anwar Holdings announced that the price agreed in the Share Purchase Agreement signed regarding the sale of company’s entire stake in Taageer Finance Company is OMR0.162 per share of Taageer. If the transaction is approved by the Central Bank of Oman (CBO) and the Capital Market Authority (CMA), Al Anwar will record a profit of OMR0.269mn in the group financials and OMR2.842mn in parent company financials. (MSM) KEO bags contract for design of Duqm SEZ industrial zones – The Special Economic Zone Authority of Duqm (SEZAD) has awarded a contract to KEO International Consultants to provide consultancy services. KEO’s role is to provide advisory services to the Authority in the development of the Northern and Central Industrial Zones — two massive parcels of real estate that encompass a significant chunk of the SEZ. In addition to carrying out planning, feasibility study, and design of these industrial zones, KEO will also prepare the final detailed design for the development of these areas. (Bloomberg) Gulf Hotels Group signs restaurant fit-out deal – Gulf Hotels Group has signed an agreement with Almoayyed Interiors to carry out the interior fit-out for a new Indian restaurant at the Gulf Hotel Bahrain. The new 120-seat Indian restaurant is being developed in partnership with leading Indian chef Vineet Bhatia, who operates acclaimed restaurants in Europe and the Middle East, including two Michelin starred restaurants in London and Geneva. (GulfBase.com) BIBF signs deal with University of Bolton – Bahrain Institute of Banking & Finance (BIBF) has signed a MoU with the University of Bolton to develop an MBA in Islamic banking. As per the MoU, BIBF will act as lead content provider for Islamic finance subjects and will supervise all dissertations, while the University of Bolton faculty will deliver the core MBA subjects. Graduates of BIBF's Islamic finance programs will be eligible for exemptions from some of the subjects, providing them with a shortened pathway to obtain an MBA with a specialization in Islamic finance. (GulfBase.com) ABG & WB to begin research on risk-management challenges – Al Baraka Banking Group announced its collaboration with the World Bank (WB) to begin a research partnership. The partnership’s first initiative will be a study examining the risk-management challenges facing Islamic banks, with a particular focus on Musharaka and Mudaraba under the profit-and-loss-sharing system. The preliminary findings of the research are expected to be available in 1Q2015. (GulfBase.com) VC Bank reports 84% increase in FY2014 net profit – Venture Capital Bank BSC (VC Bank) reported a net profit of $15mn for the year ended June 30, 2014, representing an 84% increase over $8.1mn profit for the year ended June 30, 2013. The bank reported total income of $23.7mn for the year compared with total income of $15.3mn for the prior year ended June 30, 2013. Net profit and total revenue for the final quarter ended June 30, 2014 amounted to $9.7mn and $12.4mn respectively, compared to $1mn and $4.3mn respectively for the comparative quarter ended June 30, 2013. Total balance sheet assets as of June 30, 2014 amounted to $249mn, indicating a 13% YoY growth. Total assets under management rose 8% to $1.24bn as compared to $1.1bn as of June 30, 2013. The bank’s capital adequacy ratio stands at a very robust 46.5%, considerably higher than the minimum requirement of the Central Bank of Bahrain (CBB) of 12%. (GulfBase.com) GFH repays $33mn debt in 2014; BHB announces increase in GFH paid-up capital – Gulf Finance House (GFH) has repaid $25mn to debt holders marking total debt principal payments of $33mn so far in 2014. This sum represents more than 15% of GFH’s total outstanding facilities. GFH’s outstanding facilities stand at $169mn representing a sound leverage ratio of close to 0.28. Meanwhile, the Bahrain Bourse (BHB) announced that the paid-up capital of Gulf Finance House (GFH) has been increased due to the issuance of 129,452,537 shares, pursuant to the approval from the EGM held on April 14, 2014, and this will be effective August 6, 2014. The previous total outstanding shares were 3,358,017,401 & the new outstanding shares are 3,487,469,938, whereas the previous total paid-up capital was $1.033bn and the new total paid up capital is $1.073bn. (Bahrain Bourse)

- 7. Contacts Saugata Sarkar Abdullah Amin, CFA Shahan Keushgerian Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6569 Tel: (+974) 4476 6509 saugata.sarkar@qnbfs.com.qa abdullah.amin@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa Sahbi Kasraoui Ahmed Al-Khoudary QNB Financial Services SPC Manager – HNWI Head of Sales Trading – Institutional Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6544 Tel: (+974) 4476 6548 PO Box 24025 sahbi.alkasraoui@qnbfs.com.qa ahmed.alkhoudary@qnbfs.com.qa Doha, Qatar DISCLAIMER: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange; QNB is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. While this publication has been prepared with the utmost degree of care by our analysts, QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 7 of 7 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg (* Market closed on 05 August 2014) Source: Bloomberg 80.0 90.0 100.0 110.0 120.0 130.0 140.0 150.0 160.0 170.0 180.0 190.0 200.0 210.0 Jul-10 Jul-11 Jul-12 Jul-13 Jul-14 QE Index S&P Pan Arab S&P GCC 0.4% 1.4% 0.3% 0.8% 0.3% (0.4%) (0.9%) (1.6%) (0.8%) 0.0% 0.8% 1.6% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D% WTD% YTD% Gold/Ounce 1,288.82 0.0 (0.3) 6.9 DJ Industrial 16,429.47 (0.8) (0.4) (0.9) Silver/Ounce 19.78 (1.9) (2.7) 1.6 S&P 500 1,920.21 (1.0) (0.3) 3.9 Crude Oil (Brent)/Barrel (FM Future) 104.61 (0.8) (0.2) (5.6) NASDAQ 100 4,352.84 (0.7) 0.0 4.2 Natural Gas (Henry Hub)/MMBtu 3.85 1.5 2.7 (11.4) STOXX 600 332.10 0.3 0.1 1.2 LPG Propane (Arab Gulf)/Ton 99.38 (0.4) (0.9) (21.4) DAX 9,189.74 0.4 (0.2) (3.8) LPG Butane (Arab Gulf)/Ton 117.50 (0.6) (0.2) (13.4) FTSE 100 6,682.48 0.1 0.0 (1.0) Euro 1.34 (0.3) (0.4) (2.7) CAC 40 4,232.88 0.4 0.7 (1.5) Yen 102.60 0.0 (0.0) (2.6) Nikkei 15,320.31 (1.0) (1.3) (6.0) GBP 1.69 0.1 0.4 2.0 MSCI EM 1,063.11 (0.6) 0.3 6.0 CHF 1.10 (0.3) (0.4) (1.8) SHANGHAI SE Composite 2,219.95 (0.2) 1.6 4.9 AUD 0.93 (0.3) (0.1) 4.4 HANG SENG 24,648.26 0.2 0.5 5.8 USD Index* 81.33 0.0 0.0 1.6 BSE SENSEX 25,908.01 0.7 1.7 22.4 RUB 36.04 0.6 0.7 9.6 Bovespa 56,202.10 (0.7) 0.5 9.1 BRL 0.44 (1.0) (1.1) 3.5 RTS 1,191.37 (1.7) (1.8) (17.4) 189.3 160.7 144.7